No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Rhode Island Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

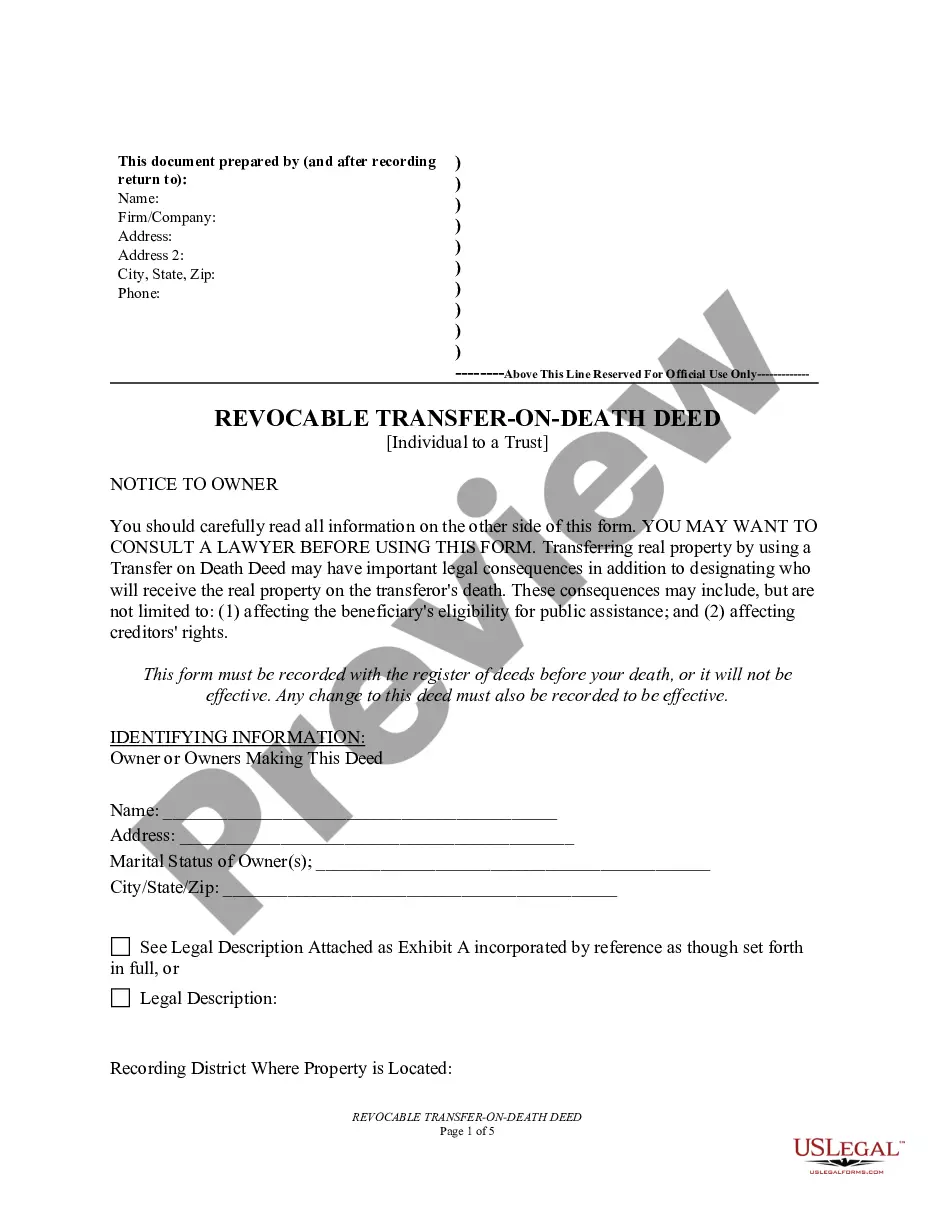

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

US Legal Forms - one of many largest libraries of legitimate kinds in the United States - provides a variety of legitimate record web templates you may acquire or print out. Utilizing the website, you will get thousands of kinds for company and personal functions, categorized by types, states, or key phrases.You will discover the newest variations of kinds such as the Rhode Island Report to Creditor by Collection Agency Regarding Judgment Against Debtor within minutes.

If you currently have a monthly subscription, log in and acquire Rhode Island Report to Creditor by Collection Agency Regarding Judgment Against Debtor from the US Legal Forms collection. The Down load switch can look on each kind you perspective. You get access to all previously delivered electronically kinds within the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed below are easy directions to help you get started off:

- Make sure you have picked out the proper kind for your area/area. Select the Review switch to examine the form`s content. Browse the kind description to actually have selected the right kind.

- If the kind doesn`t suit your needs, make use of the Lookup discipline towards the top of the monitor to find the one who does.

- If you are satisfied with the shape, affirm your option by simply clicking the Get now switch. Then, select the pricing strategy you favor and provide your qualifications to register for an bank account.

- Method the purchase. Use your bank card or PayPal bank account to perform the purchase.

- Find the file format and acquire the shape in your product.

- Make changes. Complete, modify and print out and indication the delivered electronically Rhode Island Report to Creditor by Collection Agency Regarding Judgment Against Debtor.

Every single format you put into your account does not have an expiry particular date which is the one you have for a long time. So, if you wish to acquire or print out yet another copy, just go to the My Forms area and click on the kind you will need.

Obtain access to the Rhode Island Report to Creditor by Collection Agency Regarding Judgment Against Debtor with US Legal Forms, the most comprehensive collection of legitimate record web templates. Use thousands of skilled and state-particular web templates that satisfy your small business or personal requires and needs.

Form popularity

FAQ

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Although the debt won't be factored into your credit score after 7 years, there are still consequences. When you stop paying your debt, the creditor will start charging late fees and interest will continue to accumulate, increasing the balance you owe.

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment, abuse, and other behavior intended to bully debtors. If a debt collector is violating the FDCPA in their attempts to collect money from you, you have the right to sue them.

A judgment is a court order stating that you owe the debt collector money because of a lawsuit. You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.

Creditors in Rhode Island have ten years to sue you for an unpaid loan, promissory note, or credit card. A creditor can still call and send you bills even after the statute of limitations has expired.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Statute of limitations on debt for all states StateWrittenPromissoryRhode Island10 years10South Carolina3 years3South Dakota6 years6Tennessee6 years646 more rows ?