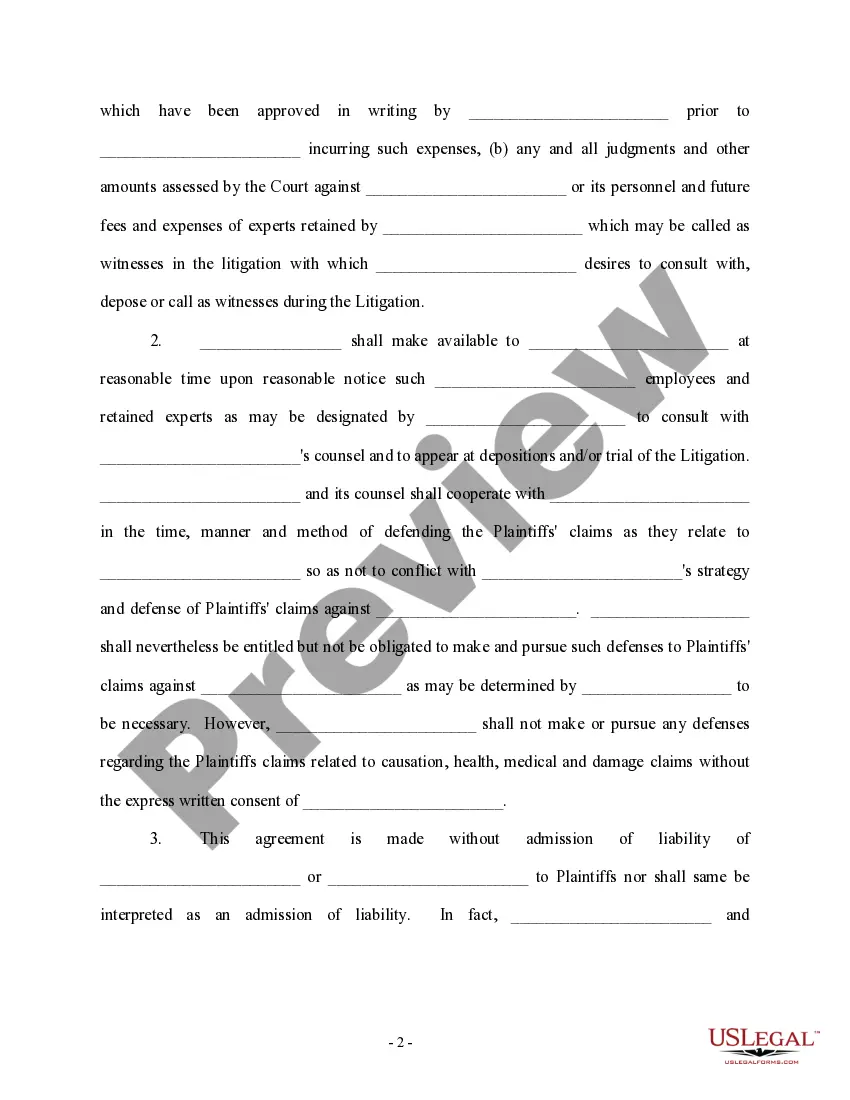

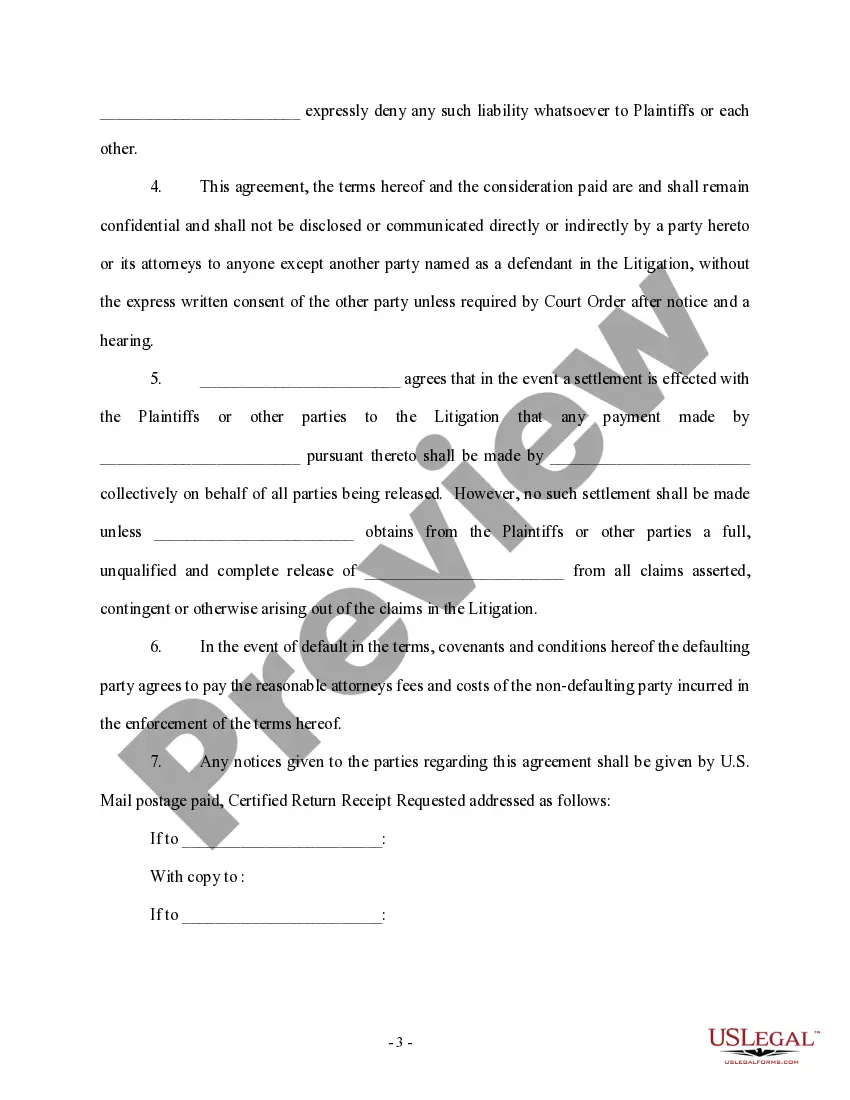

Rhode Island Indemnification Agreement for Litigation

Description

How to fill out Indemnification Agreement For Litigation?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can discover numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms like the Rhode Island Indemnification Agreement for Litigation within moments.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Once you are satisfied with the form, confirm your choice by selecting the Buy now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- If you already have an account, Log In and download the Rhode Island Indemnification Agreement for Litigation from your US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the appropriate form for your city/state. Click on the Review option to examine the form's content.

- Check the form details to ensure you have chosen the correct form.

Form popularity

FAQ

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

An indemnification agreement provides additional protection for businesses by ensuring that they are not held liable for damages or losses that occur outside of their control. This agreement allows the company to continue its operations while protecting against lawsuits.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

As an initial matter, there are generally three forms of indemnification agreements: (1) the broad form, which includes the sole negligence of the indemnitee; (2) the moderate form, which includes all negligence, but the sole negligence of the indemnitee; and (3) the narrow form, which includes only the negligence of

To indemnify another party is to compensate that party for losses that that party has incurred or will incur as related to a specified incident.

In an indemnity agreement, one party will agree to offer financial compensation for any potential losses or damages caused by another party, and to take on legal liability for whatever damages were incurred.

The rule of indemnity, or the indemnity principle, says that an insurance policy should not confer a benefit that is greater in value than the loss suffered by the insured. Indemnities and insurance both guard against financial losses and aim to restore a party to the financial status held before an event occurred.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c