Rhode Island Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you currently in a situation where you regularly require documents for both professional or personal purposes? There are numerous credible document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Rhode Island Unrestricted Charitable Donation of Cash, specifically designed to comply with both state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Rhode Island Unrestricted Charitable Donation of Cash template.

Choose a convenient file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Unrestricted Charitable Donation of Cash at any time if necessary. Simply select the needed form to download or print the document template.

- If you do not have an account and want to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is applicable to the correct city/county.

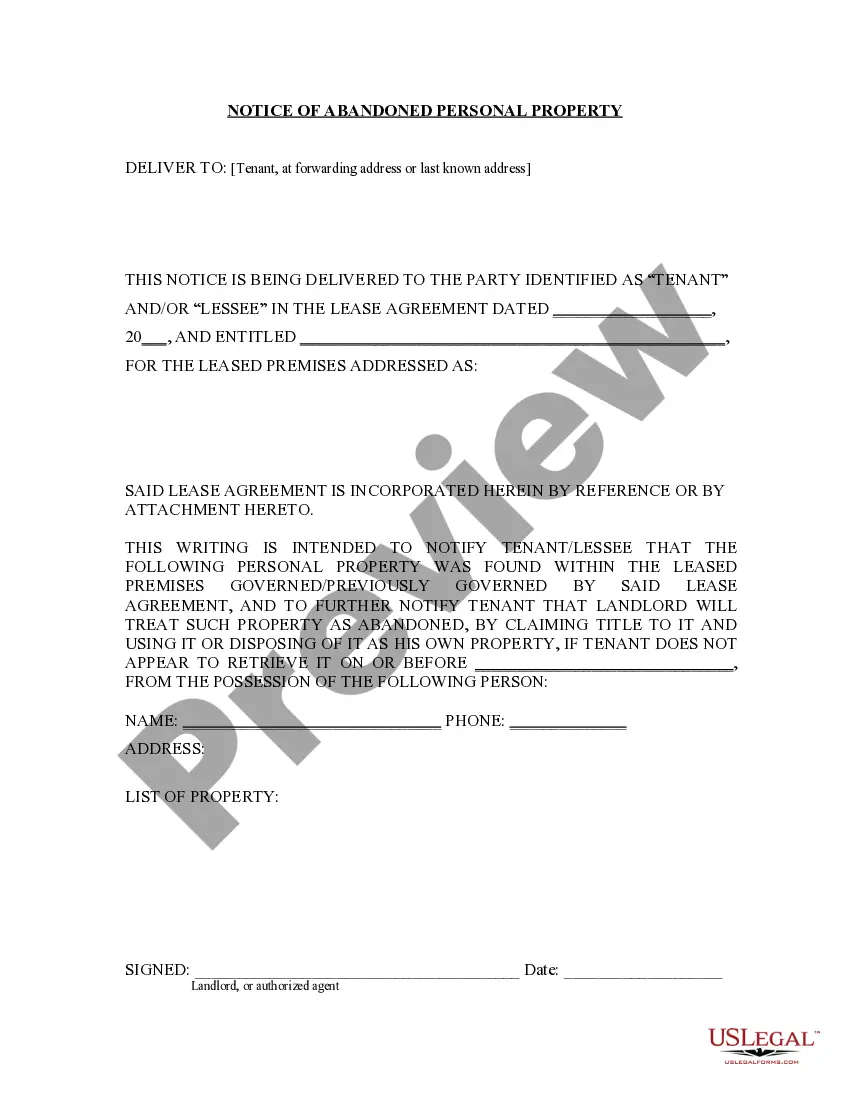

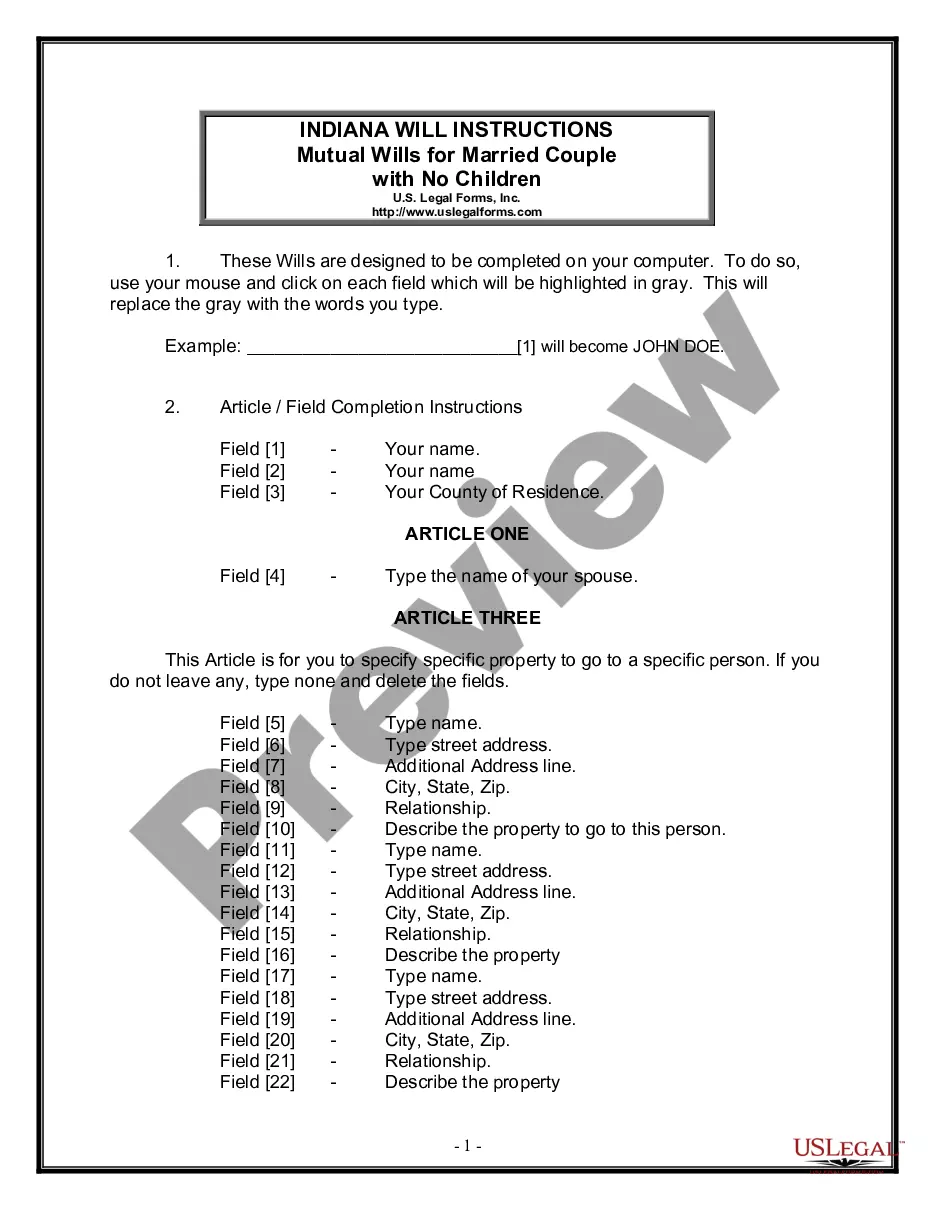

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, utilize the Search field to find a form that fits your needs and specifications.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, complete the required information to create your account, and make the payment using your PayPal or credit card.

Form popularity

FAQ

Form 8283 is used to report non-cash charitable contributions, but it can be relevant if your cash donations exceed certain thresholds. For large contributions, including the Rhode Island Unrestricted Charitable Contribution of Cash, you may need to fill out this form for transparency. The form requires details about the donation and the organization. Utilizing resources like uslegalforms can guide you through the filing process and ensure compliance.

The maximum amount you can write off for charitable donations can vary based on your income and the type of charity. Generally, you can deduct up to 60% of your adjusted gross income for cash contributions, including the Rhode Island Unrestricted Charitable Contribution of Cash. It's crucial to consult with a tax professional to understand your specific situation. Tools available on uslegalforms can help you keep accurate records, making tax time much easier.

The maximum donation you can claim on taxes without proof is $300 for individuals and $600 for married couples filing jointly. This applies to cash donations, including the Rhode Island Unrestricted Charitable Contribution of Cash. While you do not need documentation for amounts under this limit, keeping track of all your contributions is still a good practice. Consider using professional services like uslegalforms to simplify your tax preparation.

Yes, you can claim charitable contributions, including the Rhode Island Unrestricted Charitable Contribution of Cash. To benefit from these deductions, ensure you keep thorough records of your donations. This includes receipts or bank statements detailing the cash amount and the recipient organization. By using platforms like uslegalforms, you can easily manage and document your contributions.

