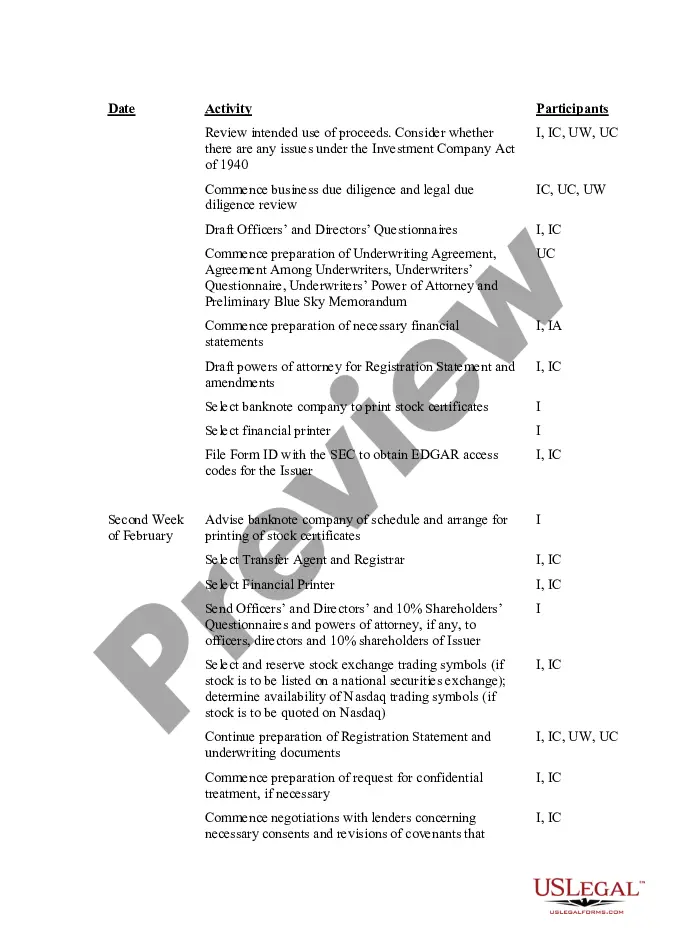

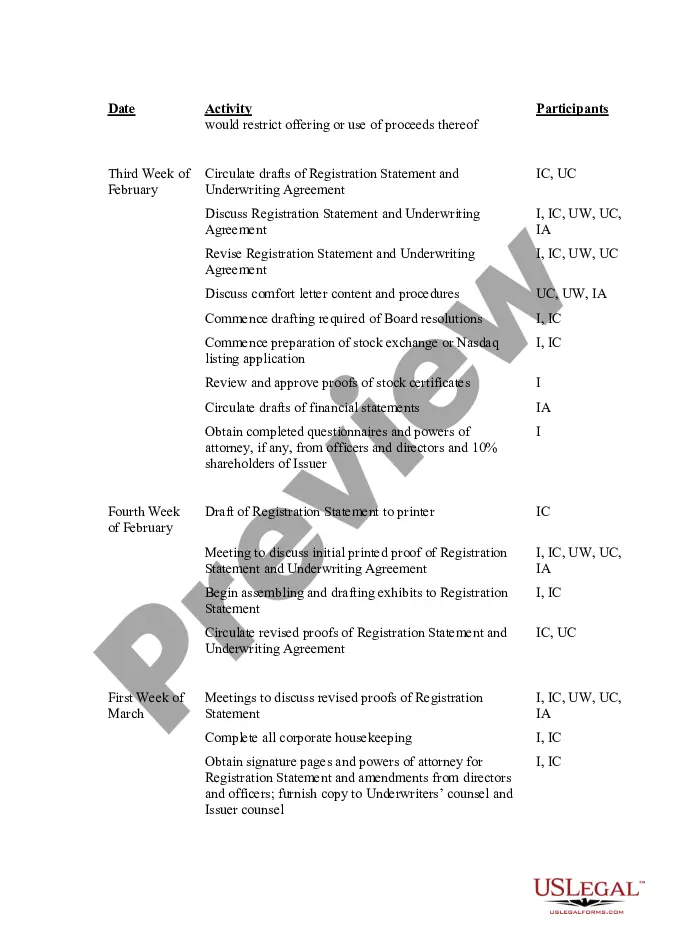

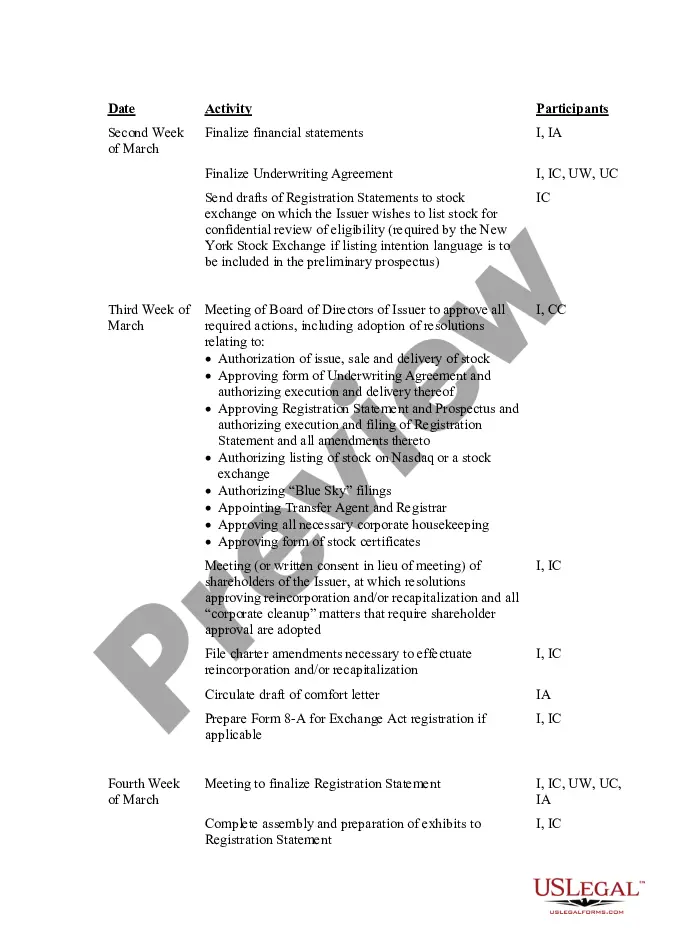

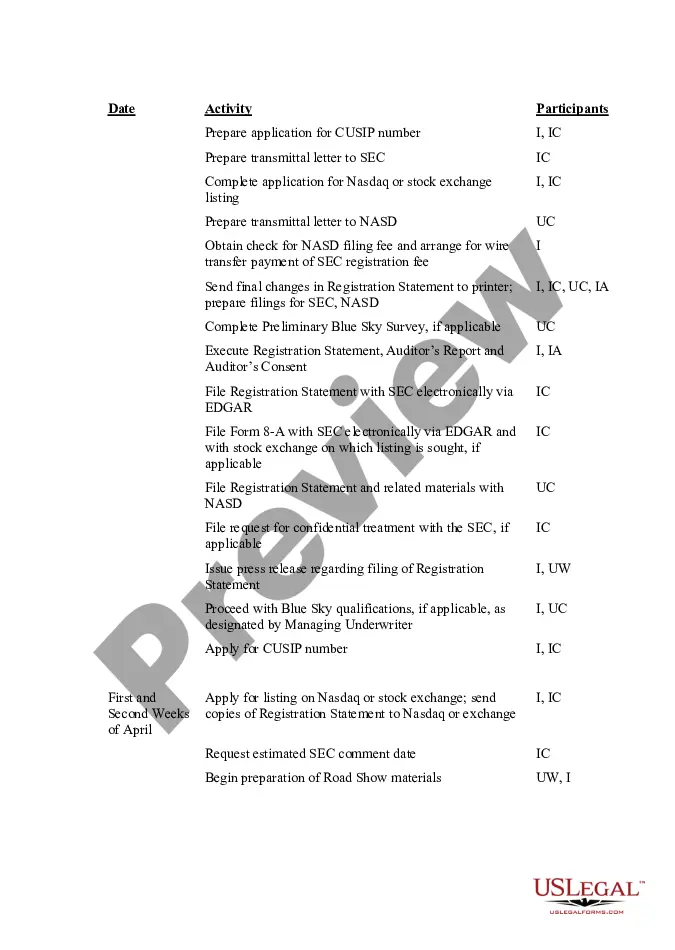

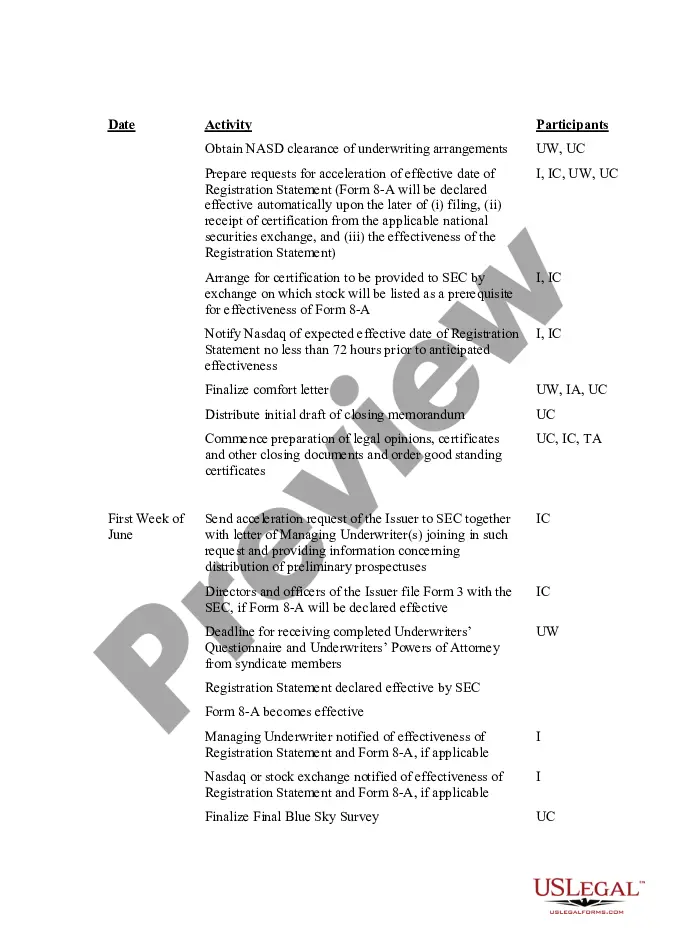

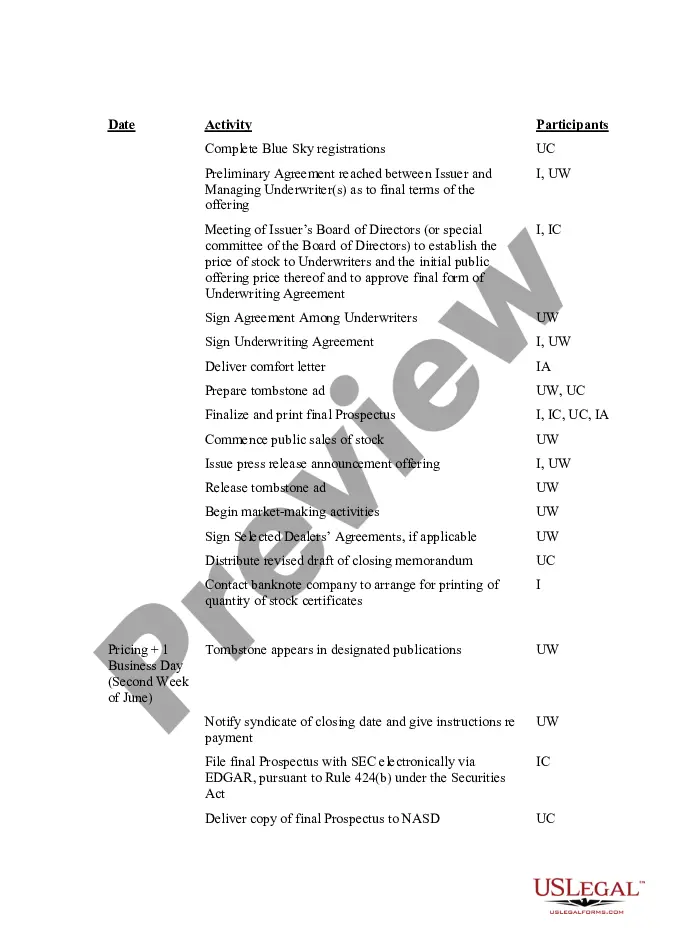

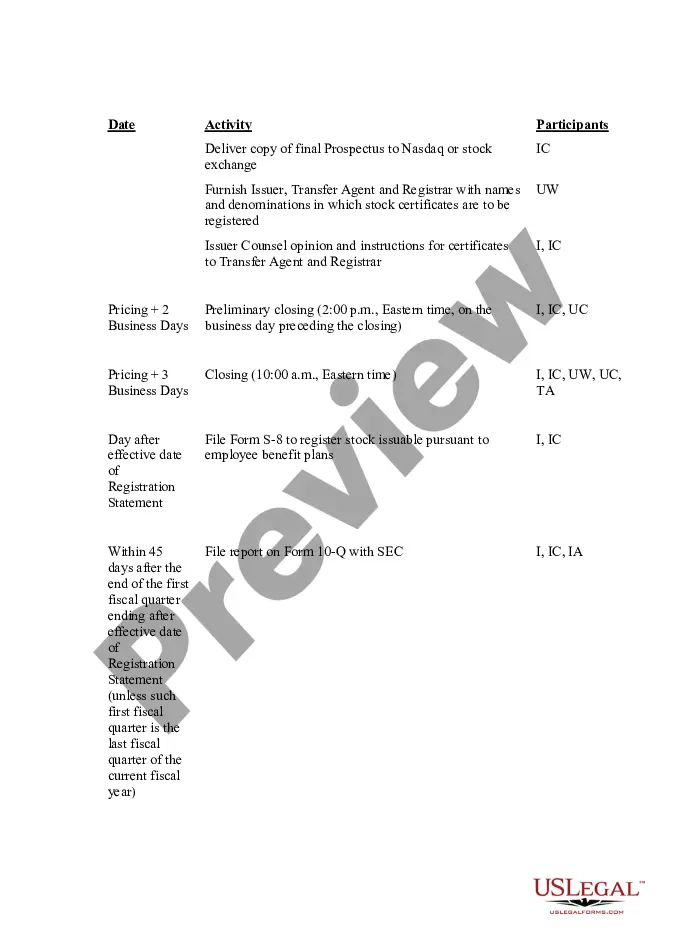

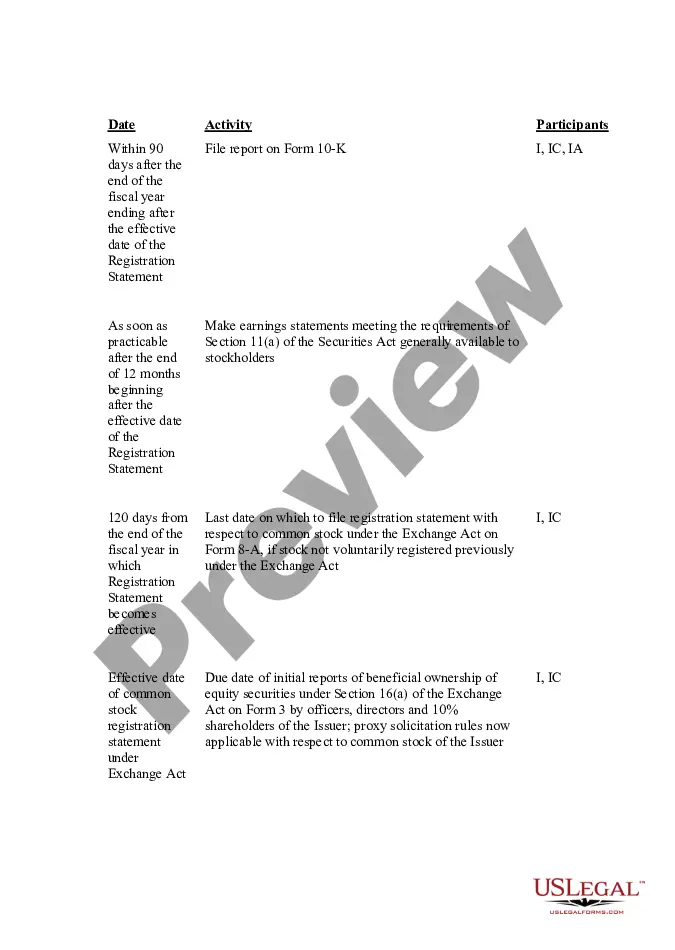

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Rhode Island IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

If you need to total, obtain, or print out authorized record layouts, use US Legal Forms, the biggest selection of authorized forms, that can be found on the Internet. Take advantage of the site`s simple and hassle-free research to obtain the files you require. A variety of layouts for company and person purposes are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Rhode Island IPO Time and Responsibility Schedule with a number of clicks.

