Rhode Island Sample Letter regarding Motion to Sell Property of an Estate

Description

How to fill out Sample Letter Regarding Motion To Sell Property Of An Estate?

US Legal Forms - one of the most significant libraries of legal forms in the United States - delivers an array of legal file web templates you may obtain or printing. Using the internet site, you will get thousands of forms for enterprise and specific functions, sorted by classes, suggests, or keywords and phrases.You can get the most recent types of forms such as the Rhode Island Sample Letter regarding Motion to Sell Property of an Estate in seconds.

If you already have a monthly subscription, log in and obtain Rhode Island Sample Letter regarding Motion to Sell Property of an Estate through the US Legal Forms collection. The Acquire option will show up on each and every form you see. You have access to all earlier saved forms from the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, listed below are straightforward directions to help you started:

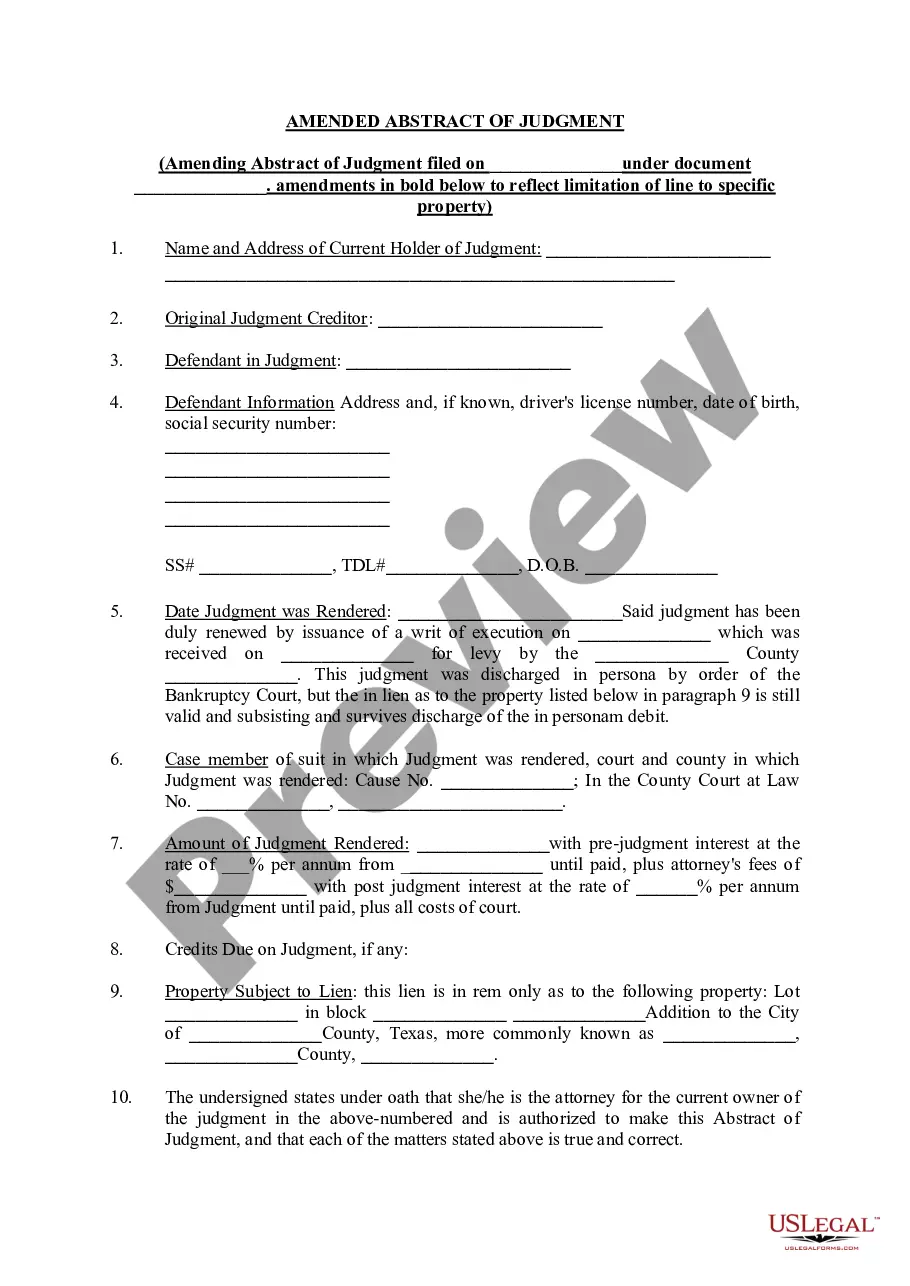

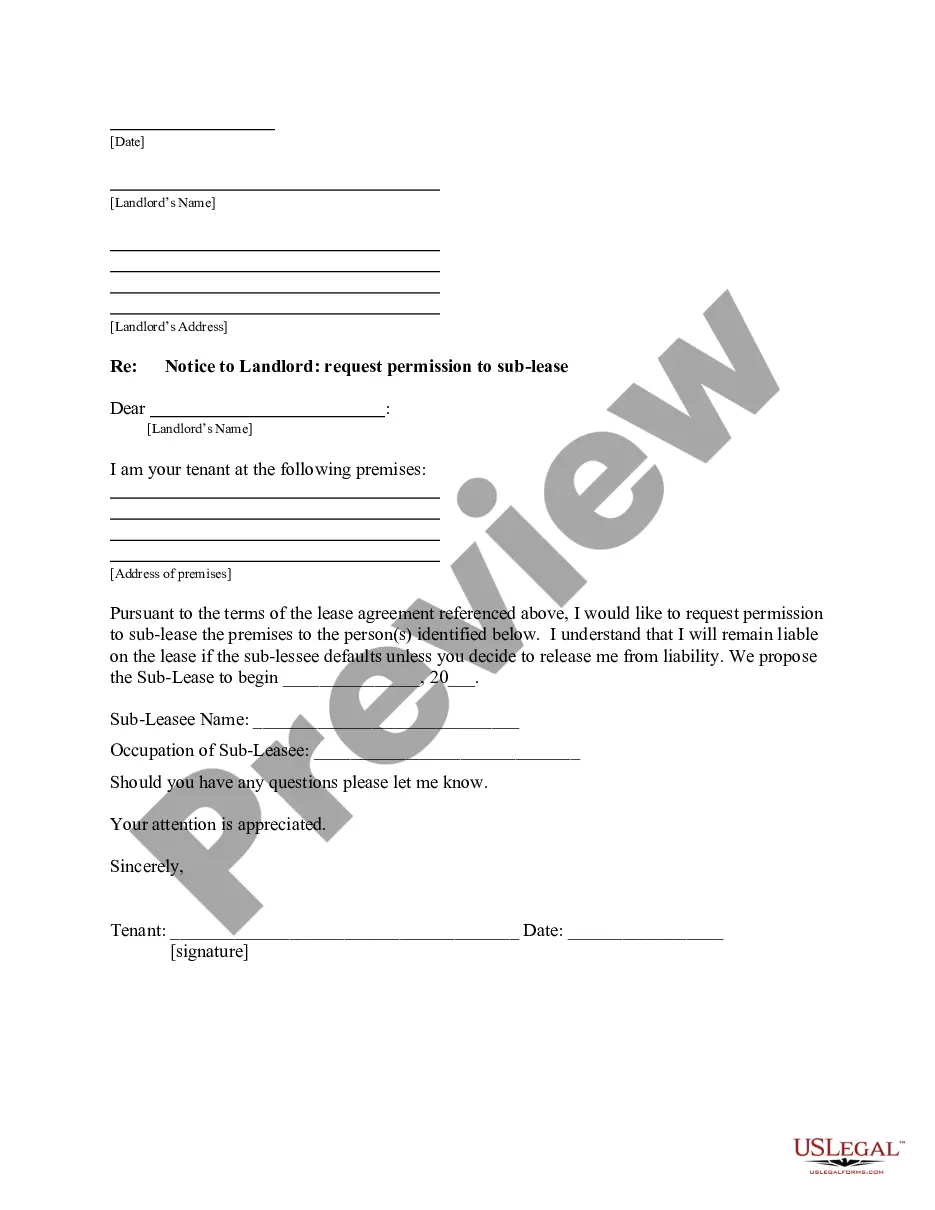

- Be sure to have selected the best form for your town/area. Click the Preview option to check the form`s articles. See the form explanation to actually have chosen the correct form.

- In the event the form does not suit your demands, use the Research industry on top of the monitor to obtain the the one that does.

- When you are pleased with the form, confirm your decision by clicking the Purchase now option. Then, opt for the rates plan you favor and provide your references to sign up to have an profile.

- Procedure the transaction. Make use of your bank card or PayPal profile to complete the transaction.

- Select the structure and obtain the form on your product.

- Make changes. Load, revise and printing and indicator the saved Rhode Island Sample Letter regarding Motion to Sell Property of an Estate.

Every format you included with your money does not have an expiry day and is also your own eternally. So, if you wish to obtain or printing an additional copy, just go to the My Forms section and click on in the form you need.

