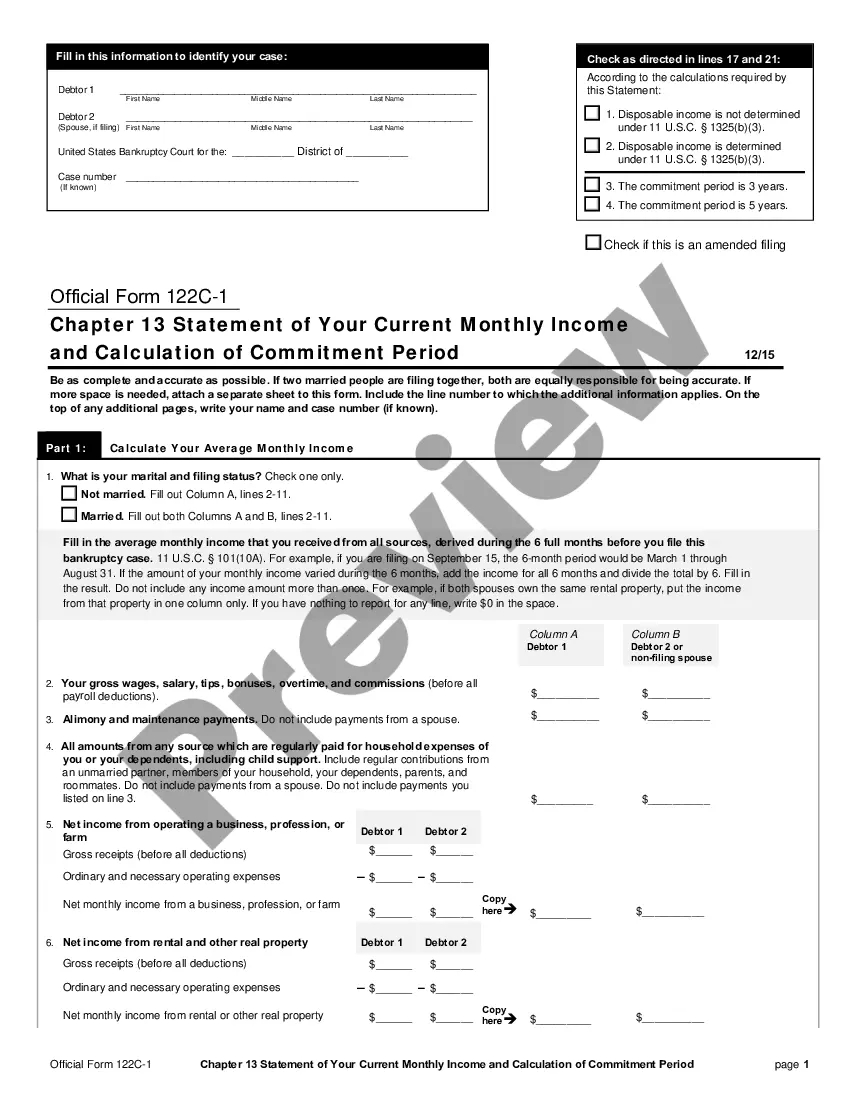

Rhode Island Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

US Legal Forms - one of the biggest libraries of legitimate varieties in America - provides a variety of legitimate record themes you may down load or print. Using the web site, you will get a large number of varieties for company and person uses, categorized by groups, says, or keywords.You can get the most recent versions of varieties much like the Rhode Island Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 within minutes.

If you currently have a registration, log in and down load Rhode Island Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from your US Legal Forms collection. The Download switch will show up on each and every type you look at. You gain access to all previously saved varieties inside the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, allow me to share simple recommendations to help you started out:

- Ensure you have picked the best type for your personal city/county. Click the Review switch to check the form`s content material. See the type information to actually have selected the right type.

- If the type doesn`t satisfy your demands, utilize the Research field on top of the display screen to obtain the one which does.

