A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

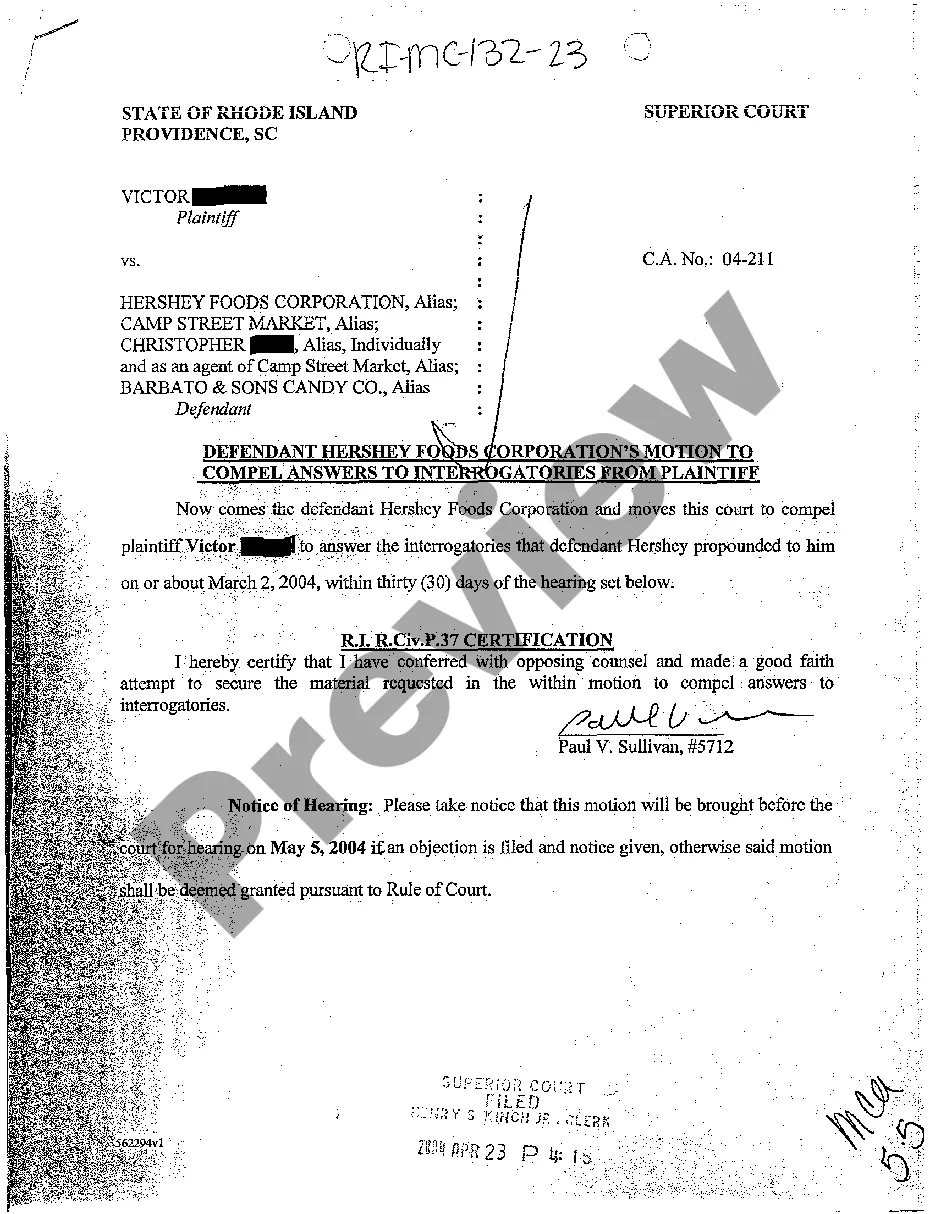

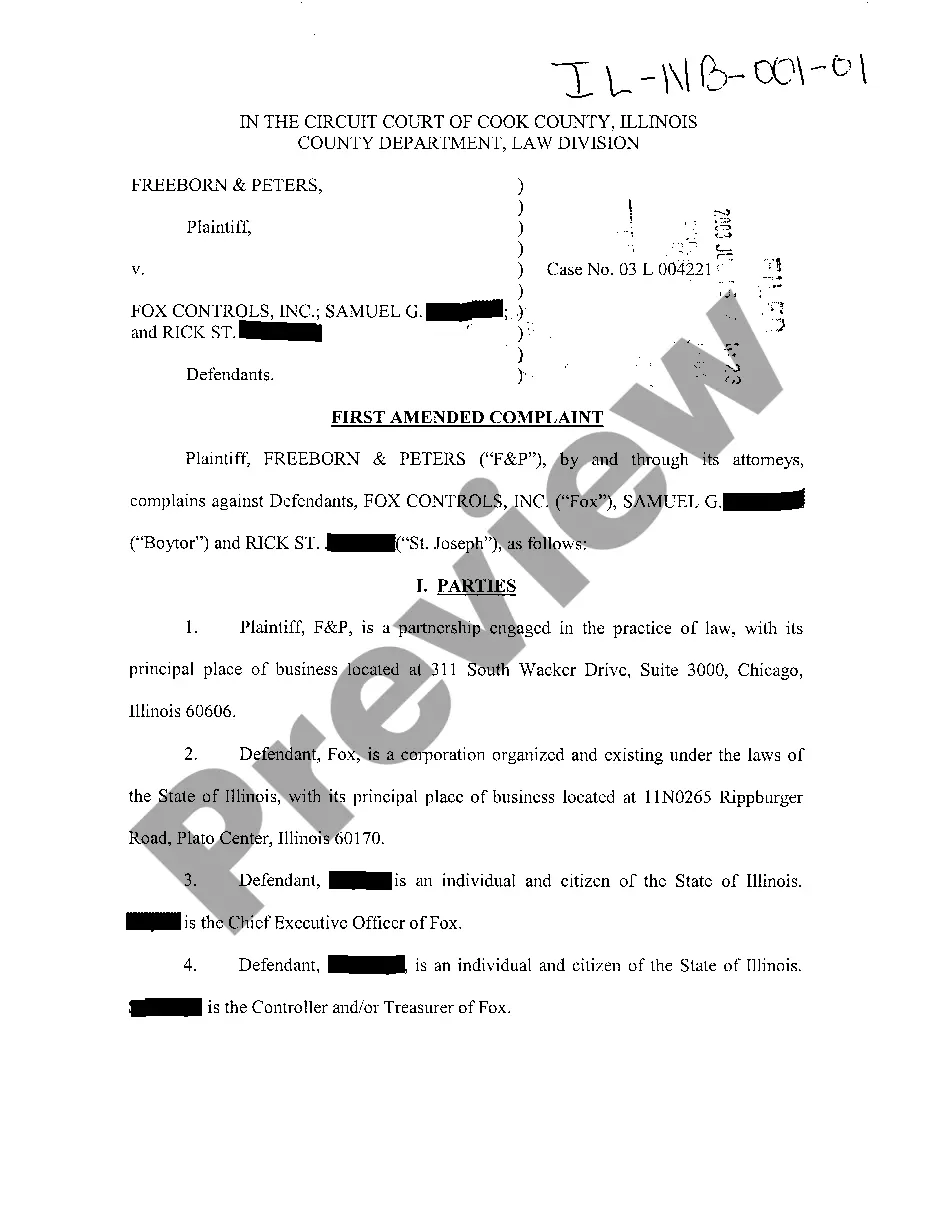

South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

Selecting the appropriate legal document format can be quite the challenge.

Of course, there are numerous templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms platform. The service provides thousands of templates, including the South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, which you can use for professional and personal purposes.

Should the form not meet your requirements, utilize the Search field to find the correct form.

- All of the forms have been reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Download button to find the South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- Use your account to browse through the legal forms you have acquired in the past.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

- First, ensure you have selected the correct form for your region/state. You can review the form using the Preview button and examine the form details to confirm it is the appropriate one for you.

Form popularity

FAQ

When debt is guaranteed, it signifies that a third party agrees to take over the payment responsibilities if the original borrower cannot meet their obligations. This arrangement provides lenders with an added layer of security. In the context of the South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it ensures that stakeholders are committed to upholding their financial responsibilities, improving trust between borrowers and lenders.

A guarantee of company debt is a legal promise by a guarantor to fulfill the debt obligations of a company if the company defaults. This arrangement can provide reassurance to lenders, often making it easier for the company to secure necessary financing. By utilizing the South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, businesses can enhance their financial credibility and maintain growth.

