Rhode Island Personal Property Inventory

Description

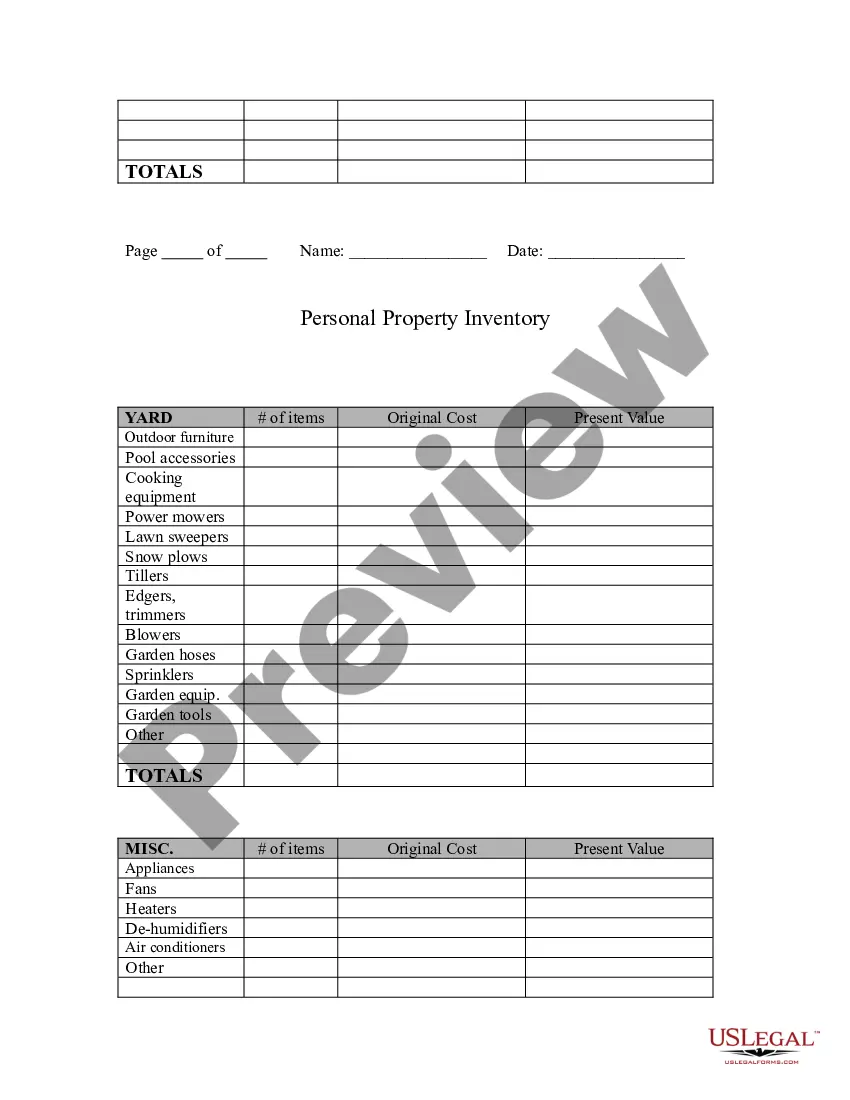

How to fill out Personal Property Inventory?

You can spend hours online looking for the valid document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are analyzed by professionals.

You can easily download or print the Rhode Island Personal Property Inventory from the service.