- If you are satisfied with the shape, confirm your selection by clicking on the Get now switch. Then, opt for the prices strategy you want and provide your accreditations to sign up for the accounts.

- Process the deal. Use your credit card or PayPal accounts to accomplish the deal.

- Find the structure and down load the shape on the device.

- Make modifications. Fill up, revise and print and signal the saved Rhode Island Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Every single template you included in your account lacks an expiry date and it is the one you have forever. So, in order to down load or print an additional copy, just check out the My Forms section and click on the type you require.

Gain access to the Rhode Island Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 with US Legal Forms, the most extensive collection of legitimate record themes. Use a large number of specialist and express-certain themes that fulfill your business or person needs and demands.

Form popularity

FAQ

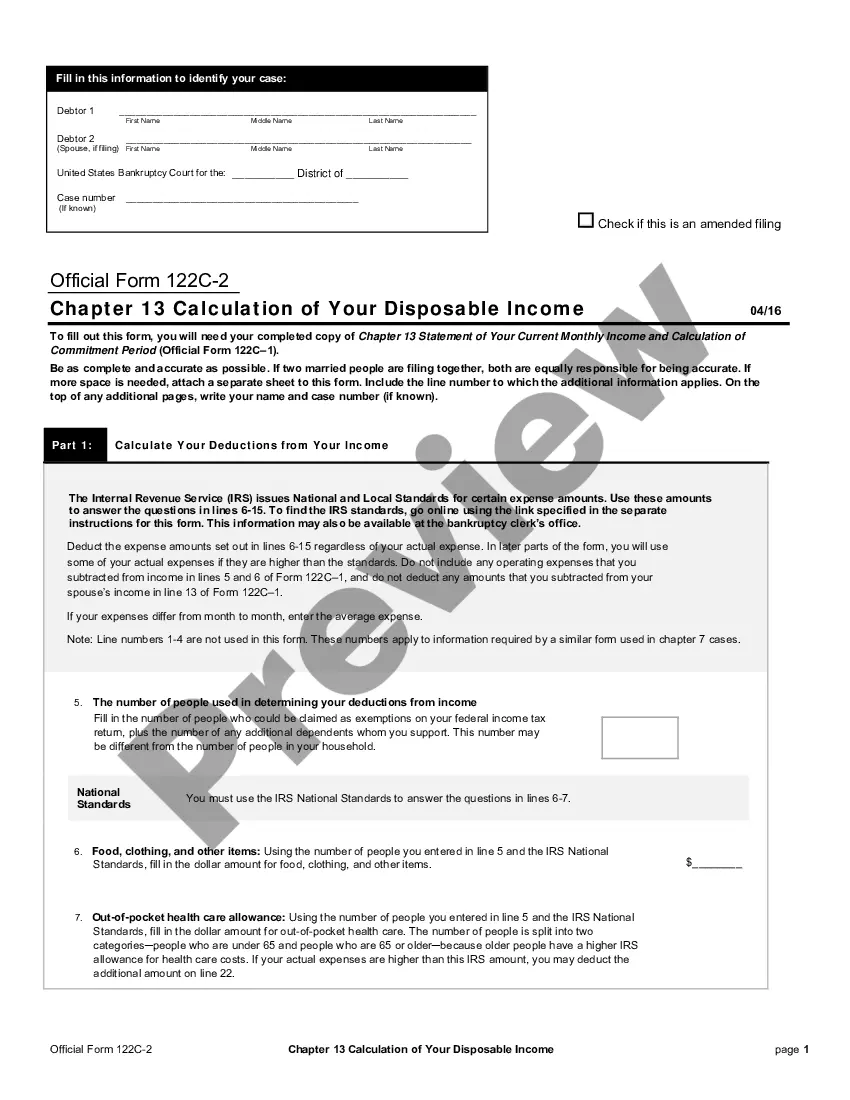

The disposable income calculation starts with your gross income. You must also be a wage earner in order to file a Chapter 13. Then, certain expenses are deducted based on an IRS deduction. The deduction is based upon a national average, taking into consideration the metropolitan area you live.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

After subtracting all the allowed expenses from your ?current monthly income,? the balance is your ?disposable income.? If you have no disposable income ? your allowed expenses exceed your ?current monthly income? ? then you've passed the means test.