For reporting noncash charitable contributions, you will typically use IRS Form 8283. This form allows you to detail the noncash donations you made, such as property or goods, while still benefiting from the generous tax deductions available for your Rhode Island Unrestricted Charitable Contribution of Cash. Be sure to attach the form to your tax return, alongside documentation that supports the value of your contributions. You can find guidance on how to fill this out through tools available on US Legal Forms.

Charitable contributions, such as a Rhode Island Unrestricted Charitable Contribution of Cash, should be classified under a separate expense category in your accounts. This clarity helps in tracking how much you support nonprofits and allows for accurate financial reporting. It's beneficial for tax purposes, too, as clear classifications can enhance your deduction process. For help with classification, check out resources through US Legal Forms.

In your accounting system, the journal entry for a Rhode Island Unrestricted Charitable Contribution of Cash typically involves debiting the charitable contributions expense account and crediting your cash account. This reflects the reduction in cash due to your generous contribution and acknowledges the expense. It's essential to maintain clear records for these entries to ensure accuracy in financial reporting. Platforms like US Legal Forms can provide templates for these transactions.

When recording your Rhode Island Unrestricted Charitable Contribution of Cash, you need to treat it as an expense on your income statement. This contributes to reducing your taxable income, which can result in tax savings. It's important to document each donation properly to support your accounting entries. For assistance in navigating these accounting practices, consider using resources from US Legal Forms.

To claim a deduction for your Rhode Island Unrestricted Charitable Contribution of Cash, you must itemize your deductions on your tax return. This means you need to keep track of your donations and obtain receipts from the charities. Additionally, be mindful of the IRS guidelines which require certain documentation for contributions above a specific amount. Using platforms like US Legal Forms can help guide you through the deduction process.

Noncash charitable contributions involve donating items instead of cash, like clothing, property, or stocks. These contributions can be a valuable way to support charities while benefiting from potential tax deductions. When considering a Rhode Island Unrestricted Charitable Contribution of Cash, understanding the difference helps you make informed choices about your giving strategy. Always document these donations carefully to ensure you receive the appropriate tax benefits.