Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a broad array of legal templates available for acquisition or printing.

On the website, you can discover thousands of forms for business and personal uses, categorized by types, states, or keywords.

You can quickly find the latest forms like the Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan in moments.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

If you are content with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your information to create an account.

- If you already have an account, Log In and retrieve the Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan from your US Legal Forms collection.

- The Download button will appear on every type you view.

- You can access all the previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some easy steps to begin.

- Ensure you have chosen the correct type for your city/state.

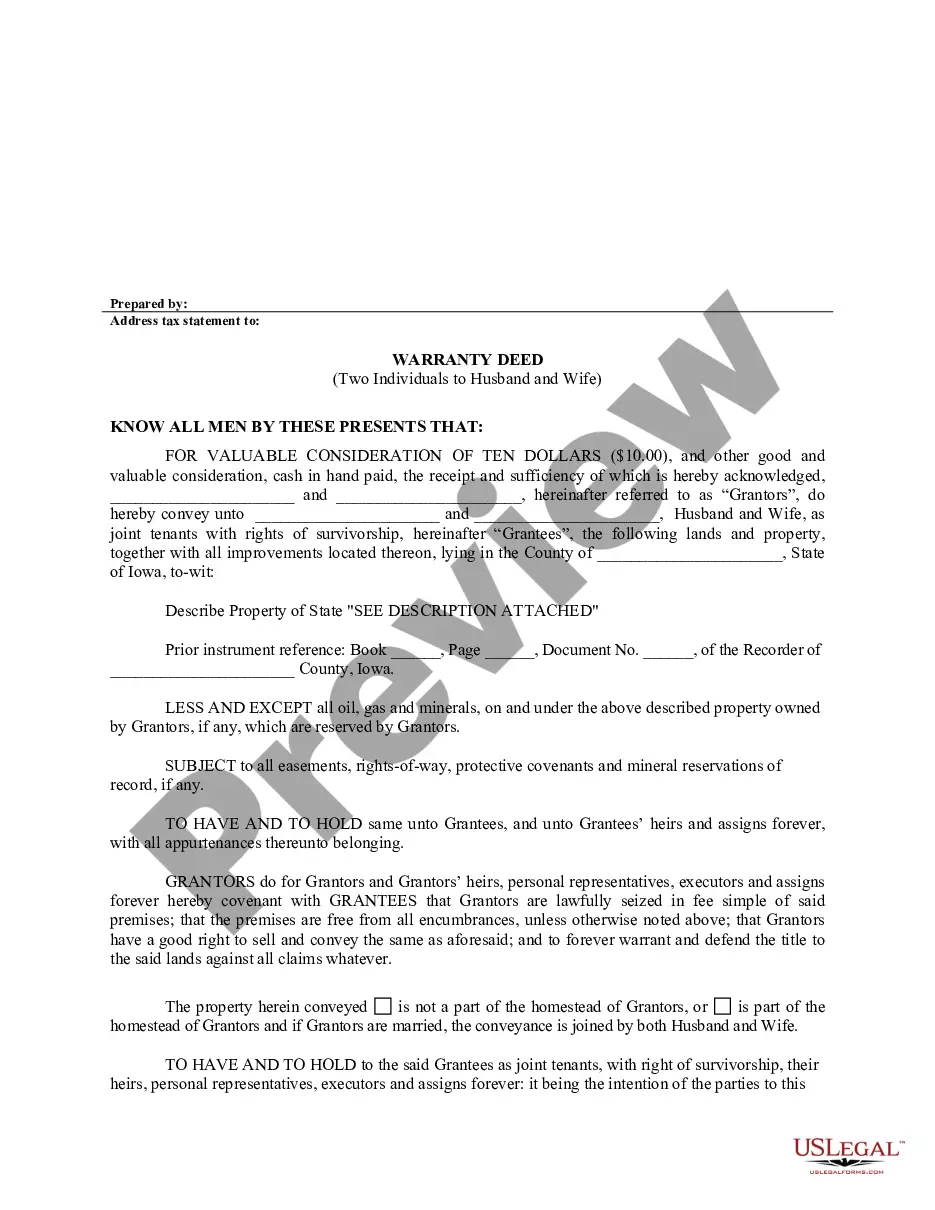

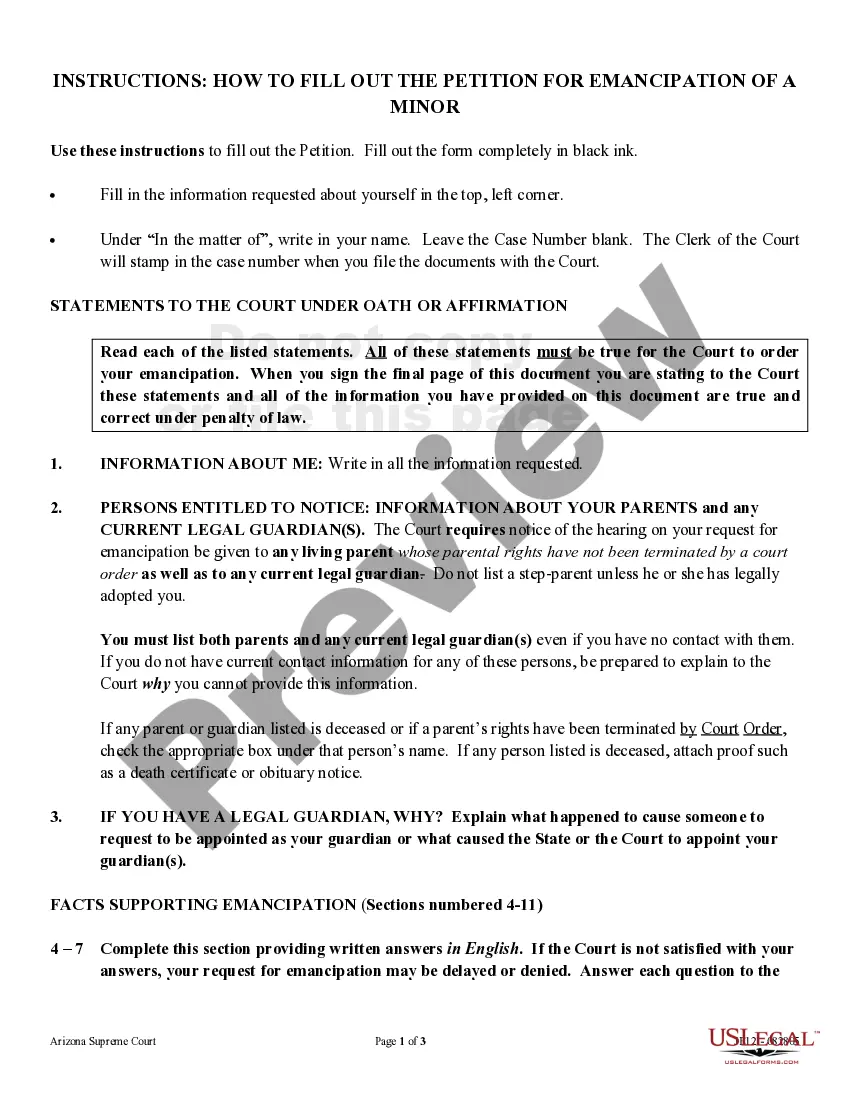

- Click the Preview button to review the form's details.

Form popularity

FAQ

To reinstate a revoked entity in Rhode Island, you will need to follow the prescribed steps set by the Secretary of State. This process often includes submitting an application, paying fees, and demonstrating compliance with state requirements. If financial issues were a factor in the revocation, a Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan can serve as a valuable tool to rectify these matters. For guidance, consider using USLegalForms to access the necessary templates.

A Letter of Good Standing in Rhode Island is an official document that confirms your business is in compliance with state regulations. It shows that your LLC or corporation has been properly maintained and is authorized to conduct business. If you're facing issues with reinstatement, having a Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan can support your case by illustrating your intent to address any financial shortcomings. You can obtain this letter through the Secretary of State's office.

To reinstate a Rhode Island license, you must first ensure that you meet all eligibility requirements. You will need to submit the required documents, including a completed application form and any relevant fees. In some cases, you may also need to provide a Rhode Island Sample Letter for Insufficient Amount to Reinstate Loan to demonstrate your financial eligibility and responsibility. Utilizing resources like USLegalForms can simplify this process.

Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default. Once the loan is reinstated, the borrower resumes making regular payments on the debt.

In foreclosure, a house is sold as collateral after the homeowners default on their loan. Housing repossession is a more general term for when a mortgage lender or loan provider takes ownership of a property because the owners haven't paid their bills. It's a consequence of foreclosure.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.