Rhode Island Call Asset Transfer Agreement

Description

How to fill out Call Asset Transfer Agreement?

US Legal Forms - one of many most significant libraries of authorized forms in the USA - gives an array of authorized record web templates you are able to acquire or print. Utilizing the site, you will get 1000s of forms for enterprise and individual purposes, sorted by types, says, or key phrases.You can get the most recent types of forms such as the Rhode Island Call Asset Transfer Agreement within minutes.

If you already possess a registration, log in and acquire Rhode Island Call Asset Transfer Agreement in the US Legal Forms collection. The Acquire key can look on every type you view. You have accessibility to all earlier acquired forms in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, here are easy instructions to help you get started off:

- Make sure you have picked the best type for the metropolis/area. Go through the Review key to examine the form`s information. See the type outline to ensure that you have selected the correct type.

- If the type does not satisfy your specifications, use the Search discipline towards the top of the display screen to discover the the one that does.

- Should you be happy with the form, validate your choice by simply clicking the Buy now key. Then, choose the costs prepare you like and provide your credentials to sign up for an accounts.

- Procedure the transaction. Utilize your charge card or PayPal accounts to complete the transaction.

- Select the format and acquire the form in your product.

- Make alterations. Complete, edit and print and indication the acquired Rhode Island Call Asset Transfer Agreement.

Each design you put into your money lacks an expiration time which is yours for a long time. So, if you would like acquire or print yet another backup, just visit the My Forms portion and then click in the type you will need.

Gain access to the Rhode Island Call Asset Transfer Agreement with US Legal Forms, the most comprehensive collection of authorized record web templates. Use 1000s of skilled and status-certain web templates that fulfill your business or individual requires and specifications.

Form popularity

FAQ

When selling real estate in Rhode Island, all transactions have a real estate conveyance tax, pursuant to RIGL 44-25-1. This payment is collected at closing and a portion of these funds are remitted to the State of Rhode Island and a portion is remitted to the local city or township.

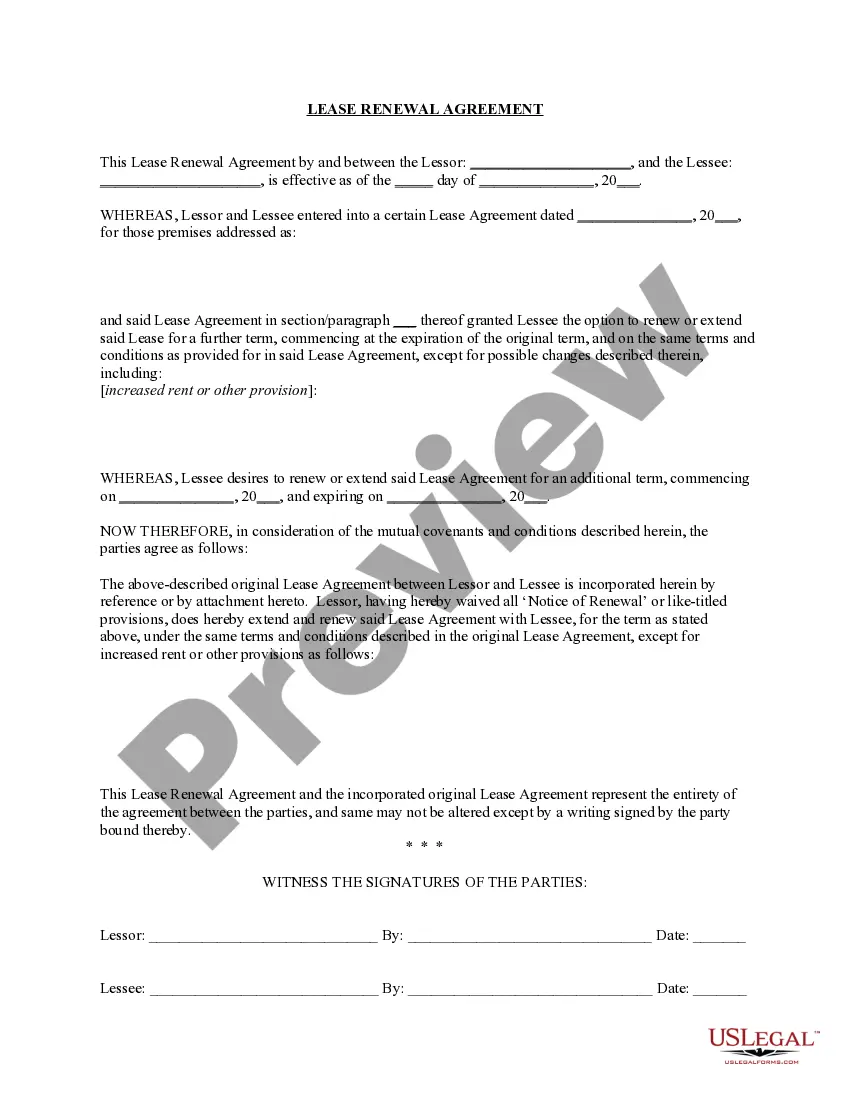

An asset transfer agreement is a contract between two parties whereby one party agrees to transfer ownership of an asset to the other party. The agreement sets out the terms and conditions of the transfer, including the price, date of transfer, and any other relevant details.

An asset transfer agreement is a legal document between a seller and a purchaser that outlines the terms under which the ownership of property will be transferred. Assets aren't considered legally transferred until it is written in a legal agreement and signed by both parties.

The following points should be included in an asset transfer agreement: Details of the companies involved. The details of the assets that are being transferred. The ?whereas? clause. Warranties and other legal terms and conditions. Undertaking and obligation clauses. Termination terms and conditions.

Most assets like company stock, bonds, certificates of deposit (CDs), mutual funds, etc. can be transferred in-kind from one investment account to another. These assets can also be transferred to another person or charitable organization as gifts.

A common method of asset transfer is through sale or purchase agreements. These agreements outline the terms and conditions of the transfer, including the purchase price, payment terms, and warranties.

An asset transfer agreement is a contract between two parties whereby one party agrees to transfer ownership of an asset to the other party. The agreement sets out the terms and conditions of the transfer, including the price, date of transfer, and any other relevant details.

The deed transfer tax is known as the realty transfer tax in Rhode Island. The current rate is $2.30 per $500.00. The deed transfer tax is usually paid by seller.