Rhode Island Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company

Description

Form popularity

FAQ

A Rhode Island Resolution of Meeting of LLC Members to Accept Resignation of Officer of the Company serves as a formal decision made by the LLC members. In this context, the resolution specifies the authority given to the company to borrow funds. This resolution outlines the terms of the borrowing arrangement and ensures that all members agree to the proposed financial action. Utilizing an organized platform like uslegalforms can help you create this resolution efficiently and ensure compliance with Rhode Island laws.

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.

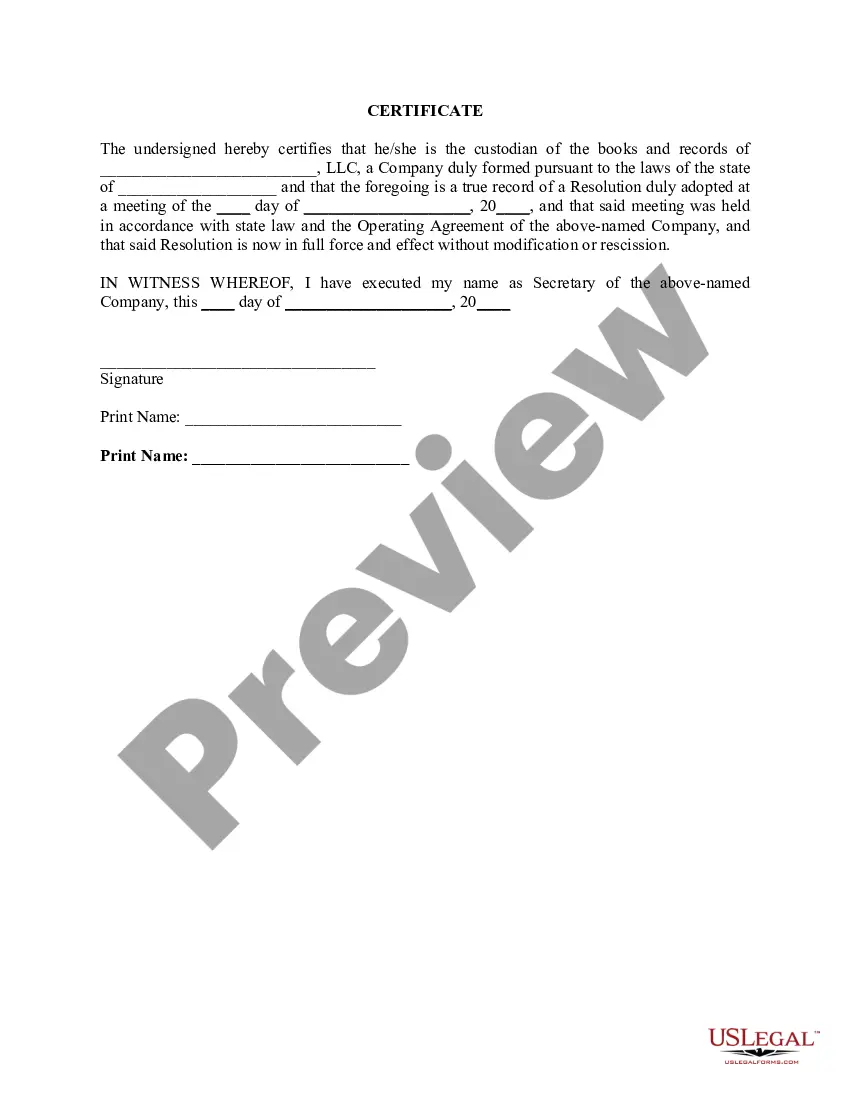

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

You can amend your Rhode Island LLC by filing Articles of Amendment to Articles of Organization with the Rhode Island SOS. You can download the form on the SOS website. Fill out the amendment form and submit it to SOS by mail or in person. You do not need original signatures on your amendment.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

A resolution in business refers to a proposal made during a meeting of the company's shareholders or directors. It is discussed, and its approval represents an official confirmation of an action of any kind that will be taken by the company.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC is a limited liability company, which is a type of legal entity that can be used when forming a business. An LLC offers a more formal business structure than a sole proprietorship or partnership.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).