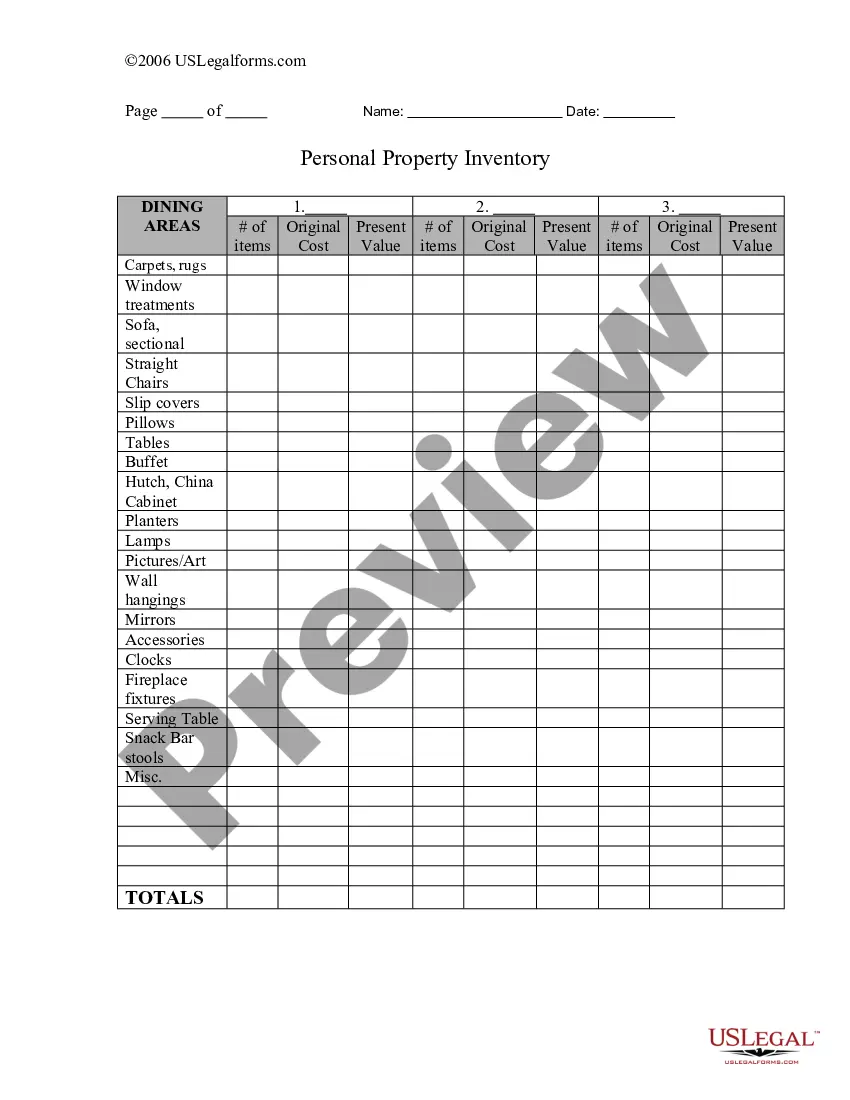

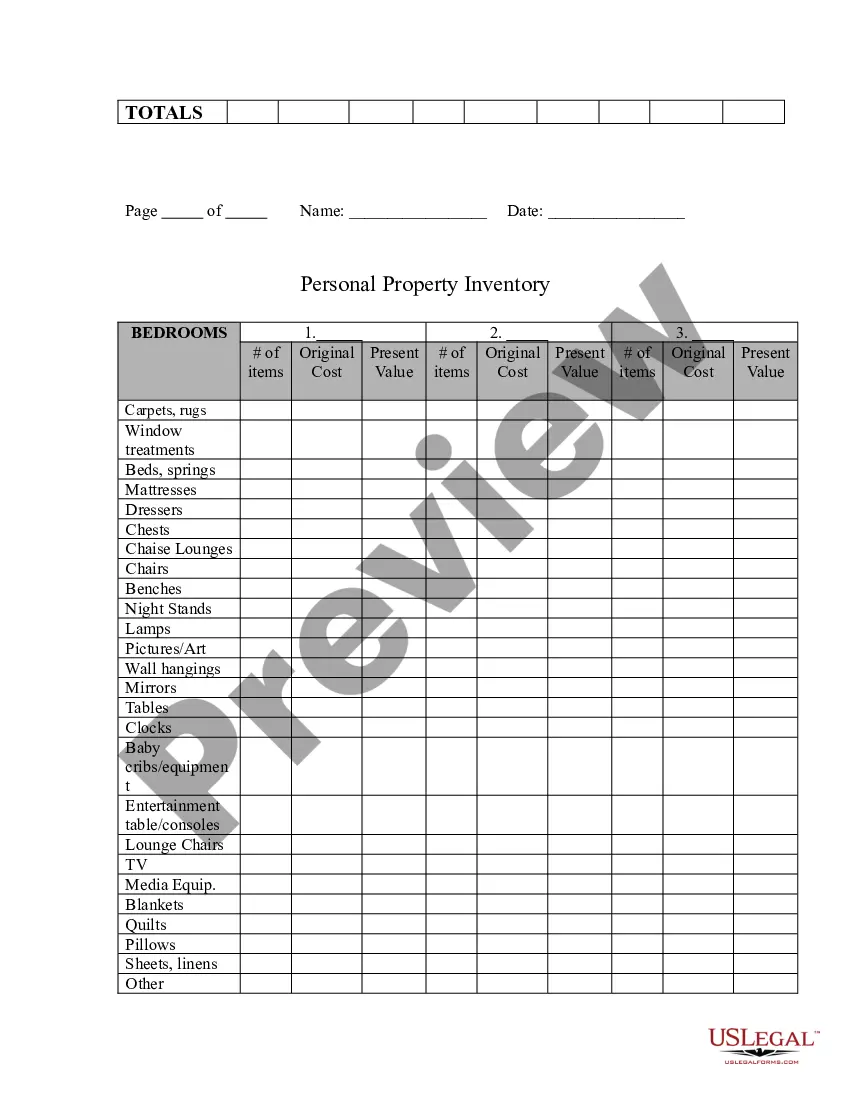

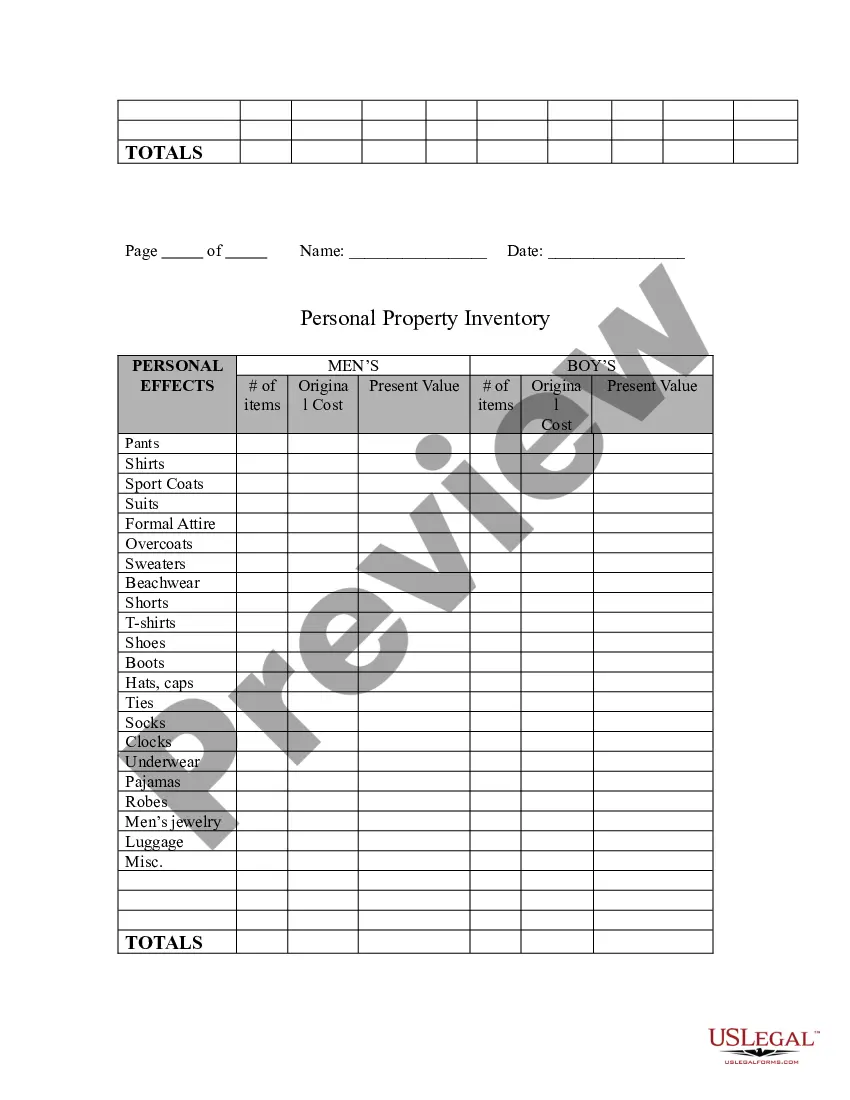

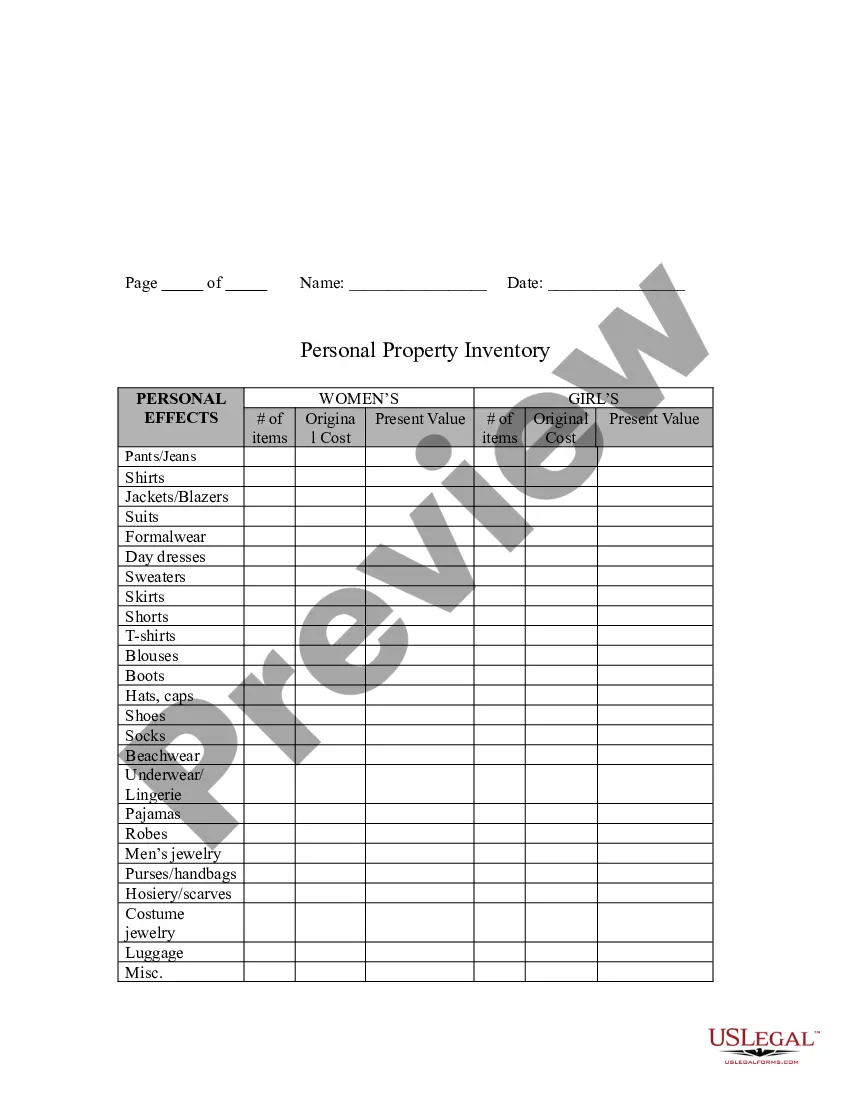

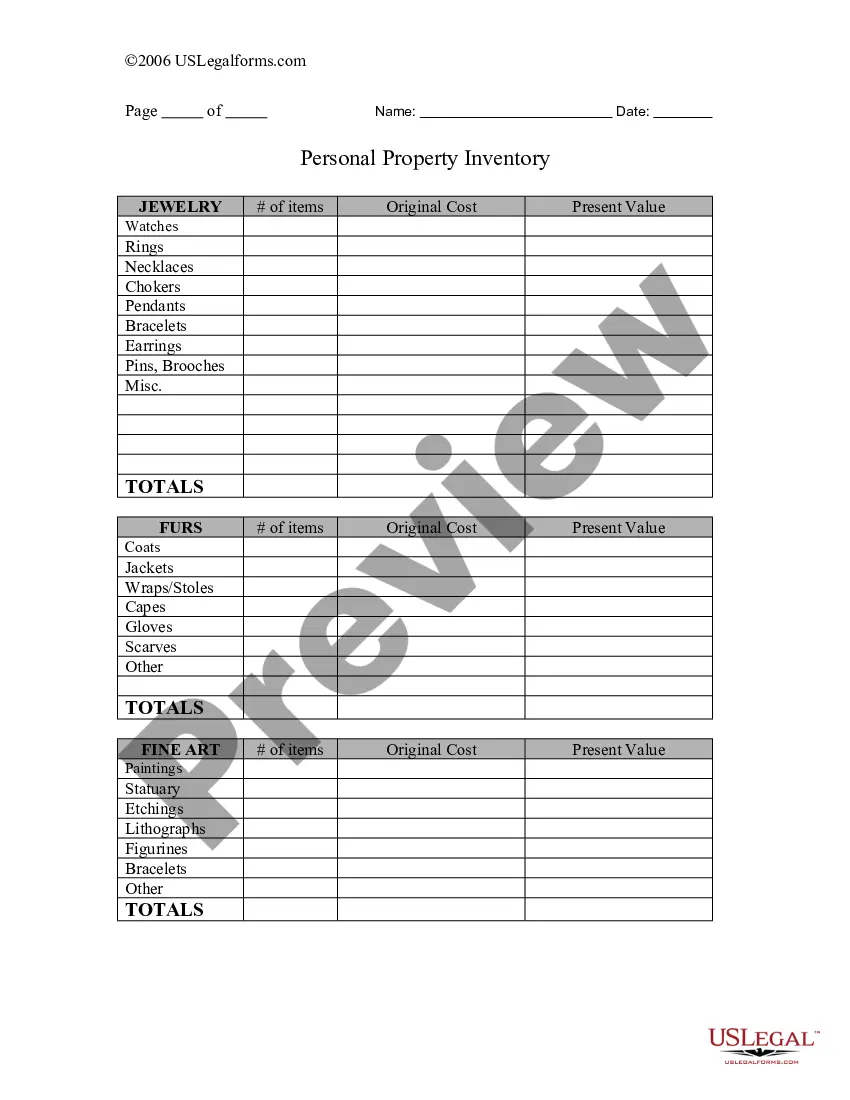

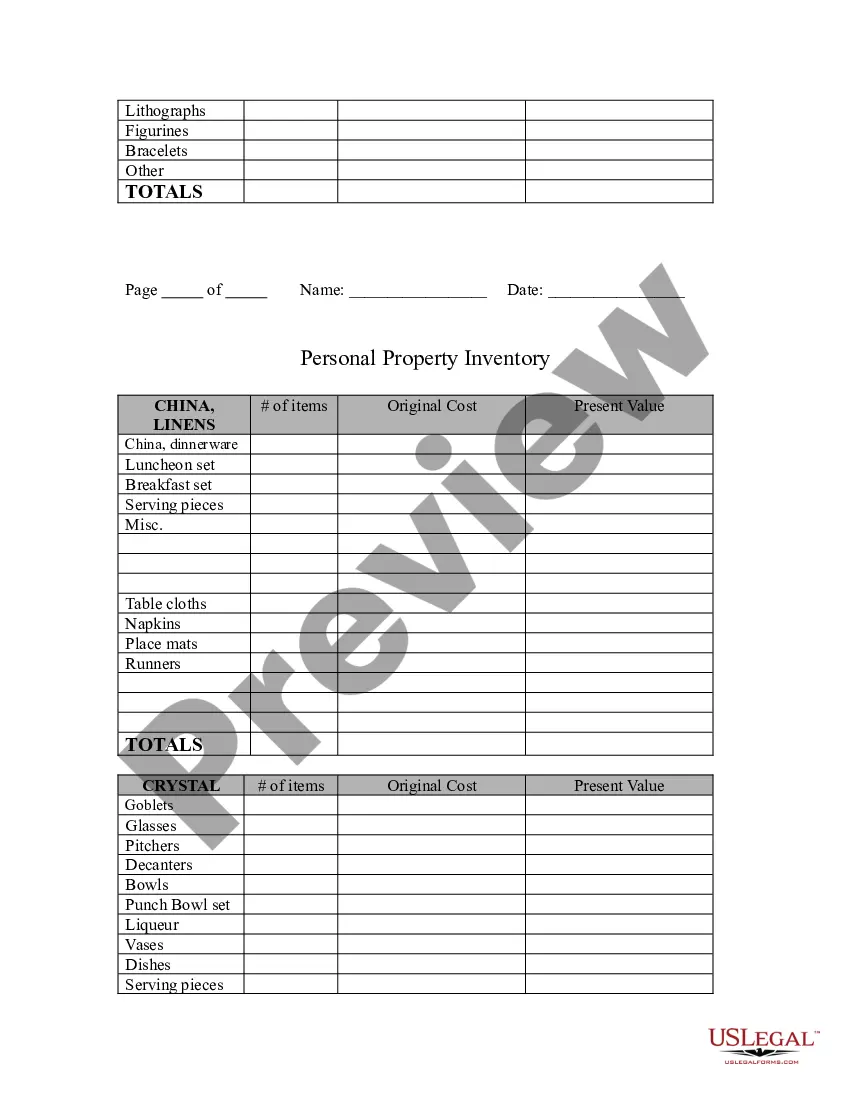

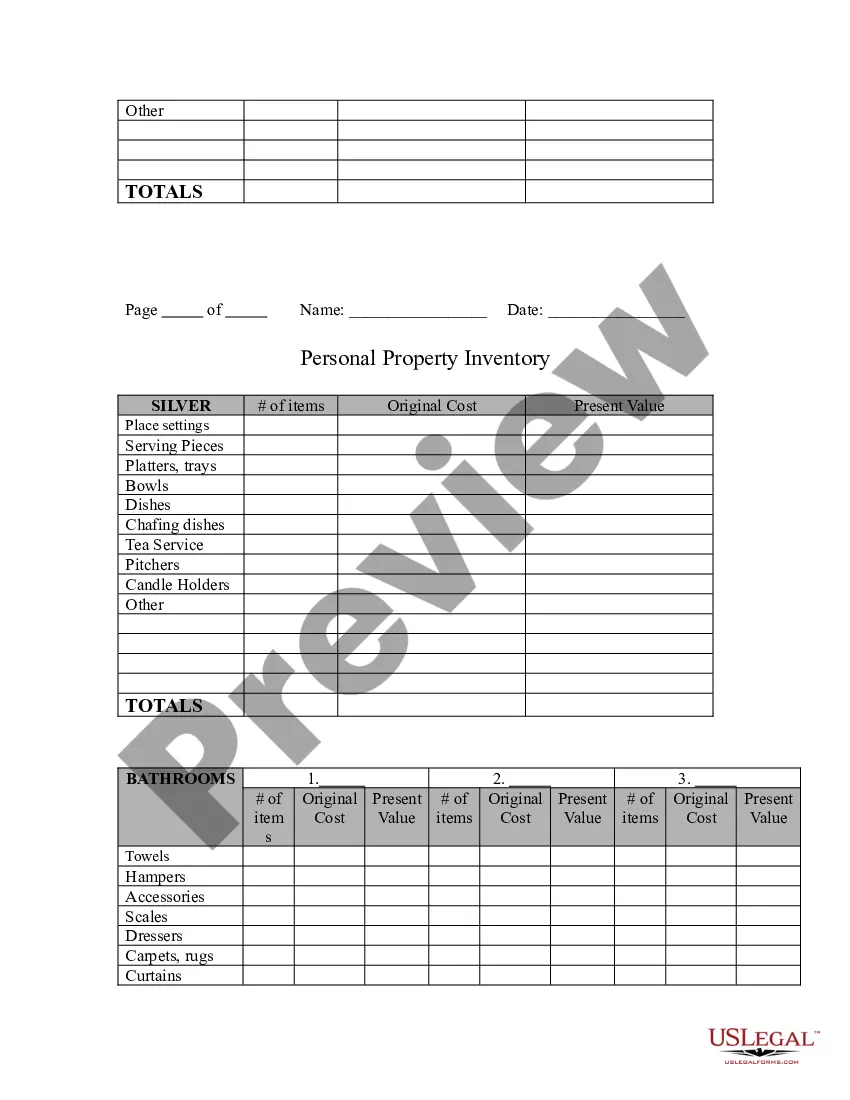

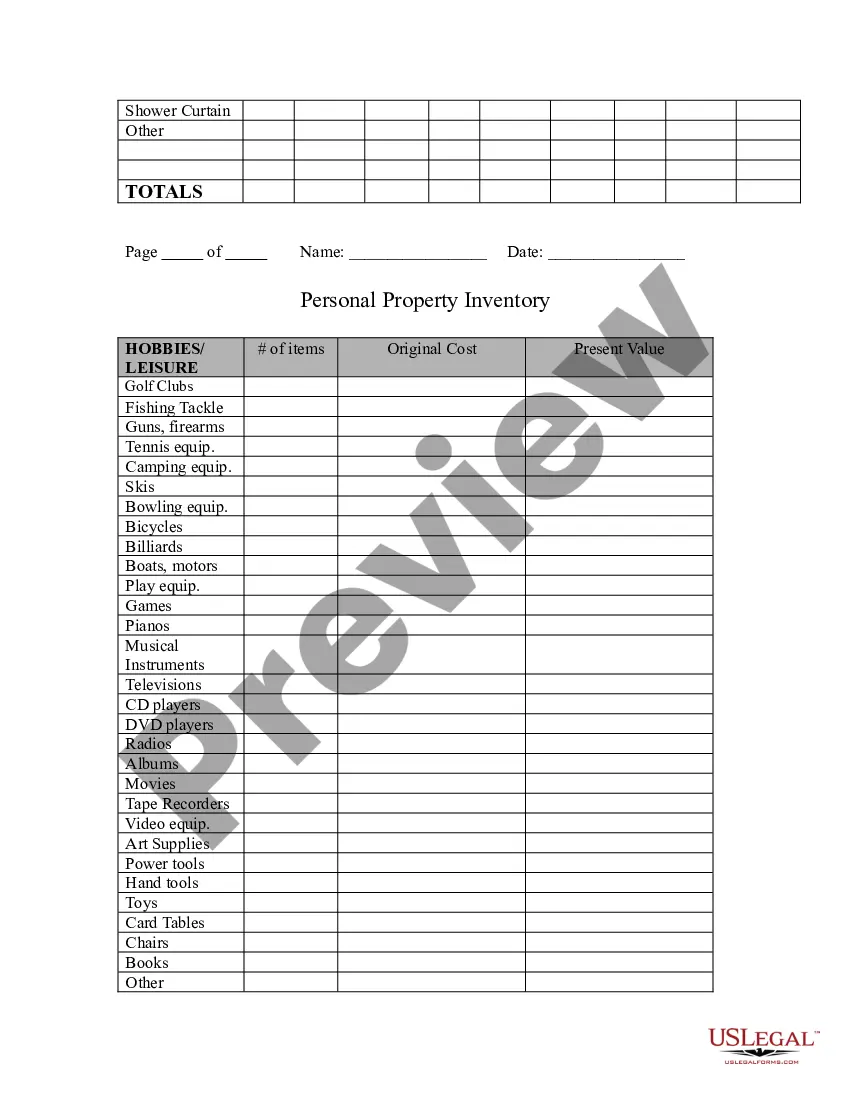

If available, use the Preview option to check the document format as well.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire option.

- After that, you can complete, edit, print, or sign the Rhode Island Personal Property Inventory.

- Every legal document you obtain is yours permanently.

