South Carolina Employment Application for Accountant

Description

How to fill out Employment Application For Accountant?

If you require to complete, obtain, or produce legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Employ the site's simple and user-friendly search option to locate the documents you seek. Various templates for business and personal uses are categorized by type, state, or keywords.

Utilize US Legal Forms to obtain the South Carolina Employment Application for Accountant in just a few clicks.

Each legal document format you buy is yours indefinitely. You have access to every document you have downloaded in your account.

Be proactive and obtain, and print the South Carolina Employment Application for Accountant using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the South Carolina Employment Application for Accountant.

- You can also view forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

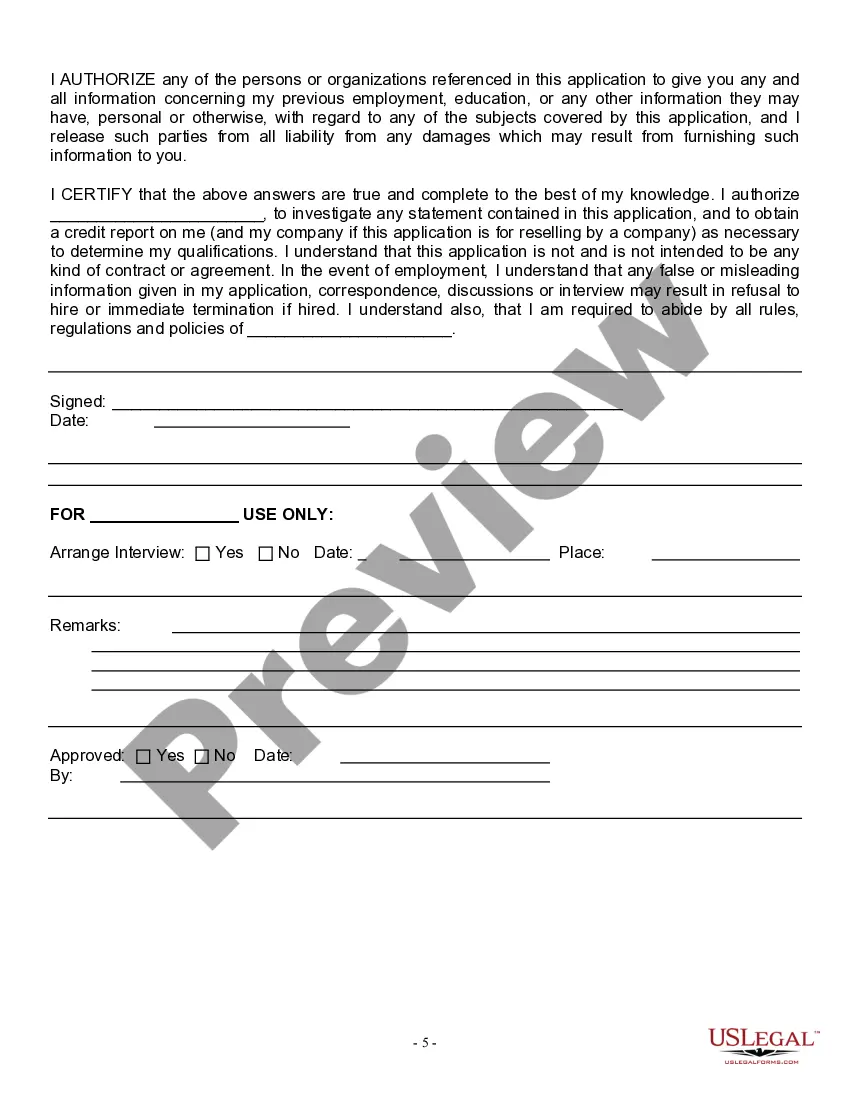

- Step 2. Utilize the Preview feature to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, select the Buy now button. Choose your preferred pricing plan and enter your credentials to create an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the South Carolina Employment Application for Accountant.

Form popularity

FAQ

Types of Accounting Careers With an accounting degree, you can work for the state or federal government, companies, nonprofit organizations, schools, law firms and accounting firms. However, you can also work for yourself as a consultant or CPA, or even own your own accounting firm.

How much does a Staff Accountant I make in South Carolina? The average Staff Accountant I salary in South Carolina is $54,386 as of March 29, 2022, but the range typically falls between $49,471 and $59,877.

Becoming a staff accountant offers you the potential for salary growth and career advancement. If you have a four-year accounting degree and a year of experience, you're in a great position to land a staff accountant position.

Yes. Your firm can have non-CPA owners, but the majority of the firm's ownership (at least 51%) must be held by CPAs who are currently licensed in some state. All owners must be active individual participants in the firm. Investors, LLPs, LLCs, and commercial interests are not permitted to be firm owners.

Steps to Become a CPA in South CarolinaComplete 150 semester hours of acceptable college-level coursework in accounting.Accumulate the required hours of experience.Complete the AICPA ethics course and exam.Pass the Uniform CPA Examination.Apply for a license.Receive a license.

The Highest Paying Cities for CPAsSan Francisco, California. Median Annual Salary: $96,099.New York, New York. Median Annual Salary: $94,951.Houston, Texas. Median Annual Salary: $85,867.Atlanta, Georgia. Median Annual Salary: $82,174.Dallas, Texas. Median Annual Salary: $82,089.Seattle, Washington.Chicago, Illinois.

You can work in a number of roles with an accounting degree besides accounting. Some positions may include budget analyst, business and financial consultant, financial analyst, financial examiner, finance manager, management analyst or personal financial advisor.

Best Cities for AccountantsSan Francisco, California.New York, New York.Los Angeles, California.San Jose, California.Boston, Massachusetts.Philadelphia, Pennsylvania.Atlanta, Georgia.Washington, D.C.More items...?

The accounting director/controller often holds a Vice President position in the organization, which makes it one of the highest paying accounting jobs in the market. They report to the Chief Financial Officer and draw a salary of about $152,000.

Accountants typically work in offices. This may be in a corporate office, a government office, or a private office. Because many of the documents accountants prepare and submit are time sensitive, the work environment is often fast-paced.