South Carolina Instructions to Clients with Checklist - Long

Description

How to fill out Instructions To Clients With Checklist - Long?

Discovering the right legitimate document format might be a have difficulties. Naturally, there are a lot of themes available on the Internet, but how do you obtain the legitimate kind you require? Use the US Legal Forms web site. The service gives thousands of themes, such as the South Carolina Instructions to Clients with Checklist - Long, that can be used for business and private needs. All the kinds are checked out by specialists and satisfy state and federal requirements.

In case you are already signed up, log in to your profile and then click the Obtain option to have the South Carolina Instructions to Clients with Checklist - Long. Use your profile to look throughout the legitimate kinds you possess acquired formerly. Visit the My Forms tab of your profile and have yet another backup in the document you require.

In case you are a brand new consumer of US Legal Forms, here are basic guidelines so that you can comply with:

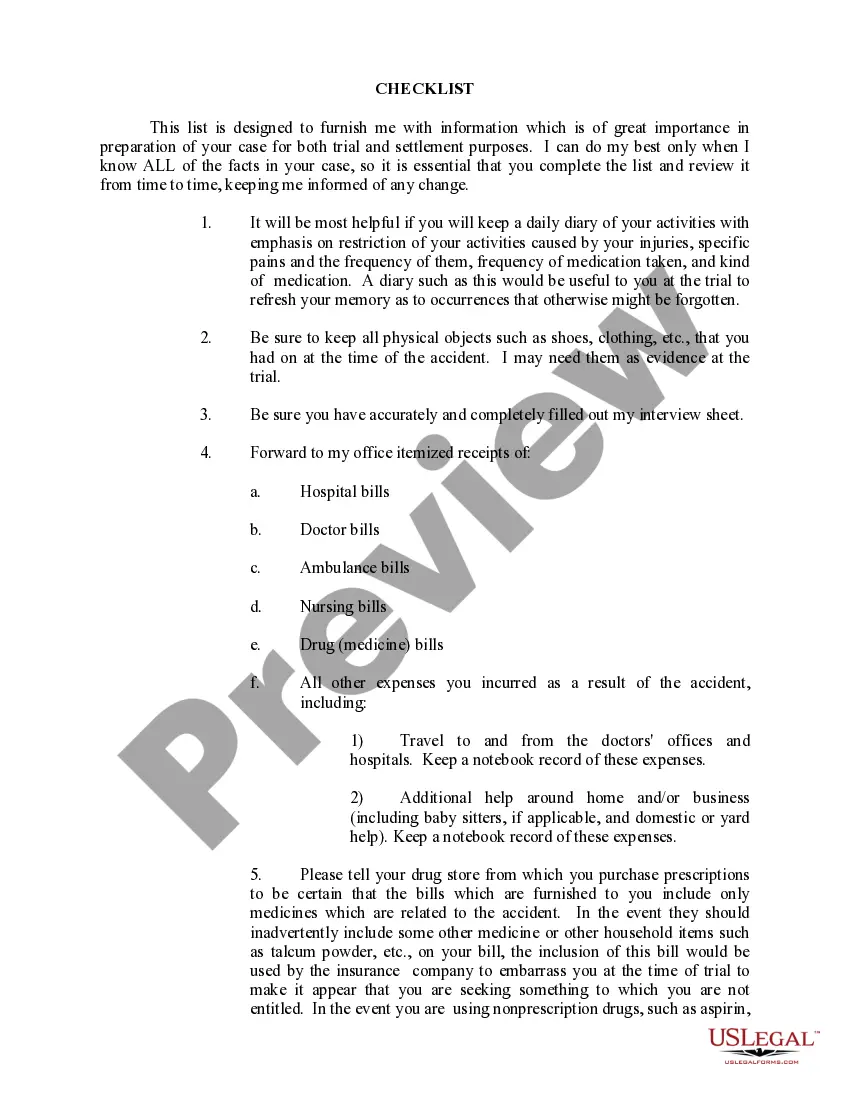

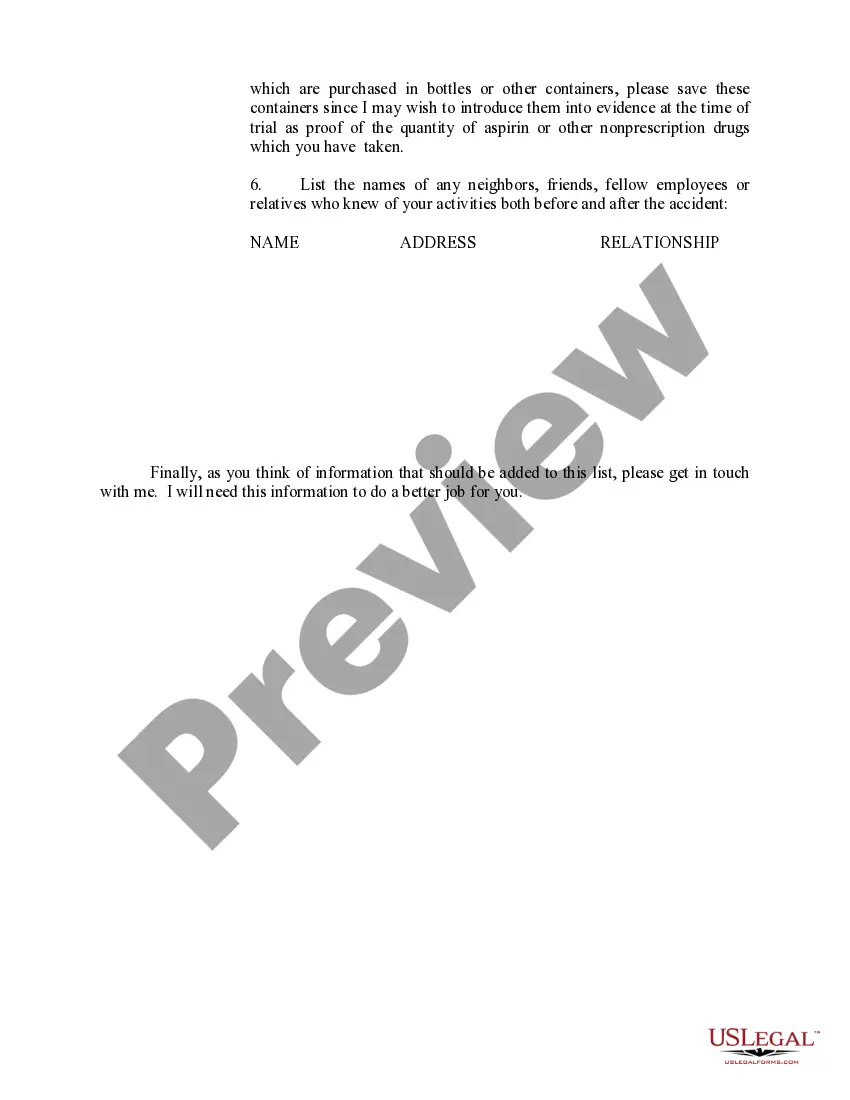

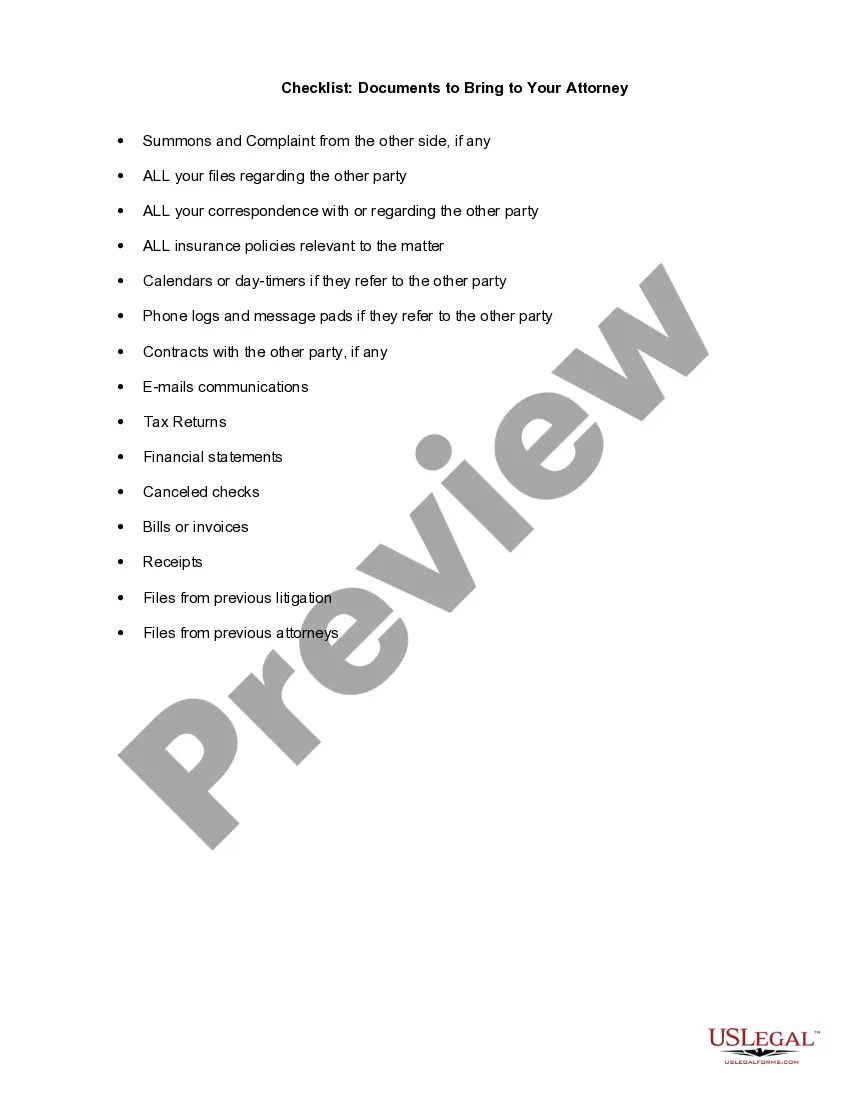

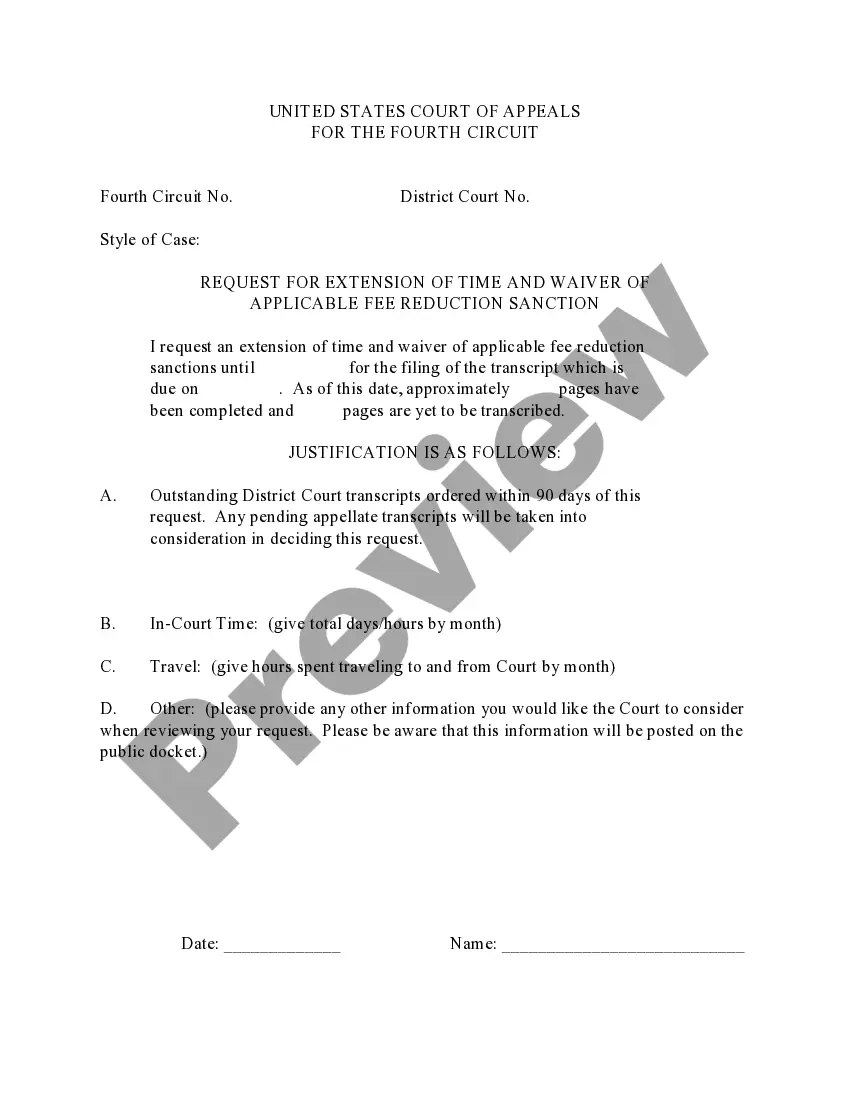

- Initially, be sure you have chosen the appropriate kind for the city/region. You can look over the shape while using Preview option and look at the shape description to make sure this is basically the best for you.

- When the kind will not satisfy your needs, take advantage of the Seach discipline to get the right kind.

- When you are positive that the shape is proper, click the Buy now option to have the kind.

- Opt for the pricing prepare you desire and type in the needed info. Make your profile and pay money for the transaction utilizing your PayPal profile or bank card.

- Choose the submit file format and down load the legitimate document format to your gadget.

- Complete, revise and produce and indication the attained South Carolina Instructions to Clients with Checklist - Long.

