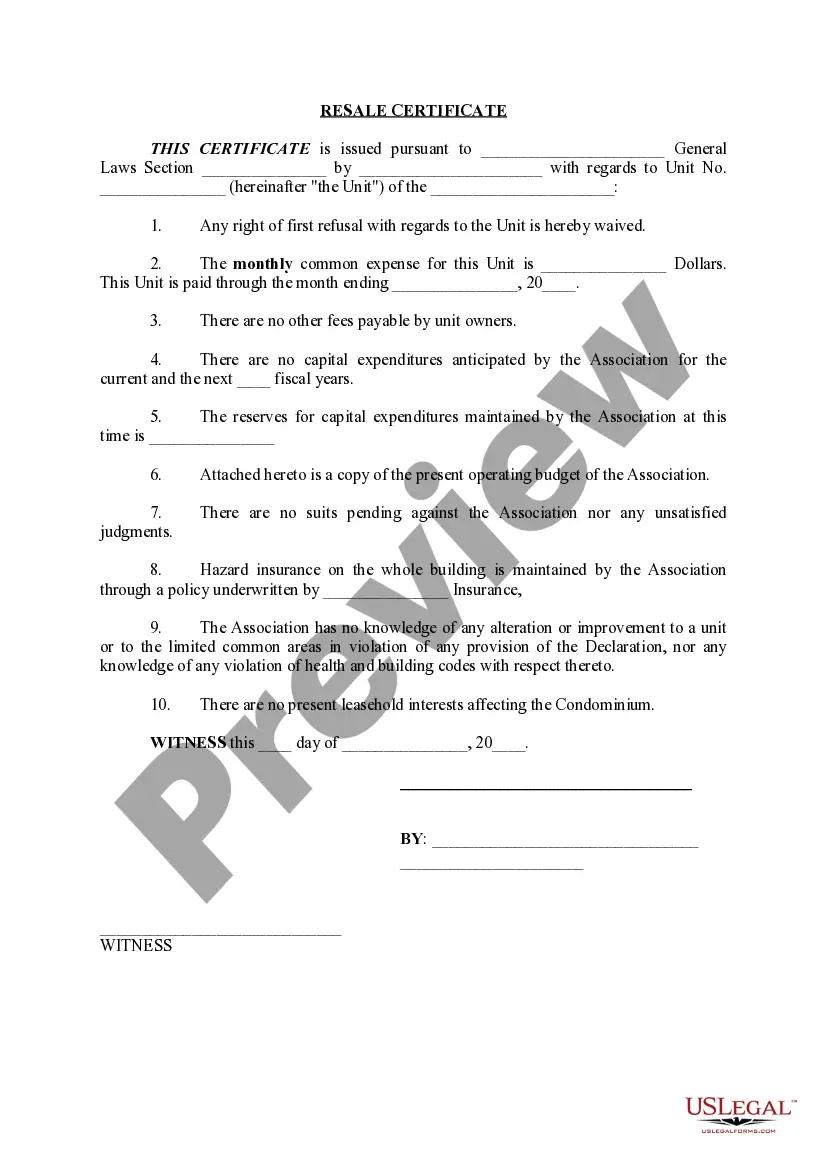

Rhode Island Resale Certificate

Description

How to fill out Rhode Island Resale Certificate?

The work with documents isn't the most simple job, especially for people who rarely deal with legal paperwork. That's why we advise making use of correct Rhode Island Resale Certificate samples created by skilled lawyers. It allows you to avoid problems when in court or dealing with formal organizations. Find the documents you require on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can easily create an account. Use this simple step-by-step help guide to get your Rhode Island Resale Certificate:

- Make sure that file you found is eligible for use in the state it’s needed in.

- Verify the file. Utilize the Preview option or read its description (if available).

- Click Buy Now if this file is what you need or use the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these simple actions, it is possible to complete the form in an appropriate editor. Check the filled in data and consider requesting a legal professional to examine your Rhode Island Resale Certificate for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Form popularity

FAQ

Retail Licenses A retail license specifically authorizes your business to sell items to the public.In many cases, your resale license doubles as authorization to sell items at retail -- and, of course, to collect the tax.

A resale certificate is also called a sales tax certificate, reseller permit, or sales tax exemption certificate.It does not exempt you from paying sales tax on items you use in your business (e.g., office supplies). Qualifying goods are either items you plan to resell or use as parts in products or services you sell.

Step 1 Begin by downloading the Rhode Island Resale Certificate. Step 2 Include the buyer's retail permit number. Step 3 List what the buyer's business sells. Step 4 Enter the name of the seller.

It is also important to realize the difference between a resale certificate and a resale license. A resale license is issued to businesses and individuals who sell goods and services subject to sales tax. A resale certificate is the form you issue to suppliers, and it includes a spot for your resale license number.

Most businesses operating in or selling in the state of Alaska are required to purchase a resale certificate annually. Even online based businesses shipping products to Alaska residents must collect sales tax.The certificate also allows you to buy items without paying sales tax that you will be reselling.

How do you register for a sales tax permit in Rhode Island? You can register online, or by mailing a Business Application and Registration Form to Division of Taxation, One Capitol Hill, Providence, RI 02908 along with the $10 fee.

Resale Certificate. Even though it's important for your taxes, your resale number isn't the same as a tax ID number. Your business's TIN goes on federal tax returns, and if you need to pay state taxes on your business income, you can apply for a state TIN. The resale number involves state sales tax.

(Rhode Island retailers should not accept Exemption Certificates from other states.)Purchases made by state or municipal governments from other states are subject to Rhode Island sales tax.

Making sales of merchandise, goods, or other items in California without first getting a seller's permit violates the law and subjects you to fines and penalties. California law requires a seller's permit be held for warehouse locations when: the retailer has one or more sales offices in this state, the sale is