Rhode Island Modeling Services Contract - Self-Employed

Description

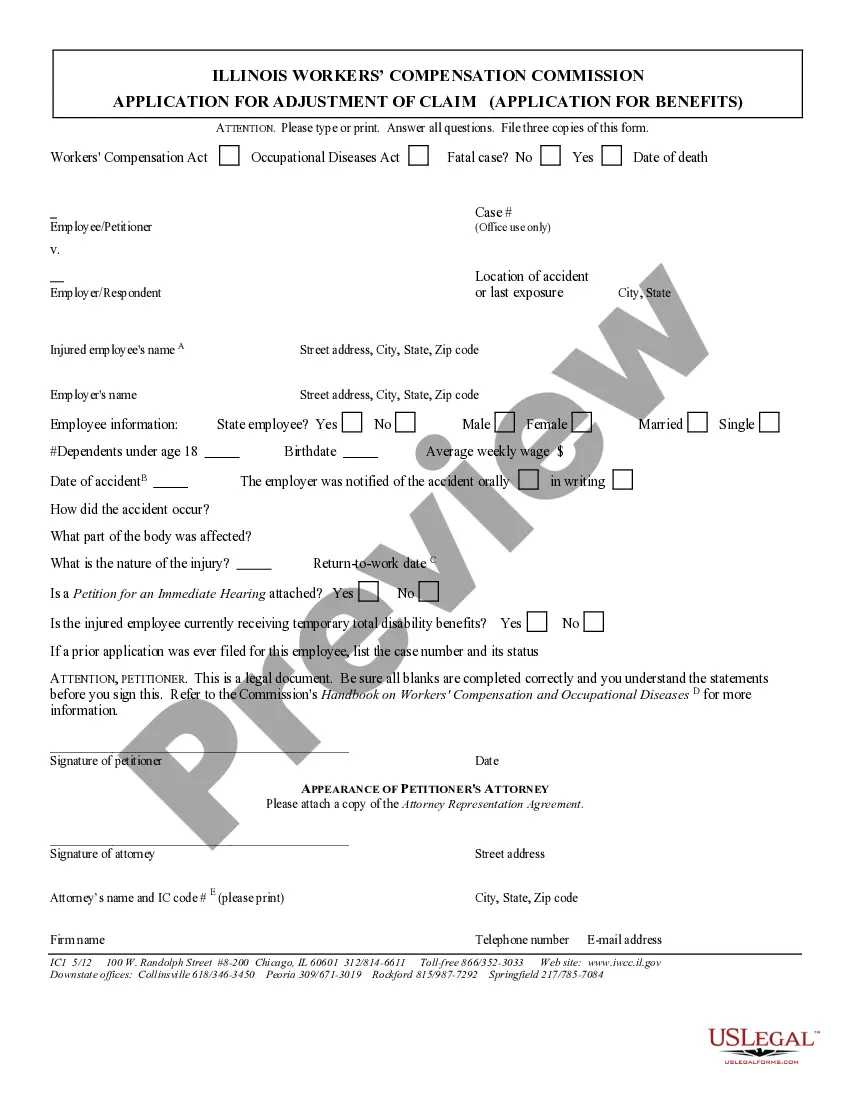

How to fill out Modeling Services Contract - Self-Employed?

It is feasible to spend several hours online attempting to locate the valid document template that satisfies the state and federal criteria you require. US Legal Forms offers thousands of valid forms that are reviewed by experts.

It is easy to acquire or print the Rhode Island Modeling Services Contract - Self-Employed from our service.

If you have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the Rhode Island Modeling Services Contract - Self-Employed. Every legal document format you purchase is yours indefinitely. To retrieve an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

Select the template from the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Rhode Island Modeling Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the county/city of your preference. Review the form description to confirm you have selected the appropriate form.

- If available, utilize the Review button to verify the document format as well.

- If you wish to find another version of the form, take advantage of the Lookup field to find the template that suits your needs and requirements.

- Once you have located the template you want, click Get now to proceed.

- Select the pricing plan you desire, input your details, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

To show proof that you are self-employed, you can use several documents. An invoice template, a business name registration, and a copy of your Rhode Island Modeling Services Contract - Self-Employed serve as valid proof. Additionally, maintaining proper records of your income and expenses can support your status as a self-employed individual.

Yes, you can write your own legally binding contract, provided it meets certain legal requirements. Ensure the document includes clear terms, signatures from both parties, and complies with local laws. To avoid pitfalls, it can be beneficial to reference a structured format such as a Rhode Island Modeling Services Contract - Self-Employed.

Writing a self-employment contract begins with defining the working relationship and outlining the job specifics. Clearly state payment details, including rates and due dates. Always include terms for termination and confidentiality. You can utilize solutions like the Rhode Island Modeling Services Contract - Self-Employed to streamline your contract creation process.

To become an independent contractor in Rhode Island, start by identifying your niche or area of expertise. Next, register your business with the Rhode Island Secretary of State and obtain any necessary licenses. Establish a reliable client base and consider drafting a strong Rhode Island Modeling Services Contract - Self-Employed to formalize your agreements.

When writing a contract for a 1099 employee, focus on the nature of the work and outline both parties' responsibilities. State the compensation, technology needs, and any deadlines. Including a clause about confidentiality is also wise. You might find that using a Rhode Island Modeling Services Contract - Self-Employed simplifies this process significantly.

Setting up as a self-employed contractor requires several steps. First, choose a business name and register it if necessary. Next, obtain any required licenses or permits in Rhode Island. Finally, you may want to consider creating a Rhode Island Modeling Services Contract - Self-Employed to formalize agreements with clients.

To write a self-employed contract, start by clearly defining the scope of work, including specific tasks and deadlines. Make sure to outline payment terms, such as rates and methods. Additionally, include clauses about confidentiality and termination. Using a template like the Rhode Island Modeling Services Contract - Self-Employed can help ensure you cover all necessary aspects.

The self-employment tax in Rhode Island encompasses Social Security and Medicare taxes for self-employed individuals. This tax rate is typically around 15.3% on your net earnings, which may seem burdensome but provides essential benefits. It's crucial to factor this tax into your overall business expenses. By using a Rhode Island Modeling Services Contract - Self-Employed, you can better manage your finances and ensure accurate reporting for the self-employment tax.

Choosing between an LLC and being an independent contractor depends on your business goals and risk tolerance. An LLC offers personal liability protection, while operating as an independent contractor may involve simpler tax reporting with fewer initial costs. Weigh your options carefully, considering factors like taxation and legal protections. A Rhode Island Modeling Services Contract - Self-Employed can be beneficial in either scenario, as it can help structure your agreements clearly.

Yes, Rhode Island does require a contractor license for certain types of work. Depending on the nature of your services, you may need to apply for a license from the Department of Labor and Training. Always verify the licensing needs for your specific trade to remain compliant. Incorporating a Rhode Island Modeling Services Contract - Self-Employed can demonstrate your professionalism in licensed capacity.