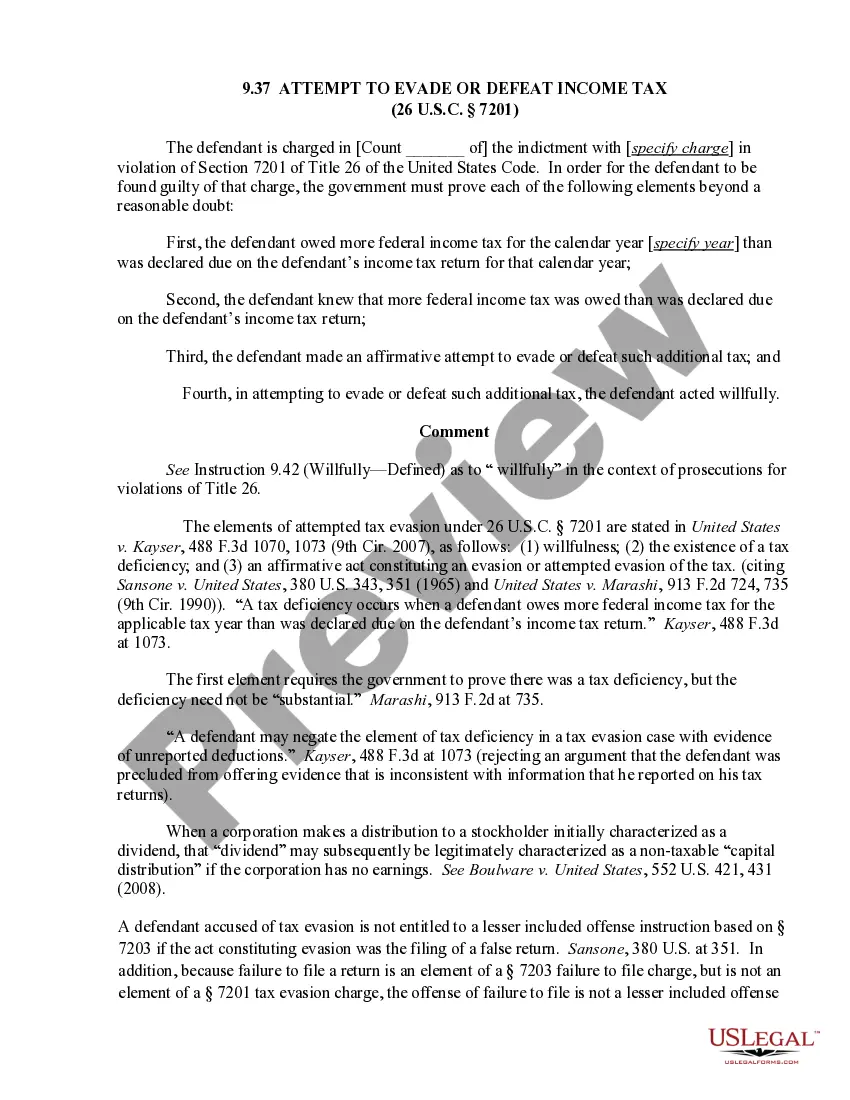

The means test compares a debtor's income for the previous six months to what he or she owes on debts. If a person has enough money coming in to gradually pay down debts, the bankruptcy judge is unlikely to allow a Chapter 7 discharge.

