South Carolina Minutes for Corporation

Description

How to fill out Minutes For Corporation?

Finding the appropriate legitimate document template may be challenging.

Indeed, there are numerous templates accessible online, but how do you identify the authentic form you need.

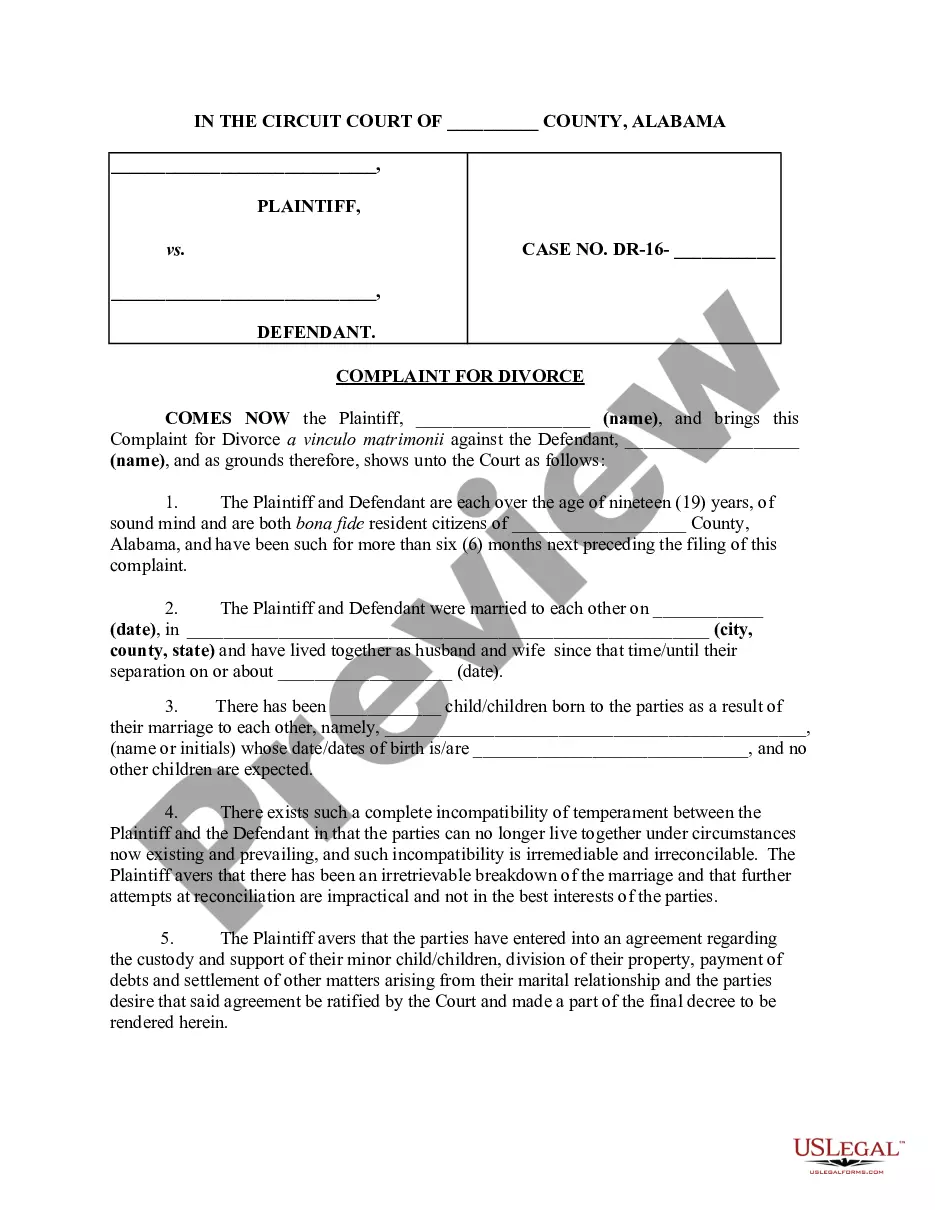

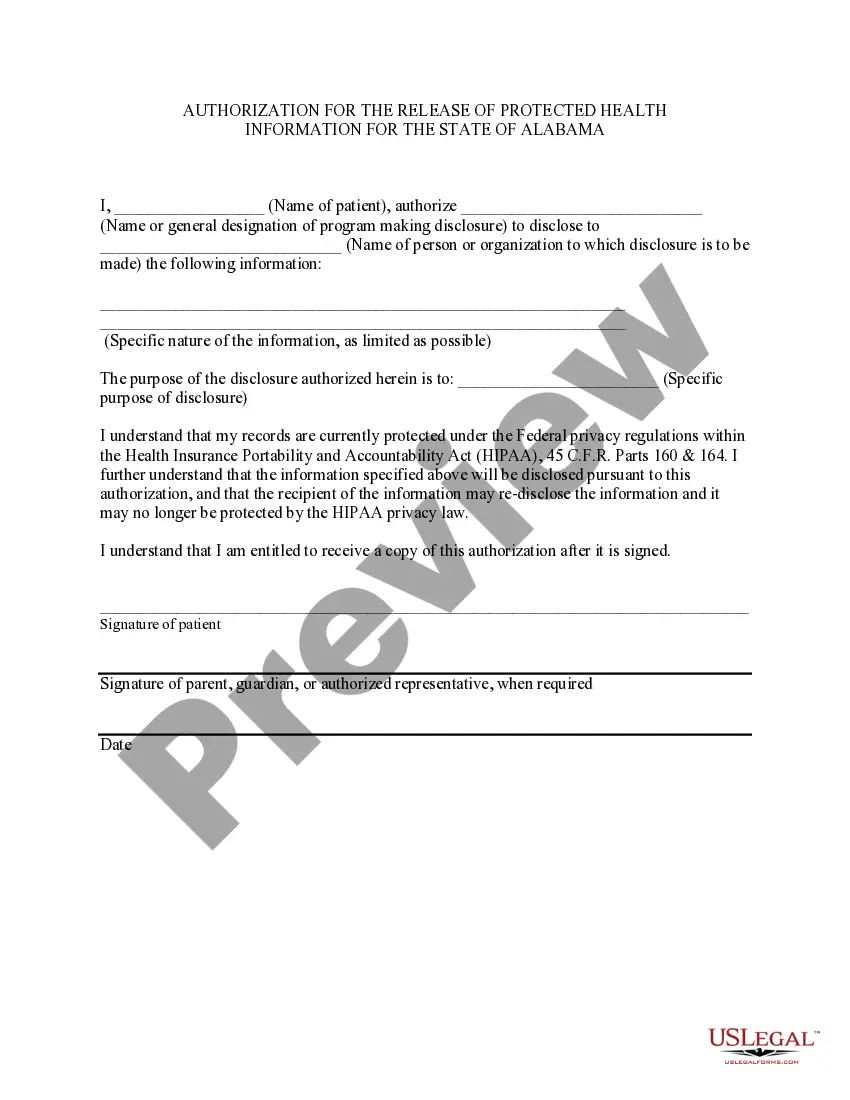

Leverage the US Legal Forms website. This platform provides a vast collection of templates, including the South Carolina Minutes for Corporation, suitable for business and personal use.

You can review the document using the Review option and examine the form description to verify that it meets your needs.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Obtain button to access the South Carolina Minutes for Corporation.

- Use your account to search for the legal documents you have previously acquired.

- Navigate to the My documents section in your account to get an additional copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

Writing minutes for a corporation involves capturing crucial details of the meeting in a clear manner. Start by noting the meeting's date, time, and location. Record all participants and summarize the discussions, decisions, and action items. By following these steps, you ensure accurate South Carolina minutes for corporation, providing a valuable record for future reference.

Recording minutes in an S Corporation follows the same principles as any corporate entity. Begin with the meeting information, including date, time, and attendees. Next, summarize discussions, including votes and resolutions. Lastly, clearly state the outcomes to maintain proper compliance with South Carolina minutes for corporation requirements.

Taking corporate meeting minutes involves preparing a structured template to capture relevant details. Begin with the meeting details, including participants and agenda items. Document each topic discussed, resolutions passed, and any actions to be taken. This approach is essential for maintaining proper South Carolina minutes for corporation, enhancing transparency and accountability.

