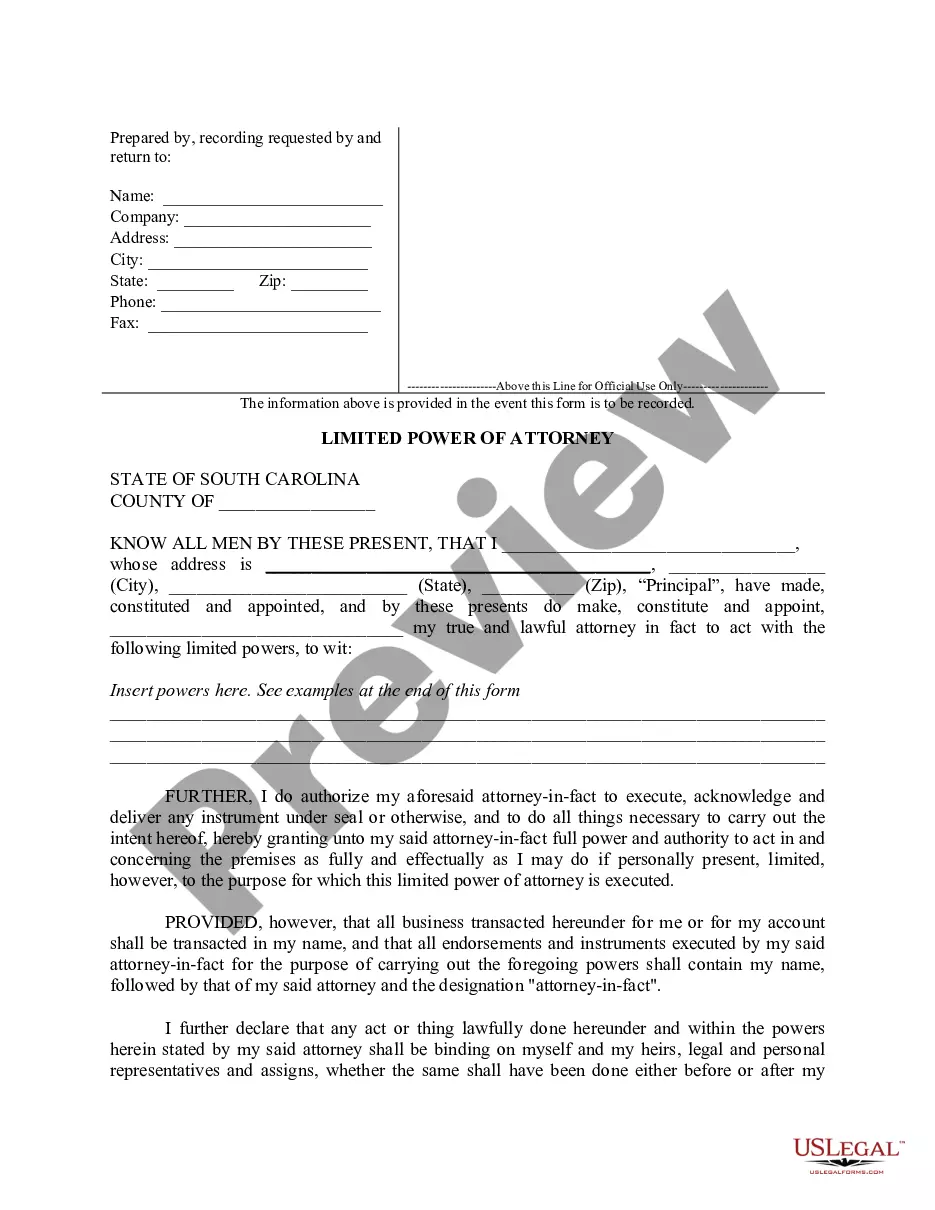

South Carolina Limited Power of Attorney where you Specify Powers with Sample Powers Included

