Rhode Island Aging Accounts Payable

Description

How to fill out Aging Accounts Payable?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of forms like the Rhode Island Aging Accounts Payable in just moments.

If you possess a subscription, Log In and download the Rhode Island Aging Accounts Payable from the US Legal Forms library. The Download button will appear on each form you view. You can find all previously acquired forms in the My documents section of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Edit. Complete, modify, print, and sign the downloaded Rhode Island Aging Accounts Payable form.

- To begin using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your jurisdiction/state.

- Choose the Review option to check the form's contents.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

- Once you are happy with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

When you pay off an invoice, remove the current or past due amount from your report. For example, say you paid off the $100 invoice that's 61 90 days past due for Vendor 3. After you pay Vendor 3 the $100, make sure you change the 61 90 days column to say $0.

An aging schedule is an accounting table that shows a company's accounts receivables, ordered by their due dates. Often created by accounting software, an aging schedule can help a company see if its customers are paying on time.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

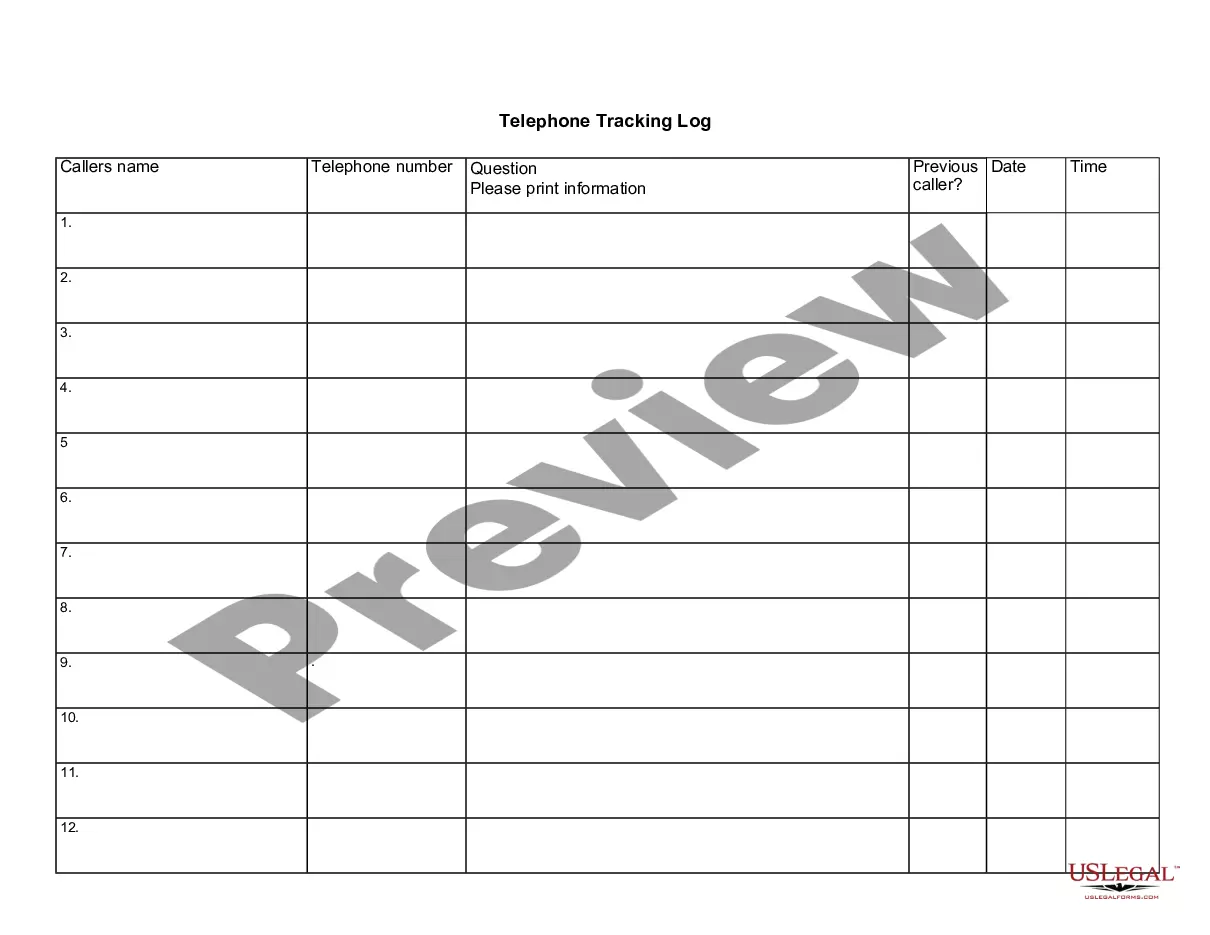

The report is typically set up with 30-day time buckets. This approach results in a report where each successive column lists supplier invoices that are 0 to 30 days old, 31 to 60 days old, 61 to 90 days old, and older than 90 days.

The Accounts Payable Aging Report lists vendors to which you owe money in the rows. The columns separate your bills by how many days they are overdue, with the first column being bills that are not overdue, and the fifth column being bills that are more than 90 days overdue.

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

Aging of Accounts Receivables = (Average Accounts Receivables 360 Days)/Credit SalesAging of Accounts Receivables = ($ 4, 50,000.00360 days)/$ 9, 00,000.00.Aging of Accounts Receivables = 90 Days.

AP Aging ReportsGo to Reports on the top menu.Choose Vendors and Payables.Select A/P Aging Detail.Tick the Customize Report tab.In the Dates field choose Custom.Enter the date for April in the From and To field.Tap OK.16-Feb-2021

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.