South Carolina Guidelines for Declaring a Mobile Home Derelict and For Its Destruction or Sale

Description

How to fill out South Carolina Guidelines For Declaring A Mobile Home Derelict And For Its Destruction Or Sale?

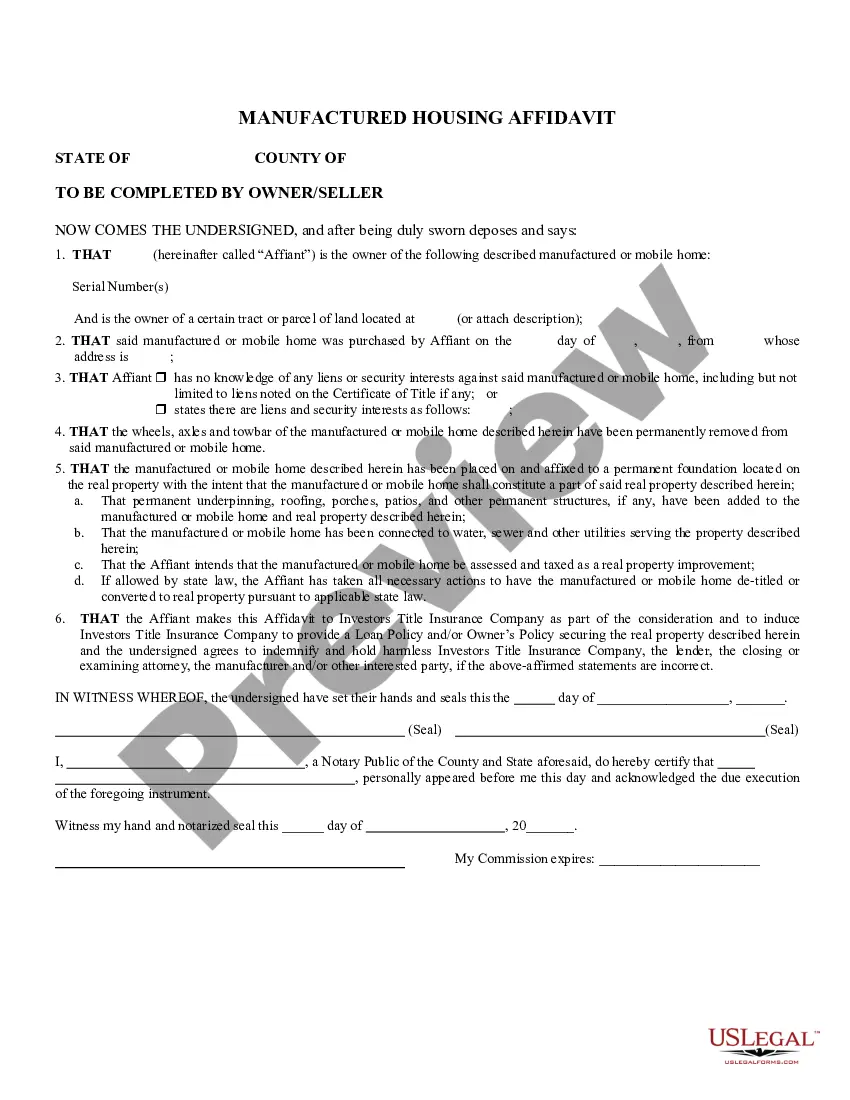

Handling official paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your South Carolina Guidelines for Declaring a Mobile Home Derelict and For Its Destruction or Sale template from our service, you can be sure it complies with federal and state laws.

Working with our service is straightforward and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your South Carolina Guidelines for Declaring a Mobile Home Derelict and For Its Destruction or Sale within minutes:

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Guidelines for Declaring a Mobile Home Derelict and For Its Destruction or Sale in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the South Carolina Guidelines for Declaring a Mobile Home Derelict and For Its Destruction or Sale you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

You must have the title. If the title does not have a Bill of Sale on the back, you must bring the Bill of Sale.

Detitling is a process to combine a manufactured home with land into one assessment, resulting in one tax bill. This should be done through the local County and SCDMV offices. One benefit to the homeowner is increased financing options on a detitled home that would not be available otherwise.

On average, the numbers are 5 to 9 units per acre.

What is the oldest manufactured home you can move? ing to the HUD regulations, if your home was built before 1976 it doesn't meet the current safety standards and shouldn't be moved even a short distance.

(A) Intangible property held for the owner by a court, state, or other government, governmental subdivision or agency, public corporation, or public authority which remains unclaimed by the owner for more than five years after becoming payable or distributable is presumed abandoned.

Property Taxes ? In South Carolina, mobile homes are taxed and assessed as real property. Therefore, whether the mobile home is being actively used as a residence or abandoned and in poor condition, the mobile home will remain on the tax roll. Mobile homes are NOT assessed, taxed and regulated the same as vehicles.

When applying, please have a copy of the Manufactured Home title certificate and a copy of the most recent real property tax receipt for the manufactured home. The fee for the detitle permit is $53. The home must also be affixed to the property.