Rhode Island Asset Sale Agreement

Description

How to fill out Asset Sale Agreement?

Are you presently within a position where you need documents for either business or personal purposes almost every day.

There are numerous authentic document templates available online, but locating versions you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Rhode Island Asset Sale Agreement, which are designed to comply with federal and state requirements.

Once you find the correct form, click Buy now.

Select the payment method you prefer, complete the necessary details to create your account, and proceed to pay using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Asset Sale Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific city/state.

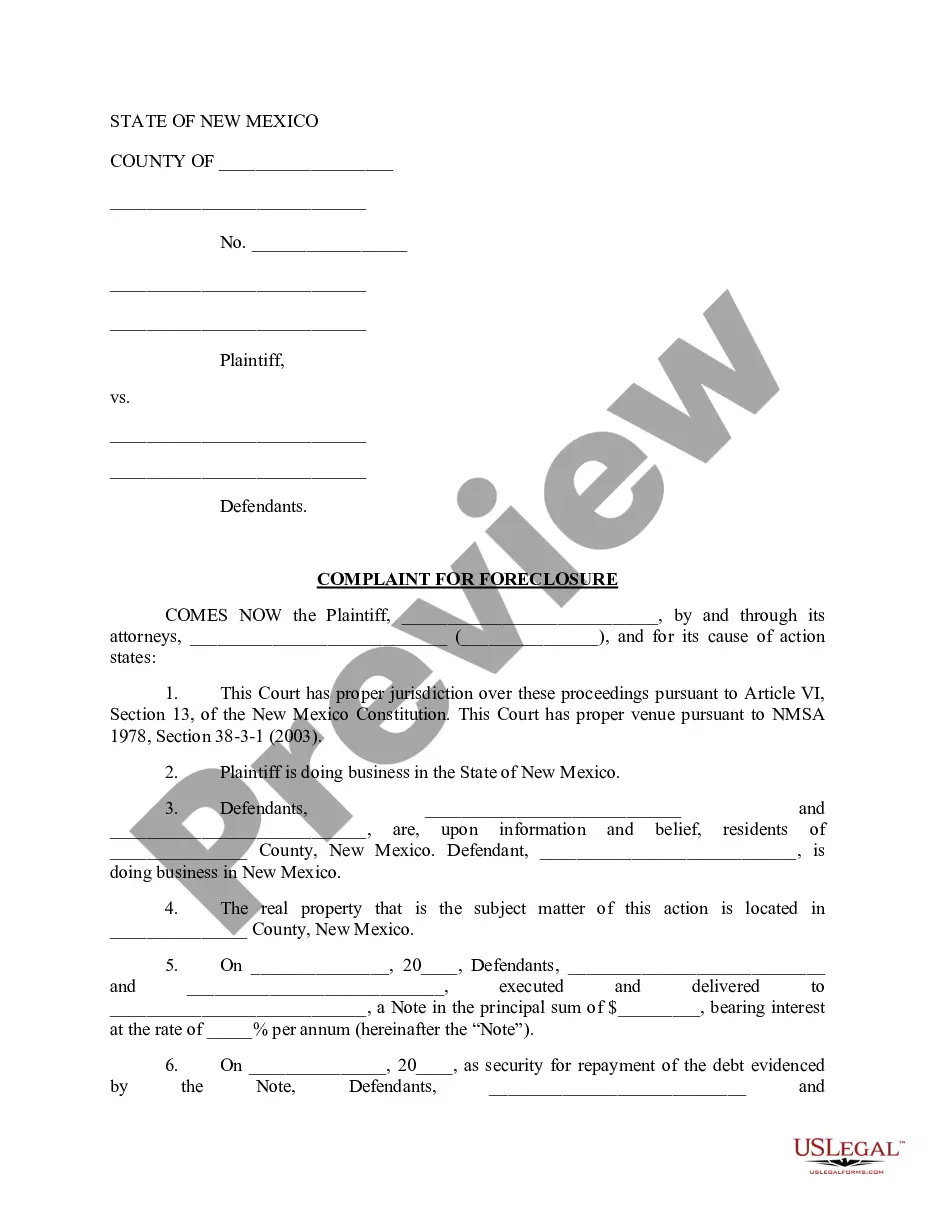

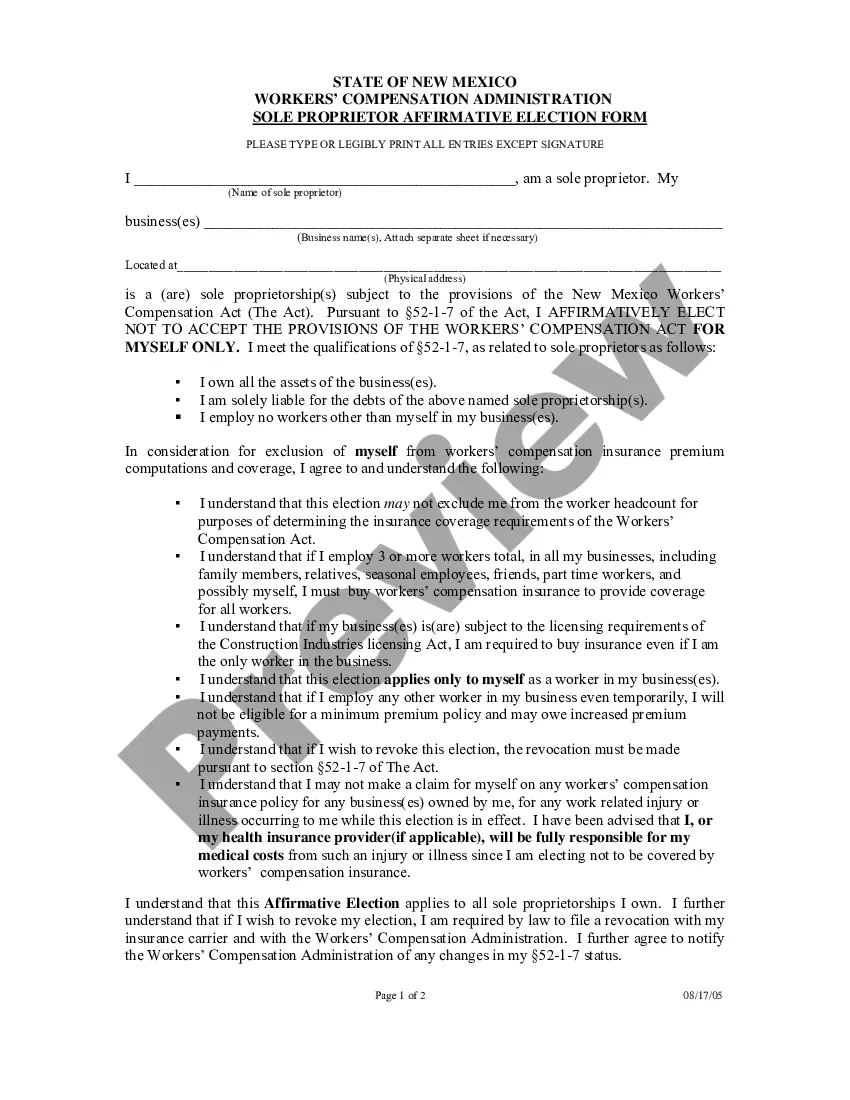

- Use the Review button to examine the form.

- Check the outline to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

The purchaser has paid a sum of Rs............... as earnest money on...................... (the receipt of which sum, the vendor hereby acknowledges) and the balance amount of consideration will be paid at the time of execution of conveyance deed. 3. The sale shall be completed within a period of.........

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...