In case you are previously a US Legal Forms buyer, log in for your profile and click on the Acquire button to get the Rhode Island IPO Time and Responsibility Schedule. You may also gain access to forms you in the past saved from the My Forms tab of your profile.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the correct city/country.

- Step 2. Make use of the Preview method to check out the form`s content. Do not neglect to read the outline.

- Step 3. In case you are unhappy using the type, use the Search discipline on top of the display to locate other versions in the authorized type web template.

- Step 4. Upon having identified the shape you require, click the Buy now button. Choose the costs program you prefer and put your accreditations to register to have an profile.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Select the format in the authorized type and obtain it on your own system.

- Step 7. Total, modify and print out or signal the Rhode Island IPO Time and Responsibility Schedule.

Every single authorized record web template you get is your own property for a long time. You have acces to every type you saved with your acccount. Click on the My Forms segment and choose a type to print out or obtain again.

Be competitive and obtain, and print out the Rhode Island IPO Time and Responsibility Schedule with US Legal Forms. There are millions of skilled and condition-specific forms you may use for your personal company or person demands.

Form popularity

FAQ

Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island's tax system ranks 42nd overall on our 2023 State Business Tax Climate Index.

Minimum Income to File Taxes in California IF your filing status is . . .AND at the end of 2022 you were* . . .THEN file a return if your gross income** was at least . . .Married filing separatelyany age$5Head of householdunder 65 65 or older$19,400 $21,150Qualifying widow(er)under 65 65 or older$25,900 $27,3002 more rows

?Because of the law I signed, billion-dollar companies have to pay a minimum of 15 percent,? Mr. Biden said, referring to the Inflation Reduction Act of 2022. ?God love them.? The new corporate minimum tax was one of the most significant changes to the U.S. tax code in decades.

Rhode Island minimum tax is $400.00. If line 22a or 22b of Federal 1120S is applicable, refer to Rhode Island Schedule S for your tax calculation. Enter the tax from Schedule S, line 8. If Qualified Sub-chapter S Subsidiary, multiply the number of Q-Subs that are a part of this filing by the minimum tax and enter here.

Rhode Island does not allow the use of federal itemized deductions.

The RI-1040 Resident booklet contains returns and instructions for filing the 2022 Rhode Island Resident Individual Income Tax Return. Read the in- structions in this booklet carefully. For your convenience we have provided ?line by line instructions? which will aid you in completing your return.

Subtract the amount of credits on line 12 from the Rhode Island Income Tax Amount on line 11, but not less than the minimum tax of $400.00. If filing a combined return, the minimum tax is calculated by multiplying the number of members that have nexus in Rhode Island times the minimum tax $400.00.