Rhode Island Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

If you want to full, obtain, or print out legal file web templates, use US Legal Forms, the biggest assortment of legal forms, that can be found on the Internet. Take advantage of the site`s easy and handy research to obtain the documents you want. Numerous web templates for enterprise and specific purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to obtain the Rhode Island Shared Earnings Agreement between Fund & Company in just a few mouse clicks.

In case you are presently a US Legal Forms client, log in for your profile and click on the Obtain switch to have the Rhode Island Shared Earnings Agreement between Fund & Company. You may also entry forms you earlier delivered electronically from the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct town/nation.

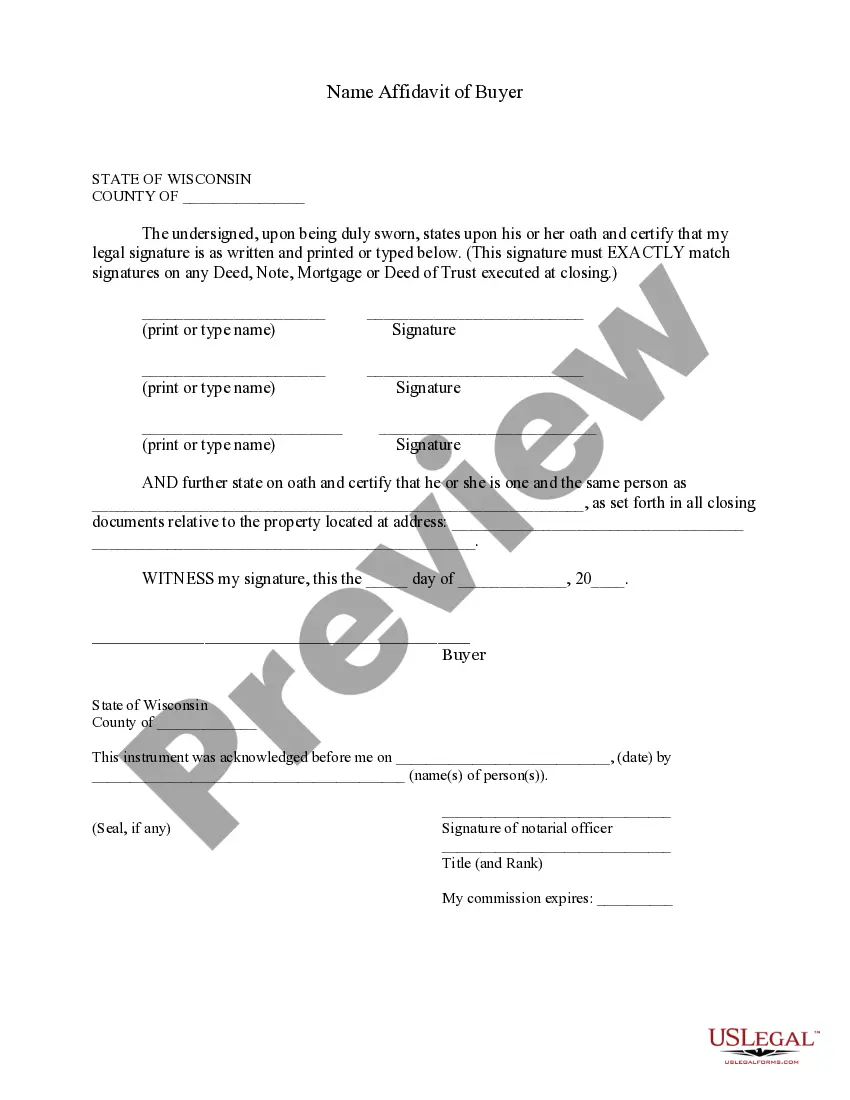

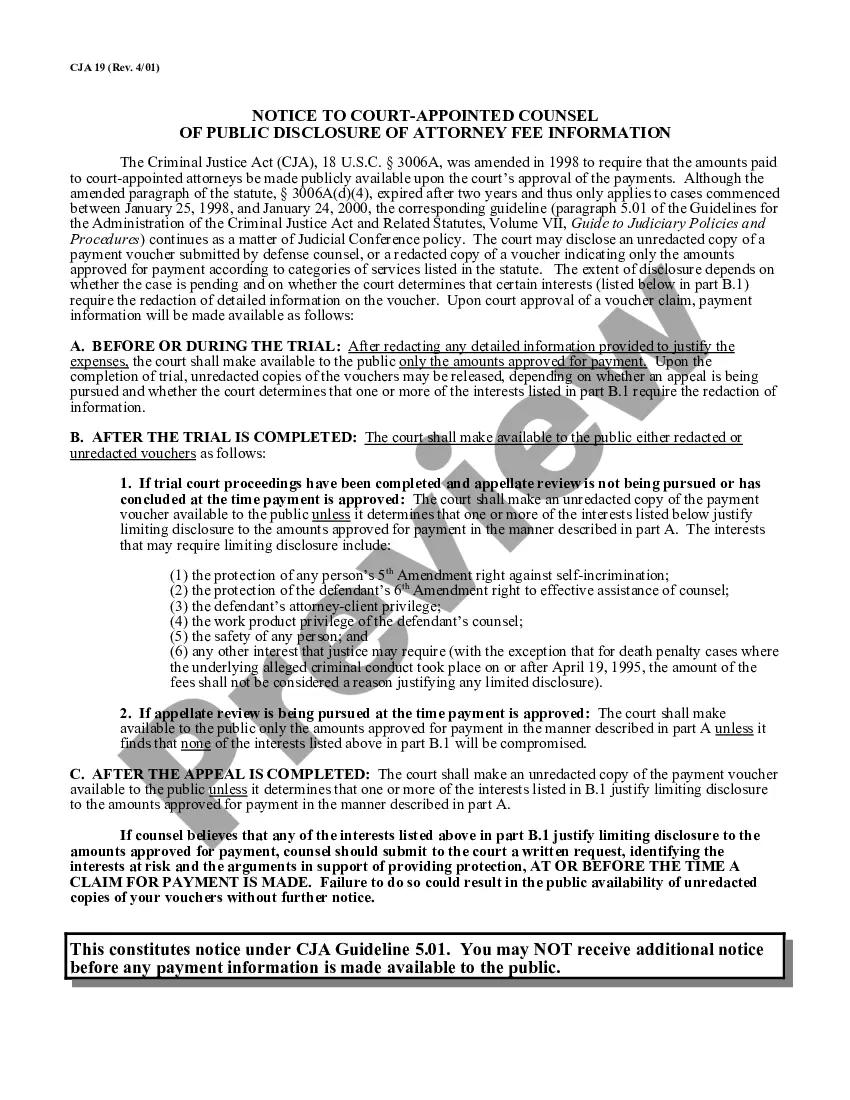

- Step 2. Utilize the Preview option to examine the form`s content. Don`t overlook to read the explanation.

- Step 3. In case you are unsatisfied with all the type, make use of the Look for discipline at the top of the display screen to locate other types of your legal type format.

- Step 4. After you have located the shape you want, click on the Purchase now switch. Opt for the costs plan you choose and add your references to sign up for the profile.

- Step 5. Approach the transaction. You can use your charge card or PayPal profile to perform the transaction.

- Step 6. Choose the structure of your legal type and obtain it on your own product.

- Step 7. Complete, modify and print out or sign the Rhode Island Shared Earnings Agreement between Fund & Company.

Each legal file format you acquire is your own for a long time. You may have acces to each and every type you delivered electronically within your acccount. Go through the My Forms area and pick a type to print out or obtain again.

