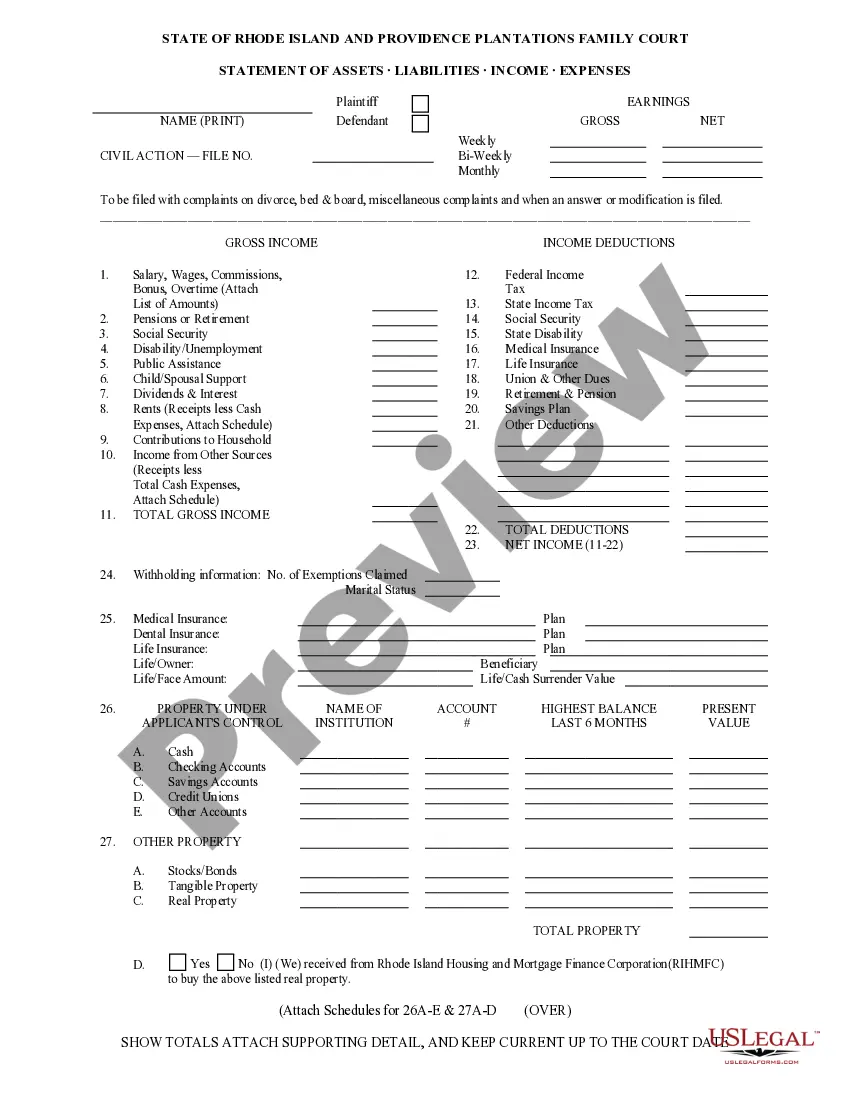

The Rhode Island Statement of Assets Liabilities Income and Expenses (ROSALIE) is an annual filing requirement for any individual, business, or organization doing business in the state of Rhode Island. ROSALIE requires a comprehensive financial statement that includes a balance sheet, income statement, and statement of changes in equity. The statement is used to assess and evaluate a business's financial health and performance. It is used by organizations to identify potential areas of improvement in their finances and operations. The ROSALIE filing requirements are divided into two categories: Corporate and Non-Corporate. The Corporate ROSALIE filing requires entities to provide a balance sheet, income statement, statement of changes in equity, and a statement of cash flows. Taxpayers are required to break down their assets by type, such as cash, accounts receivable, inventory, and property, plant, and equipment. The liabilities must be broken down into current liabilities and long-term liabilities. The income statement must include revenues, cost of goods sold, gross profit, expenses, and net income. The Non-Corporate ROSALIE filing requires entities to provide a balance sheet, income statement, and statement of changes in equity. Taxpayers are required to break down their assets by type, such as cash, accounts receivable, inventory, and property, plant, and equipment. The liabilities must be broken down into current liabilities and long-term liabilities. The income statement must include revenues, cost of goods sold, gross profit, expenses, and net income. The ROSALIE filing is due on the 15th day of the 4th month following the close of the taxpayer's taxable year. Taxpayers must file the statement electronically with the Rhode Island Division of Taxation.

