Rhode Island Audiologist Agreement - Self-Employed Independent Contractor

Description

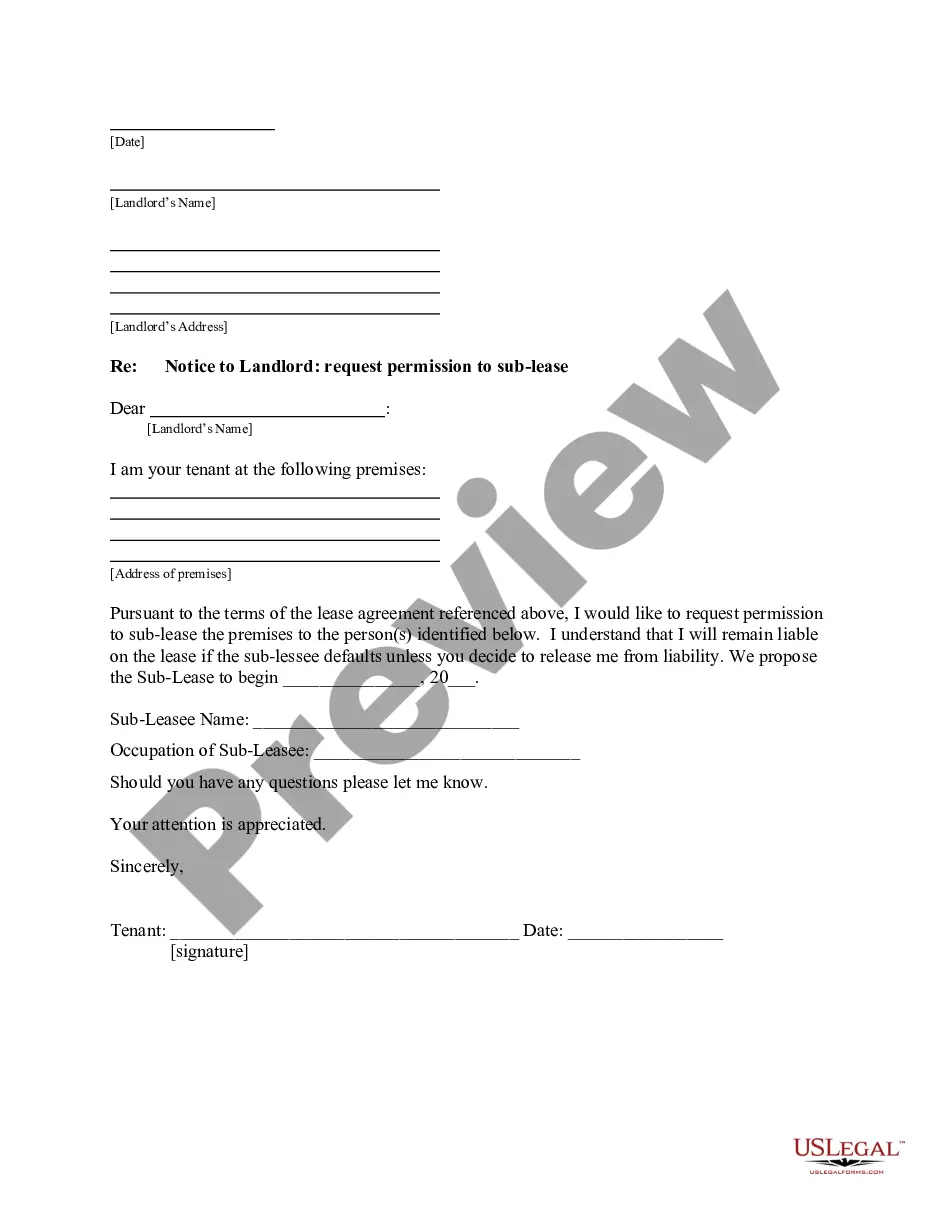

How to fill out Audiologist Agreement - Self-Employed Independent Contractor?

If you wish to total, download, or produce authorized record layouts, use US Legal Forms, the biggest selection of authorized forms, that can be found on the web. Utilize the site`s easy and hassle-free research to get the documents you want. A variety of layouts for business and specific purposes are sorted by classes and says, or search phrases. Use US Legal Forms to get the Rhode Island Audiologist Agreement - Self-Employed Independent Contractor in a couple of click throughs.

When you are already a US Legal Forms customer, log in to your profile and then click the Obtain switch to have the Rhode Island Audiologist Agreement - Self-Employed Independent Contractor. You can also accessibility forms you previously delivered electronically within the My Forms tab of your own profile.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the correct metropolis/nation.

- Step 2. Make use of the Preview method to look through the form`s content. Don`t forget to read the explanation.

- Step 3. When you are unsatisfied using the kind, take advantage of the Look for area at the top of the screen to get other variations in the authorized kind template.

- Step 4. Once you have discovered the shape you want, go through the Purchase now switch. Pick the rates program you choose and add your qualifications to sign up on an profile.

- Step 5. Method the transaction. You can use your charge card or PayPal profile to complete the transaction.

- Step 6. Find the format in the authorized kind and download it on your own device.

- Step 7. Full, edit and produce or indication the Rhode Island Audiologist Agreement - Self-Employed Independent Contractor.

Every authorized record template you acquire is your own property permanently. You might have acces to each and every kind you delivered electronically in your acccount. Click on the My Forms area and select a kind to produce or download again.

Compete and download, and produce the Rhode Island Audiologist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many professional and condition-certain forms you can use for your business or specific requirements.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

There are a number of advantages to being a contractor. Contract work provides greater independence and, for many people, a greater perceived level of job security than traditional employment. Less commuting, fewer meetings, less office politics and you can work the hours that suit you and your lifestyle best.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.