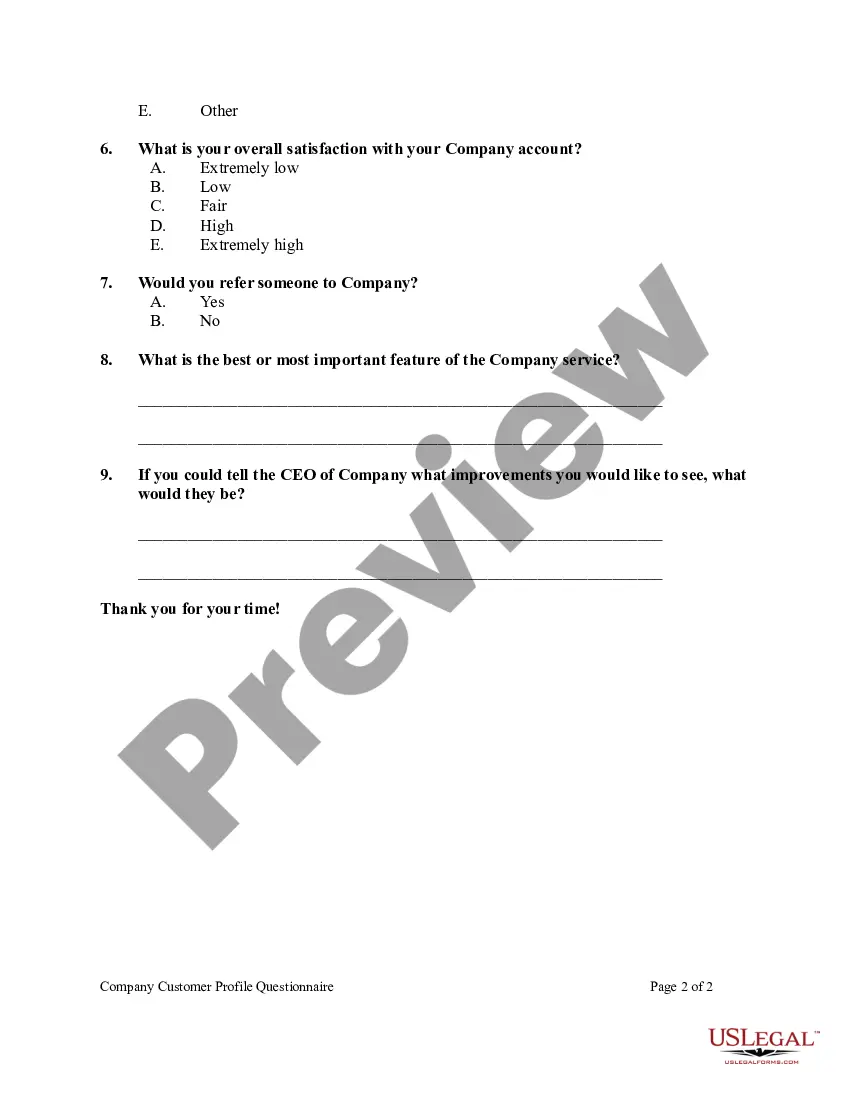

Rhode Island Company Customer Profile Questionnaire

Description

How to fill out Company Customer Profile Questionnaire?

If you want to finalize, acquire, or produce legitimate document templates, utilize US Legal Forms, the largest selection of legal forms that is accessible online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Rhode Island Company Customer Profile Questionnaire in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Rhode Island Company Customer Profile Questionnaire.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct region/country.

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

To file for a single member LLC in Rhode Island, you need to prepare the Articles of Organization and submit them to the Secretary of State. Ensure you have chosen a unique name for your LLC and included the required information. Depending on your business activities, you may also need additional permits. Utilizing the Rhode Island Company Customer Profile Questionnaire can help you gather all necessary documents and details for your filing.

To verify a business in Rhode Island, you can check the business entity database maintained by the Rhode Island Secretary of State. This online tool allows you to search for your business by name or identification number. Regularly verifying your business information will help you maintain compliance and accuracy. Using the Rhode Island Company Customer Profile Questionnaire might facilitate understanding of your verification needs.

A single member LLC is not required to file Form 1065 in Rhode Island. Since it is considered a disregarded entity, the income is reported on your personal tax return instead. This makes compliance simpler, yet staying informed about local regulations is crucial. Completing the Rhode Island Company Customer Profile Questionnaire can provide you with clarity on your filing requirements.

To obtain a seller's permit in Rhode Island, you need to register your business with the Rhode Island Division of Taxation. This can typically be done online through their website, where you will also find detailed instructions and any necessary forms. Don't forget to gather your business information beforehand to ensure a smooth application process. The Rhode Island Company Customer Profile Questionnaire can serve as a helpful tool in organizing your business details.

Single member LLCs do not need to file Form 1065 since it is primarily used for partnerships. Instead, the income from your single member LLC is reported directly on your individual tax return using Schedule C. Keeping accurate records will help you navigate tax season effectively. Utilize the Rhode Island Company Customer Profile Questionnaire for additional insights into your business obligations.

No, a single member LLC is not considered a partnership. It is classified as a sole proprietorship for tax purposes, meaning all profits and losses are reported on your personal tax return. This structure provides liability protection while allowing for simpler filing requirements compared to a partnership. To ensure you’re compliant, consider exploring the Rhode Island Company Customer Profile Questionnaire.

A single member LLC does not need to appoint a partnership representative since it is treated as a disregarded entity for federal tax purposes. This means that the single member reports the income and expenses directly on their personal tax return. However, if your LLC has specific needs or concerns, you might consider consulting professionals for tailored guidance. Completing a Rhode Island Company Customer Profile Questionnaire can help streamline this process.

To look up a business in Rhode Island, head over to the Rhode Island Secretary of State's website, where you can find a user-friendly business lookup tool. Enter the business name or number, and you'll access detailed information about the entity. Additionally, leveraging the Rhode Island Company Customer Profile Questionnaire can assist you in gathering comprehensive data for your research.

Filing an annual report in Rhode Island is an essential step for maintaining your business's active status. You can complete the process easily through the Rhode Island Secretary of State's online portal. Simply follow the instructions to fill out the required information and submit your report on time. Using the Rhode Island Company Customer Profile Questionnaire can help ensure you include all necessary details for compliance.

Finding out if a business is registered in Rhode Island is straightforward. You can use the Rhode Island Secretary of State's website and navigate to the business entity search section. Enter the required details, such as the business name or owner name, to verify registration status. The Rhode Island Company Customer Profile Questionnaire may also provide insights into a business's legitimacy and compliance.