Rhode Island Sample Letter for Credit - Christmas Extension Announcement

Description

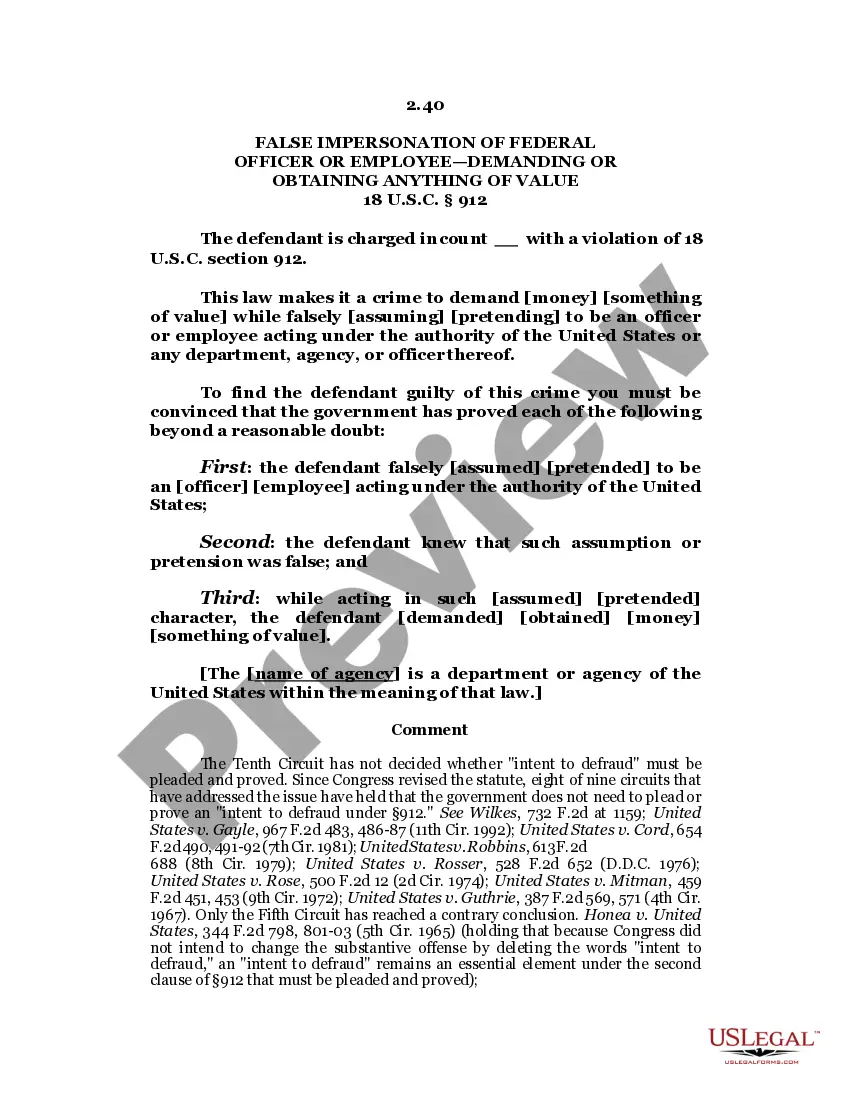

How to fill out Sample Letter For Credit - Christmas Extension Announcement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template documents that you can download or print.

By using the site, you can access numerous forms for both business and personal purposes, organized by categories, states, or keywords.

You can instantly obtain the latest versions of forms such as the Rhode Island Sample Letter for Credit - Christmas Extension Announcement.

Examine the form outline to confirm that you have chosen the right form.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already have a monthly subscription, sign in and download the Rhode Island Sample Letter for Credit - Christmas Extension Announcement from your US Legal Forms library.

- The Download button will be visible on each form you review.

- You can access all your previously purchased forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/area.

- Press the Review button to check the form’s content.

Form popularity

FAQ

To file an extension for Rhode Island state taxes, you can use Form RI-4868, which can be submitted online or by mail. This form notifies the state that you need additional time to complete your tax return. To make this process easier, consider consulting a Rhode Island Sample Letter for Credit - Christmas Extension Announcement that outlines the necessary steps and documents needed.

The RI form for business extensions should be mailed to the Rhode Island Division of Taxation, typically to their dedicated processing address. Always review the mailing instructions provided with the form to ensure proper submission. Sending the form to the correct address guarantees it will be processed effectively. Check a Rhode Island Sample Letter for Credit - Christmas Extension Announcement for accurate mailing directions.

Absolutely, a Rhode Island extension can be filed electronically via approved tax preparation software. This feature makes it easy and straightforward to manage your state tax responsibilities. It’s essential that you follow the specific guidelines set forth by the state. For clarity, use resources like a Rhode Island Sample Letter for Credit - Christmas Extension Announcement.

Yes, Form 4868 can be filed electronically through numerous tax software programs. E-filing this form helps you submit your extension request efficiently and securely. Ensure you keep a confirmation of your submission for your records. Refer to a Rhode Island Sample Letter for Credit - Christmas Extension Announcement for further details on filing extensions in the state.

Some IRS forms, such as Form 1116 for foreign tax credits or certain schedules for corporations, cannot be filed electronically. It's essential to know these limitations when preparing your tax documents. Check with a reliable source or platform to ensure compliance with IRS regulations. A detailed Rhode Island Sample Letter for Credit - Christmas Extension Announcement can provide more insights into filing methods.

Indeed, Rhode Island grants an automatic extension for state tax filings. This extension provides taxpayers with additional time without the stress of immediate submission deadlines. While this is beneficial, remember that any tax payments due should be made by the original deadline to avoid interest or penalties. A Rhode Island Sample Letter for Credit - Christmas Extension Announcement can clarify the terms.

Yes, you can file the RI-4868 electronically through various tax software platforms. This method makes it convenient to submit your extension request while ensuring accuracy. Always check that your chosen platform complies with Rhode Island’s filing requirements. Using a Rhode Island Sample Letter for Credit - Christmas Extension Announcement can help streamline this process.