- To retrieve another copy of a purchased form, visit the My documents tab and click on the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the simple directions below.

- First, ensure that you have selected the correct format for the region/city that you choose.

- Review the form description to ensure you have chosen the correct document.

Form popularity

FAQ

You should file your tangible personal property tax return with the local government where the property is located. In Rhode Island, check with your local tax office for details and specific procedures. Using tools from uslegalforms can simplify the process of managing your Rhode Island Personal Property Inventory, ensuring your filings are correct and timely.

The IRS generally considers any physical property that can be touched or moved as tangible personal property. This includes items like furniture, vehicles, and equipment. To effectively manage your assets, maintaining a current Rhode Island Personal Property Inventory will help delineate what qualifies as tangible for tax purposes.

While this question pertains to Florida, it’s good to understand that tangible personal property tax returns vary by state. If you own property in Florida, you may need to file a return to report tangible assets. For managing multiple properties across states, organizing your Rhode Island Personal Property Inventory becomes crucial.

When dealing with personal property tax on your federal tax return, you generally report it as an itemized deduction on Schedule A of Form 1040. This deduction can benefit you if you include your Rhode Island Personal Property Inventory properly. Make sure to follow the IRS guidelines to ensure accurate reporting.

In Rhode Island, you typically file a tangible personal property tax return with your local city or town hall. It is essential to check your specific municipality’s requirements for filing and deadlines. Ensuring that you complete this process accurately will help you maintain an organized Rhode Island Personal Property Inventory.

