Rhode Island Invoice Template for CEO

Description

How to fill out Invoice Template For CEO?

You can dedicate time online searching for the valid document template that meets the federal and state standards you need.

US Legal Forms provides thousands of valid forms that have been reviewed by professionals.

It is easy to obtain or create the Rhode Island Invoice Template for CEO from our service.

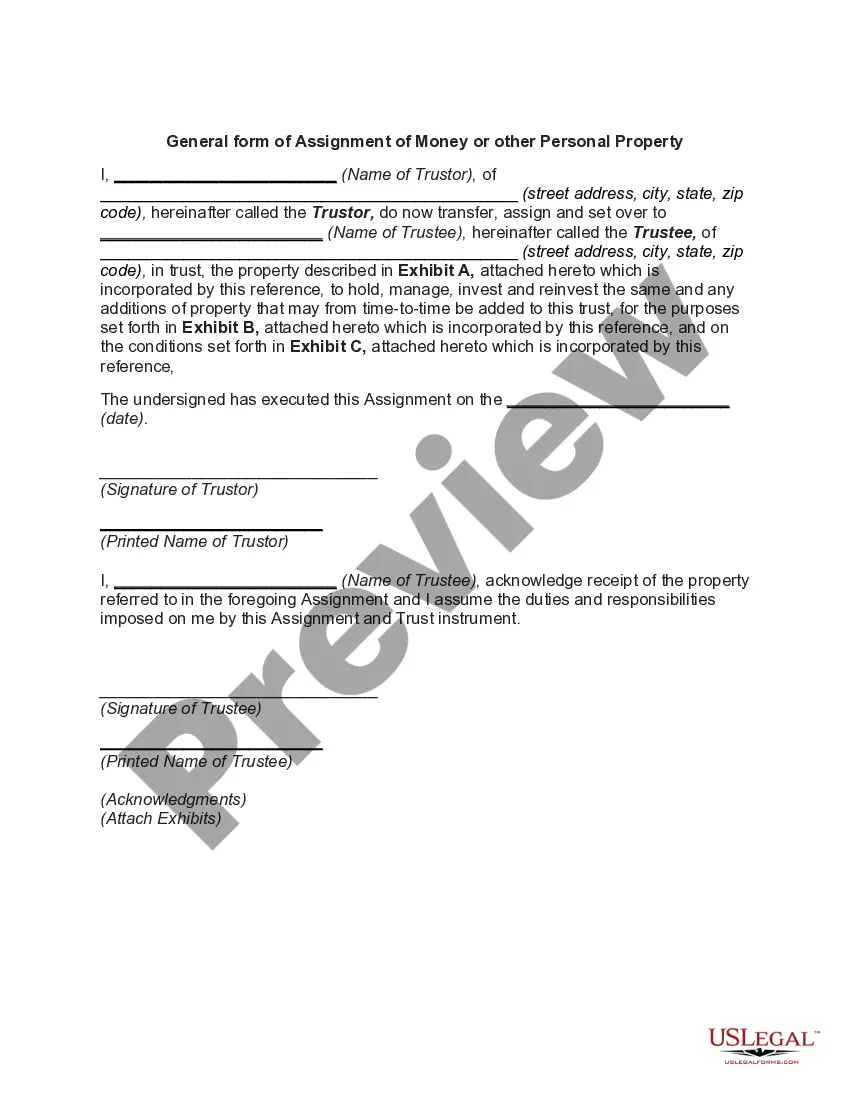

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download button.

- After that, you can complete, edit, generate, or sign the Rhode Island Invoice Template for CEO.

- Every valid document template you download is yours permanently.

- To retrieve another copy of the downloaded form, visit the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions outlined below.

- First, make sure you have chosen the correct document template for the region/area you select.

- Review the form description to ensure you have picked the right form.

Form popularity

FAQ

Rhode Island offers some tax benefits for retirees, such as exemptions on certain retirement income. However, property taxes may still be a concern. It’s a good idea to evaluate your options and consider tools like the Rhode Island Invoice Template for CEO to manage retirement income effectively.

The RI-1065 form is required for partnerships operating in Rhode Island and involves reporting the partnership's income, deductions, and credits. All partnerships must file this form, ensuring compliance with state tax laws. If you use a Rhode Island Invoice Template for CEO, it can help organize your income and expenses to simplify the filing process.

After taxes, an income of $100,000 in Rhode Island can drop significantly depending on your specific tax situation, including deductions and exemptions. Generally, you might expect to take home around $70,000 after state and federal tax obligations. Using a Rhode Island Invoice Template for CEO can assist you in budgeting and financial management to account for these deductions.

The RI W3 form is a summary of the state income tax withheld and filed by employers in Rhode Island. This form consolidates information about employees and their wages, ensuring compliance with state tax laws. If you manage payroll, having a Rhode Island Invoice Template for CEO can help streamline your reporting process.

Rhode Island offers some tax benefits, particularly for small businesses. By leveraging resources like the Rhode Island Invoice Template for CEO, you can navigate the tax landscape effectively. It’s essential to weigh the benefits against the costs to determine if it fits your financial strategy.

In Rhode Island, property tax exemptions may apply for seniors beginning at age 65. If you qualify, it can bring significant savings, allowing you to focus resources on other areas, such as using a Rhode Island Invoice Template for CEO. However, ensure you check the local regulations, as they can vary by municipality.

Rhode Island has a reputation for higher income and property taxes compared to some states. However, it offers various tax incentives for businesses and individuals considering benefits like the Rhode Island Invoice Template for CEO. While it may not be the most tax-friendly option, the state's support for entrepreneurs can lead to long-term gains.