To give a corporate guarantee, the corporate stockholder must complete a guarantee agreement outlining their responsibilities and the extent of their liability. This document should be clear, transparent, and compliant with South Carolina laws to ensure its validity. Utilizing resources like the US Legal Forms platform can streamline this process, helping you create a legally sound agreement that meets your needs.

A continuing guaranty agreement is a contract where a guarantor agrees to be responsible for any future debts incurred by a debtor. This type of agreement is particularly useful for businesses seeking ongoing credit. The South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders offers a robust framework for stockholders to back corporate debts, ensuring stability and support for business operations.

A guarantee of corporate debt is a formal promise by an individual or entity to cover a corporation's debt obligations. This can include loans or credit that the corporate entity has taken on. Through the South Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, stockholders can secure financing for their business while minimizing risk for lenders, creating a more favorable lending environment.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

A South Carolina LLC operating agreement is a legal document that is designed to guide the users of any size business in properly creating an agreement that would provide needed protections for any company. This agreement is not required in this State in order to conduct business within the State.

An LLC operating agreement is not required in South Carolina, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

The life of a corporation is unlimited. Although corporate charters specify a life term, they also include rules for renewal. Because the corporation is an entity separate from its owners, the death or withdrawal of an owner does not affect its existence, unlike a sole proprietorship or partnership.

Considerations. Although shareholders of a corporation are the owners of the business from a legal standpoint, they have no personal liability for the actions and obligations of the business, according to "Law of Corporations and Other Business Organizations" by Angela Schneeman.