Rhode Island Amend Bylaws - Directors - Corporate Resolution Form

Description

How to fill out Amend Bylaws - Directors - Corporate Resolution Form?

Have you ever found yourself needing documents for various organizations or specific purposes almost all the time.

There are numerous legal document templates accessible online, but finding trustworthy forms can be challenging.

US Legal Forms offers a wide array of template options, including the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form, which can be tailored to meet both state and federal requirements.

You can find all the document templates you have purchased in the My documents section.

You can obtain an additional copy of the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form at any time if needed. Simply click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct jurisdiction/area.

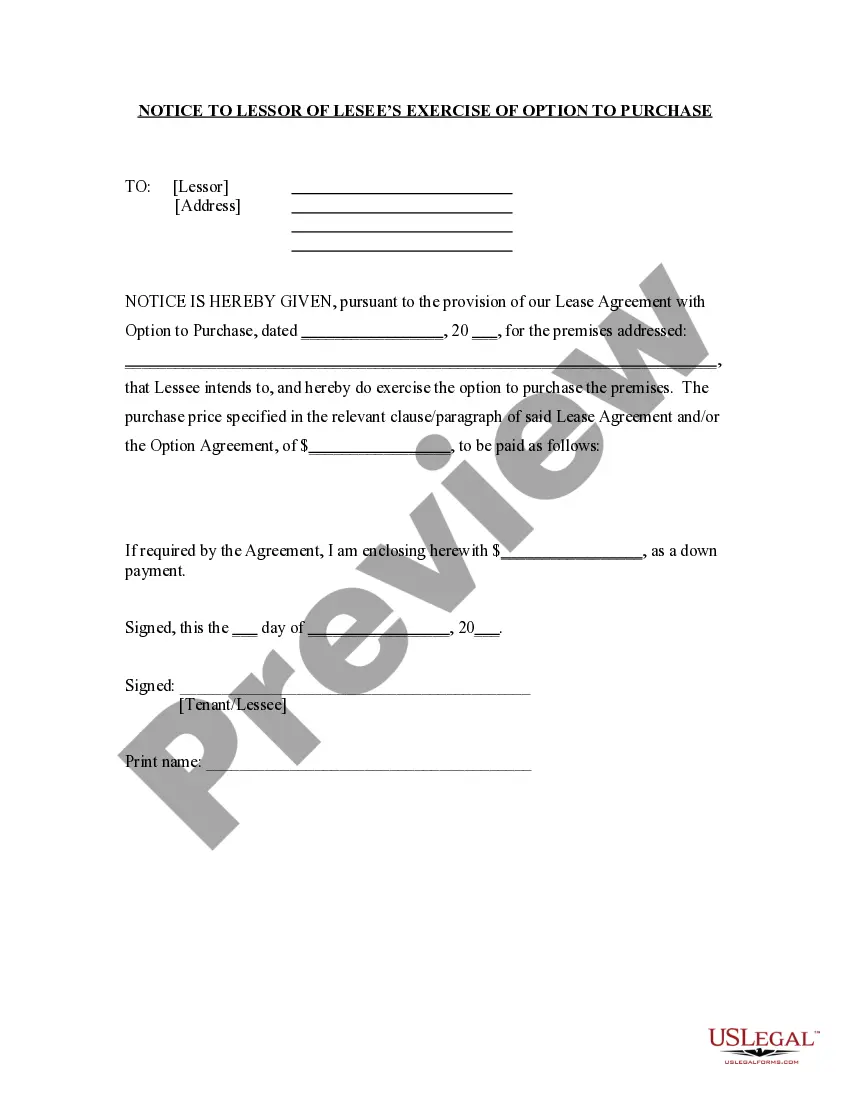

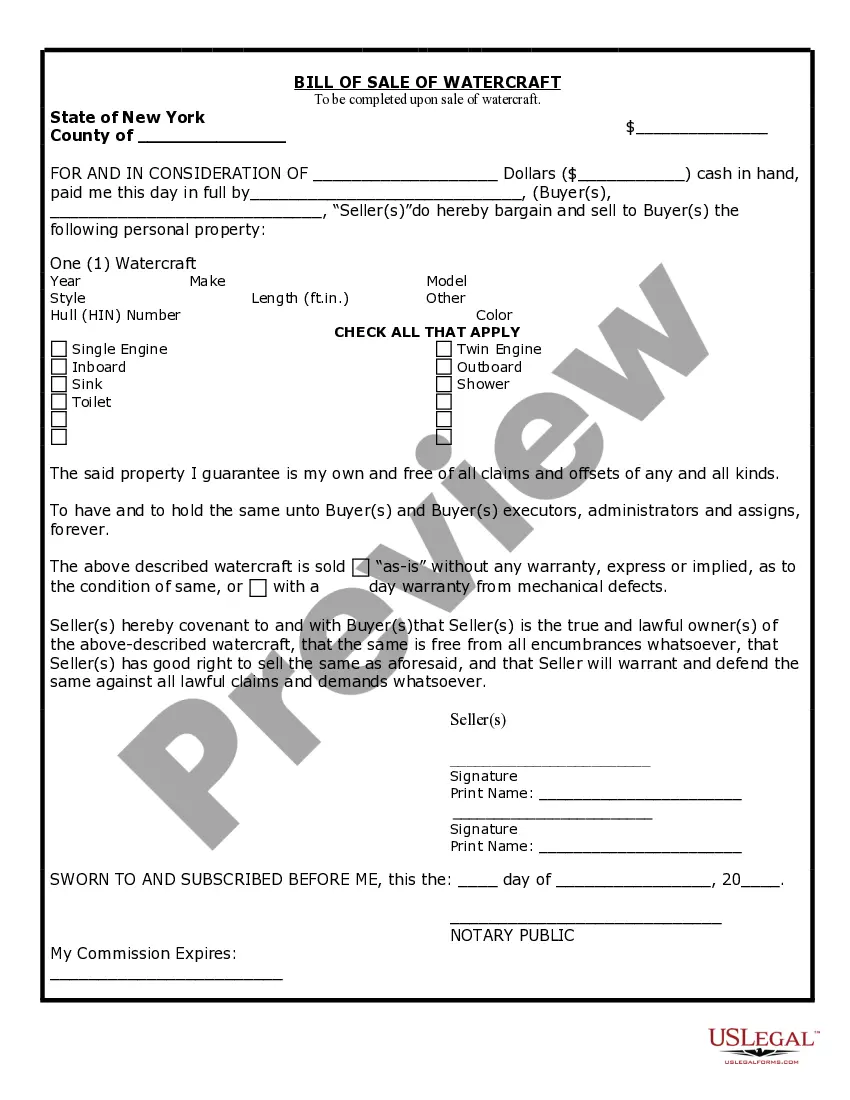

- Use the Review button to check the form.

- Examine the summary to confirm that you have chosen the right form.

- If the form does not match your needs, use the Search box to find the document that suits your requirements.

- Once you find the suitable form, click on Purchase now.

- Choose the payment plan you prefer, provide the necessary details to create your account, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To update corporate bylaws, first review the existing bylaws and identify the changes needed. Then, draft the amendments and present them for approval at a board meeting. Using the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form can streamline this process, ensuring that your amendments comply with state law and are formally recorded.

The difference lies in their functions: bylaws outline the governing structure and operational rules of an organization, while a corporate resolution records specific actions or decisions made under those rules. Both are essential, but they serve different purposes in maintaining organizational integrity. Utilizing the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form ensures you manage these documents correctly.

A corporate resolution of the Homeowners Association (HOA) involves decisions made by the board regarding governance and policy matters. These resolutions can cover a variety of issues, such as budget approvals or community rules. If you need to draft one, consider using the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form to maintain professionalism and compliance.

The purpose of a corporate resolution is to formally document significant decisions made by a company's board or members. This documentation serves as a legal record and can be vital during audits or disputes. Using the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form helps ensure that these decisions adhere to state requirements.

To fill out a corporate resolution form, first identify the specific decision to be documented. Then, include details such as the date, the participants, and the resolution's exact wording. By using the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form from US Legal Forms, you can easily ensure your form meets the necessary legal standards.

A resolution is not a bylaw; rather, it is a formal decision made by a company's board or members. While bylaws govern the overall rules and operations of the organization, resolutions address specific actions or policies. Understanding the differences is crucial when navigating the Rhode Island Amend Bylaws - Directors - Corporate Resolution Form to ensure compliance.