US Legal Forms is the biggest collection of legitimate kinds that you will find various document themes. Use the company to down load professionally-produced papers that comply with condition requirements.

Form popularity

FAQ

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

26 USC section 250, Foreign-derived intangible income and global intangible low-taxed income. IRC section 250 contains provisions applicable to both the global intangible low-taxed income (GILTI) provision and the foreign derived intangible income (FDII) provision. It generally provides a deduction for GILTI.

The income tax withholding for the State of South Carolina includes the following changes: The maximum standard deduction in the case of any exemptions has changed from $4,200 to $4,580. The exemption allowance has changed from $2,670 to $2,750. The table for State income tax withholding calculation has changed.

Section 250 and Qualifying Sales: The sale of general property is for foreign use if the property is either subject to domestic use within three years of the sale or the property is subject to manufacture, assembly, or other processing outside of the United States.

Section 250, which addresses the deductions for global intangible low-taxed income (GILTI) and foreign derived intangible income (FDII), and Section 267A, which addresses the taxation of foreign income.

Line s - SUBSISTENCE ALLOWANCE Police and all commissioned law enforcement officers paid by South Carolina municipal, county, state governments or the federal government, full-time firefighters, and full-time emergency medical service personnel are entitled to subsistence allowances of $8.00 per regular workday.

Sec. 250. Foreign-Derived Intangible Income And Global Intangible Low-Taxed Income.

Review a copy of your 2021 South Carolina Individual Income Tax return. If you don't have an amount on line 10, you didn't have a tax liability. If you do have an amount on line 10, you may have a tax liability. To determine whether you did: ?Add your refundable credits found on ?lines 21 and 22.