Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

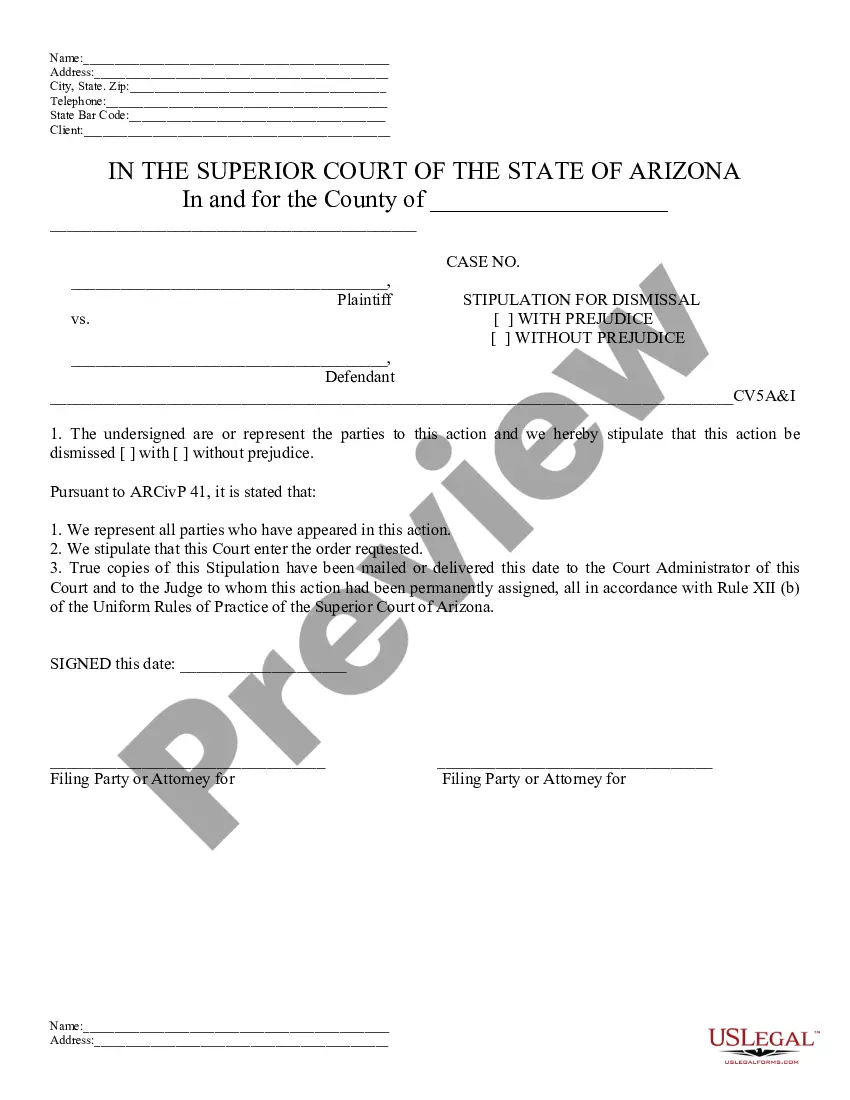

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the largest collections of legal templates in the U.S. - offers a range of legal document samples that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest forms such as the Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

If the form doesn’t meet your needs, use the Search box at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred payment plan and provide your details to create an account.

- If you already have a subscription, Log In and download the Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple tips to get started.

- Make sure you have chosen the correct form for your city/region.

- Preview the form by clicking the Preview button to check its content.

Form popularity

FAQ

Rhode Island does accept out-of-state resale certificates, provided they comply with the state's regulations. Businesses must ensure that the resale certificate includes the necessary details to be considered valid. Understanding how this interacts with the Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption is beneficial, especially for those involved in real estate transactions. Always consult with a tax professional to ensure compliance.

The Foreign Investment in Real Property Tax Act (FIRPTA) mandates that buyers withhold 10% of the net proceeds when a non-resident alien sells real estate. This act ensures that non-resident sellers fulfill their tax obligations in the United States. Understanding the implications of FIRPTA is crucial, especially when considering the Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which helps clarify reporting requirements.

The US capital gains tax for non-residents on real estate depends on various factors, including the length of property ownership. Generally, non-residents face a flat 30% on any gains from the sale of U.S. real estate. However, the Rhode Island Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption may provide you with options to avoid or reduce this tax obligation. Therefore, be sure to explore your exemptions before selling.

The purchase of prescription medicine, groceries, gasoline, and clothing are tax-exempt. Some services in Rhode Island are subject to sales tax.

Use Form 1099-S to report the sale or exchange of real estate.

Reporting the SaleUse Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

Reporting Home Sale Proceeds to the IRSIt is required to report the sale of a home if you received a Form 1099-S reporting the proceeds from the sale or if there is a non-excludable gain. Form 1099-S is an IRS tax form reporting the sale or exchange of real estate.

(Rhode Island retailers should not accept Exemption Certificates from other states.) If the customer is a manufacturer, the customer must present a Manufacturers Exemption Certificate. If the customer is a farmer, the customer must present a copy of the Farmer Tax Exemption Certificate.

Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S.

A Rhode Island resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.