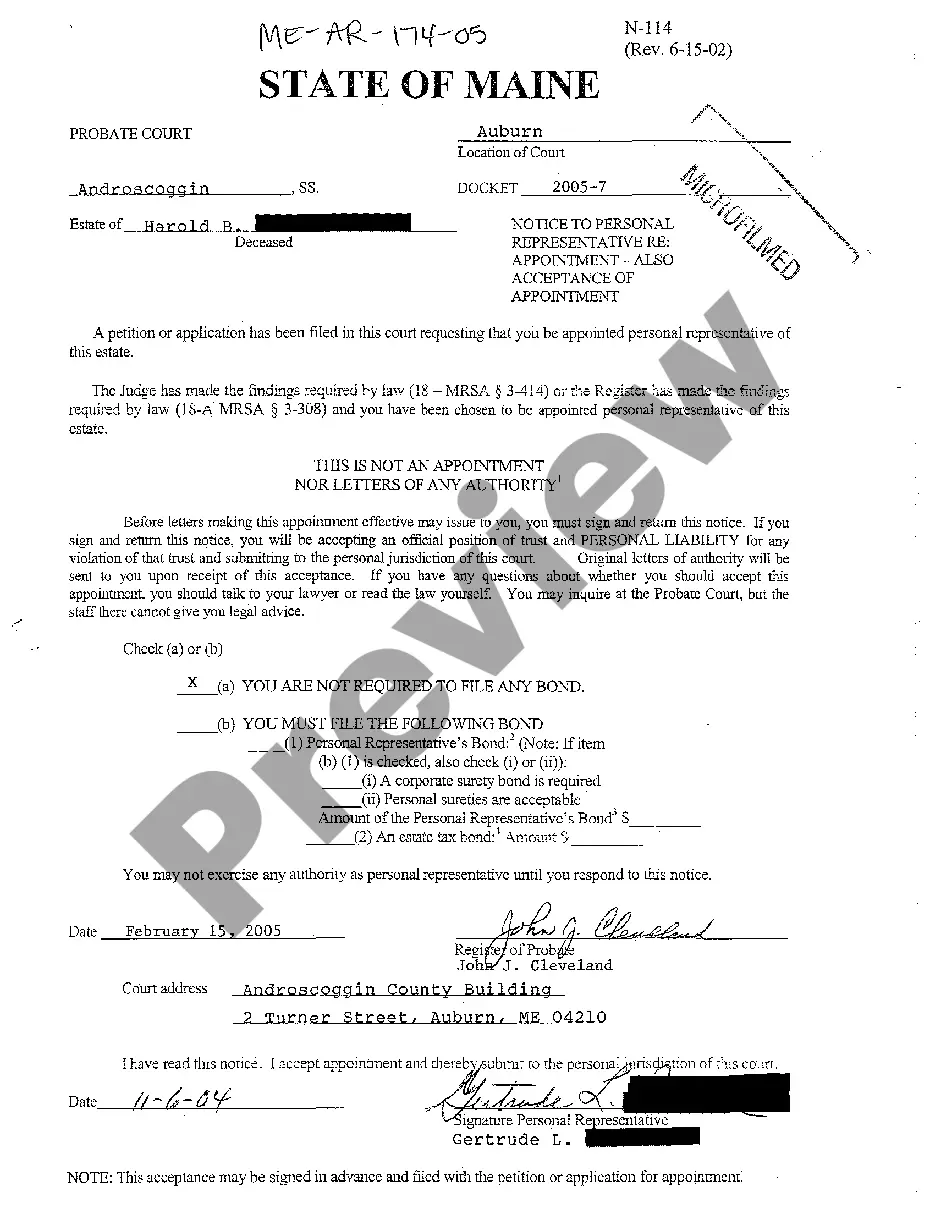

Rhode Island Assignment and Bill of Sale of Equipment and Machinery

Description

How to fill out Assignment And Bill Of Sale Of Equipment And Machinery?

If you need to extensive, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Leverage the website's user-friendly and efficient search to find the documents you require.

A variety of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click on the Buy now option. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the payment. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Rhode Island Assignment and Bill of Sale of Equipment and Machinery.

- Use US Legal Forms to acquire the Rhode Island Assignment and Bill of Sale of Equipment and Machinery in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Rhode Island Assignment and Bill of Sale of Equipment and Machinery.

- You can also access forms you previously saved via the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your specific area/country.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Rhode Island, a bill of sale does not typically need to be notarized for it to be valid. However, notarization can provide extra protection and legitimacy, especially in larger transactions involving expensive equipment. If you choose to notarize your document, it can serve as a proof of the transaction, which may be beneficial if issues arise later on.

In Rhode Island, a bill of sale is not legally required for all transactions, but it is highly recommended. A proper bill of sale can provide clarity during ownership transfers, especially for equipment and machinery. It becomes particularly important for avoiding issues over ownership rights or asset recovery.

Yes, a bill of sale transfers ownership of equipment from one party to another. When you complete the Rhode Island Assignment and Bill of Sale of Equipment and Machinery, it serves as proof that the buyer now holds title to the business equipment. This document is essential for legal purposes and can help prevent disputes regarding ownership in the future.

Yes, a notary can notarize a bill of sale, providing that the involved parties are present and sign the document in the notary's presence. Notarization can enhance the legitimacy of the Rhode Island Assignment and Bill of Sale of Equipment and Machinery, adding peace of mind to the transaction. Make sure to bring valid identification and any other required documentation when visiting the notary.

Yes, the West Virginia DMV typically requires a bill of sale when you transfer ownership of equipment or machinery. This document serves as proof of the transaction and protects both the buyer and seller under the Rhode Island Assignment and Bill of Sale of Equipment and Machinery. If you're transitioning equipment across state lines, ensure you have the necessary paperwork for both states.

In Rhode Island, a bill of sale does not require notarization to be legally binding. However, notarizing the document can add an extra layer of authenticity and protect both parties involved in the Rhode Island Assignment and Bill of Sale of Equipment and Machinery. If you choose to notarize your bill of sale, consider using a notary service for smooth processing.

The mailing address for your federal income tax return depends on whether you are enclosing a payment or filing electronically. Typically, the IRS provides specific mailing addresses based on your state of residence and the form used. Keeping your Rhode Island Assignment and Bill of Sale of Equipment and Machinery on file can help you accurately report any related income or expenses on your federal taxes.

When it comes to mailing an IRS estate tax return, the address varies based on your location and whether you are including a payment. Generally, you can find the correct mailing address on the IRS website or the form instructions. It’s wise to keep detailed records, such as a Rhode Island Assignment and Bill of Sale of Equipment and Machinery, to support your returns, should any questions arise.

To mail your Rhode Island state tax return, direct it to the appropriate address as listed on your specific tax form. Each form may have a designated mailing address for processing. Ensuring you have your Rhode Island Assignment and Bill of Sale of Equipment and Machinery on hand can help you accurately report any taxable transactions you may have conducted throughout the year.

Your Rhode Island Sales and Use Tax Return (STR) should be mailed to the Rhode Island Division of Taxation. The specific address for this is provided on the STR form itself. Consider keeping copies of your returns and any related documents, including your Rhode Island Assignment and Bill of Sale of Equipment and Machinery, for your records. This organization will enhance your tax filing process.