Overview of this form

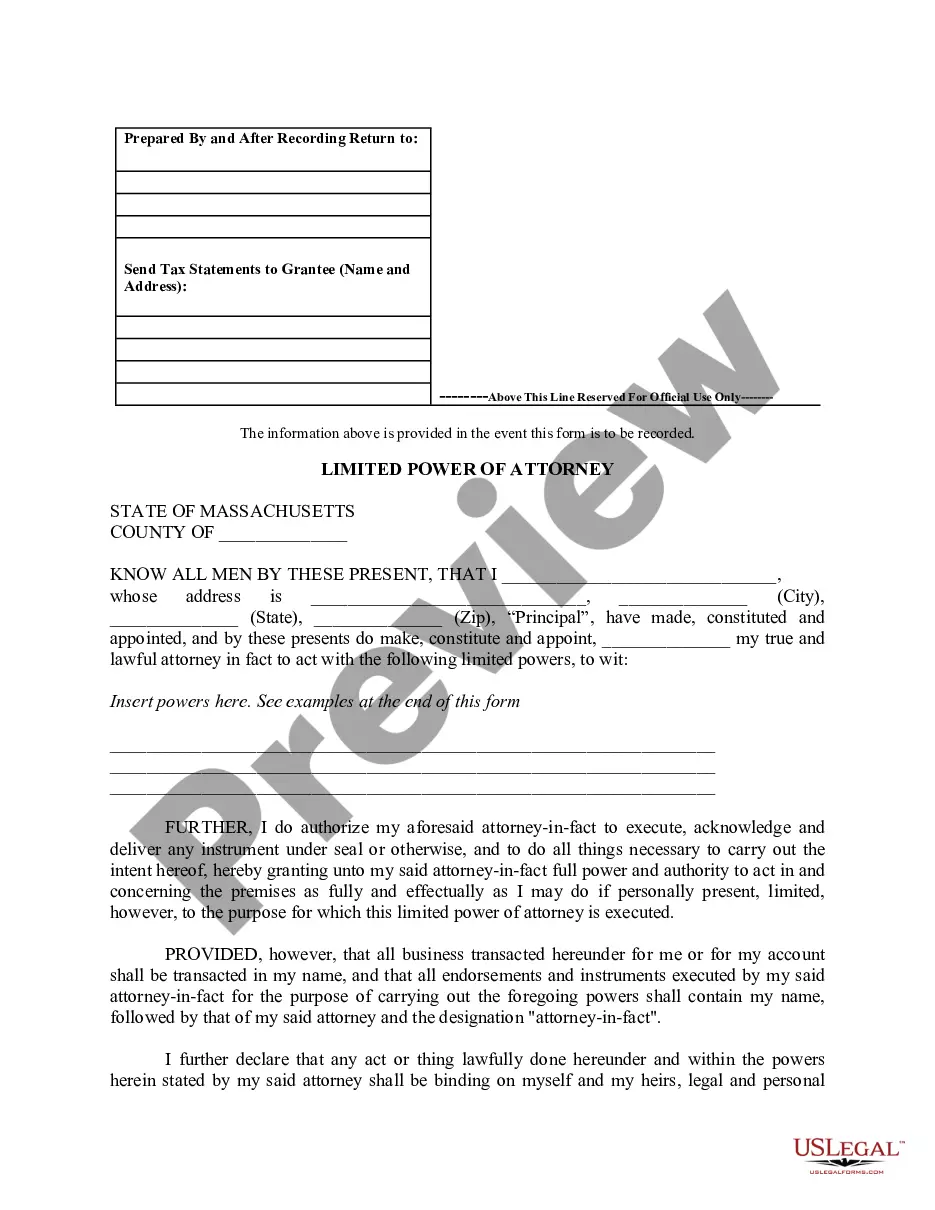

The Limited Power of Attorney is a legal document that allows you to designate someone else, referred to as your agent, to make specific decisions on your behalf in South Carolina. This form is unique in that it enables you to specify the precise powers you grant to your agent, differentiating it from a general power of attorney, which typically provides broader authority. This form includes sample powers for illustration, which should be customized to suit your needs.

