Form with which an individual may formally accept his/her election as a corporate officer or representative.

South Carolina Acceptance of Election - Corporate Resolutions

Description

How to fill out Acceptance Of Election - Corporate Resolutions?

Are you in a location where you need documents for both business or personal reasons nearly every time.

There are numerous official form templates available online, but obtaining forms you can trust isn't simple.

US Legal Forms offers thousands of template forms, including the South Carolina Acceptance of Election - Corporate Resolutions, which are created to comply with federal and state requirements.

Choose the payment plan you prefer, enter the necessary information to process your payment, and complete the transaction using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Acceptance of Election - Corporate Resolutions template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your correct city/region.

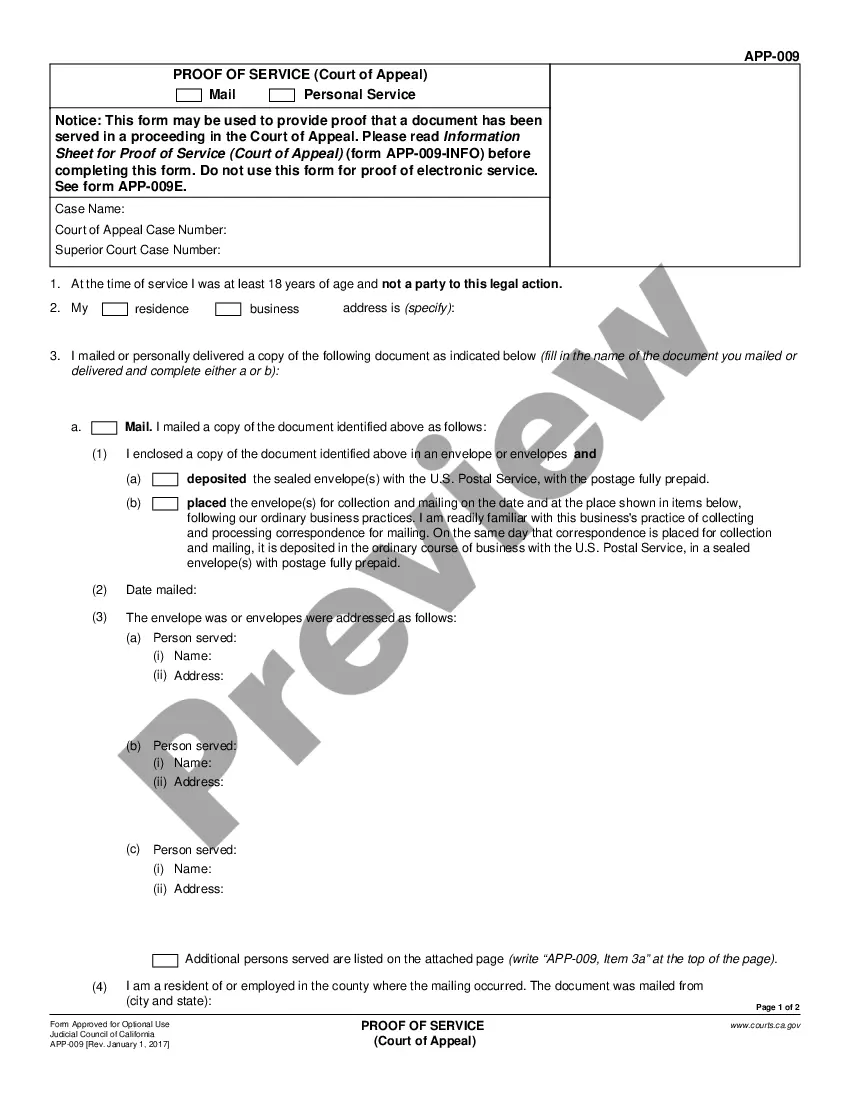

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn't what you're seeking, use the Search field to find the form that fits your needs and requirements.

- Once you locate the correct form, click Get now.

Form popularity

FAQ

When a board resolution is passed by a simple majority, it is called an ordinary resolution. Votes cast in favor are more than the ones against. A resolution with a majority of just over 50% of the quorum is considered passed. For example, 6 'yes' votes out of 10 are considered a majority.

Obviously, the resolution is approved when the majority of the board members vote yes. There should also be a place for the board president to sign and date the resolution.

The resolution is often used to express the body's approval or disapproval of something which they cannot otherwise vote on, due to the matter being handled by another jurisdiction, or being protected by a constitution.

Who needs to sign a board resolution? The board members need to sign the board resolution. The President and Secretary only need to sign when the resolution is certified. But they can sign an uncertified board resolution as well, but it is not required.

To approve the Ratification Resolution, a majority of not less than one-half or 50% of the votes cast by the shareholders of the Corporation, whether in person or by proxy, must be voted in favour of it. Until the Ratification Resolution is passed, the Ratification Options may not be exercised.

When recording a resolution in the minutes, the exact wording of the resolution, the names of proposers and seconders, and the names of those voting in favor of or contrary to the resolution should be recorded.

It's a formal document that solidifies in writing important decisions that boards of directors make. Boards usually write up board resolutions when they appoint new directors to the board. Resolutions authorize committees to take action on matters that the board voted on.

Board resolutions serve as compliance documents when there is a need to verify the choices that both shareholders and directors have made in regards to the company. These resolutions are often sent to agencies that need a record of the goings-on of a corporation such as government agencies or oversight committees.

Resolutions. A resolution is simply another form of a motion, but it's more formal and usually used for more important or ceremonial issues. Resolutions adopted by the board and later approved by the directors are considered a formal act of the corporation and not just a board action.