An example of a personal property inventory could include items such as furniture, electronics, appliances, and jewelry. For instance, you might list a leather sofa valued at $1,000, a 55-inch television, and a collection of art pieces. Having a detailed Rhode Island Personal Property Inventory allows you to understand your assets better and is essential in the event of loss or damage. You can use platforms like uslegalforms to create a comprehensive inventory template.

To register for sales tax in Rhode Island, first visit the Rhode Island Division of Taxation's website. You will need to complete the sales and use tax registration form. This process helps you stay compliant with state regulations and ensures that your Rhode Island Personal Property Inventory is properly documented for tax purposes. After submitting your application, you may receive confirmation within a few days.

To write an inventory of your personal belongings, begin by categorizing your items by location or type. For each item, record a description, quantity, and estimated value. Using a platform like US Legal Forms can help you create a well-structured Rhode Island Personal Property Inventory that ensures nothing is overlooked. Remember to review and update your inventory regularly to keep it accurate.

A Rhode Island Personal Property Inventory is beneficial for various reasons. It provides a clear overview of your assets, which can be crucial for insurance purposes or financial planning. Additionally, having an organized list helps during home moves, estate planning, or if you ever need to report a loss. By keeping this document updated, you ensure that your valuable items are well accounted for.

When creating a Rhode Island Personal Property Inventory, include both everyday items and valuable possessions. Document furniture, electronics, art, jewelry, and collectibles, ensuring you provide detailed descriptions for each. This comprehensive list will help you track your belongings and assist in situations like insurance claims. Remember, the more information you provide, the better equipped you'll be.