Remain competitive and obtain, and print out the Rhode Island Shared Earnings Agreement between Fund & Company with US Legal Forms. There are thousands of professional and condition-particular forms you can use for the enterprise or specific demands.

Form popularity

FAQ

(1) For tax years beginning on or after January 1, 2019, a pass-through entity may elect to pay the state tax at the entity level at the rate of five and ninety-nine hundredths percent (5.99%).

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

(a) In a sale of real property and associated tangible personal property owned by a nonresident, the buyer shall deduct and withhold on the payments an amount equal to six percent (6%) of the total payment to nonresident individuals, estates, partnerships, or trusts, and seven percent (7%) of the total payment to ...

Job Development Fund Tax Employers pay an assessment of 0.21% to support the Rhode Island Governor's Workforce Board, as well as employment services and unemployment insurance activities.

The personal income tax rate in Rhode Island is 3.75%?5.99%. Rhode Island does not have reciprocity with other states.

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level. A PTE can be any of the following: Estates. Trusts. S corporations.

Pass-through entities are also subject to R.I. Gen. Laws § 44-11-2.2 which requires income taxes to be withheld at the highest income tax rate (currently 5.99% for individuals or 7% for corporations) for income attributable to this state for non-resident members/shareholders/partners.

How is a sole proprietorship different from an LLC or freelancing? A Rhode Island LLC is a limited liability company that can be formed by one or multiple people. The primary difference in an LLC is that it is a separate legal entity from the owner. In other words, your business and your personal assets are separate.