South Carolina Sample Letter for Certificate of Administrative Dissolution - Revocation

Description

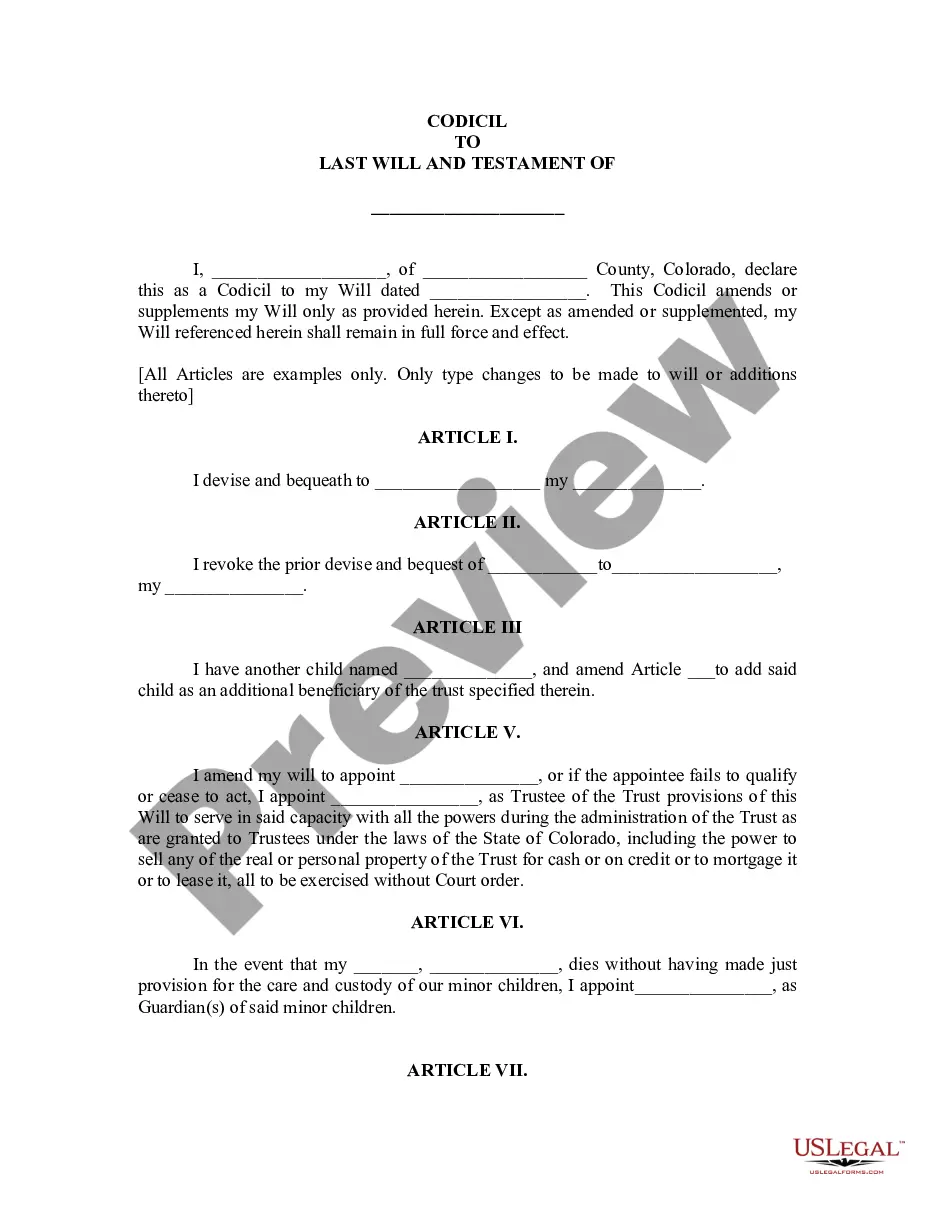

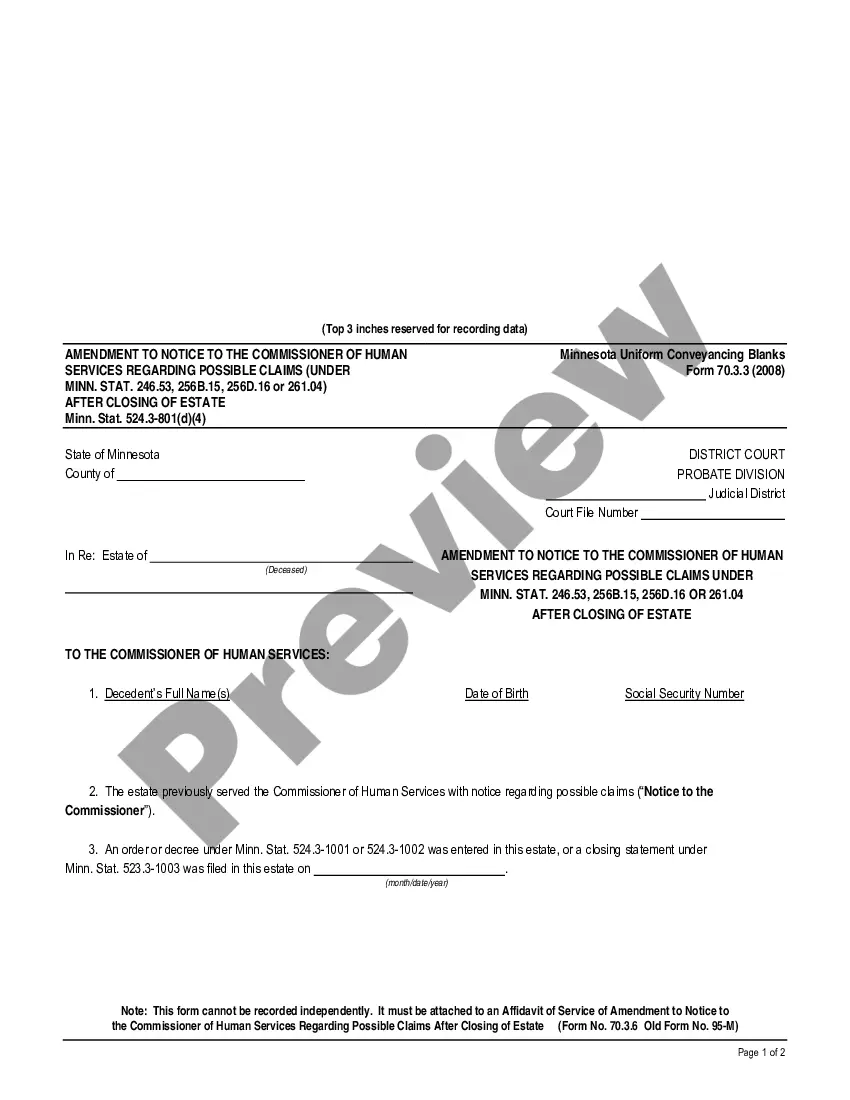

How to fill out Sample Letter For Certificate Of Administrative Dissolution - Revocation?

You can invest hours on the web attempting to find the authorized record design which fits the federal and state needs you will need. US Legal Forms provides 1000s of authorized kinds which are examined by pros. It is simple to download or printing the South Carolina Sample Letter for Certificate of Administrative Dissolution - Revocation from your support.

If you have a US Legal Forms bank account, you may log in and click the Down load key. Following that, you may full, revise, printing, or indication the South Carolina Sample Letter for Certificate of Administrative Dissolution - Revocation. Every authorized record design you purchase is yours eternally. To obtain another duplicate of any obtained type, check out the My Forms tab and click the corresponding key.

If you are using the US Legal Forms site the first time, stick to the basic guidelines listed below:

- First, make sure that you have chosen the correct record design for that county/town of your choosing. Look at the type outline to make sure you have chosen the right type. If readily available, use the Preview key to appear with the record design as well.

- If you wish to find another variation of the type, use the Look for area to get the design that suits you and needs.

- After you have found the design you need, click on Acquire now to move forward.

- Find the rates strategy you need, enter your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal bank account to purchase the authorized type.

- Find the structure of the record and download it in your product.

- Make alterations in your record if needed. You can full, revise and indication and printing South Carolina Sample Letter for Certificate of Administrative Dissolution - Revocation.

Down load and printing 1000s of record themes using the US Legal Forms web site, that offers the biggest assortment of authorized kinds. Use skilled and express-certain themes to handle your business or person needs.

