A Rhode Island Limited Liability Company (LLC) is a type of business entity that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. It is the most flexible type of business entity available in the state of Rhode Island. A Rhode Island LLC is formed by filing Articles of Organization with the Secretary of State. The two main types of Rhode Island Limited Liability Companies (LCS) are single-member LCS and multi-member LCS. A single-member LLC is owned by one person and is treated as a disregarded entity for tax purposes. A multi-member LLC is owned by two or more people and is treated as a partnership for tax purposes. Both types of LCS provide limited liability protection to their owners, meaning that the owners' personal assets are not at risk in the event the LLC is sued or incurs debts. Additionally, LCS are not subject to double taxation, meaning that profits and losses are “passed through” to the owners and are only taxed once at the owner’s individual tax rate. By forming a Rhode Island LLC, business owners are able to enjoy the benefits of limited liability, pass-through taxation, and flexibility in management and operations.

Rhode Island Limited Liability Company (LLC)

Description

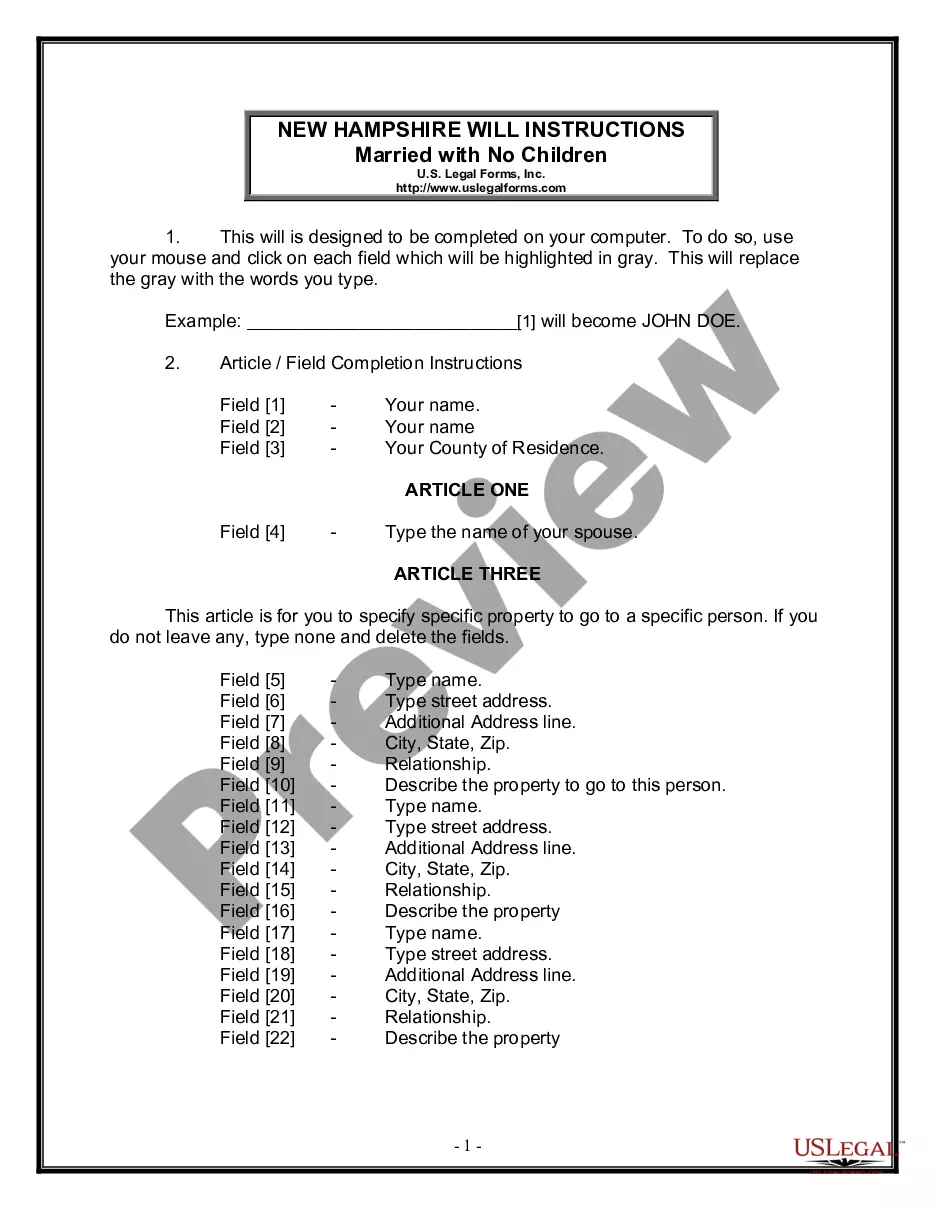

How to fill out Rhode Island Limited Liability Company (LLC)?

If you’re searching for a way to appropriately complete the Rhode Island Limited Liability Company (LLC) without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business situation. Every piece of paperwork you find on our online service is drafted in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple guidelines on how to obtain the ready-to-use Rhode Island Limited Liability Company (LLC):

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Rhode Island Limited Liability Company (LLC) and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Costs & Fees CorporationLimited Liability Company (LLC)(L3C)Initial RI Dept. of State Filing Fee$230$150RI Dept. of State Annual Report$50$50RI Division of Taxation Minimum Corporate Tax$400$400Additional Licensing FeesUse our Business Assistant to gather licensing information for your specific business type.

Rhode Island LLCs (limited liability companies) are business entities that protect their owners from being held personally liable for business debts. By default, LLCs are taxed as pass-through entities and have a flexible management structure.

The following sections cover the steps you will need to do to maintain the good standing of your Rhode Island LLC. Create an LLC Operating Agreement.Get an Employer Identification Number (EIN)Submit an Annual Report.Pay the Corporate Tax, if Applicable.

Costs to forming a Rhode Island LLC There is a $150 one-time state filing fee to form a Rhode Island LLC. There are also ongoing fees (like a $50 Annual Report fee), which we discuss below.

Name your Rhode Island LLC. Choose your registered agent. Prepare and file articles of organization. Receive a certificate from the state. Create an operating agreement. Get an Employer Identification Number. Next steps.

LLC: Core Differences. In basic terms, the owners of an LLP are considered partners in an organization, while the owners of an LLC are members. As a result, there are key differences between how the limited liability protection is recognized, how an LLC and LLP are managed and how each structure is taxed.

You can get an LLC in Rhode Island in 3-4 business days if you file online (or 2 weeks if you file by mail).