Washington Wage-and-Hour Questions Employers Often Ask involves a variety of topics related to state wage and hour laws. These questions involve understanding the state's minimum wage, overtime, and other wage and hour requirements. Employers must also understand the state's laws concerning employee classified exempt and non-exempt from overtime, as well as the laws regarding meal and rest breaks, vacation pay, and other wage and hour matters. The types of Washington Wage-and-Hour Questions Employers Often Ask include: — What is the current state minimum wage? — Are any employees exempt from overtime? — What are the rules regarding meal and rest breaks? — How should vacation pay be calculated? — What are the rules regarding tipped employees? — What are the rules regarding compensatory time? — What are the rules regarding severance pay? — What are the rules regarding sick leave? — What are the rules regarding holiday pay? — What are the rules regarding pay for workers under age 18? — What are the rules regarding final paychecks?

Washington Wage-and-Hour Questions Employers Often Ask

Description

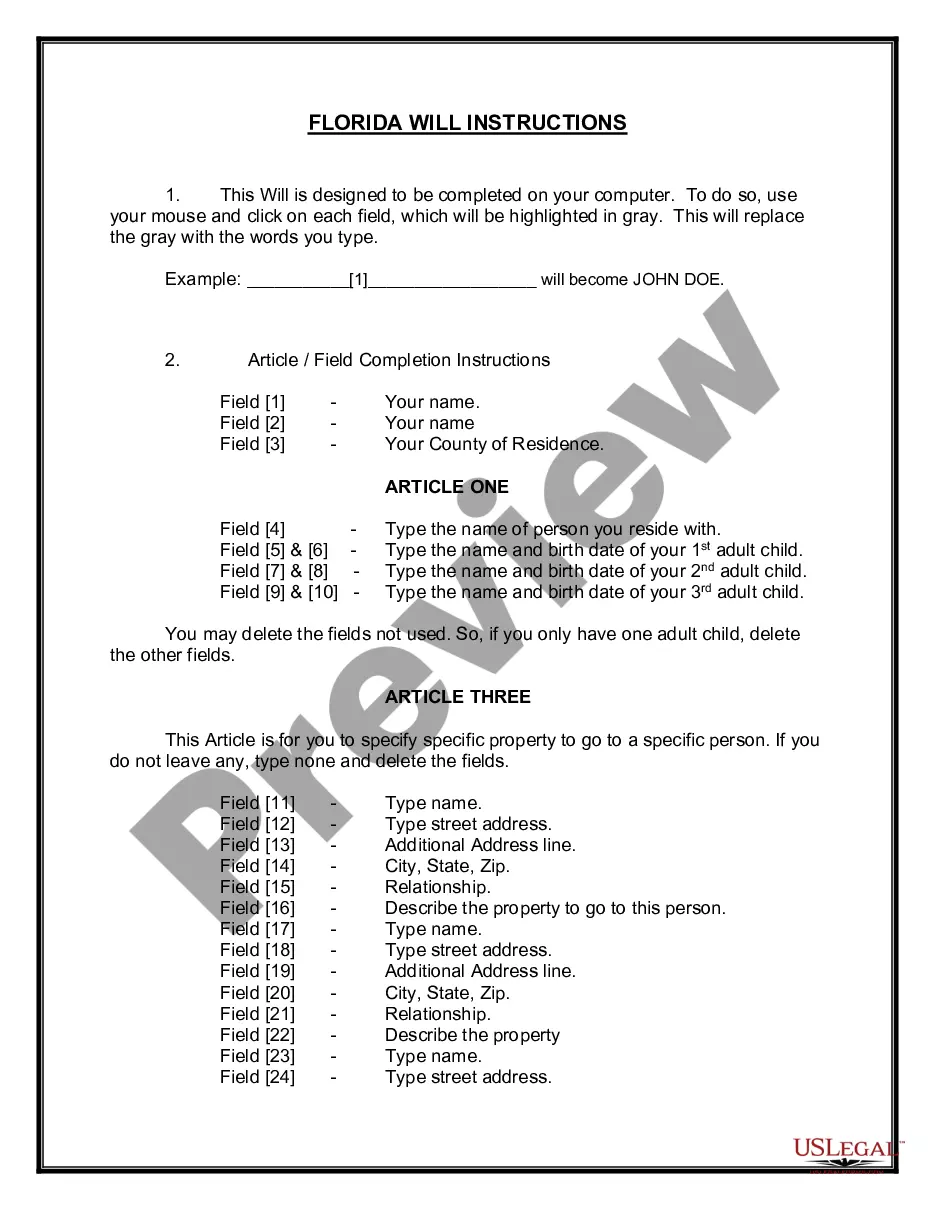

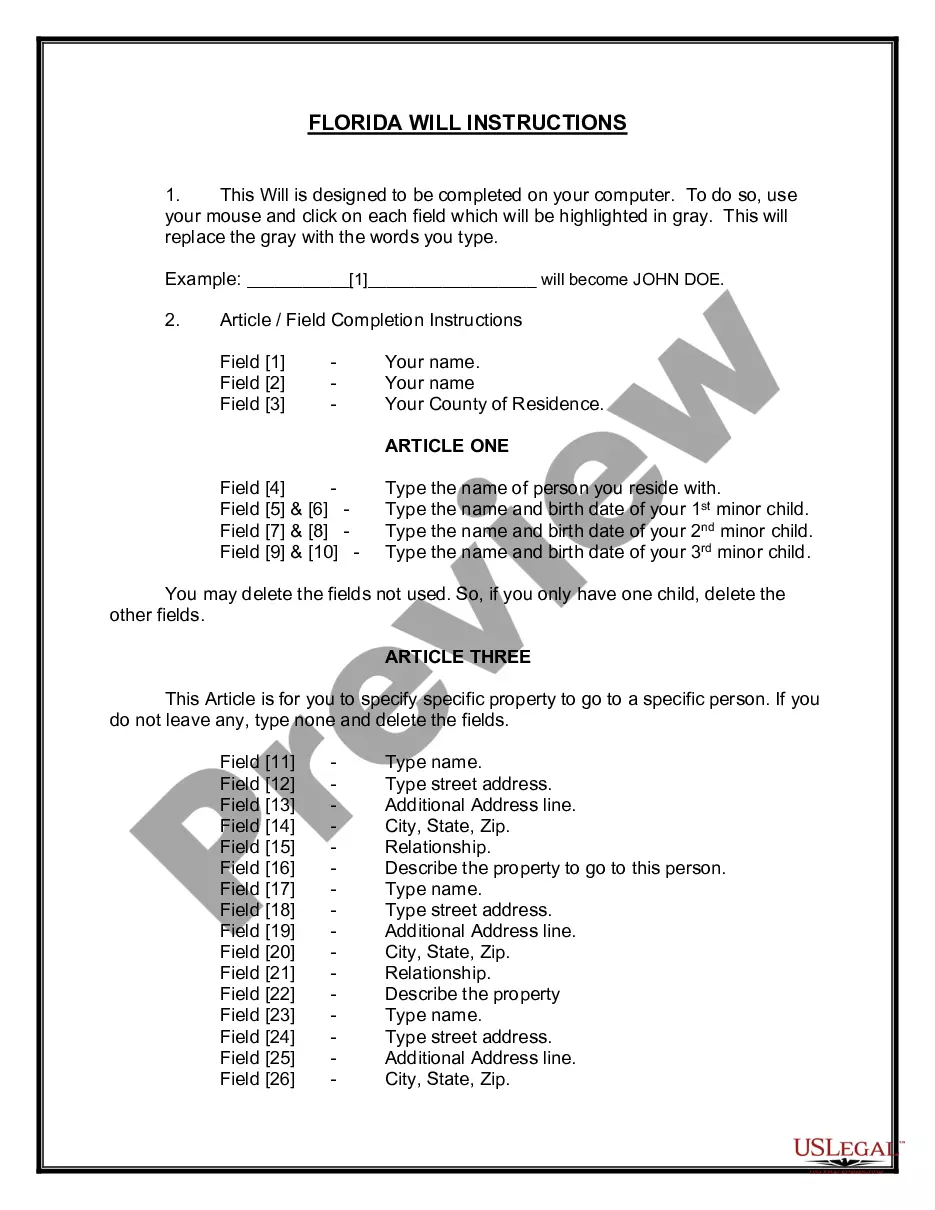

How to fill out Washington Wage-and-Hour Questions Employers Often Ask?

How much time and resources do you usually spend on drafting official paperwork? There’s a better opportunity to get such forms than hiring legal specialists or spending hours searching the web for an appropriate template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Washington Wage-and-Hour Questions Employers Often Ask.

To obtain and complete a suitable Washington Wage-and-Hour Questions Employers Often Ask template, follow these simple steps:

- Examine the form content to make sure it complies with your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Washington Wage-and-Hour Questions Employers Often Ask. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Washington Wage-and-Hour Questions Employers Often Ask on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