Rhode Island Statement of Assets Liabilities Income and Expenses

Description

How to fill out Rhode Island Statement Of Assets Liabilities Income And Expenses?

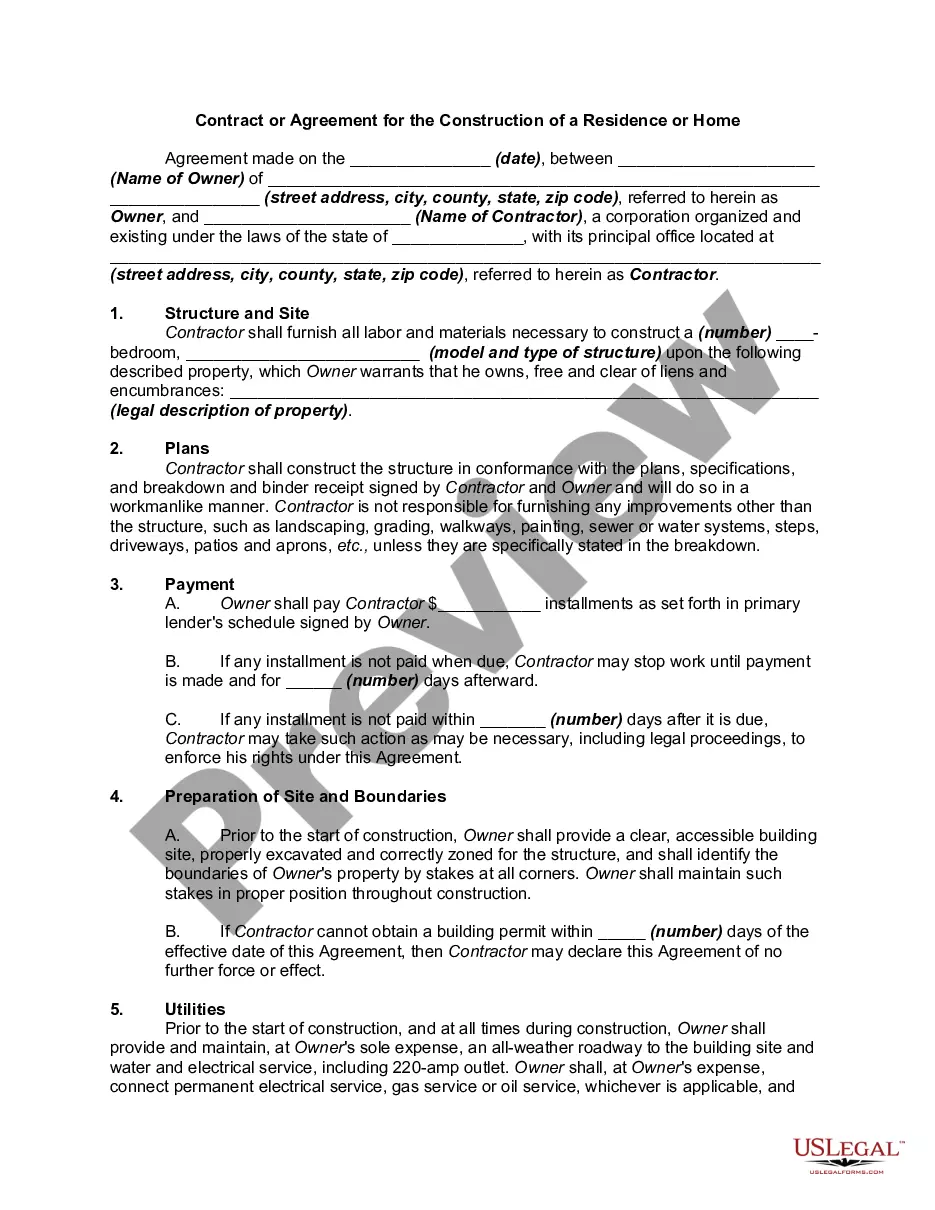

If you’re searching for a way to properly complete the Rhode Island Statement of Assets Liabilities Income and Expenses without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple guidelines on how to get the ready-to-use Rhode Island Statement of Assets Liabilities Income and Expenses:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the list to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Rhode Island Statement of Assets Liabilities Income and Expenses and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The Office of Child Support Services will serve notice upon a non-custodial parent who owes ninety (90) days worth of child support payments of the agencies intention to submit his/her name for license revocation or suspension.

In most cases, child support obligations end when a child reaches the age of 18 or when the child graduates from high school. However, payments do not stop automatically on the child's birthday. The parent must file a motion to terminate child support with the Rhode Island Family Court.

Pursuant to Section 15-8-4 of the Rhode Island General Laws, the plaintiff mother or State may pursue past liabilities for a period of six (6) years prior to the filing of a complaint.

