This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

South Carolina Articles of Incorporation for Domestic For-Profit Corporation

Description

How to fill out South Carolina Articles Of Incorporation For Domestic For-Profit Corporation?

Creating documents isn't the most straightforward job, especially for those who almost never deal with legal papers. That's why we advise using accurate South Carolina Articles of Incorporation for Domestic For-Profit Corporation samples made by professional attorneys. It allows you to stay away from difficulties when in court or handling formal organizations. Find the templates you require on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the file page. Right after downloading the sample, it will be saved in the My Forms menu.

Users with no an active subscription can quickly create an account. Look at this simple step-by-step guide to get your South Carolina Articles of Incorporation for Domestic For-Profit Corporation:

- Ensure that the form you found is eligible for use in the state it is necessary in.

- Verify the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this form is the thing you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these easy steps, it is possible to fill out the form in your favorite editor. Check the filled in details and consider requesting an attorney to examine your South Carolina Articles of Incorporation for Domestic For-Profit Corporation for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

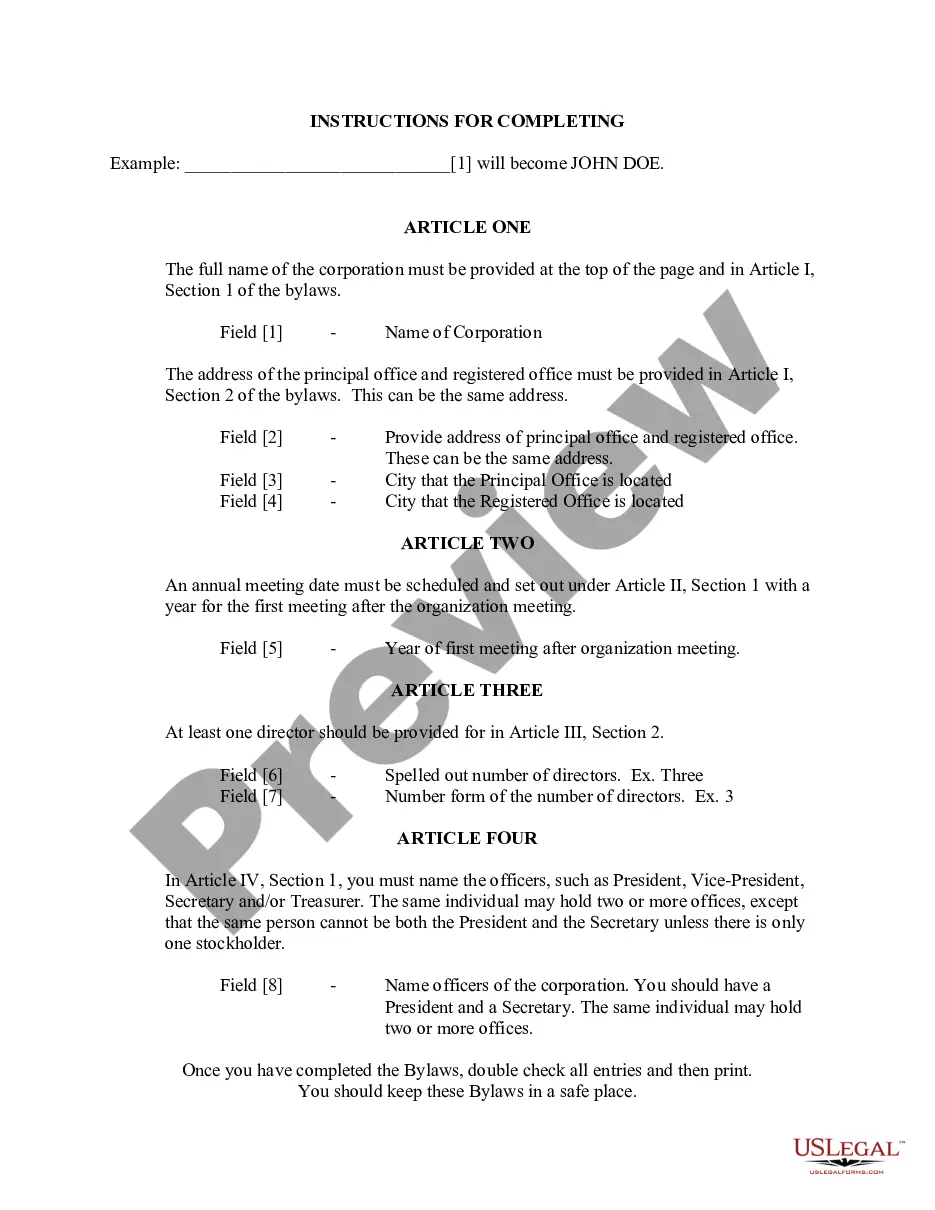

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

Are articles of incorporation public? The answer is yes. These documents, which are filed with the Secretary of State or similar agency to create a new business entity, are available for public viewing.In some states, including Arizona, the articles of incorporation can be downloaded by anyone for free.

