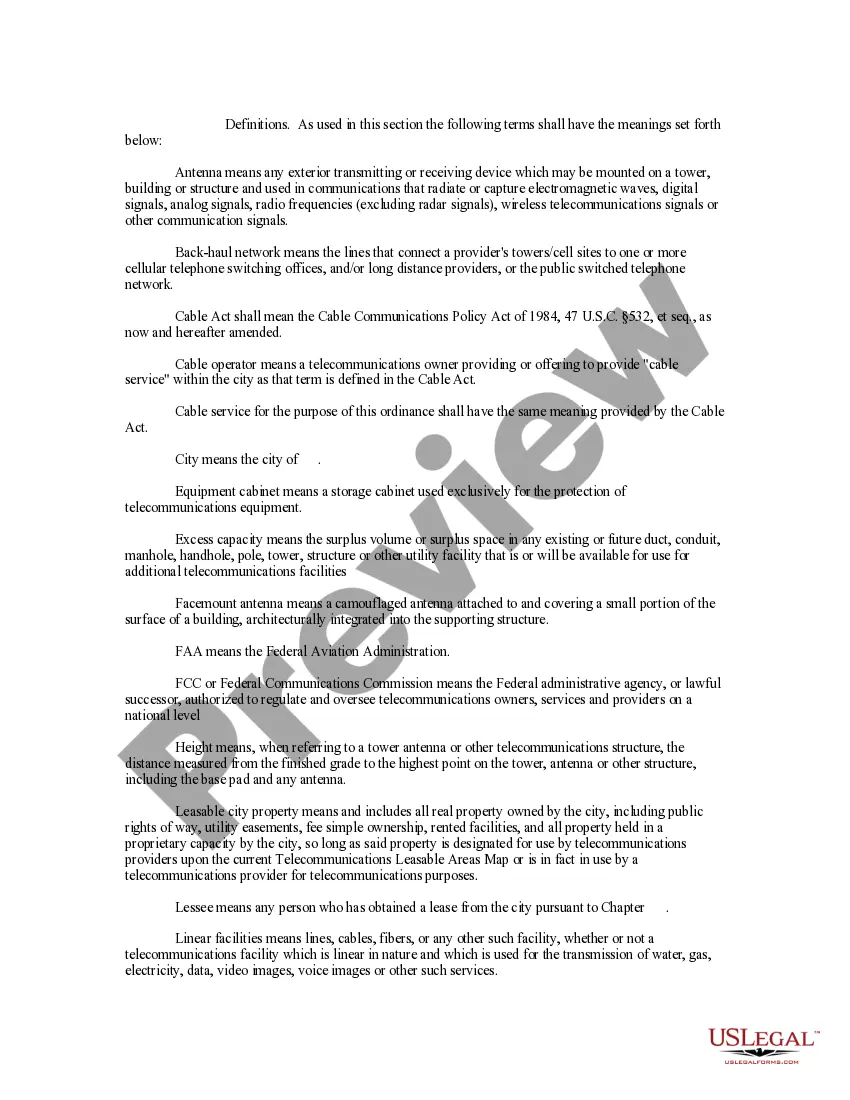

Rhode Island Telecommunications Ordinance

Description

How to fill out Telecommunications Ordinance?

Discovering the right authorized file design can be quite a battle. Obviously, there are a variety of templates available on the Internet, but how can you find the authorized develop you need? Make use of the US Legal Forms internet site. The service gives 1000s of templates, for example the Rhode Island Telecommunications Ordinance, that you can use for business and personal requirements. All of the varieties are examined by experts and satisfy federal and state specifications.

In case you are already authorized, log in for your accounts and click on the Obtain switch to get the Rhode Island Telecommunications Ordinance. Utilize your accounts to check through the authorized varieties you might have purchased formerly. Go to the My Forms tab of the accounts and have an additional version of your file you need.

In case you are a new consumer of US Legal Forms, allow me to share easy guidelines that you should stick to:

- First, make certain you have chosen the right develop for the town/state. You can check out the shape using the Review switch and browse the shape information to make sure it will be the best for you.

- In case the develop does not satisfy your expectations, take advantage of the Seach area to find the appropriate develop.

- Once you are certain that the shape is suitable, select the Get now switch to get the develop.

- Choose the costs program you need and type in the needed info. Build your accounts and purchase the transaction making use of your PayPal accounts or credit card.

- Choose the data file file format and obtain the authorized file design for your device.

- Full, revise and produce and signal the acquired Rhode Island Telecommunications Ordinance.

US Legal Forms is definitely the greatest library of authorized varieties for which you can discover numerous file templates. Make use of the company to obtain expertly-created documents that stick to condition specifications.

Form popularity

FAQ

Rhode Island law prohibits mobile electronic device use while driving without hands free capability. Additionally, minor drivers are restricted from using any mobile electronic device while driving ? with or without hands free capability.

7% Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations. The state-wide sales tax in Rhode Island is 7%. Rhode Island Sales Tax rates, thresholds, and registration guide quaderno.io ? guides ? rhode-island-sales-tax-guide quaderno.io ? guides ? rhode-island-sales-tax-guide

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island Tax Rates, Collections, and Burdens taxfoundation.org ? location ? rhode-island taxfoundation.org ? location ? rhode-island

Total amount of prepaid wireless telecommunications retail sales transactions is subject to a 2.5% charge. However, the law allows for a Seller administrative deduction. A seller shall be permitted to deduct and retain one percent (1%) of prepaid wireless E-911 charges that are collected by the seller from consumers.

Telecom taxes encompass a range of federal, state, and district taxes and fees that telecom companies are responsible for collecting and submitting. What is Telecom Tax? Breaking Down Telecom Tax Compliance - Inteserra inteserra.com ? what-is-telecom-tax-breaking-dow... inteserra.com ? what-is-telecom-tax-breaking-dow...

Collecting Sales Tax Fortunately, Rhode Island is one of the few states with no local sales tax rates. That means that you charge the 7% Rhode Island sales tax rate to every buyer in Rhode Island. Rhode Island Sales Tax Guide and Calculator 2022 - TaxJar TaxJar ? ... ? State TaxJar ? ... ? State