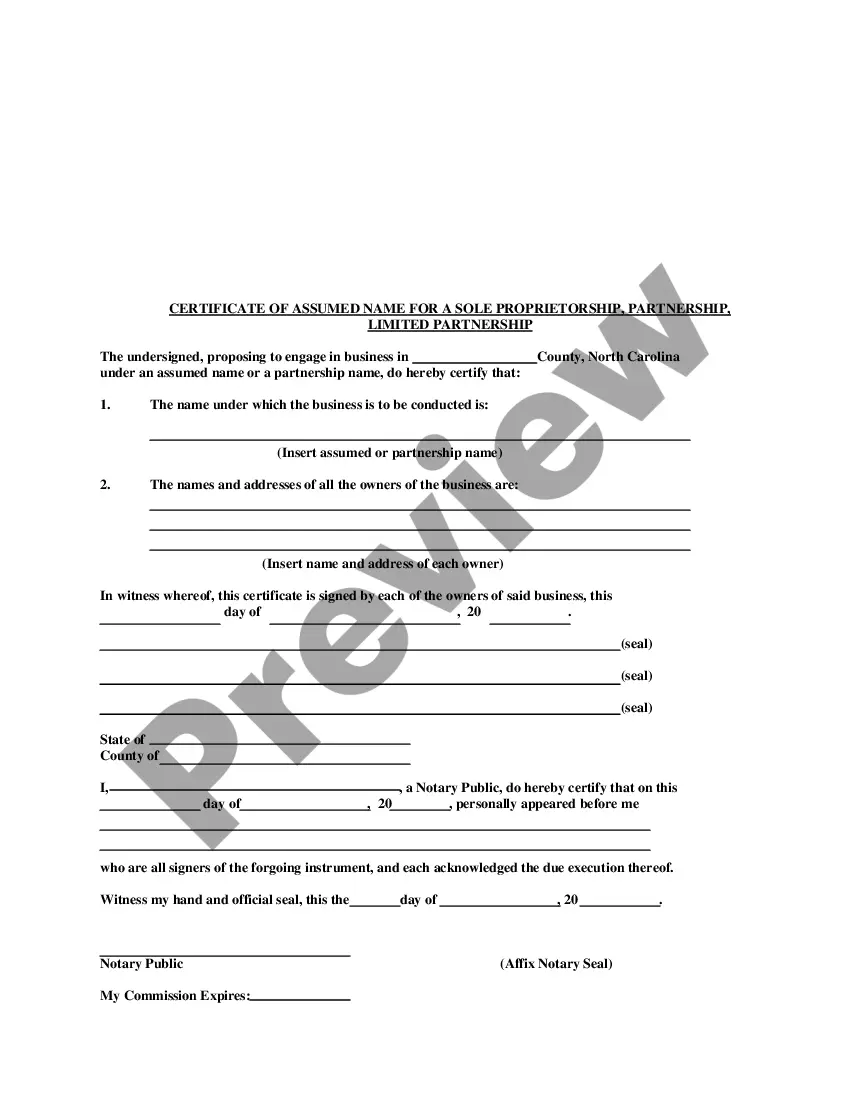

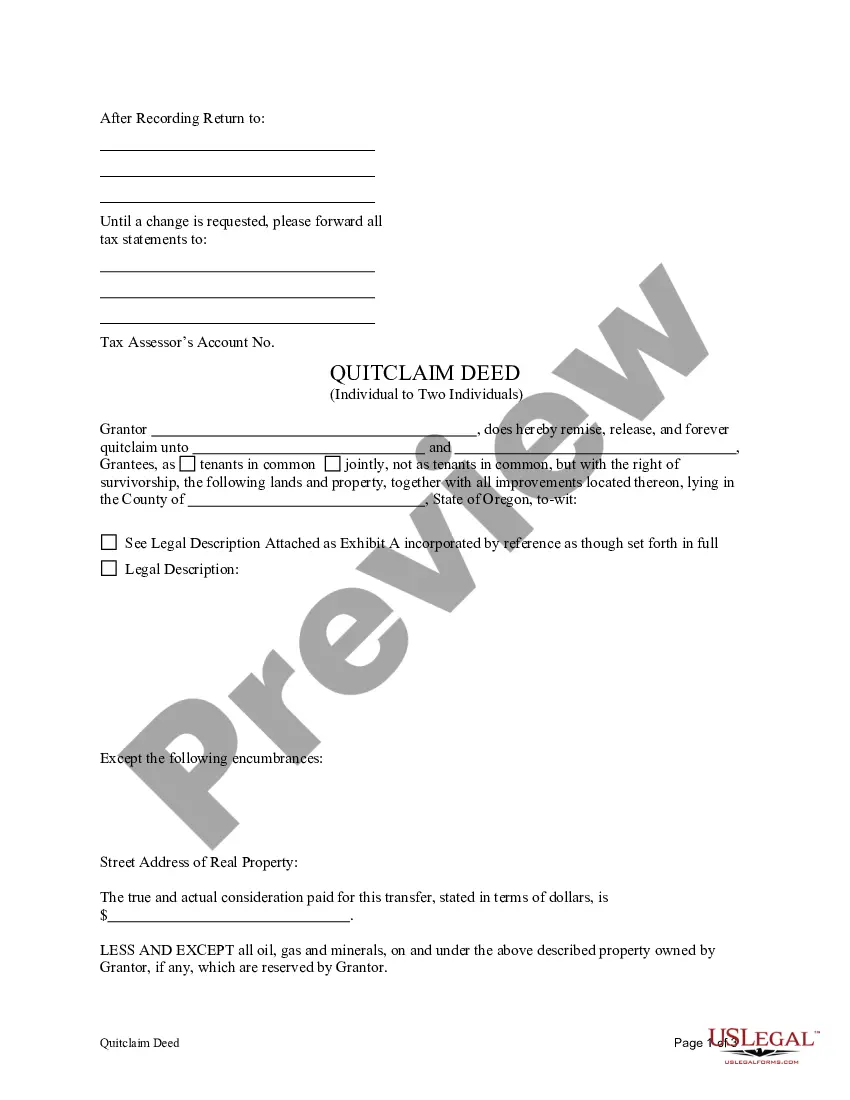

Rhode Island Articles of Organization (Domestic LLC) is the official document that is filed with the Rhode Island Secretary of State in order to form a Domestic Limited Liability Company (LLC). It includes information about the LLC such as the name, address, purpose, principal office, registered agent, and members. The Articles of Organization must be signed and dated by the organizer(s) and must be accompanied by a filing fee. There are two types of Rhode Island Articles of Organization (Domestic LLC): Standard and Special. The Standard Articles of Organization are the most commonly used documents and include the basic information required to form the LLC. The Special Articles of Organization are used to specify additional requirements that may be needed for the LLC, such as additional members or special management requirements.

Rhode Island Articles of Organization (Domestic LLC)

Description

How to fill out Rhode Island Articles Of Organization (Domestic LLC)?

US Legal Forms is the most easy and affordable way to find suitable legal templates. It’s the most extensive online library of business and individual legal documentation drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Rhode Island Articles of Organization (Domestic LLC).

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Rhode Island Articles of Organization (Domestic LLC) if you are using US Legal Forms for the first time:

