Rhode Island Employment Compensation Package

Description

How to fill out Employment Compensation Package?

US Legal Forms - one of the most significant libraries of authorized types in the United States - delivers a wide array of authorized file templates it is possible to obtain or printing. While using web site, you can find a huge number of types for business and specific purposes, categorized by classes, claims, or keywords and phrases.You will discover the newest versions of types much like the Rhode Island Employment Compensation Package within minutes.

If you already have a membership, log in and obtain Rhode Island Employment Compensation Package from your US Legal Forms library. The Download switch will show up on each form you see. You have access to all in the past delivered electronically types from the My Forms tab of your accounts.

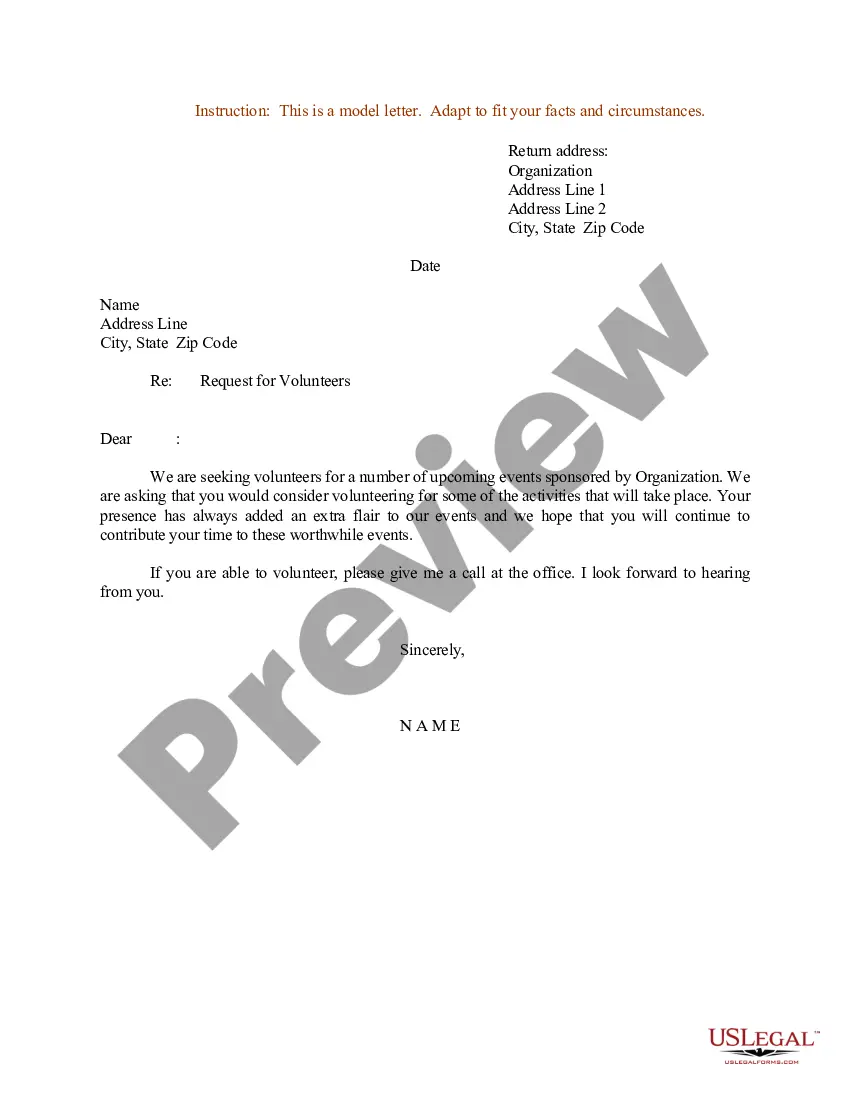

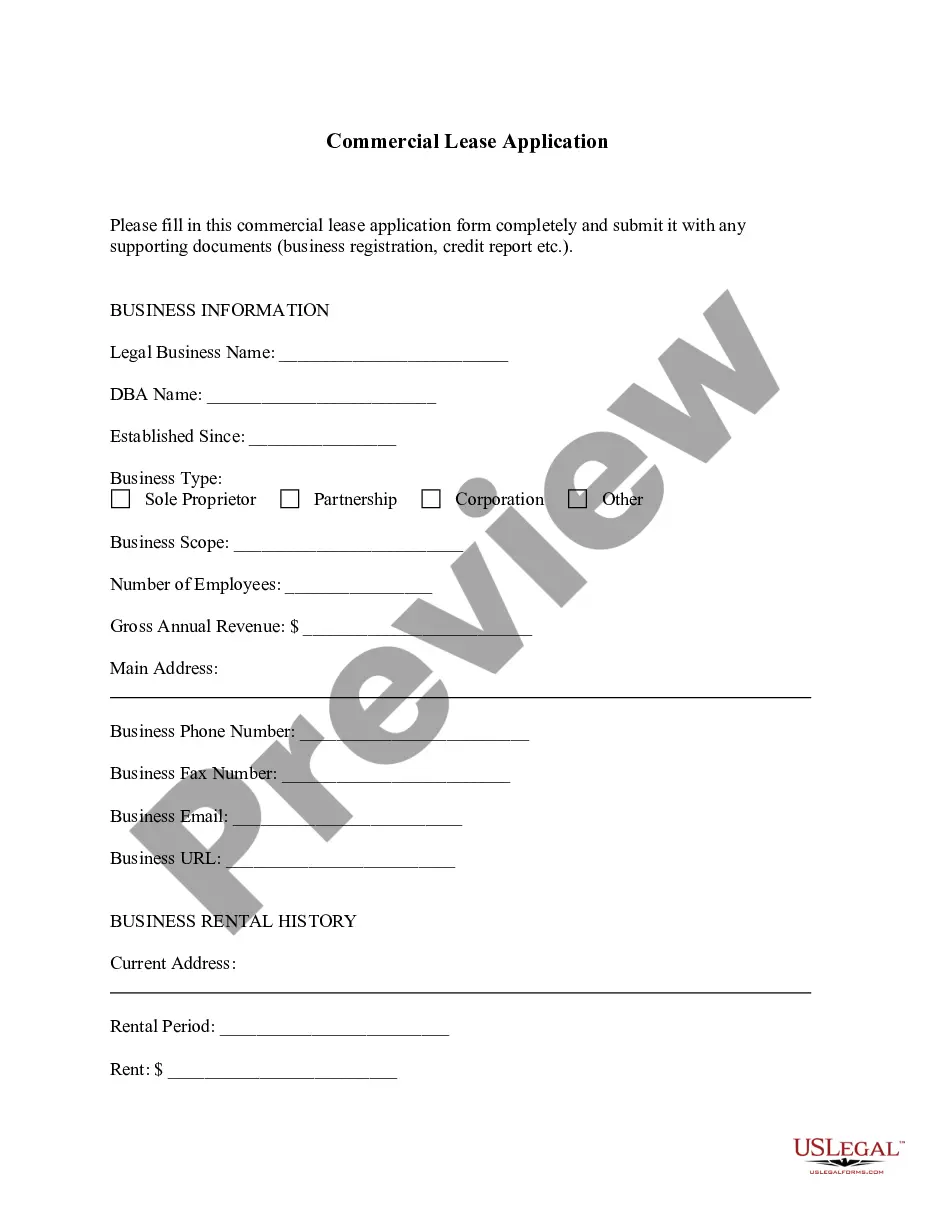

If you wish to use US Legal Forms the very first time, listed below are basic directions to help you started off:

- Be sure you have picked the proper form for the town/area. Go through the Preview switch to analyze the form`s articles. Look at the form information to ensure that you have chosen the appropriate form.

- In case the form doesn`t satisfy your requirements, utilize the Research discipline at the top of the monitor to get the one which does.

- If you are happy with the form, confirm your option by simply clicking the Acquire now switch. Then, opt for the prices strategy you favor and supply your references to sign up on an accounts.

- Method the transaction. Utilize your credit card or PayPal accounts to perform the transaction.

- Select the structure and obtain the form in your system.

- Make alterations. Load, revise and printing and indication the delivered electronically Rhode Island Employment Compensation Package.

Every single template you added to your account does not have an expiry time and is also the one you have permanently. So, in order to obtain or printing yet another duplicate, just proceed to the My Forms segment and then click on the form you want.

Get access to the Rhode Island Employment Compensation Package with US Legal Forms, by far the most considerable library of authorized file templates. Use a huge number of specialist and state-distinct templates that fulfill your organization or specific requires and requirements.

