Rhode Island LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

You have the capability to spend hours online searching for the legal document format that meets the federal and state standards you need.

US Legal Forms offers a multitude of legal forms that can be evaluated by experts.

It is easy to download or print the Rhode Island LLC Operating Agreement for S Corp from this service.

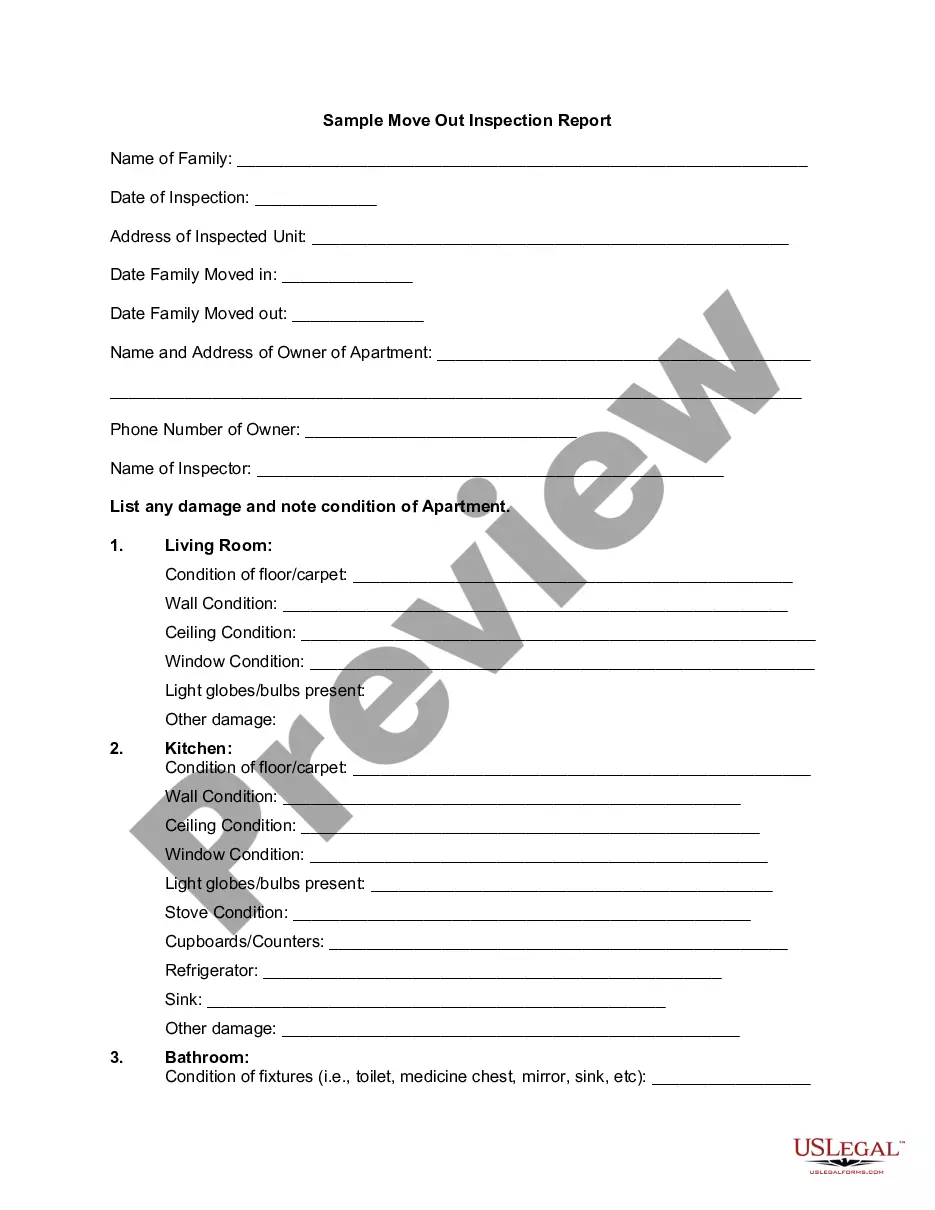

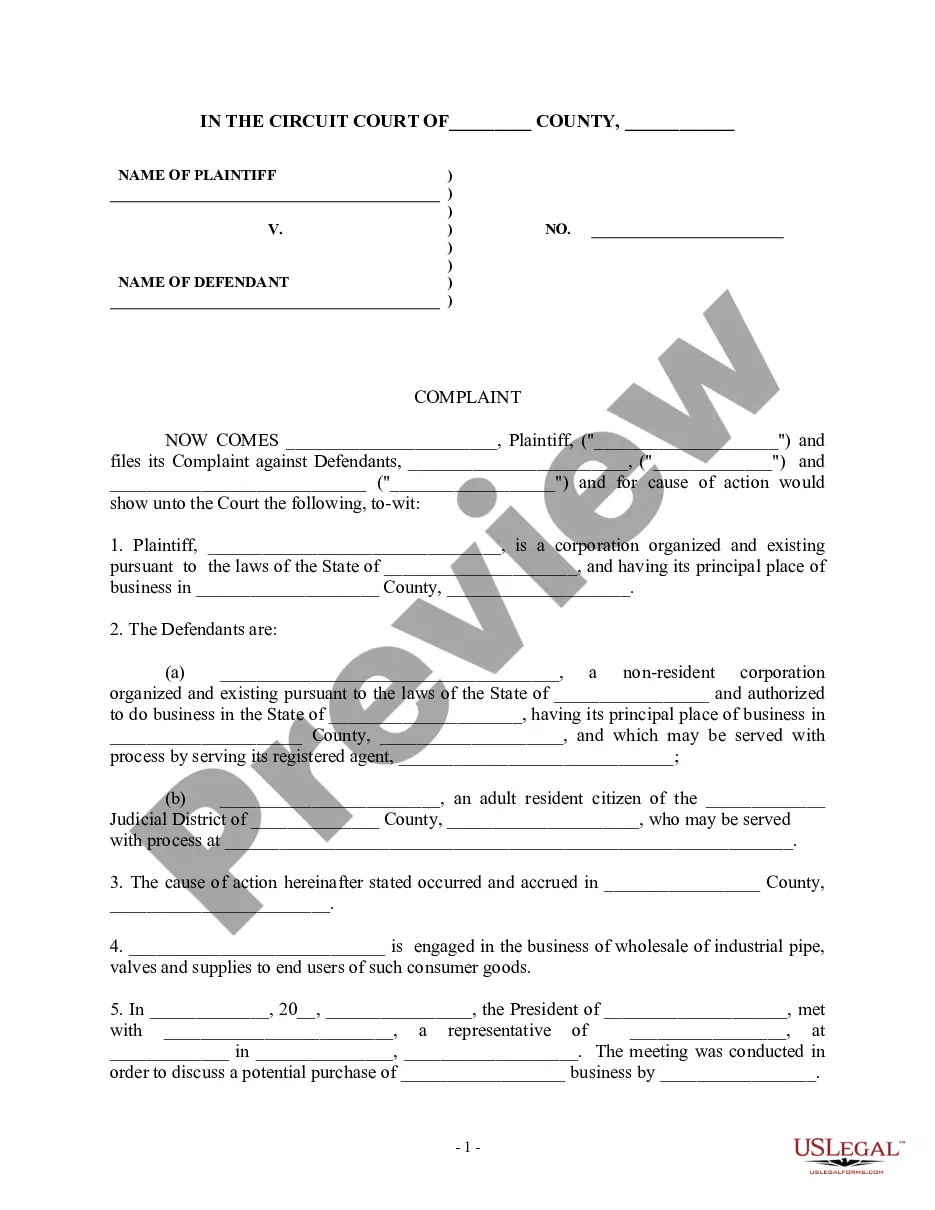

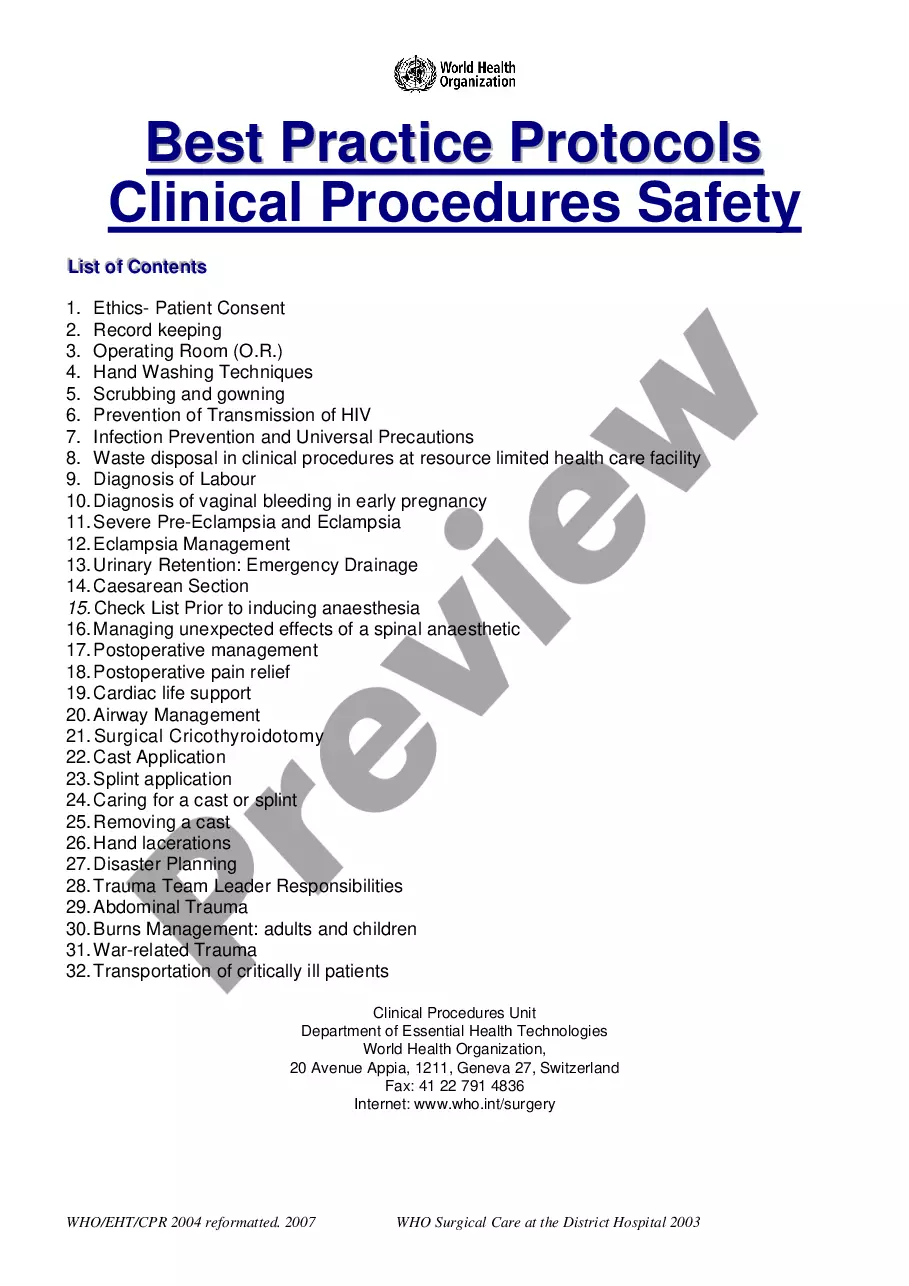

