Rhode Island Assignment of Assets

Description

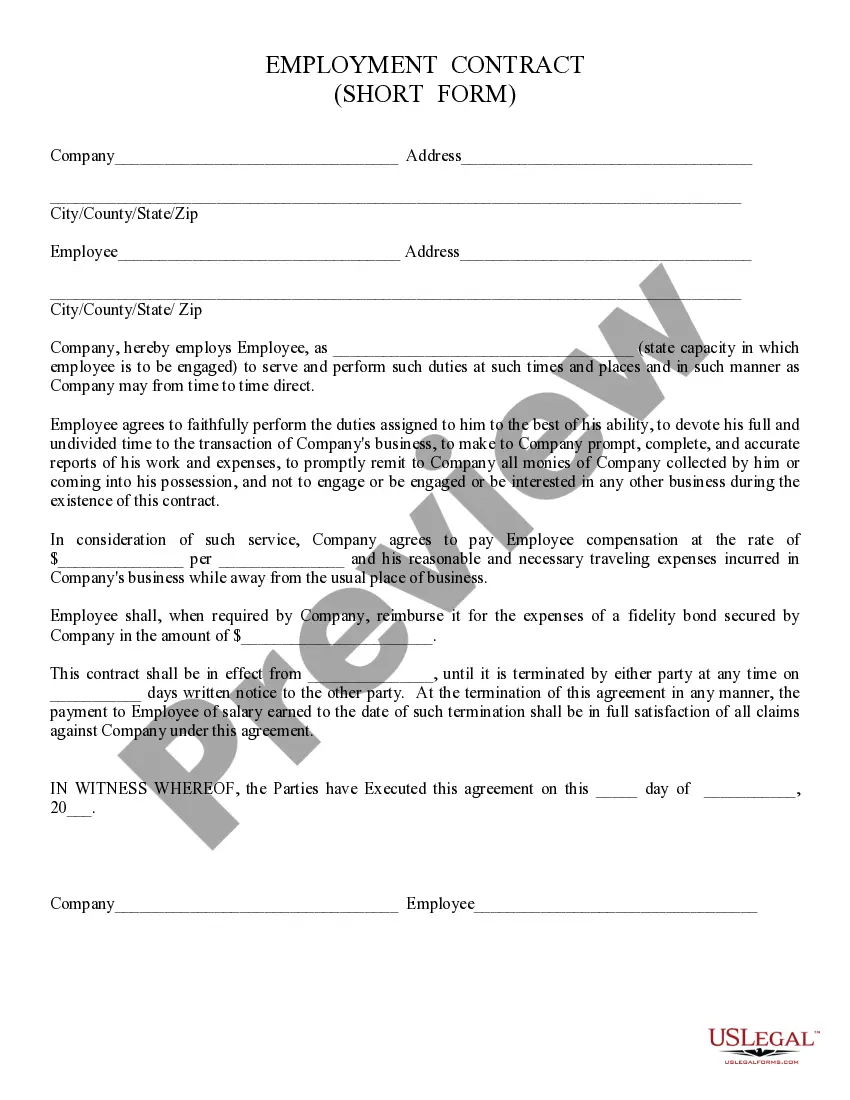

How to fill out Assignment Of Assets?

Are you presently in a situation where you require documents for possibly business or personal needs almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers thousands of form templates, including the Rhode Island Assignment of Assets, that are designed to meet both federal and state requirements.

Once you locate the correct form, click on Buy now.

Select the pricing plan you prefer, fill in the required details to set up your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After logging in, you can download the Rhode Island Assignment of Assets template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/state.

- Use the Review button to evaluate the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you’re looking for, utilize the Search area to find the form that meets your requirements.

Form popularity

FAQ

Rhode Island does not automatically divide marital assets 50/50; rather, it uses equitable distribution criteria to determine a fair outcome. Factors such as financial circumstances, contributions, and needs may influence how assets are assigned. Knowing how the court operates under Rhode Island Assignment of Assets can help you prepare your case for effective negotiations.

Rhode Island is not a community property state but follows equitable distribution principles regarding marital property. This means that assets acquired during the marriage are divided fairly, though not necessarily equally. In situations involving the assignment of assets, understanding how property is categorized is crucial for achieving a just outcome.

In a divorce in Rhode Island, the wife is entitled to a fair distribution of marital assets, which may include property, savings, and retirement accounts. The court considers various factors to determine equitable division, taking into account the length of the marriage and each spouse's contribution. Understanding your rights under the Rhode Island Assignment of Assets can help navigate this division.

A will generally needs to be probated in Rhode Island if it meets specific criteria, such as containing the decedent's signature and proper witnesses. If the estate has significant assets or claims, filing for probate is advisable to ensure lawful asset distribution. Knowing when probate is required helps clarify the Rhode Island Assignment of Assets, streamlining the estate settlement process.

Rhode Island is not typically classified as a 'stand your ground' state. Instead, it follows the principle of justified use of force, which requires individuals to retreat if it is safe to do so before using lethal force. Understanding self-defense laws can be vital, especially when discussing the implications for personal assets in violent encounters.

If you fail to file for probate in Rhode Island, it can delay the distribution of the deceased's assets and lead to legal complications. Additionally, the estate's assets may be at risk of loss or mismanagement without proper administrative oversight. To ensure the appropriate assignment of assets, timely action is critical, and you may consider utilizing resources like USLegalForms to facilitate the probate process.

Rhode Island does not recognize common law marriages established after January 1, 2013. However, common law marriages that were established before this date may still be considered valid in certain contexts. If you are addressing asset distribution in a relationship recognized under Rhode Island Assignment of Assets, it is crucial to understand how those rights may be affected.

In Rhode Island, a personal representative is the individual responsible for managing an estate after someone passes away. This person oversees the process of probate and ensures that the deceased's assets are distributed according to their will or Rhode Island law. If you've encountered complications regarding the assignment of assets, knowing your rights and responsibilities as a personal representative can help you navigate the process effectively.

Adultery can impact divorce proceedings in Rhode Island, particularly in relation to asset distribution and alimony. While Rhode Island follows a no-fault divorce system, instances of infidelity may influence the court's decisions regarding the division of property and support obligations. Understanding the implications of adultery within the context of the Rhode Island Assignment of Assets is essential for fair resolution.

While you can write a will on a piece of paper in Rhode Island, it must still meet legal requirements to be valid. A handwritten will, known as a holographic will, is acceptable as long as it is signed and dated by you. However, to ensure that your Rhode Island Assignment of Assets is properly administered, consider using formal legal services to create a comprehensive estate plan.