A domestic limited liability company (LLC) is a business entity that operates in the state where it formed. It is a type of for-profit business structure that combines the benefits of corporations and partnerships into a single business form. Because of this, they are most popular for small businesses.

To file Article of Organization in paper format, file with the South Carolina Secretary of State and pay a fee of $110. Fill out the pdf form online, print and mail 2 copies, the original and either a duplicate original or a conformed copy.

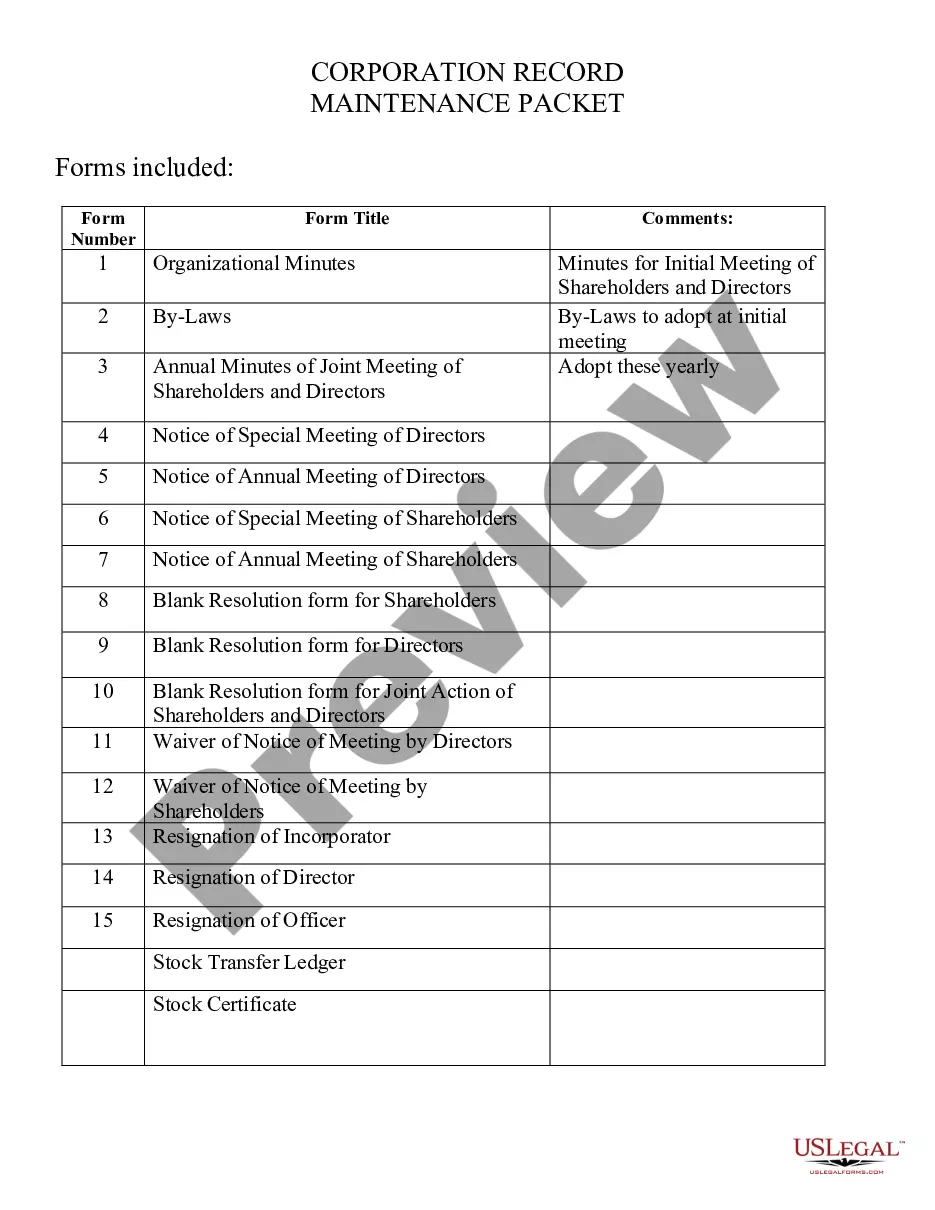

Articles of Incorporation - Domestic Corporation. Form CL-1: Initial Annual Report of Corporations. Bylaws. IRS Form SS-4: Obtain an EIN. Form 2553: S-Corp Election, if desired. Form SCDOR-111: South Carolina Department of Revenue Tax Registration Application.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State.Corporate returns must be filed as long as the corporation's charter or authority to do business is registered with South Carolina Secretary of State.

To start a corporation in South Carolina, you must file Articles of Incorporation and an Initial Report with the Secretary of State. Together these documents cost $135, plus a $15 fee for processing of your paperwork.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.