Rhode Island Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

If you wish to finish, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the website's simple and convenient search feature to locate the documents you require.

Numerous templates for business and individual purposes are categorized by types and states, or keywords.

Step 4. After you've identified the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to procure the Rhode Island Lease of Computer Equipment with Equipment Schedule and Purchase Option with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and press the Download button to retrieve the Rhode Island Lease of Computer Equipment with Equipment Schedule and Purchase Option.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

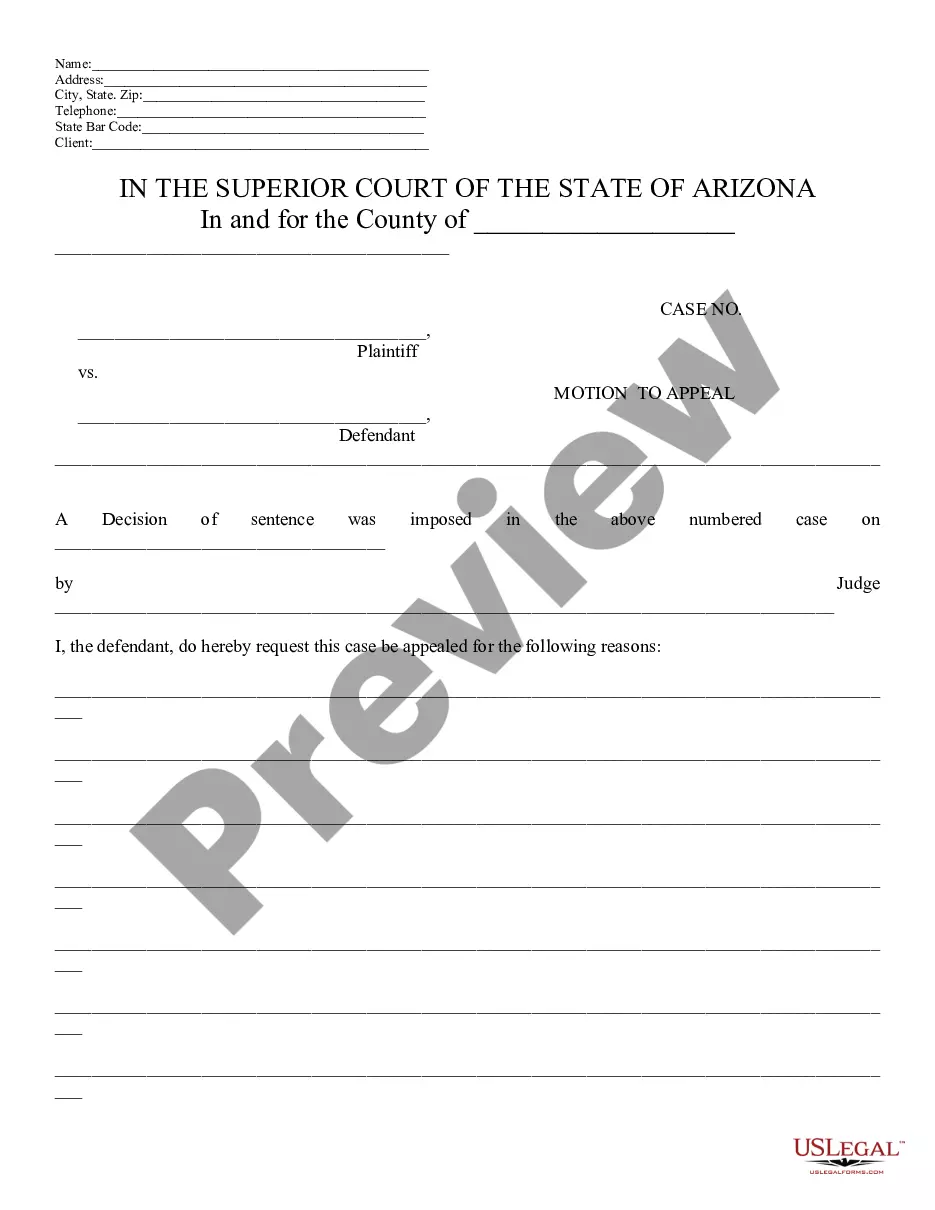

- Step 2. Use the Preview option to review the form's content. Remember to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The following aspects of a property lease transaction are fundamental:Exactly what is being rented? ( eg.Are there any areas utilised by other users? (e.g. Shared yard areas).Rentable area of premises.Exact use of the premises and facilities.Date of Occupation of the property.Lease start date.The period of Lease.More items...?01-Mar-2020

Various Types of Lease: Finance, Operating, Direct, LeveragedVarious Types of Lease.(1) Finance lease :(2) Operating lease :(3) Sale and lease back :(4) Direct lease :(5) Single investor lease :(6) Leveraged lease :(7) Domestic Lease :More items...

The three main types of leasing are finance leasing, operating leasing and contract hire.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

To evaluate whether or not you're getting a good deal, focus on the four factors that determine how much money you will end up spending, says Reed. Those factors are the monthly payments, the length of the lease, the down payment, and the mileage restrictions on the lease contract.

4 Factors to Evaluating a Lease OptionA lease option comes at the end of a lease contract. You may be able to extend the lease, stop the lease, or even purchase the home you are renting.Maintenance Record.Cost to Lease vs. Cost to Buy.Cost to Extend Lease vs. Cost of New Lease.Market Considerations.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

The three most common types of leases are gross leases, net leases, and modified gross leases.The Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

Buying or Leasing Business Equipment: Factors to considerOutright purchase. This option is when businesses decide to own the asset and make an outright purchase.Tax benefits.Ownership & Control.Leasing equipment.Frequent Equipment Upgrade.Limited upfront investment.Tax savings.Invest in Core Competencies.10-Mar-2021

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...