Obtain access to the Rhode Island Sample Letter regarding Motion to Sell Property of an Estate with US Legal Forms, by far the most substantial collection of legal file web templates. Use thousands of professional and condition-specific web templates that meet up with your business or specific requires and demands.

Form popularity

FAQ

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If a person dies with less than $15,000 of personal property, probate may be shortened under the "small estate" provision. The executor of the estate will have to file the necessary forms with the probate court, but the waiting time for the closure of these estates is typically much shorter and far less costly.

If you are in possession of a will of a deceased person, you must either file it with the appropriate court or deliver it to the person named in the will as executor, as under Rhode Island law the will is to be filed within 30 days after death.

In Rhode Island, executor fees are not explicitly stipulated by statute. Instead, the state allows for "reasonable" compensation, which is determined on a case-by-case basis. This ambiguity can be both a benefit and a drawback, depending on the complexity of the estate and the amount of work required by the executor.

If you are in the trade or business of being an executor, report fees received from the estate as self-employment income on Schedule C (Form 1040), Profit or Loss From Business.

Probate Fees Probate of Will Advertisements (Hearing & Qualification) Total$34 $60 $94Setting Off/Allowing Real Estate In-Fee to Surviving Spouse AdvertisementNo Fee $30Copies of Probate Documents (per page)$1.50Certification (plus copy cost)$3Exemplified Copy of File Contents (plus certification and copy costs)$1028 more rows

California Probate Fee Calculator: Calculate Attorney & Executor... For the first $100,000 of the estate value, both parties get 4%. For the next $100,000, they get 3%. For the following $800,000, they get 2%. For the next $9 million, they get 1%. For the following $15 million, they get 0.5%.

The length of time an executor has to settle an estate in Rhode Island can vary significantly, usually ranging from several months to over a year, depending on factors such as the size and complexity of the estate, the clarity of the will, and whether or not the probate process is contested.