?right-to-know? standard, requires employers to. inform and train workers about hazardous chemicals. and substances in the workplace.

In Washington, an employee is acting within the scope of employment ? even if coming from or going to work ? when he or she is driving in a vehicle (2) supplied by the employer, or (2) when the employer pays for the employee's related vehicle costs.

The employer has ninety days from the initial overpayment to detect and implement a plan with the employee to collect the overpayment. If the overpayment is not detected within the ninety-day period, the employer cannot adjust an employee's current or future wages to recoup the overpayment.

Workers are entitled to protection from discrimination. L&I handles safety & health, wage & hour, and some other types of workplace discrimination. Washington State does not require employers to provide leave or pay for holidays, vacations, or bereavement.

Washington law requires employers to pay non-exempt employees 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. The Fair Labor Standards Act also requires that non-exempt employees be paid 1.5 times their regular rate of pay for all hours worked over 40 in the workweek.

Employers must pay employees an agreed-upon wage on a regular, scheduled payday ? and pay them at least once per month. Employers have many options to pay employees ? by check, cash, direct deposit, or even pre-paid payroll or debit cards, as long as there is no cost to the employee to access their wages.

Washington law requires employers to pay non-exempt employees 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. The Fair Labor Standards Act also requires that non-exempt employees be paid 1.5 times their regular rate of pay for all hours worked over 40 in the workweek.

What is the Worker and Community Right to Know Program? In 1984, the Legislature passed the Worker and Community Right to Know Act (RTK), which required the state to establish a comprehensive program for disclosing information about hazardous substances in the workplace and the community.