An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

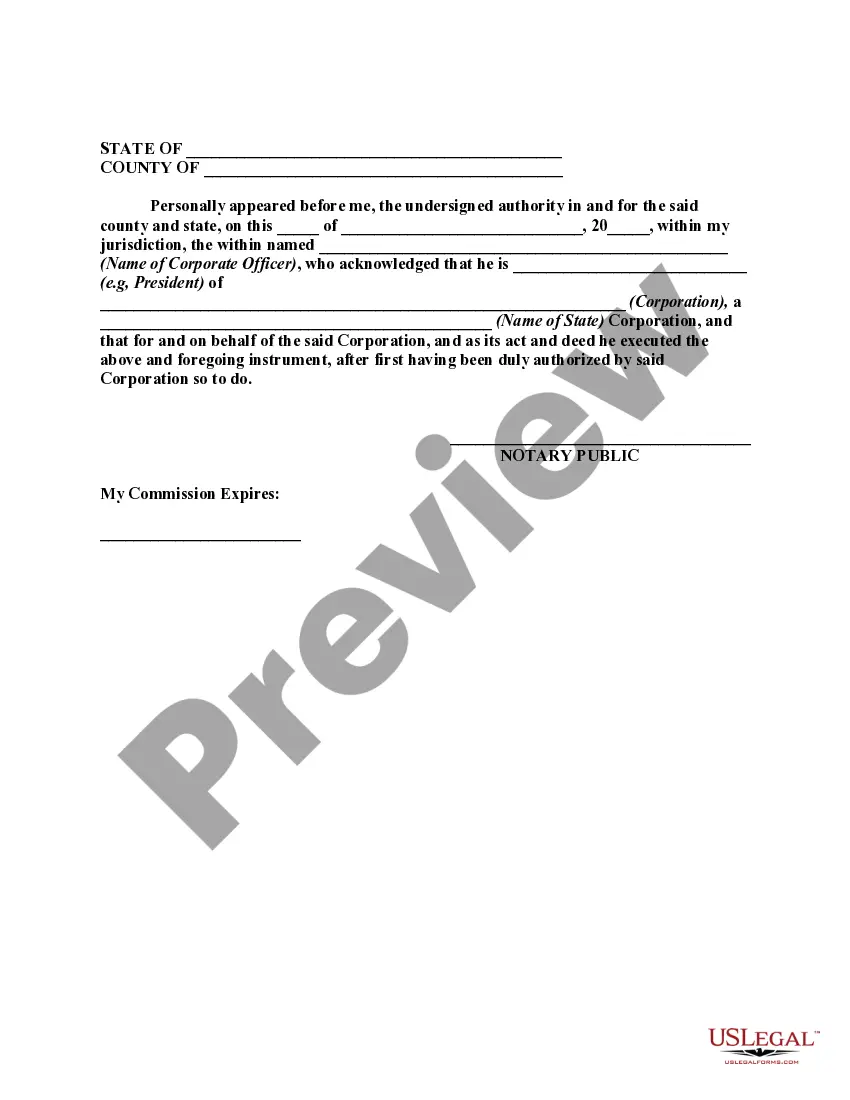

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

You might spend hours online looking for the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of authentic forms that are reviewed by professionals.

It's easy to download or print the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer from my services.

If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

- Each authentic document template you obtain is yours forever.

- To obtain another copy of the purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the easy instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Read the form details to verify that you have chosen the right form.

Form popularity

FAQ

Yes, timeshare estates are considered interests in real property in South Carolina. This classification has implications for how these properties are taxed and utilized under the law. For those intrigued by the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, understanding property classifications is essential to make informed decisions.

Line R on the SC 1040 refers to the amount of South Carolina income tax withheld during the tax year. Accurately reporting this information is essential for determining your tax refund or additional liabilities. Keeping track of these details can also benefit those looking into financial frameworks like the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

Your total taxable income is reported on Line 10 of the South Carolina 1040 form. It's important to accurately calculate this figure to ensure you meet your tax obligations. Understanding your taxable income is especially beneficial when evaluating opportunities such as the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

South Carolina does not tax Social Security benefits, which can be a significant advantage for retirees. This exemption helps in enhancing the overall tax experience for residents, especially when considering long-term investments like real property. If you are contemplating the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, it's worth noting this tax benefit.

The 1040 NR is a tax form specifically designed for non-resident aliens who are required to report income earned in the United States. This form allows the Internal Revenue Service to assess and collect taxes from those who do not qualify as U.S. residents. If you are exploring the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, understanding these tax implications is vital.

You can mail your SC 1065 to the South Carolina Department of Revenue at their designated address for business tax returns. Ensure that you check the latest mailing instructions, as these can frequently change. If you are considering the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, keeping your tax filings accurate is essential.

To apply for a tax exemption in South Carolina, you must complete the appropriate forms and submit them to your local tax authority. Begin by gathering any supporting documents that justify the exemption. You can also use resources like uslegalforms to access the necessary forms and instructions for your specific situation related to the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

In the context of the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, some items that are added back include the amount of income that was exempt from federal taxes. This typically involves tax credits and specific deductions that South Carolina does not recognize, such as certain interest income and contributions to retirement accounts. It is crucial to check the South Carolina Department of Revenue guidelines for a complete list.

Yes, you can cancel a contract in South Carolina, but it is essential to follow the terms outlined in that contract. The ability to cancel may be contingent upon specific conditions or timelines agreed upon by both parties. To navigate cancellations effectively, individuals can seek assistance from resources like USLegalForms, ensuring their options regarding contracts, including the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, are clearly understood.

Bill H 4754 in South Carolina pertains to the regulation and clarification of real estate transactions and infrastructure. This bill was introduced to improve the overall process of buying and selling property, aligning it with existing laws such as the South Carolina Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer. Understanding such legislation can significantly benefit buyers and sellers in navigating their rights.