This form is a simple Escrow Release, by which the parties to a transaction having previously hired an escrow agent to perform certain tasks release the agent from service following the completion of tasks and satisfaction of escrow agreement. Adapt to fit your circumstances.

South Carolina Escrow Release

Description

How to fill out Escrow Release?

Have you ever been in a situation where you require documents for either professional or personal reasons almost every day.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the South Carolina Escrow Release, designed to meet federal and state requirements.

Select the pricing plan you desire, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can download another copy of the South Carolina Escrow Release whenever required by selecting the appropriate form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Then, you can obtain the South Carolina Escrow Release template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct state/region.

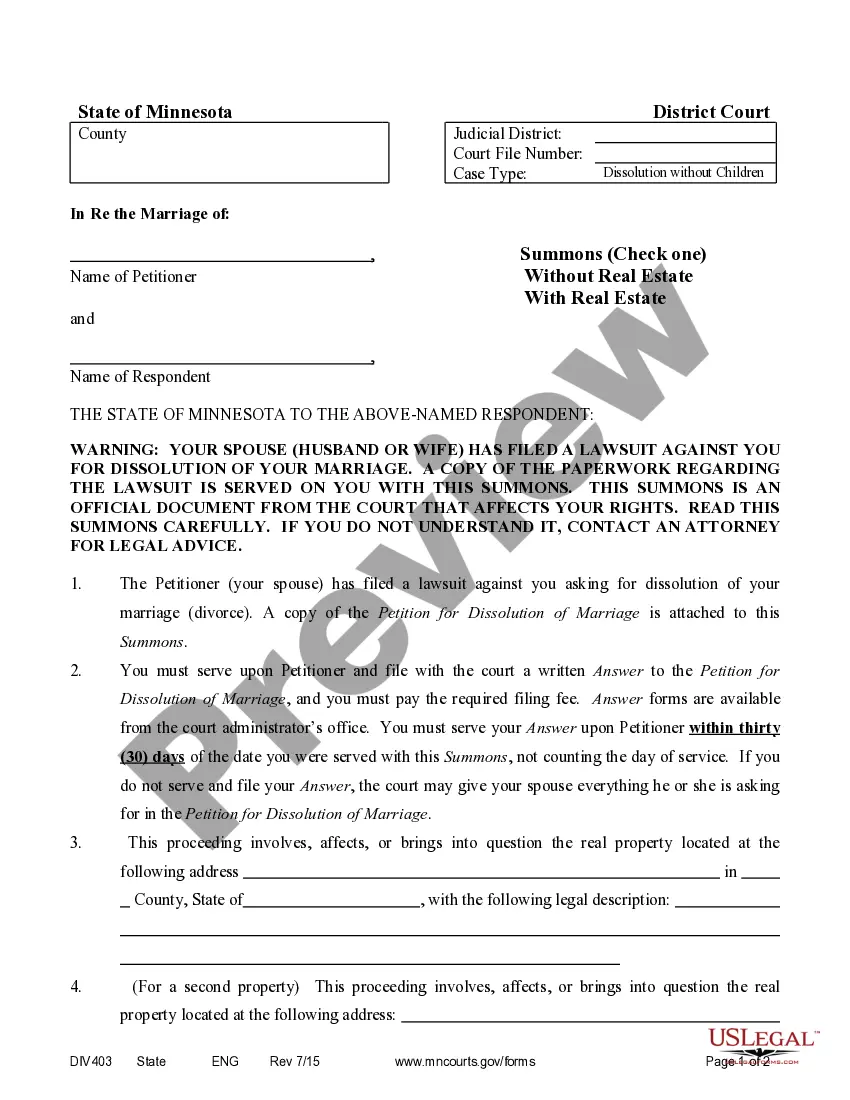

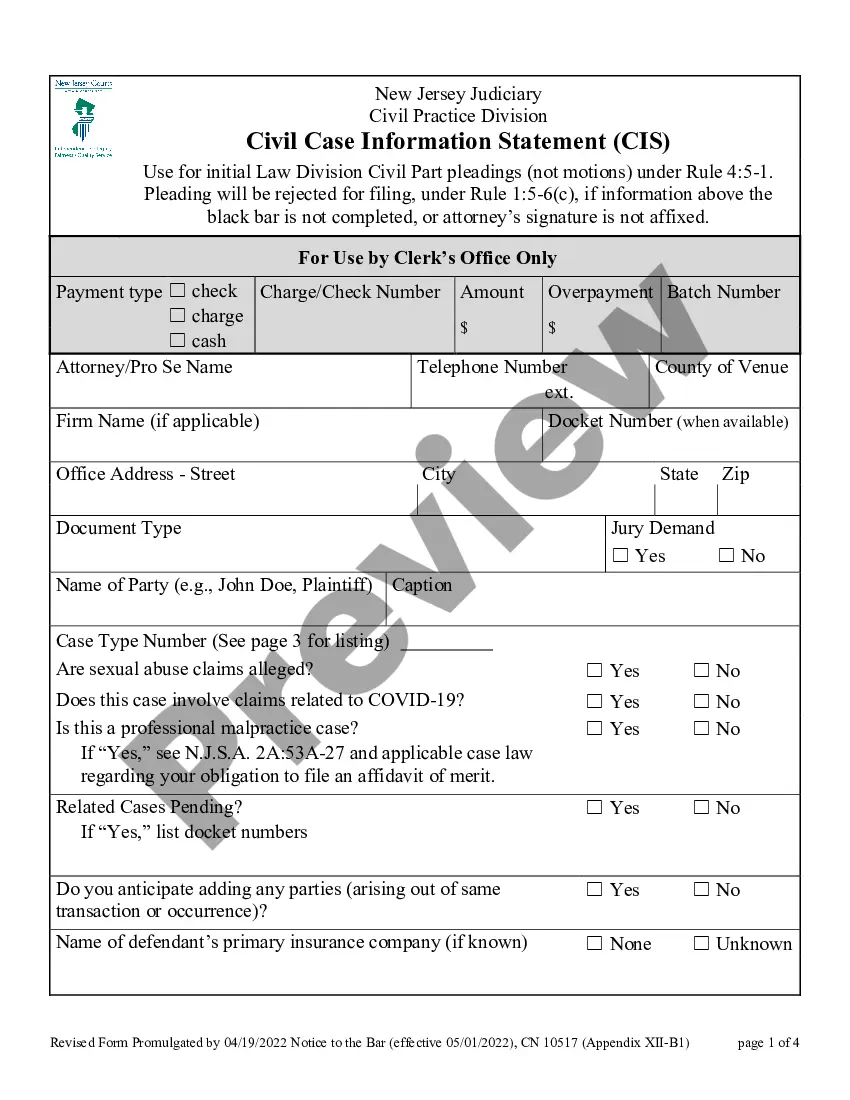

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and requirements.

- Once you locate the right form, click Acquire now.

Form popularity

FAQ

In order to release earnest money, state law requires a signed release, a court order or mediation. This law protects the real estate agent from becoming embroiled in the dispute since the agent cannot choose sides and release the money.

Long-story-short, an escrow release is the issuing of money after agreement terms are met.

Release of Earnest Money The statute requires that the broker must keep the money in the trust account until the parties complete the real estate sale or exchange transaction, or until the transaction otherwise terminates.

If your offer is not accepted, you'll get back your deposit. Keep in mind that if you back out of an offer once it's accepted and all conditions have been met, you may forfeit the full amount of the deposit and may be liable for other costs incurred by the seller.

Before pulling out your checkbook, you should understand that this deposit will go towards the amount you pay at closing. In South Carolina, this money sits in an escrow account, usually with your Realtor's company, until the closing is ready to take place.

After you make a deposit of funds into the Escrow Account, you cease to control those funds. The funds are held securely until your barrister lodges a request for funds to be released on a specified Payment Release Date.

Is Escrow Good or Bad? Escrow is generally considered good, as it protects the buyer and seller of a transaction. As well, escrow as part of mortgage payments is generally good for the lender and helps the buyer by ensuring property taxes and homeowners insurance are paid on time.

In South Carolina, a seller can get out of a real estate contract if the buyer's contingencies are not metthese include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

An escrow funds release certificate is a certification of the amount of the escrow funds (all or part) to be released from those funds placed into escrow with an escrow agent pursuant to an escrow holdback agreement. Escrow funds are only disbursed to the applicable party when it satisfies its outstanding obligations.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.