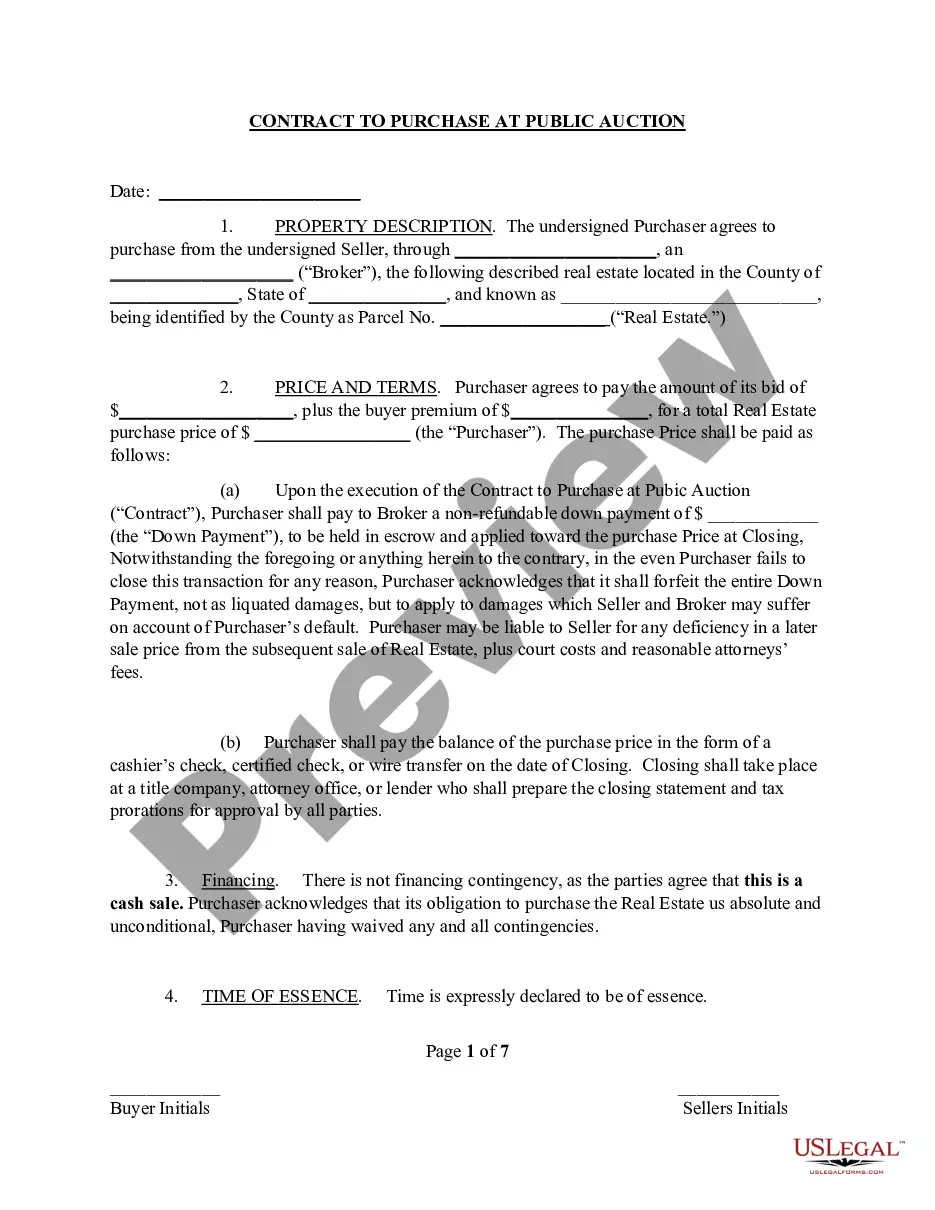

- Look at the form description or preview the document to make certain you’ve found the one meeting your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Rhode Island Articles of Organization (Domestic LLC) and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

Name your Rhode Island LLC. Choose your registered agent. Prepare and file articles of organization. Receive a certificate from the state. Create an operating agreement. Get an Employer Identification Number. Next steps.

Costs & Fees CorporationLimited Liability Company (LLC)(L3C)Initial RI Dept. of State Filing Fee$230$150RI Dept. of State Annual Report$50$50RI Division of Taxation Minimum Corporate Tax$400$400Additional Licensing FeesUse our Business Assistant to gather licensing information for your specific business type.

You can find information on any corporation or business entity in Rhode Island or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

The following sections cover the steps you will need to do to maintain the good standing of your Rhode Island LLC. Create an LLC Operating Agreement.Get an Employer Identification Number (EIN)Submit an Annual Report.Pay the Corporate Tax, if Applicable.

You can get an LLC in Rhode Island in 3-4 business days if you file online (or 2 weeks if you file by mail).

Rhode Island LLCs (limited liability companies) are business entities that protect their owners from being held personally liable for business debts. By default, LLCs are taxed as pass-through entities and have a flexible management structure.

Costs & Fees CorporationLimited Liability Company (LLC)(L3C)Initial RI Dept. of State Filing Fee$230$150RI Dept. of State Annual Report$50$50RI Division of Taxation Minimum Corporate Tax$400$400Additional Licensing FeesUse our Business Assistant to gather licensing information for your specific business type.