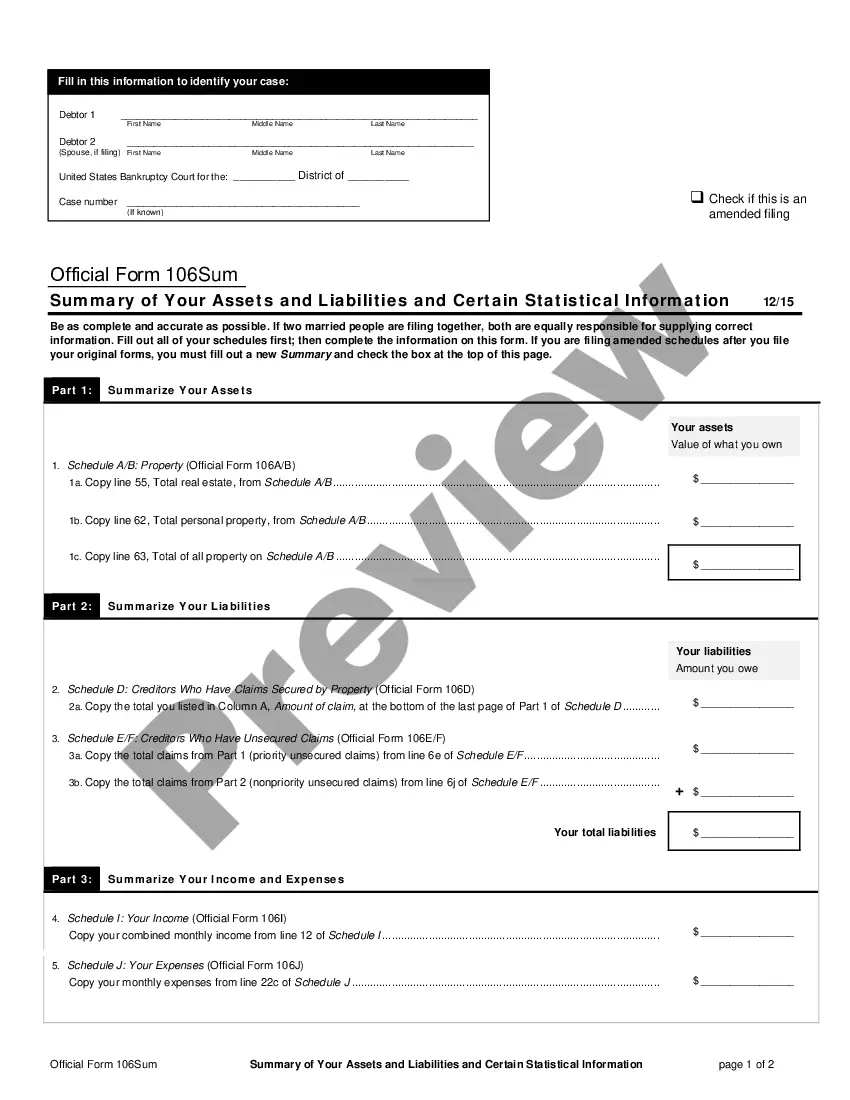

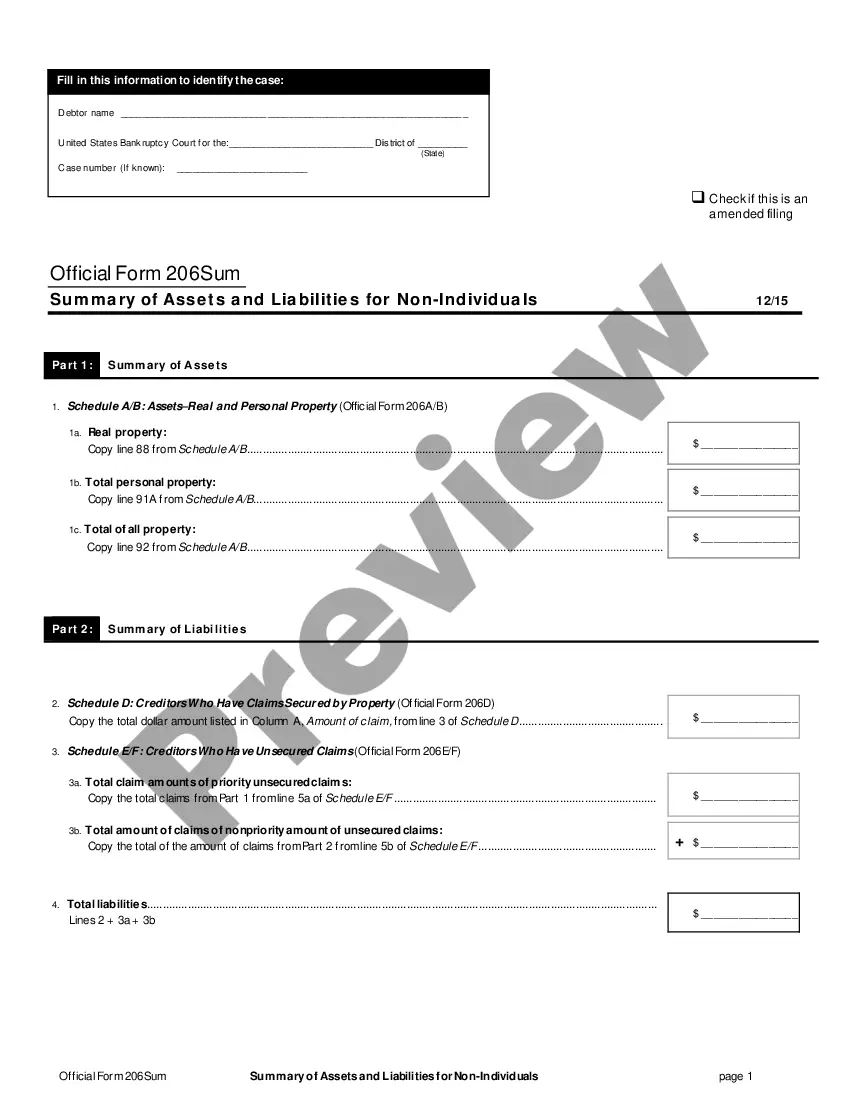

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth. Ideally, a company should have more assets than liabilities.

Under Rhode Island law, divorcing spouses have a duty to support any children they have together. The parent that lives with the child (custodial parent) is expected to give financial and emotional support directly.

6 shall be filed with Complaints for Divorce, Bed and Board Divorce, Miscellaneous Complaints, or Child Support Complaints. 6 shall be filed with Answers or Counterclaims or Modifications of Prior (Support) Orders.

If a parent or citizen under a support obligation is determined to be in willful contempt by a Justice of The Rhode Island Family Court for not paying RI child support, the nonpaying parent could be sentenced to the aci (jail) from day to day.

Motion to Adjudge in Contempt-If a non - custodial parent falls behind in his/her child support payments, a motion to adjudge in contempt may be filed by the child support agency. The filing of this motion is triggered when four (4) months worth of child support is due and owing.