Form popularity

FAQ

People who continue to operate a business that has been dissolved, are taking a serious risk. That's because once the company dissolves, the corporate protections no longer exist. That means that someone who operates the dissolved business, can be sued personally for anything the (dissolved) company does.

To revive or reinstate your South Carolina LLC, you'll first need to pay any past due taxes. Then you'll need to submit the following to the South Carolina Secretary of State: a completed South Carolina Application for Reinstatement by a Limited Liability Company Following Administrative Dissolution.

When the revocation of dissolution is effective, it relates back to and takes effect as of the effective date of the dissolution and the corporation resumes carrying on its business as if dissolution had never occurred.

The steps to get reinstated are: Fix the problem that caused it to be dissolved. For example, if you have overdue annual reports, you will have to file them all. ... Fill out the Reinstatement Form. ... File the Reinstatement Form and pay fee reinstatement fee.

If the Corporation or LLC fails to remedy the deficiencies within the specified time period then the state will Administratively Dissolve the business. When a company has been Administratively Dissolved by the state that company cannot legally conduct business and may be breaking the law if it does conduct business.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.

Administrative dissolution is the taking away of the rights, powers, and authority of a domestic corporation, LLC, or other statutory business entity by the state administrator overseeing business entities, due to the entity's failure to comply with certain obligations of the business entity statute.

Status dissolved companies have been formally closed down. Not only does that mean it no longer operates, but there are also other matters that need attending to. All assets and liabilities must be addressed, similar to the process of settling the estate of someone who has passed away.