Key parts of this document

- Principal and agent information: Names and addresses of the individual granting authority and the appointed agent.

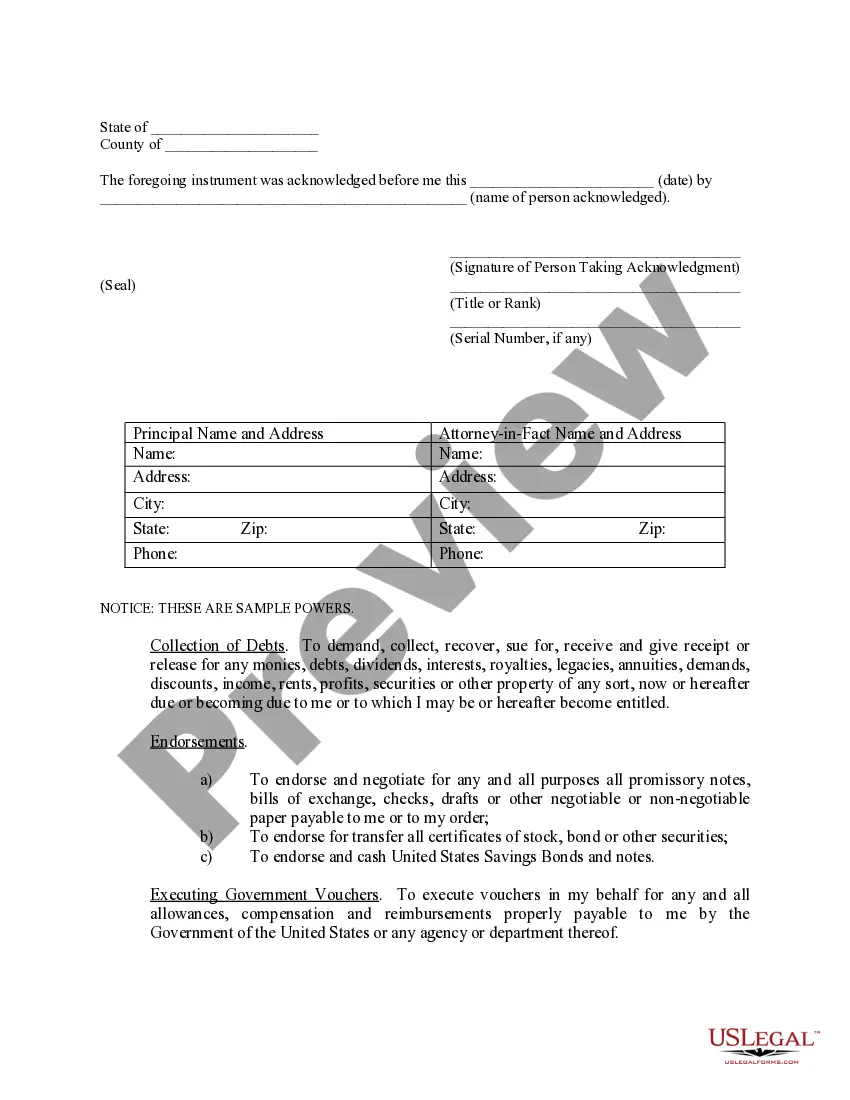

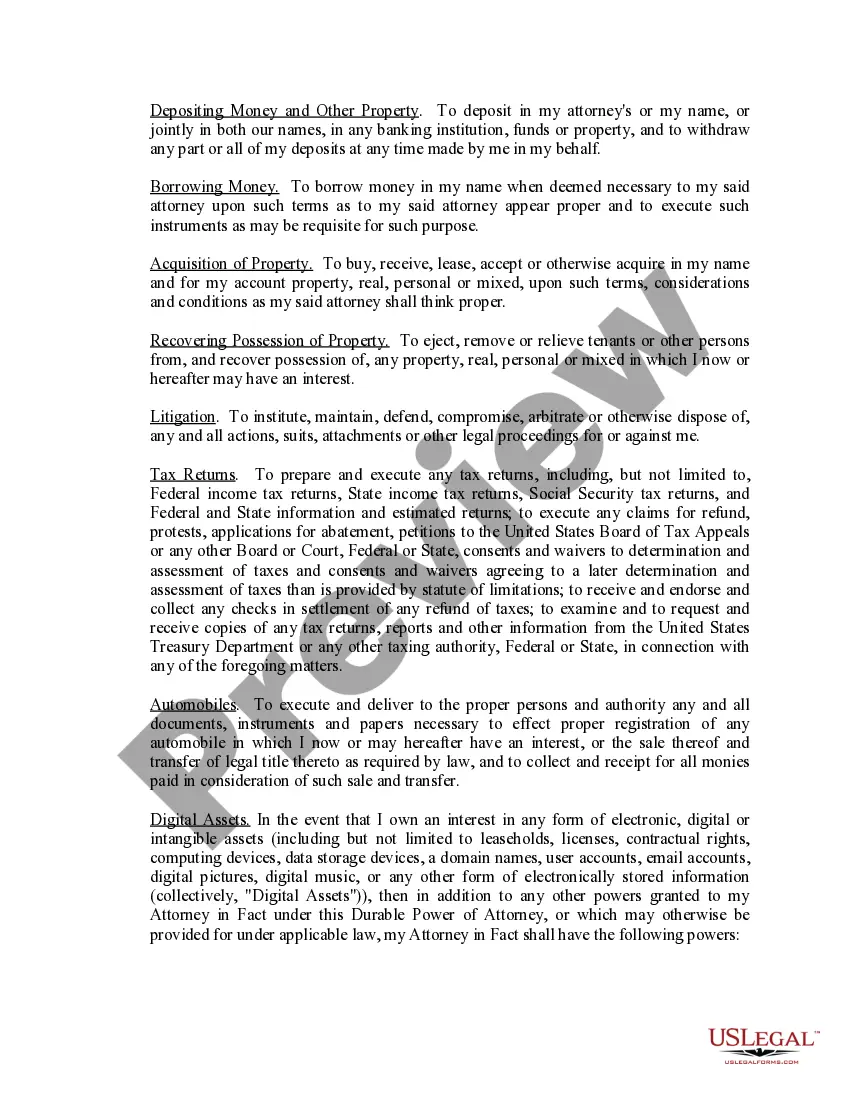

- Specified powers: A section where you can customize and specify the powers granted to the agent.

- Acknowledgment for recording: An area to include details if the form is to be officially recorded.

