This is a form for return of merchandise by a customer.

Rhode Island Merchandise Return

Description

How to fill out Merchandise Return?

Are you situated in a location where you need documents for organization or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of document templates, including the Rhode Island Merchandise Return, which can be tailored to comply with state and federal requirements.

Once you locate the suitable form, click on Buy now.

Choose the pricing plan you prefer, fill in the necessary details to finalize your purchase, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you will be able to download the Rhode Island Merchandise Return template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct jurisdiction.

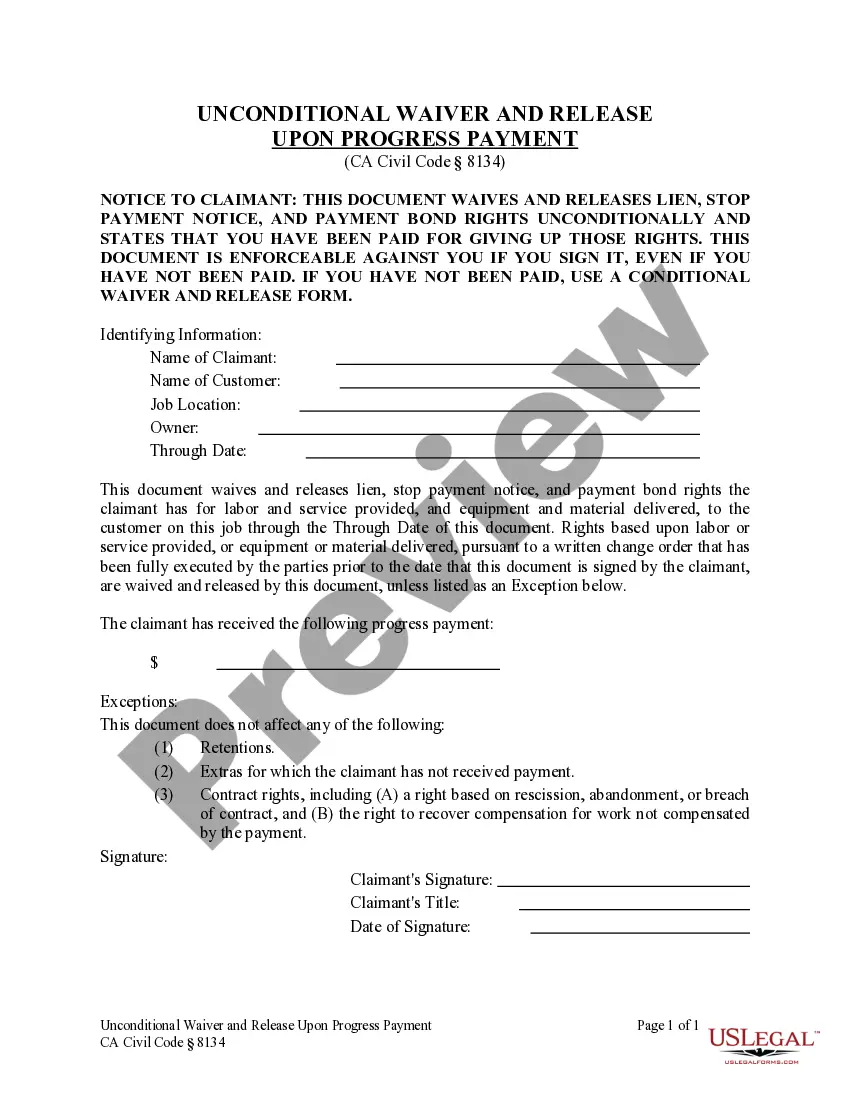

- Use the Review button to examine the form.

- Check the description to confirm that you have chosen the right document.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

To reach Rhode Island novelty, you can visit their official website for contact information, including phone numbers and email addresses. They usually provide a customer service section that offers options for inquiries about products or services. If you're interested in their Rhode Island Merchandise Return policy, be sure to specify that in your communication. This ensures you receive relevant support tailored to your needs.

When it comes to your Rhode Island license plate, the state does require you to return it if you decide to discontinue your vehicle's registration. This is part of the Rhode Island Merchandise Return process, ensuring that all plates are accounted for and properly handled. You can return the plate at your local DMV office or follow the instructions available on their website for mail returns. By doing so, you help maintain the integrity of the state's vehicle registration system.

Registering for sales tax in Rhode Island is a straightforward process. You need to fill out an application on the Rhode Island Division of Taxation website and provide relevant business information. Once your application is approved, you will receive a sales tax permit. This step is key for complying with state regulations regarding Rhode Island Merchandise Returns.

Yes, Rhode Island does have a state sales tax. The state imposes this tax on the sale of tangible goods and certain services, which can affect both consumers and retailers. As a business owner, understanding this tax is essential for managing Rhode Island Merchandise Returns, as it impacts final sale prices and refunds. For more detailed regulations, refer to the Rhode Island tax resources.

In Rhode Island, most tangible personal property is subject to sales tax, including merchandise sold in stores. However, some services, digital products, and certain groceries may also incur a tax. It's important to check specific categories to ensure compliance, especially if your business deals with Rhode Island Merchandise Returns. For a clearer understanding, you can consult the Rhode Island Division of Taxation.

To register for sales tax in Rhode Island, you need to visit the Rhode Island Division of Taxation website. Complete the online application form available on the site, ensuring you provide accurate business information. Once submitted, you will receive a unique sales tax permit number, allowing you to comply with the state's tax regulations. Remember, this step is crucial for businesses selling products subject to the Rhode Island Merchandise Return policy.

Yes, you can file your Rhode Island taxes online easily. Many platforms, like US Legal Forms, provide user-friendly tools to help you complete your Rhode Island Merchandise Return. By filing online, you simplify the process, ensure accuracy, and often receive faster refunds. Remember, choosing the right resources can make your tax filing journey much smoother.

Form RI 1040 is the state income tax return form for residents of Rhode Island. It is used to report income, calculate the tax owed, and claim any applicable credits or deductions. For your Rhode Island merchandise return, ensuring you fill out this form correctly is vital to your tax compliance.

In Rhode Island, certain items are exempt from sales tax, including groceries, prescription medications, and some medical equipment. Understanding these exemptions can help you save on your overall expenses. For more in-depth guidance on your Rhode Island merchandise return and exemptions, check out uslegalforms.

Yes, you can choose to file a federal tax return without filing a state return. However, this decision may have consequences based on where you live and your income level. When handling your Rhode Island merchandise return, check local regulations to stay compliant with state law.