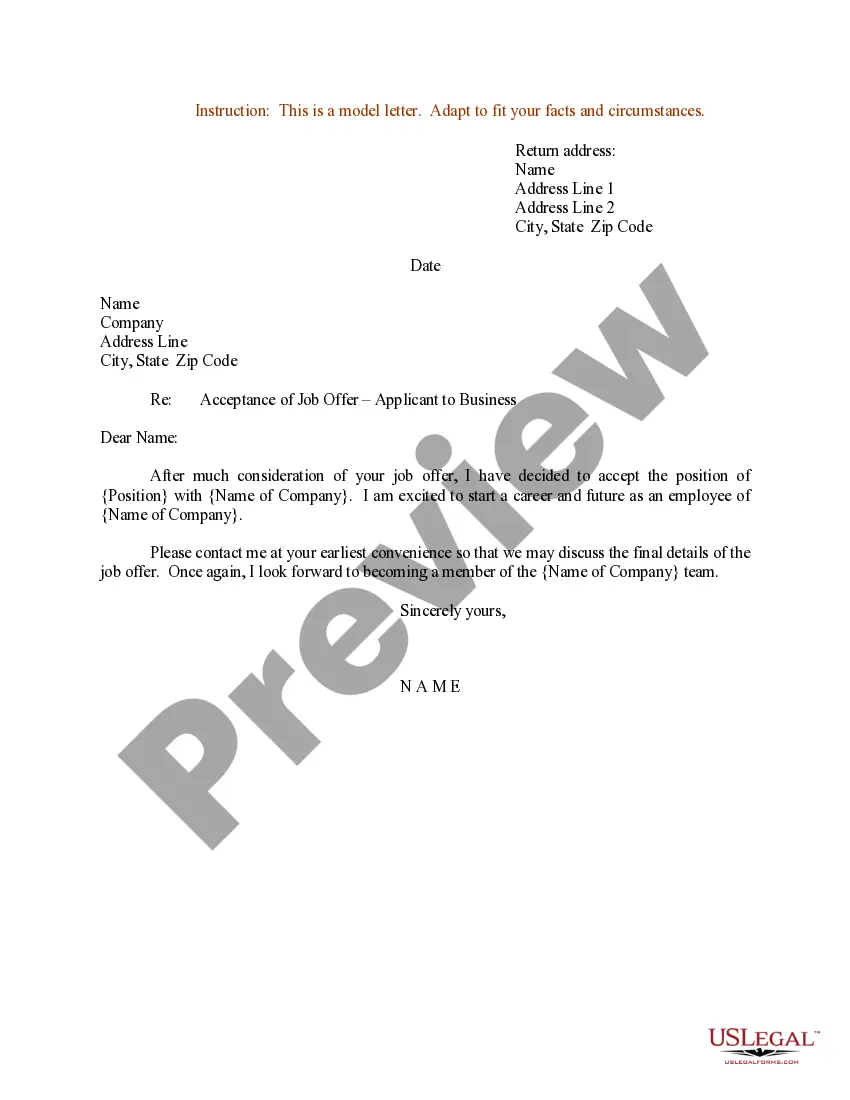

If available, utilize the Review button to look over the document format as well. If you wish to find another version of the document, use the Search field to locate the format that meets your needs and criteria. Once you have identified the format you want, click Get Now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make any necessary changes to your document. You can fill out, modify, sign, and print the Rhode Island LLC Operating Agreement for S Corp. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can fill out, modify, print, or sign the Rhode Island LLC Operating Agreement for S Corp.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of any purchased document, go to the My documents tab and click the respective button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document format for your area/city of choice.

- Check the document outline to ensure you have chosen the proper form.

Form popularity

FAQ

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on