For an individual, gross income is your total pay, which is the amount of money you've earned before taxes and other items are deducted. From your gross income, subtract the income taxes you owe. The amount left represents your disposable income.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

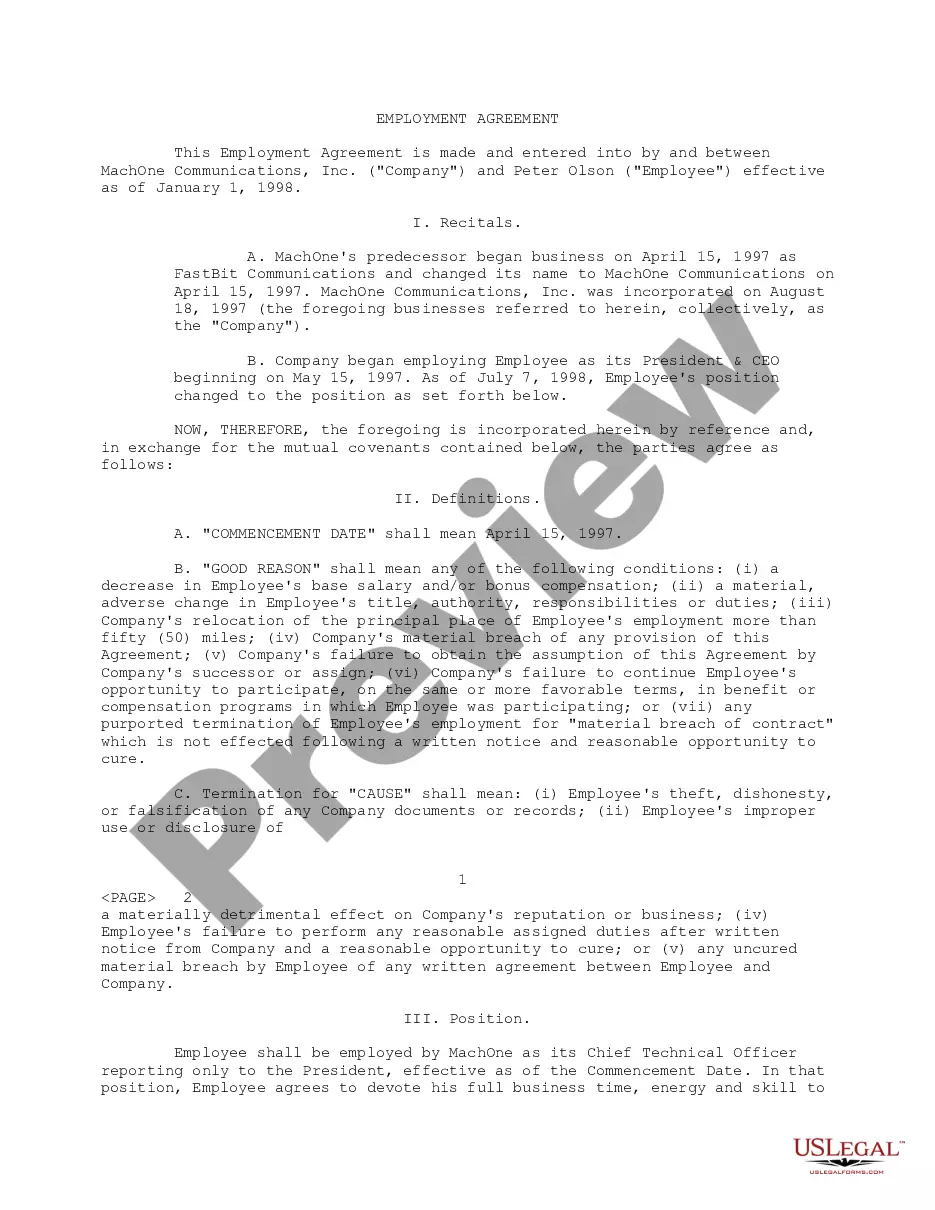

Chapter 13 cases can be filed for no money down because the attorney fees and court costs can be rolled into a 3-5 year repayment plan. While you're at it, you can also wipe away all of your other unsecured debt (credit cards, medical bills, payday loans, old collections, etc.).

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.