To write minutes for a shareholder meeting, start by noting the date, time, and location of the meeting. Next, record the names of those present and any absentees. Then, summarize the key points discussed, including decisions made and actions agreed upon. Ensuring accuracy is vital, as these minutes will serve as an important legal document for South Carolina minutes for corporation records.

Yes, South Carolina recognizes federal extensions for various filings, including income tax. If you have filed for a federal extension, ensure to adhere to any state-specific procedures. Keeping detailed South Carolina minutes for corporation meetings will assist in managing these deadlines effectively.

Yes, South Carolina accepts federal extensions for corporate tax filings. If you apply for an extension at the federal level, it's important to also verify any pertinent state requirements. Maintaining well-documented South Carolina minutes for corporation can provide clarity on filing status and ensure compliance with state laws.

Corporate minutes should be prepared after each meeting where business decisions are made. This documentation is essential for legal compliance and maintaining corporate formalities in South Carolina. Regular updates in South Carolina minutes for corporation can help protect your business and provide a clear record of all actions taken.

Yes, filing a CL-1 is necessary for corporations in South Carolina that are seeking to renew their corporate registration. This document provides essential information about your corporation's structure and operations. Documenting the decisions surrounding this filing in your South Carolina minutes for corporation will help ensure transparency.

Yes, South Carolina imposes a corporate income tax on corporations doing business in the state. The current rate is based on federal taxable income. Staying informed about your tax obligations and documenting decisions in South Carolina minutes for corporation meetings can aid in compliance and strategic planning.

Yes, corporations in South Carolina are required to file annual reports with the Secretary of State. This filing helps maintain your corporation's good standing and ensures compliance with state regulations. Remember, keeping thorough records, including South Carolina minutes for corporation meetings, is crucial for accurate reporting.