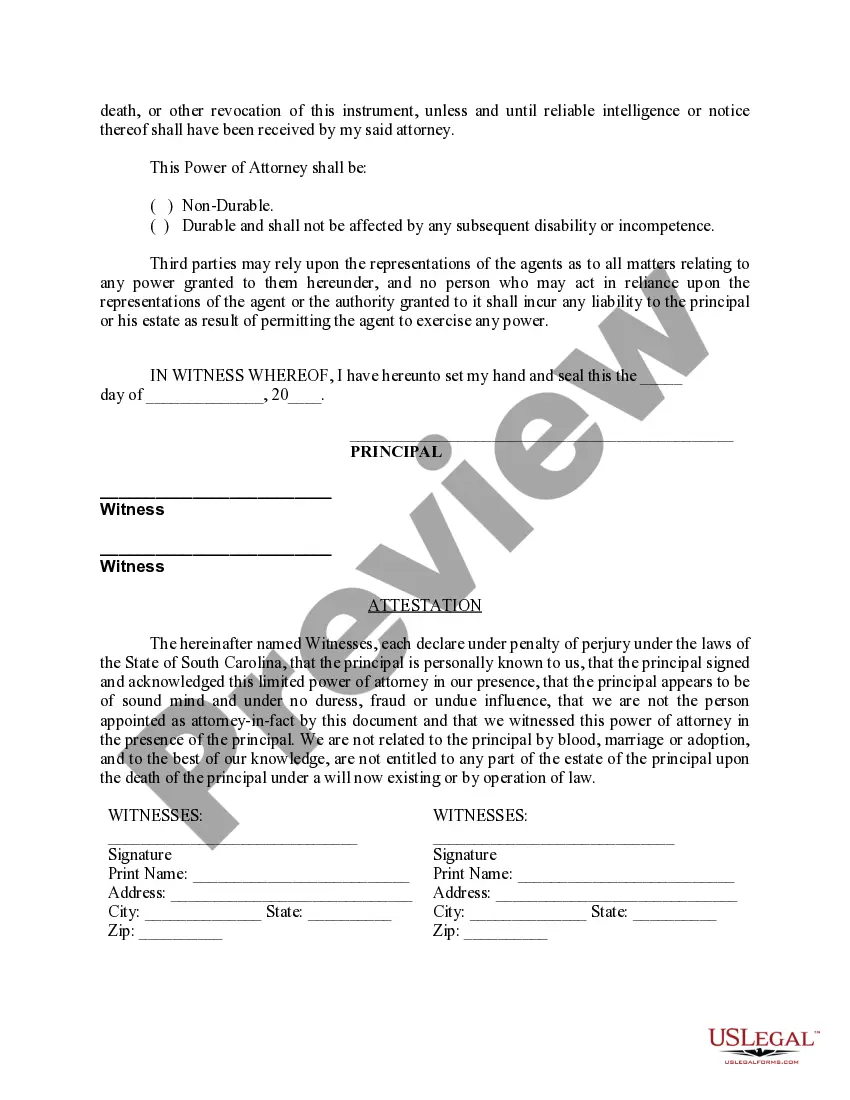

- Witness and notary sections: Spaces designated for signatures of witnesses and a notary public, if required.

- Choice between durable and non-durable: An option to indicate if the power of attorney is durable, surviving a principal's incapacity.

When this form is needed

This form is most useful when you need someone to manage specific affairs on your behalf, such as financial transactions, real estate decisions, or other legal matters. It can be used when you are temporarily unavailable or want to delegate tasks for a limited time, ensuring that your affairs are handled in your absence.

Who should use this form

- Individuals who wish to appoint a trusted person to handle specific tasks or transactions.

- People who need assistance with financial decisions but want to maintain control over other matters.

- Residents of South Carolina who are preparing for temporary incapacity or absences, such as travel or medical emergencies.

Completing this form step by step

- Identify the parties: Enter the names and addresses of both the principal and the agent.

- Specify powers: Clearly outline the specific powers you wish to grant to your agent in the designated section.

- Choose the durability option: Indicate whether this power of attorney is durable or not, based on your preference.

- Sign the document: Ensure you sign and date the form in the presence of witnesses.

- Notarize if required: Complete the notary section to formally acknowledge the document if necessary.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to specify the powers granted, leaving the agent uncertain about their authority.

- Not having the document signed in front of required witnesses, leading to potential validity issues.

- Overlooking the need for notarization, which may be necessary if the form is recorded.

- Not removing sample powers that are not applicable to your situation.

Advantages of online completion

- Convenience of instant download, allowing you to access and complete the form at your own pace.

- Editability ensures you can customize the powers and other fields easily.

- Reliability of forms drafted by licensed attorneys, providing peace of mind regarding legal compliance.

Main things to remember

- This Limited Power of Attorney allows you to grant specified powers to an agent in South Carolina.

- It is crucial to clearly outline the powers and ensure proper witnessing and notarization.

- Using this document online provides flexibility and legal assurance.

Form popularity

FAQ

Yes, South Carolina requires that Powers of Attorney are witnessed and notarized.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.

A general power of attorney is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself. For example, a general power of attorney may give your attorney-in-fact the right to sign documents for you, pay your bills, and conduct financial transactions on your behalf.

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.