Rhode Island Material Return Record

Description

How to fill out Material Return Record?

If you wish to finalize, acquire, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms accessible online.

Utilize the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Every legal document template you acquire is yours permanently. You can access each form you downloaded through your account.

Complete and download, and print the Rhode Island Material Return Record using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to search for the Rhode Island Material Return Record within a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to locate the Rhode Island Material Return Record.

- You can also find forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

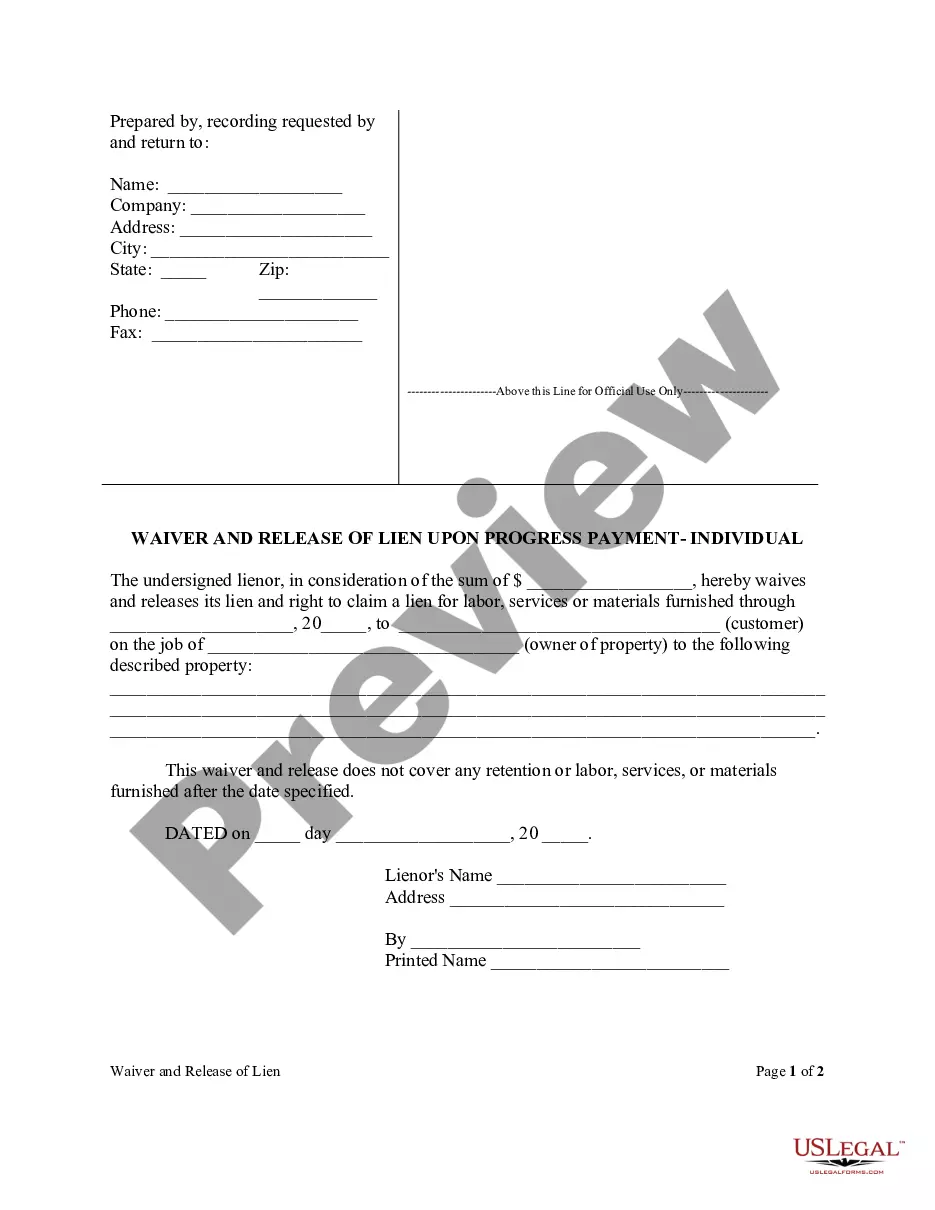

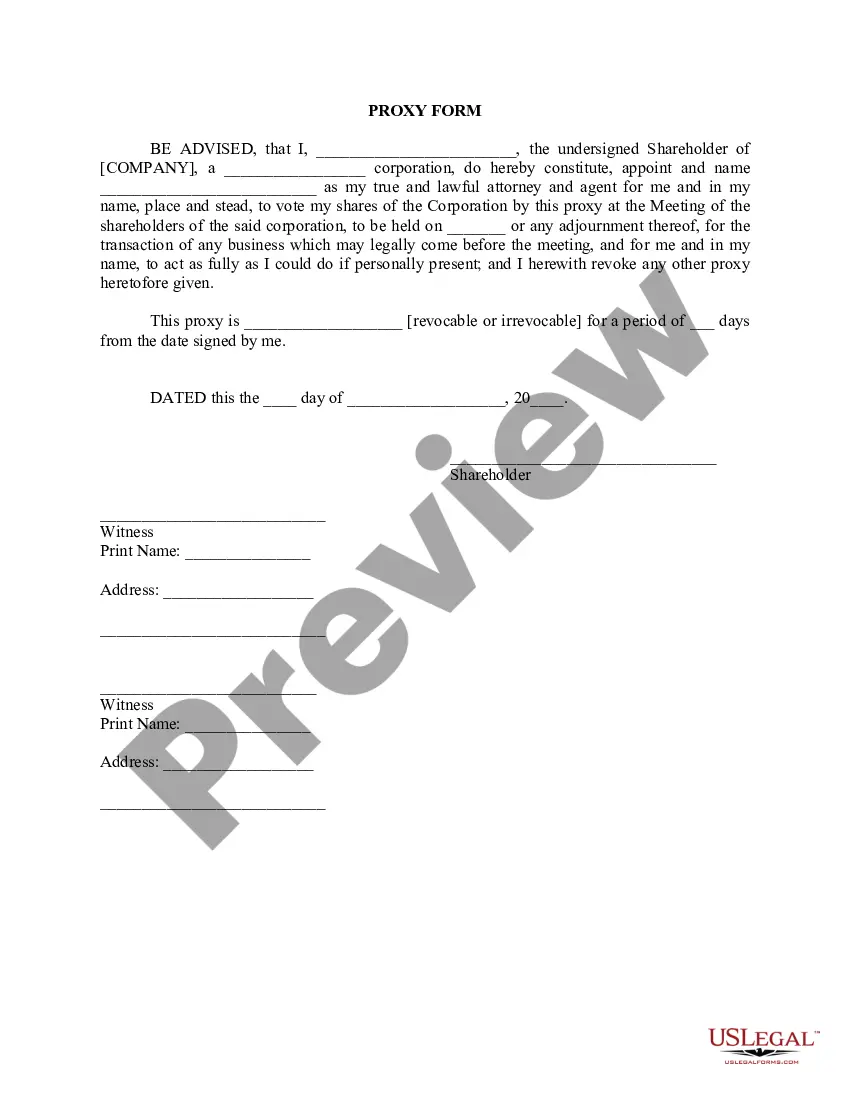

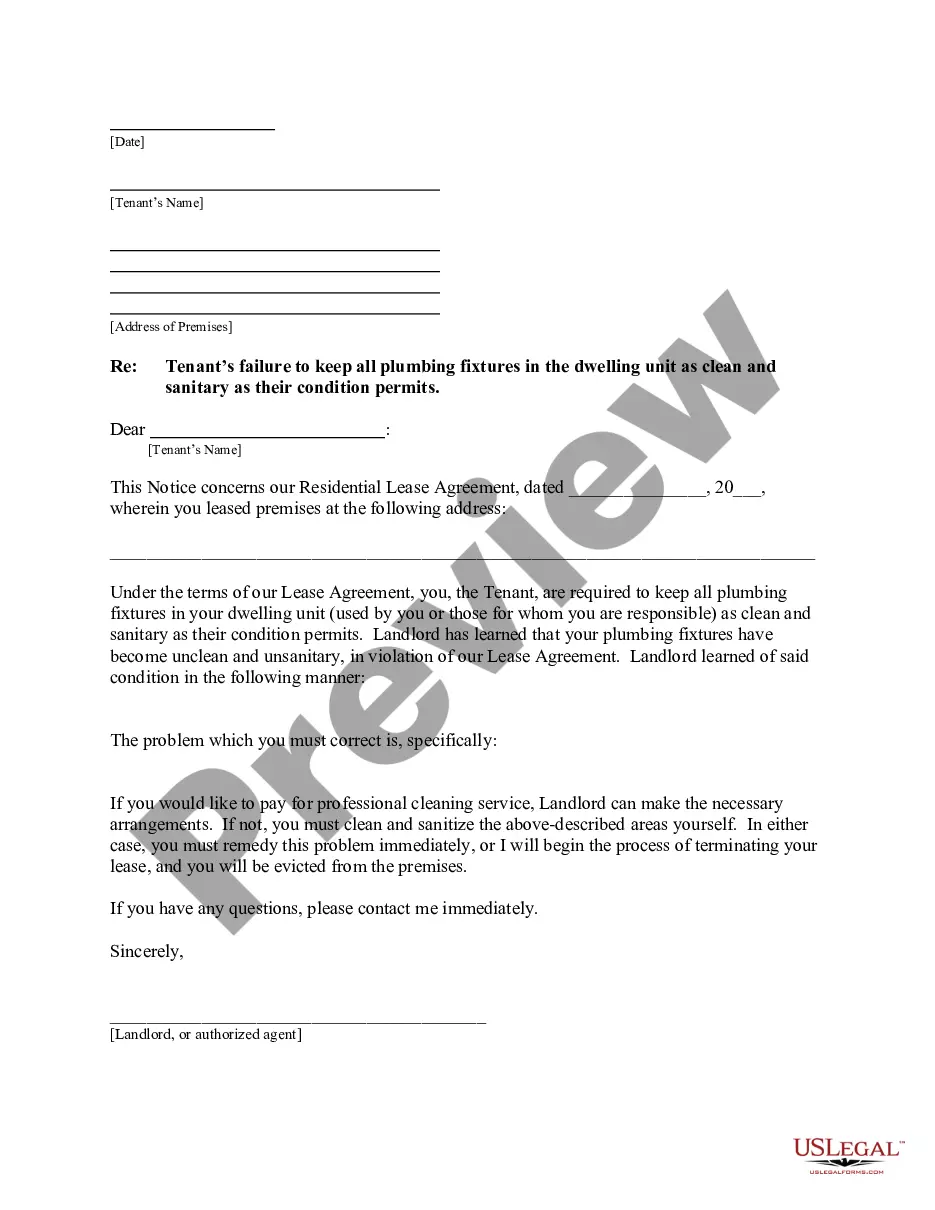