Form popularity

FAQ

The Rule of 95 is an alternative full benefit retirement eligibility date to allow members to retire earlier than their schedule-based eligibility date. Under the Rule of 95, members can retire when their age plus their years of service equal 95 provided that they are at least 62 years old.

Employee benefit examples Health insurance. Paid time off (PTO) Retirement plan benefits. Flexible work schedule. Dental insurance. Vision insurance. Life insurance. Paid family leave.

State of Rhode Island 457(b) Deferred Compensation Plan A 457(b) plan allows eligible employees to defer compensation to the future, lowering current taxable income and offering potential tax-deferred growth.

Upon completion of twenty-five (25) years of service, a Division member may retire and receive a pension of fifty percent (50%) of an average of their five (5) highest years of salary, with an additional two percent (2%) for each year after twenty-five (25) years of service, up to a maximum of sixty-five percent (65%).

Your pension is calculated based on several criteria including your years of earned service credit and your final average salary. Service Credit Factor: Each year you work for a participating employer, you accrue a percentage of your salary which are summed by year to determine your total service credit factor.

If you leave your job and terminate employment with a participating employer but are vested in the system (currently 5 years of contributing service), you may begin collecting your pension benefit when you meet your retirement eligibility criteria ? as long as you do not withdraw your contributions.

The full retirement age is 65 for persons born before 1938. The age gradually rises until it reaches 67 for persons born in 1960 or later. Social Security benefits are payable at full retirement age (with reduced benefits available as early as age 62) for anyone with enough Social Security credits.

State employees, dependents and household members can receive FREE confidential assistance with personal and job-related problems through the Blue Cross & Blue Shield of Rhode Island (BCBSRI) Employee Assistance Program (EAP) administered by Carelon Behavioral Health (Carelon, formerly Beacon Health Options - name ...