Rhode Island Letter of Intent Acquisition of 3-D Data

Description

How to fill out Letter Of Intent Acquisition Of 3-D Data?

US Legal Forms - one of several largest libraries of legitimate kinds in the United States - gives a variety of legitimate file layouts it is possible to download or print. While using site, you will get a huge number of kinds for business and personal reasons, categorized by classes, claims, or keywords.You will discover the most recent versions of kinds such as the Rhode Island Letter of Intent Acquisition of 3-D Data in seconds.

If you currently have a membership, log in and download Rhode Island Letter of Intent Acquisition of 3-D Data from your US Legal Forms local library. The Obtain key will appear on each develop you look at. You get access to all earlier delivered electronically kinds within the My Forms tab of the account.

If you would like use US Legal Forms for the first time, allow me to share easy instructions to obtain started:

- Be sure to have picked the proper develop for your personal city/county. Click on the Review key to examine the form`s content material. Browse the develop information to ensure that you have selected the correct develop.

- In the event the develop does not fit your specifications, take advantage of the Look for field on top of the screen to get the one who does.

- If you are content with the shape, verify your decision by visiting the Acquire now key. Then, select the prices program you prefer and offer your references to sign up on an account.

- Process the purchase. Make use of credit card or PayPal account to perform the purchase.

- Pick the format and download the shape in your product.

- Make alterations. Fill up, modify and print and indicator the delivered electronically Rhode Island Letter of Intent Acquisition of 3-D Data.

Each and every web template you included in your money lacks an expiry particular date and is your own property forever. So, if you wish to download or print yet another backup, just check out the My Forms area and then click in the develop you require.

Gain access to the Rhode Island Letter of Intent Acquisition of 3-D Data with US Legal Forms, the most substantial local library of legitimate file layouts. Use a huge number of skilled and express-certain layouts that meet up with your company or personal demands and specifications.

Form popularity

FAQ

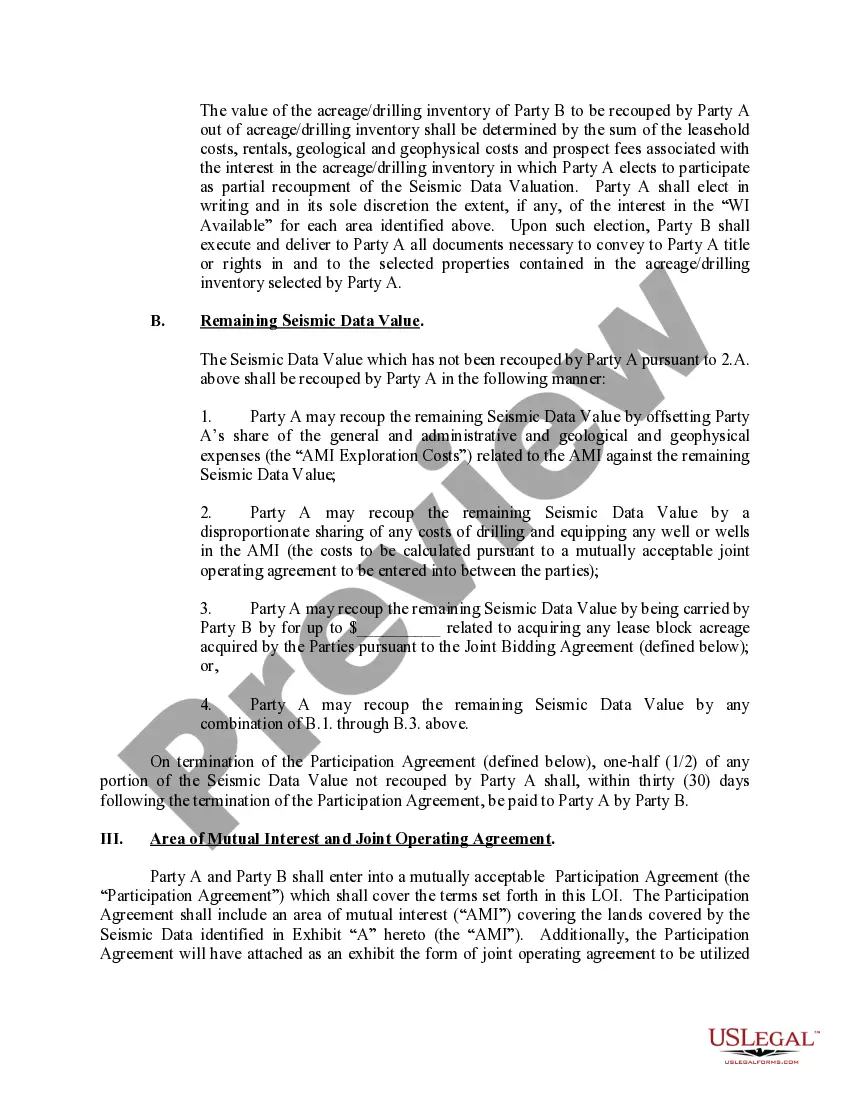

It is common for a letter of intent in a merger or acquisition to include the following sections: Purchased Assets. Assumed Liabilities. Purchase Price. Pre-Closing Covenants. Conditions To Obligations. Due Diligence. Confidentiality. Non Competition.

Typically, the LOI will include purchase price and terms, the assets and liabilities included in the deal, exclusivity, and the conditions required to close the transaction. If accepted by the sell-side, the LOI is immediately followed by the due diligence phase of the transaction.

3. Letter of intent for business transaction instructions Introduction. ... Section 1: Transaction. ... Section 2: Consideration. ... (Optional) Section 3: Timing. ... Section 4: Contingencies. ... Section 5: Notice after completion of due diligence. ... (Optional) Section 6: Extension of time for closing. ... Section 7: Final agreements. Letter of intent for business transaction ? How to guide | .com ? articles ? letter-of-intent-fo... .com ? articles ? letter-of-intent-fo...

Components of a LOI Opening Paragraph: Your summary statement. ... Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1?2 paragraphs; before or after the Project Activity) ... Credentials (1?2 paragraphs) ... Budget (1?2 paragraphs) ... Closing (1 paragraph) ... Signature.

What is a letter of intent? A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party. Letter of intent: What is an LOI and formats | Adobe Acrobat Sign adobe.com ? acrobat ? business ? resources adobe.com ? acrobat ? business ? resources

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date. Letter of Intent (LOI) for Business Transactions (With Tips) Indeed ? ... ? Career development Indeed ? ... ? Career development

LOI is a non-legally binding document that includes an introduction to your project, contact information at your agency, a description of your organization, a statement of need, your methodology and/or an achievable solution to the need, a brief discussion of other funding sources and a final summary. How to Write a LOI = Letter of Interest or Intent for Grants - GrantWatch grantwatch.com ? grantnews ? how-to-write... grantwatch.com ? grantnews ? how-to-write...

The key terms of an LOI are the following: Purchase price and terms. Assets and liabilities included, especially working capital. Form of consideration, such as cash, stock, earnout, or notes. Legal transaction structure (asset sale or stock sale) Seller's ongoing role and compensation.