Are you currently in a position the place you will need files for either business or personal purposes just about every day? There are a variety of authorized papers web templates available online, but discovering types you can rely on isn`t effortless. US Legal Forms provides thousands of type web templates, just like the Rhode Island Contest of Final Account and Proposed Distributions in a Probate Estate, which are published in order to meet state and federal requirements.

When you are presently familiar with US Legal Forms site and also have your account, just log in. Afterward, you may down load the Rhode Island Contest of Final Account and Proposed Distributions in a Probate Estate design.

If you do not provide an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for that proper metropolis/state.

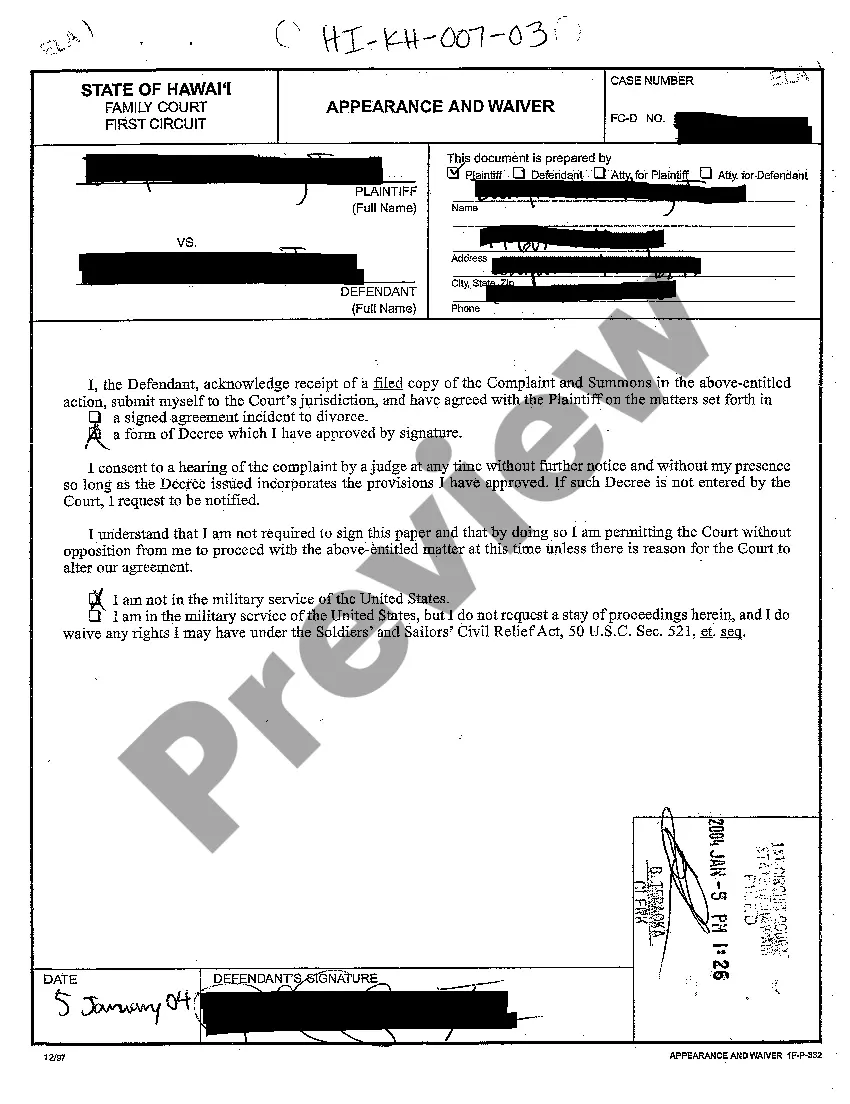

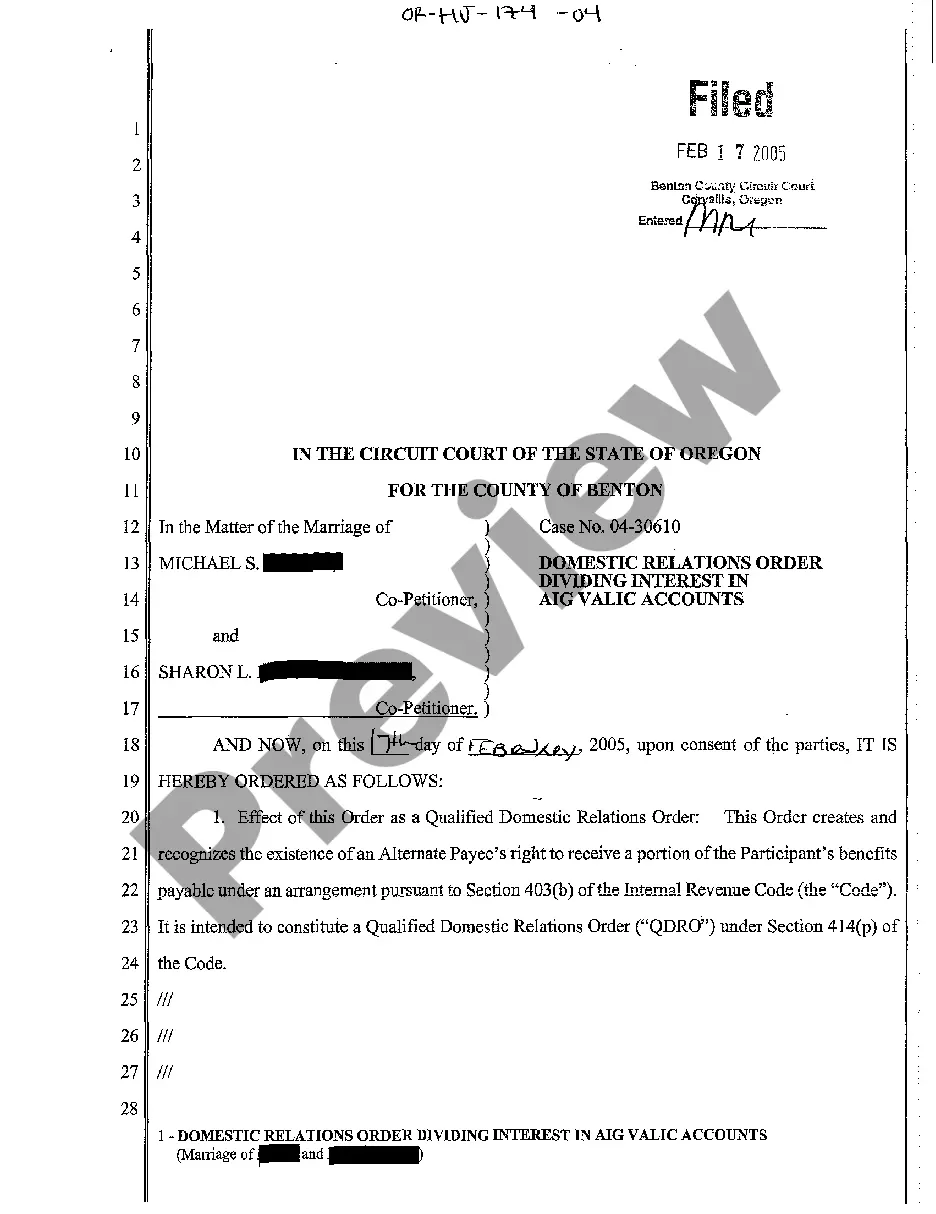

- Utilize the Review key to examine the shape.

- Browse the outline to actually have selected the right type.

- In the event the type isn`t what you`re trying to find, utilize the Search industry to get the type that meets your needs and requirements.

- If you get the proper type, just click Purchase now.

- Pick the prices plan you need, fill out the required details to produce your account, and purchase your order using your PayPal or charge card.

- Decide on a convenient data file file format and down load your copy.

Find every one of the papers web templates you have purchased in the My Forms menu. You can obtain a more copy of Rhode Island Contest of Final Account and Proposed Distributions in a Probate Estate anytime, if required. Just select the necessary type to down load or produce the papers design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to conserve time and prevent mistakes. The support provides professionally manufactured authorized papers web templates which can be used for a range of purposes. Generate your account on US Legal Forms and begin creating your life a little easier.