- Step 2. Utilize the Preview function to review the document’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have located the form you want, click the Buy Now option. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Rhode Island Material Return Record.

Form popularity

FAQ

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit and click on Employer and Information returns.

Under the old law, certificates of exemption from the Rhode Island sales and use tax did not expire. As of July 1, 2017, sales tax exemption certificates are valid for four years from the date of issuance. Sales tax exemption certificates issued on or before July 1, 2017, expire on June 30, 2021.

A Rhode Island resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

State of Rhode Island Division of Taxation. Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form.

What is a W-3 form? Technical answer: Form W-3 is used to total up all parts of Form W-2. Both forms are filed together and sent to Social Security Administration (SSA) every year. Form W-3 is also known as Transmittal of Wage and Tax Statements.

How to fill out the Rhode Island Resale CertificateStep 1 Begin by downloading the Rhode Island Resale Certificate.Step 2 Include the buyer's retail permit number.Step 3 List what the buyer's business sells.Step 4 Enter the name of the seller.Step 5 List the property being purchased from the seller.More items...?

Form W-3 Transmittal of Wage and Tax Statements. 2019. Department of the Treasury.

Form RI-941 is a new form intended to be filed starting in 2020 by: 1) Those employers eligible to remit, on a Quarterly basis, the Rhode Island state income tax withheld from employees' wages.

More about the Rhode Island Schedule WThis form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government.

How to File and Pay Sales Tax in Rhode IslandFile online File online at the Rhode Island Division of Taxation.File by mail You can use the Rhode Island Streamlined Sales Tax Return and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $200 or more.More items...