Rhode Island Resolution of Meeting of LLC Members to Hire Outside Service

Description

How to fill out Resolution Of Meeting Of LLC Members To Hire Outside Service?

Have you ever found yourself in a circumstance where you need documents for either business or personal purposes almost constantly? There is a multitude of legal document templates accessible online, but finding ones that you can rely on isn't straightforward.

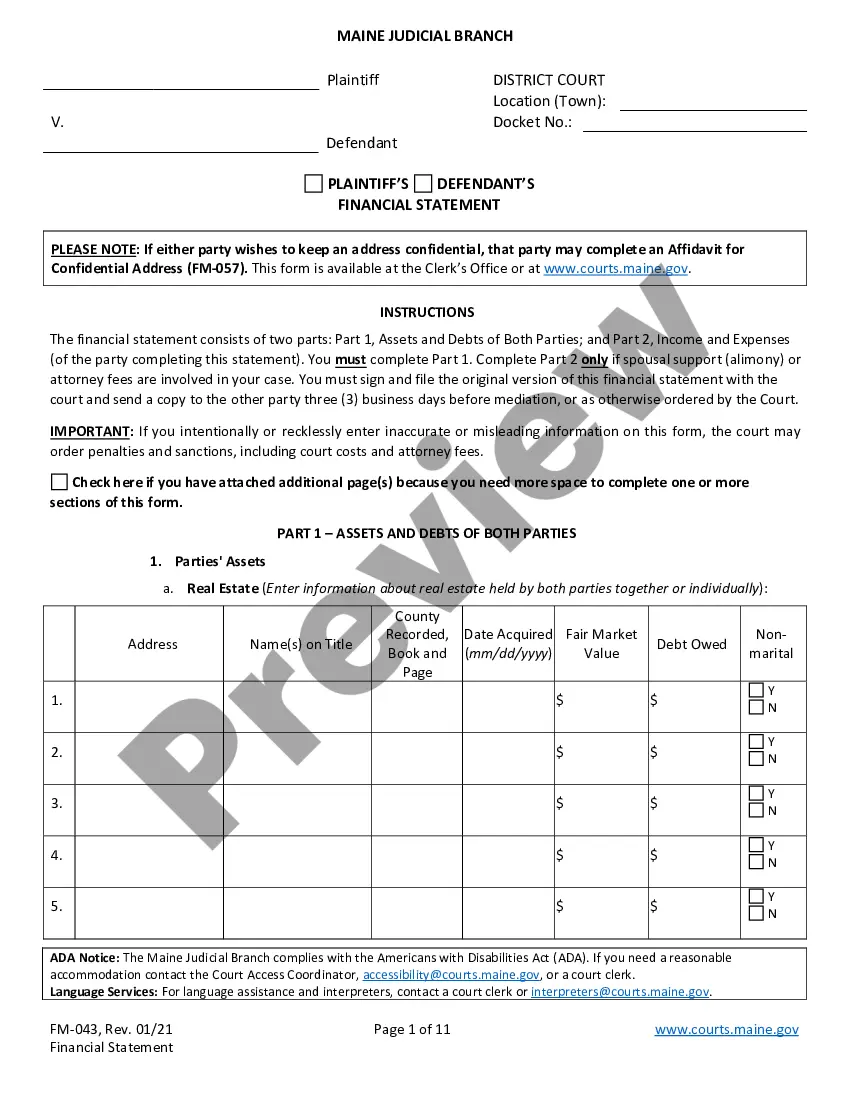

US Legal Forms offers a vast collection of document templates, including the Rhode Island Resolution of Meeting of LLC Members to Hire Outside Service, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Rhode Island Resolution of Meeting of LLC Members to Hire Outside Service template.

- Locate the document you need and ensure it is appropriate for your specific state/region.

- Use the Preview button to review the document.

- Read the details to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search bar to find the document that meets your requirements.

- Once you find the correct form, click on Buy now.

- Select the payment plan you prefer, fill in the necessary details to process your payment, and complete your purchase using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Creating a non-resident LLC in the USA involves several steps, including selecting a state for registration, choosing a unique name for your LLC, and appointing a registered agent. You'll also need to file the necessary formation documents with the state and comply with their specific regulations, which may include a Rhode Island Resolution of Meeting of LLC Members to Hire Outside Service for added clarity. Platforms like uslegalforms provide easy access to the forms and guidance needed to facilitate this process, ensuring you stay compliant with all requirements.

A sole proprietorship is useful for small scale, low-profit and low-risk businesses. A sole proprietorship doesn't protect your personal assets. An LLC is the best choice for most small business owners because LLCs can protect your personal assets.

For federal tax purposes, a sole proprietor's net business income is taxed on his or her individual income tax return at the proprietor's individual tax rates. A single-member LLC is a "disregarded entity" for tax purposesthat is, it is taxed the same as a sole proprietorship.

Typically, doing business is defined by activities such as maintaining a physical office or having employees in the state. Rhode Island LLC and corporation law lists several activities that are not classified as transacting business in the state.

Documents Of Resolution (DOR) Documents of Resolution (DORs) are the first tools that establish action plans and time frames, developed by the examiner, to induce and monitor compliance by the credit union officials. They are a step beyond remedial recommendations in the Findings section of an examination report.

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. Many states also impose ongoing fees, such as annual report and/or franchise tax fees. Check with your Secretary of State's office.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.