South Carolina Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

Have you been in a place that you need files for both company or personal reasons just about every day time? There are plenty of legitimate papers layouts available on the net, but locating types you can rely isn`t effortless. US Legal Forms delivers a large number of form layouts, much like the South Carolina Oil, Gas and Mineral Deed - Individual to Two Individuals, which can be composed to fulfill federal and state demands.

If you are already acquainted with US Legal Forms internet site and get a merchant account, basically log in. Afterward, you are able to download the South Carolina Oil, Gas and Mineral Deed - Individual to Two Individuals design.

If you do not provide an profile and want to begin using US Legal Forms, follow these steps:

- Find the form you need and make sure it is for the correct town/county.

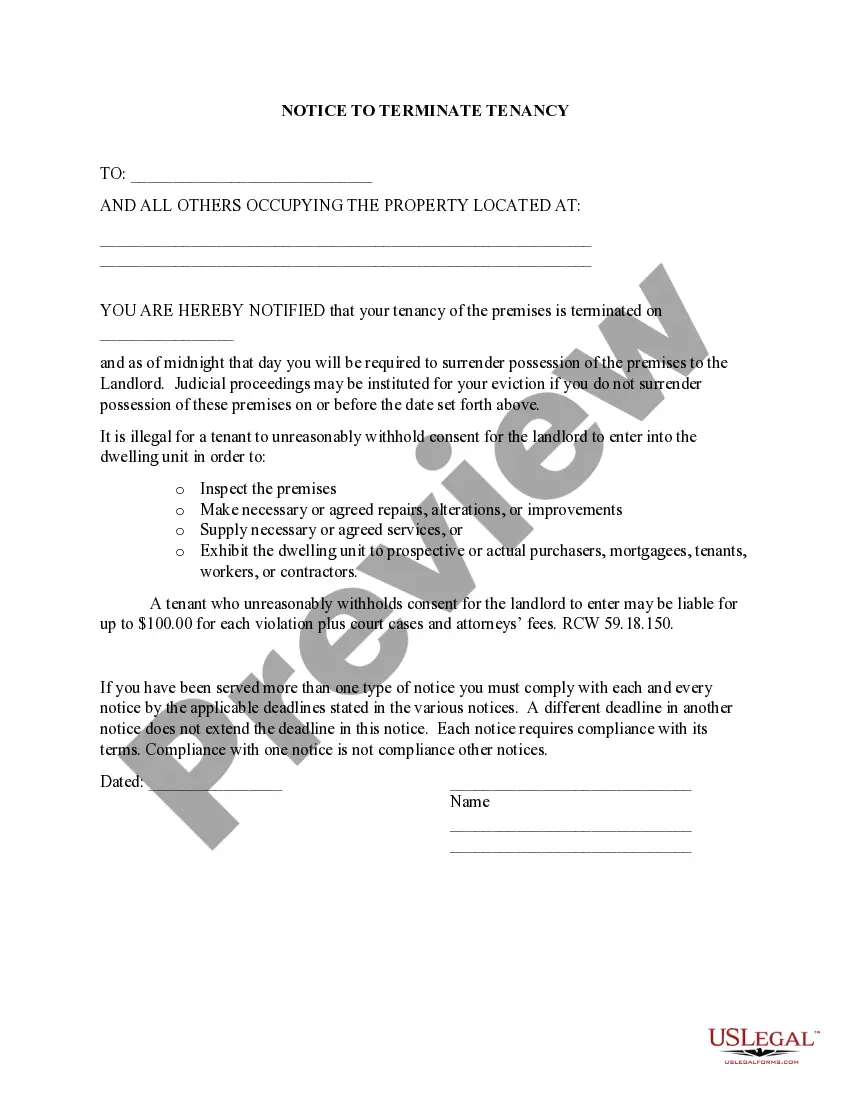

- Make use of the Review option to examine the form.

- Look at the description to actually have selected the correct form.

- If the form isn`t what you are trying to find, make use of the Research area to get the form that meets your needs and demands.

- When you obtain the correct form, click on Purchase now.

- Opt for the costs plan you would like, submit the desired info to produce your bank account, and buy your order making use of your PayPal or charge card.

- Pick a convenient document formatting and download your duplicate.

Get each of the papers layouts you possess purchased in the My Forms food list. You can obtain a further duplicate of South Carolina Oil, Gas and Mineral Deed - Individual to Two Individuals whenever, if possible. Just click on the essential form to download or print the papers design.

Use US Legal Forms, by far the most comprehensive selection of legitimate forms, in order to save efforts and avoid errors. The service delivers appropriately made legitimate papers layouts that you can use for an array of reasons. Create a merchant account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

The deed recording fee is one dollar and eighty-five cents for each five hundred dollars, or fractional part of five hundred dollars, of the realty's ?value? as determined by S.C.

The South Carolina deed recording fee is imposed for ?the privilege of recording a deed,? and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.

To add a name to your property you must sign a new deed conveying interest to an individual. To take someone's name off property they must sign a new deed conveying their interest to someone else. We DO NOT PREPARE documents in the Register of Deeds Office. We only RECORD documents.

Transfer Tax/Deed Stamps (Seller) South Carolina has a real estate transfer tax of $1.85 per $500 of the sales price. The seller typically pays this fee when transferring the property from the seller's name to the buyer.

The prior owner conveying the property is primarily responsible for payment, and the new owner is secondarily responsible. The deed-recording fee rate is $1.85 for each $500.00 of the real estate's value.

Please note: South Carolina is an Attorney State when it comes to Deed preparation. Any preparation by an individual is considered an unauthorized practice of law. UCC Forms - Click on the SC Secretary of State's Web site below.