Rhode Island Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

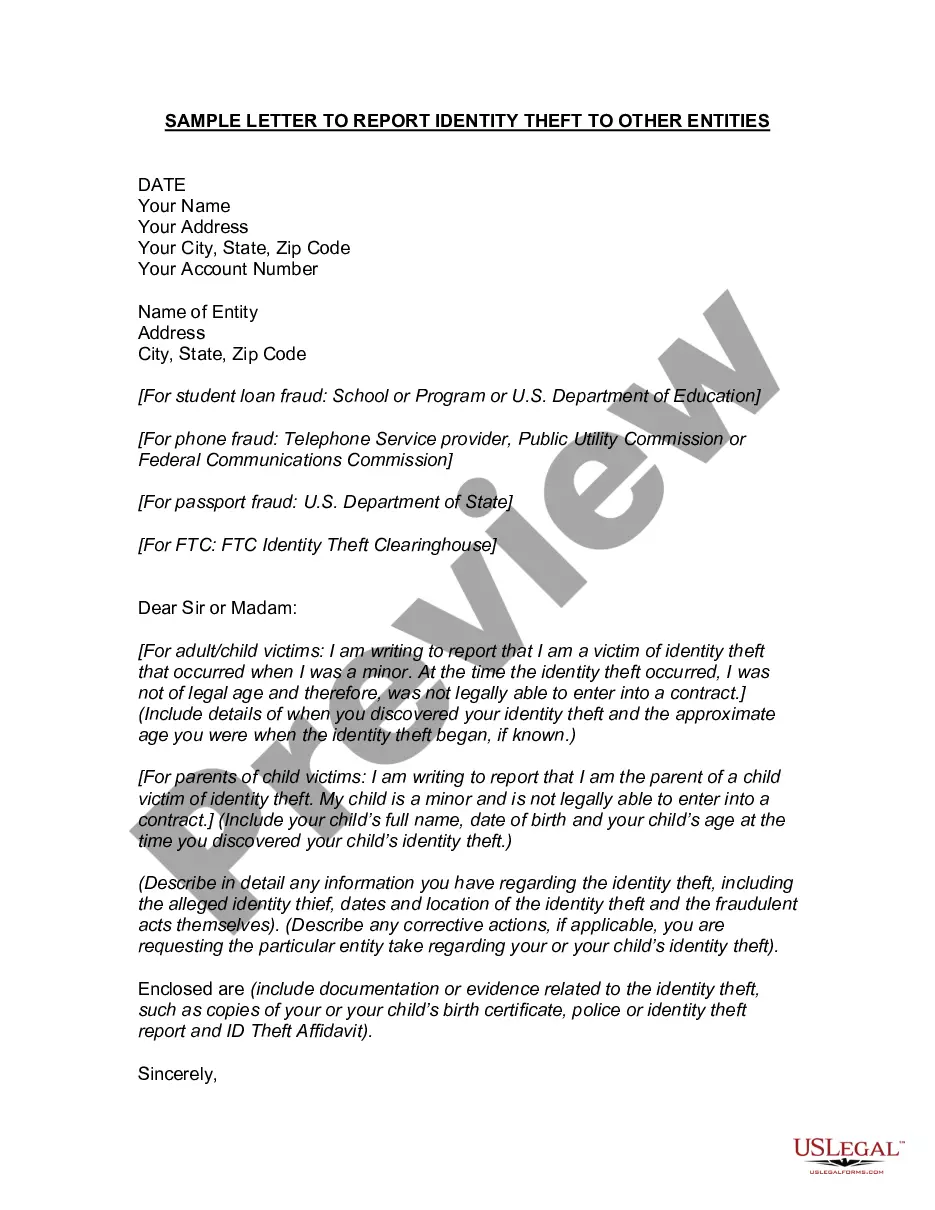

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

If you need to full, acquire, or print out legitimate document themes, use US Legal Forms, the most important collection of legitimate types, which can be found on the web. Make use of the site`s simple and easy handy lookup to find the papers you need. Different themes for enterprise and person purposes are categorized by categories and states, or keywords. Use US Legal Forms to find the Rhode Island Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts within a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in for your accounts and click the Acquire switch to obtain the Rhode Island Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. You can also access types you earlier delivered electronically from the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Utilize the Preview choice to check out the form`s information. Do not forget about to see the information.

- Step 3. Should you be unhappy together with the form, make use of the Lookup field near the top of the monitor to get other versions in the legitimate form design.

- Step 4. After you have found the shape you need, select the Get now switch. Pick the costs plan you choose and add your accreditations to sign up to have an accounts.

- Step 5. Method the financial transaction. You may use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the file format in the legitimate form and acquire it on the device.

- Step 7. Total, edit and print out or signal the Rhode Island Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

Each and every legitimate document design you purchase is your own property eternally. You may have acces to every form you delivered electronically within your acccount. Go through the My Forms portion and pick a form to print out or acquire once again.

Remain competitive and acquire, and print out the Rhode Island Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts with US Legal Forms. There are many professional and condition-distinct types you may use to your enterprise or person requires.

Form popularity

FAQ

You may receive a debt collection letter, to which you can respond by notifying the debt collector of the identity theft and providing it with proof of the theft, such as your Identity Theft Report. You should also contact the business that reported the debt to the collection agency and tell it to stop.

In most states, you're not liable for any debt that occurred as a result of fraudulent accounts being opened. Plus, under federal law, you are only liable for the first $50 in fraudulent charges on your credit card if someone uses your card to make a purchase.

Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills. As debt accumulates and payments are missed, your scores may be negatively affected, because of the payment history associated with the accounts or the increase in your credit utilization.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Employers are responsible for employee identity theft, therefore should perform the best policies for handling, storing and accessing the personal data of employees.

Your liability for fraudulent purchases made with your credit card is up to $50, if you tell the credit card company about the fraudulent charges within 60 days of when the company sends you the statement showing the fraudulent charges.

The Federal Trade Commission's Red Flag Rule requires many businesses and organizations to implement a written Identity Theft Prevention Program designed to detect the warning signs, or red flags, of identity theft in their day-to-day operations.