Rhode Island Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Are you in a situation where you need documents for either business or personal reasons almost all the time.

There is a range of legal document formats available online, but finding reliable versions is not straightforward.

US Legal Forms offers thousands of templates, such as the Rhode Island Simple Equipment Lease, designed to meet federal and state requirements.

Once you find the correct form, click on Get now.

Choose the payment plan you want, fill in the required details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you will be able to download the Rhode Island Simple Equipment Lease template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/state.

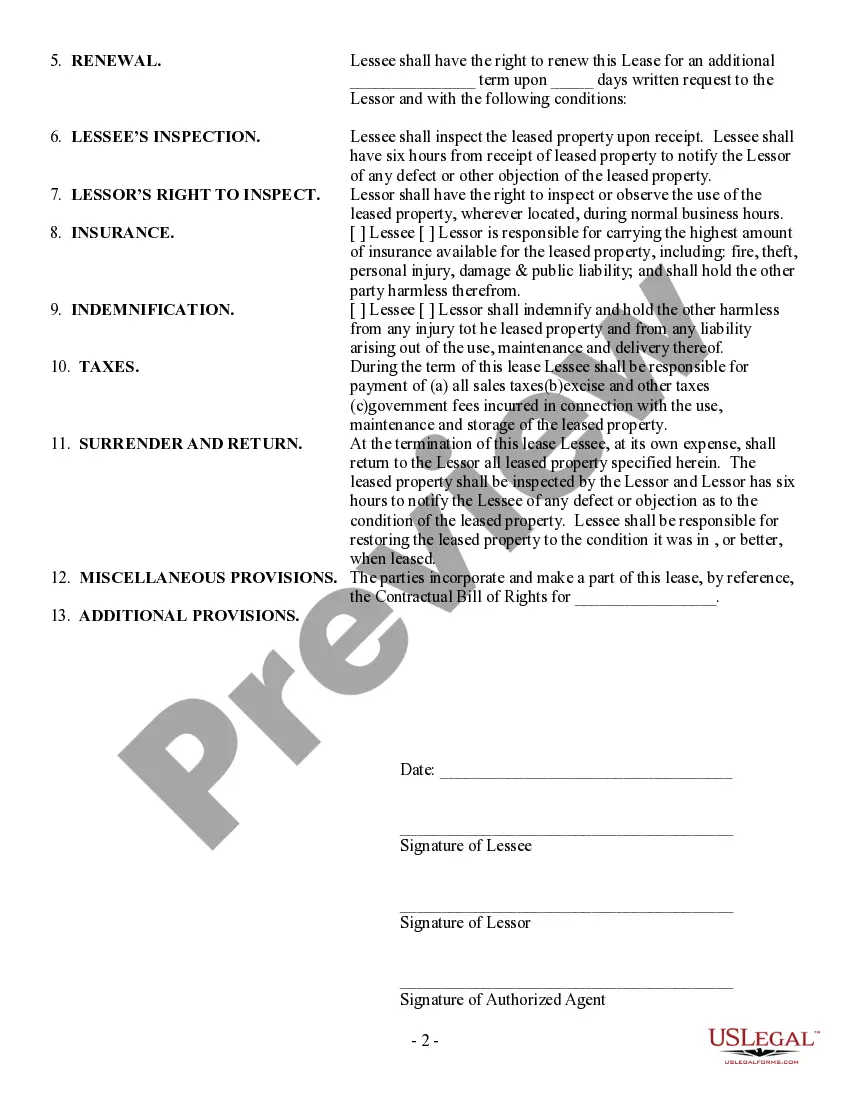

- Use the Review button to examine the form.

- Read the description to confirm that you have chosen the correct document.

- If the form isn’t what you are looking for, use the Search section to find the form that fits your needs.

Form popularity

FAQ

Leasing equipment to your LLC involves a few key steps. First, ensure your LLC is registered and in good standing. Next, identify the equipment you want to lease and research a reputable leasing company that provides a Rhode Island Simple Equipment Lease. Finally, submit the necessary documentation, finalize the lease agreement, and make sure all the details align with your LLC's financial goals.

Typically, a credit score of 650 or higher is ideal for securing favorable terms on an equipment lease, including a Rhode Island Simple Equipment Lease. However, some leasing companies may accommodate lower scores with higher interest rates. A strong credit score can enable access to better rates and terms. Checking your credit score before applying helps you set realistic expectations.

A good lease rate usually factors in your equipment's value, your business credit profile, and the leasing company's terms. For a Rhode Island Simple Equipment Lease, rates around 5% to 9% are often viewed as favorable. Furthermore, terms that are straightforward and transparent contribute to a good leasing experience. Compare multiple offers to determine the best deal for your business.

A good equipment lease rate typically falls between 4% and 8%, depending on the specifics of the lease terms and equipment type. A Rhode Island Simple Equipment Lease can offer competitive rates, particularly for businesses with strong credit histories. Be sure to analyze your options to ensure you’re getting a rate that suits your budget and equipment needs. Always seek clarity on any additional fees that might apply.

Setting up an equipment lease involves a few straightforward steps. First, identify the equipment you need and research potential leasing companies that offer a Rhode Island Simple Equipment Lease. Next, gather necessary documentation such as financial statements and tax returns. Finally, complete the application process and review the terms before signing the lease.

Interest rates for an equipment lease vary based on the leasing company and the equipment itself. Typically, you might find rates anywhere from 5% to 15% for a Rhode Island Simple Equipment Lease. Your specific business situation and creditworthiness will play a critical role in determining the exact rate. Exploring various leasing options can help you secure a desirable rate.

The average interest rate on equipment financing generally ranges from 4% to 10%. However, for a Rhode Island Simple Equipment Lease, factors like your credit score and the equipment type impact the final rate. Generally, higher credit scores lead to lower rates, making financing more accessible. It’s best to compare multiple options to find the most favorable terms for your needs.

Yes, a non-profit can lease equipment. By utilizing a Rhode Island Simple Equipment Lease, non-profits can access necessary equipment without the heavy upfront costs. This arrangement allows organizations to allocate funds to other vital areas while still obtaining the tools needed for their operations. Consider exploring the options available through the uslegalforms platform, which simplifies the leasing process tailored specifically for non-profits.

Yes, you can secure a lease under your LLC, which can provide liability protection for your personal assets. When doing so, ensure the lease explicitly names the LLC as the lessee. A well-drafted Rhode Island Simple Equipment Lease from platforms like US Legal Forms will ensure your business interests are safeguarded.

Transferring equipment to an LLC typically involves drafting a bill of sale or an equipment transfer agreement. You’ll need to clearly specify the terms of transfer and the equipment involved. Consider documenting this process within your Rhode Island Simple Equipment Lease to keep everything organized, and using US Legal Forms can simplify the documentation.